Yieldstreet Review

Yieldstreet Review: Earn Passive Income With Alternative Investments

Published Aug 30, 2022•Updated Aug 30, 2022

Passive Income

Art & Culture

Real Estate

Investing in an alternative asset is one of the easiest ways to diversify your portfolio beyond stocks and bonds. However, alternative asset investing is complicated for most retail investors because the risk-return profile of non-traditional assets is hard to analyze.

Yieldstreet is on a mission to solve that.

It’s an alternative investment platform that simplifies and streamlines the process to make alternative investing as accessible as possible.

But how does Yieldstreet work? What are the costs, pros and cons, and the potential returns involved?

In this detailed Yieldstreet review we will walk you through what the investment platform offers, how to get started, its annual returns and much more.

Borrow our cheat sheet

MoneyMade member rating

4.4

Fees

1% on average

Minimum to invest

$2500

Returns

3%

Risk

Low

Bonus offer

Claim $100 in REIT shares now

Pros and cons:

Pros

Gives non-accredited investors the opportunity to invest in a collection of alternative asset classes that can generate passive income via the Prism Fund

Offers portfolio diversification as alternative investments typically have a low correlation with the stock market

The Yieldstreet platform is also accessible via their mobile and tablet apps for iOS and Android

Investments are backed by assets that provide a bit of a safety net in the event that a borrower defaults

Can invest via IRAs through Yieldstreet Wallet

Cons

Investments offered on the Yieldstreet platform are illiquid

Investors need to have a US-based address and bank account to invest in a Yieldstreet offering

The direct investment opportunities aren’t available to non-accredited investors

What is Yieldstreet?

Yieldstreet is a crowdfunding investment platform that helps you invest in a wide range of alternative asset-based investments.

Founded by Milind Mehere (CEO) and Michael Weisz (president) in 2014 and based in New York, Yieldstreet has managed over $2.6B in investments with $1.25 returned as principal and interest. Their Net IRR (internal rate of return) is 10.65% as of January 2022.

Unlike most other crowdfunding platforms that focus on a particular type of asset class (such as commercial real estate or litigation financing), Yieldstreet offers a variety of asset-backed debt investments.

These investment options include (but aren’t limited to):

- Real estate investment loans

- Accounts receivable financing

- Fine art

- Marine finance

- Loans backed by artwork

- Litigation finance

How does Yieldstreet work?

How does Yieldstreet work?

Yieldstreet allows investors to invest in private market debt opportunities, and there are two main ways you can invest: direct investments and Prism Fund investments.

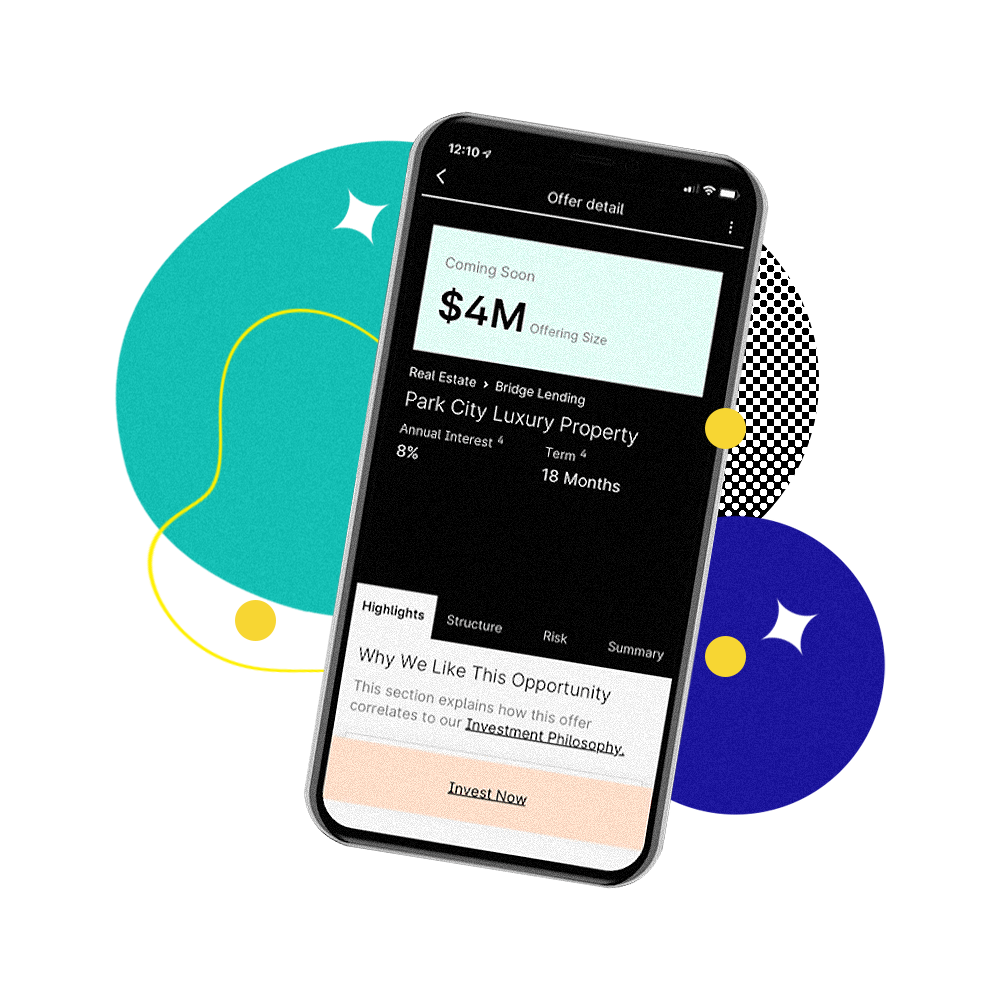

Direct investments allow you to invest in one alternative asset class. Direct investments are only open to accredited investors with a $10,000 minimum investment. These are typically investors with a net worth of at least $1,000,000 (not including the value of their primary residence) or investors who have an annual income of $200,000 for the last two years.

Prism Fund investments allow investors to add a number of asset classes to their portfolio with one allocation. It is open to accredited and non-accredited investors with a $500 minimum investment.

Here’s how both work:

Direct investments

- Originators (borrowers) post opportunities on Yieldstreet’s platform. Yieldstreet then carefully analyzes each opportunity before making it available to an investor.

- A Yieldstreet investor can then go through the platform looking for a deal or asset class that interests them - such as fine art, real estate, marine finance, etc.

- A Yieldstreet investor is essentially lending money to these borrowers and makes a return on the yield paid by the borrower.

- Yieldstreet charges a fee to manage the loan, collect payments and distribute the yield back to the investors.

Prism Fund

The Prism fund is a multi-asset fund that was launched during the pandemic and contains a variety of different asset classes. It works similarly to a mutual fund where investors pool their money into the fund. The Prism Fund is open to all investors (accredited and non-accredited).

Unlike a mutual fund, investments in the Prism Fund are largely illiquid which limits your ability to quickly sell your shares. However, the Fund expects to offer investors the ability to liquidate a portion of their shares based on a quarterly basis. This is subject to approval by the Fund’s Board of Directors and depends in part on the performance of the fund. The fund expects to pay out quarterly distributions at an 8% annualized rate.

The fund had originally planned to close in March 2024 when all of the assets would be sold and the profits distributed to investors. However, in December 2021, the Prism Fund’s Board of Directors approved a change to remove the terminal date and turn the Prism Fund into a perpetual fund. This allows the fund to invest in a wider range of possible investments instead of being limited to investments with terms that would mature before the original end date of March 2024.

Who can invest with Yieldstreet?

Both accredited and non-accredited investors can invest with Yieldstreet. However, non-accredited investors can only invest in the Prism Fund. Investing in the Prism Fund is open to all individual US investors with the exception of residents of Nebraska and North Dakota.

To participate in all of the investment opportunities Yieldstreet has to offer, you will need to be an accredited investor. To be an accredited investor, you typically need to make at least $200,0000 per year for the past two years (or $300,000 if you file jointly). Or, you need a net worth of more than $1 million, excluding the value of your primary residence.

Where Yieldstreet gets it right

Diversification

Investing with Yieldstreet is one way to diversify your investment portfolio using alternative assets. You can invest in anything from real estate to art and marine finance.

Mobile app

For those who like to invest on the go, Yieldstreet offers convenient apps for Apple and Android users.

Opportunity for non-accredited investors

While non-accredited investors do not have access to the full range of investments available on the Yieldstreet platform, at least there are some opportunities available. Non-accredited investors can still participate in the Prism Fund.

Where Yieldstreet could do better

Lack of liquidity

When you invest with Yieldstreet expect your money to be locked in for a few years. Those looking for an investment with a quick turnaround might want to look elsewhere.

Limited investment opportunities

While Yieldstreet is open to both accredited and non-accredited investors, there are a limited number of offerings available to non-accredited investors through the Prism Fund.

Limited history

Yieldstreet is a recently formed company (founded in 2014, launched its first offering in 2015) with a limited operating history. While this isn’t necessarily a negative, it is something investors should consider as there can be more risk associated with a newer company.

Can you really make money on Yieldstreet?

The platform-wide net internal rate of return (IRR) on Yieldstreet is 10.65%. Investors will earn interest payments as well as the return of their principal investment over the duration of the loan.

In Q3 of 2021, the Prism Fund distributed an annualized ~8%, meeting its target objective. Distributions for the Prism Fund are made quarterly – usually in February, June, September, and December. Other offerings may pay distributions quarterly, monthly, or based on the occurrence of certain events. You can find the specific payment schedules for each investment on the offering page.

Yieldstreet does charge a management fee that ranges from 0% to 2.5%. You can find the fees on the individual offering page for each investment. There is also an annual fund expense which is disclosed on the offering page. Fees are collected from the cash flows of the offerings.

How do I make money with Yieldstreet?

Investors make money in the form of interest payments. Depending on the type of offering, you might receive distributions on a monthly basis, quarterly basis, event-based basis (usually for legal investments) or upfront.

How do I cash out with Yieldstreet?

When a distribution is made on your investment, you will receive an email informing you that the funds have been distributed into your Yieldstreet Wallet. At this point you can withdraw your funds and deposit them into your external bank account or, you also have the option to participate in the distribution reinvestment plan (DRIP). If you participate in DRIP, instead of receiving recurring payments, your distributions will automatically go back into your Yieldstreet Prism Fund and will add to your initial principal.

Yieldstreet vs traditional investing

Adding alternative investments to your overall investment strategy can be a great way to diversify. Alternative investments can be a useful addition because they typically have a lower correlation with traditional assets like stocks. This can potentially help to protect your portfolio in times of market stress.

Compared to traditional investments like stock and bonds, Yielstreet investments are much less liquid. There is no public market for Yieldstreet shares, which means you can’t expect to sell your shares on a daily, weekly or monthly basis like you can with a stock. Once you purchase Yieldstreet shares you can expect your money to be tied up for the duration of the offering. So, if you think you will need your investment money in the short term, perhaps you should look for a more liquid investment opportunity.

However, the Prism Fund intends to offer to repurchase a limited number of shares from existing investors on a quarterly basis (March, May, August, and November). This is subject to approval by the Fund’s Board of Directors and depends on how the fund performs. The number of shares to be repurchased will be limited to no more than 20% of shares in a calendar year or no more than 5% of shares per quarter.

Remember, before you make any investment it’s important to research the risks involved. To get a more thorough understanding of the risks associated with investing in Yieldstreet you can read through important documents such as Yieldstreets Prism Fund Prospectus.

What other people are saying about Yieldstreet?

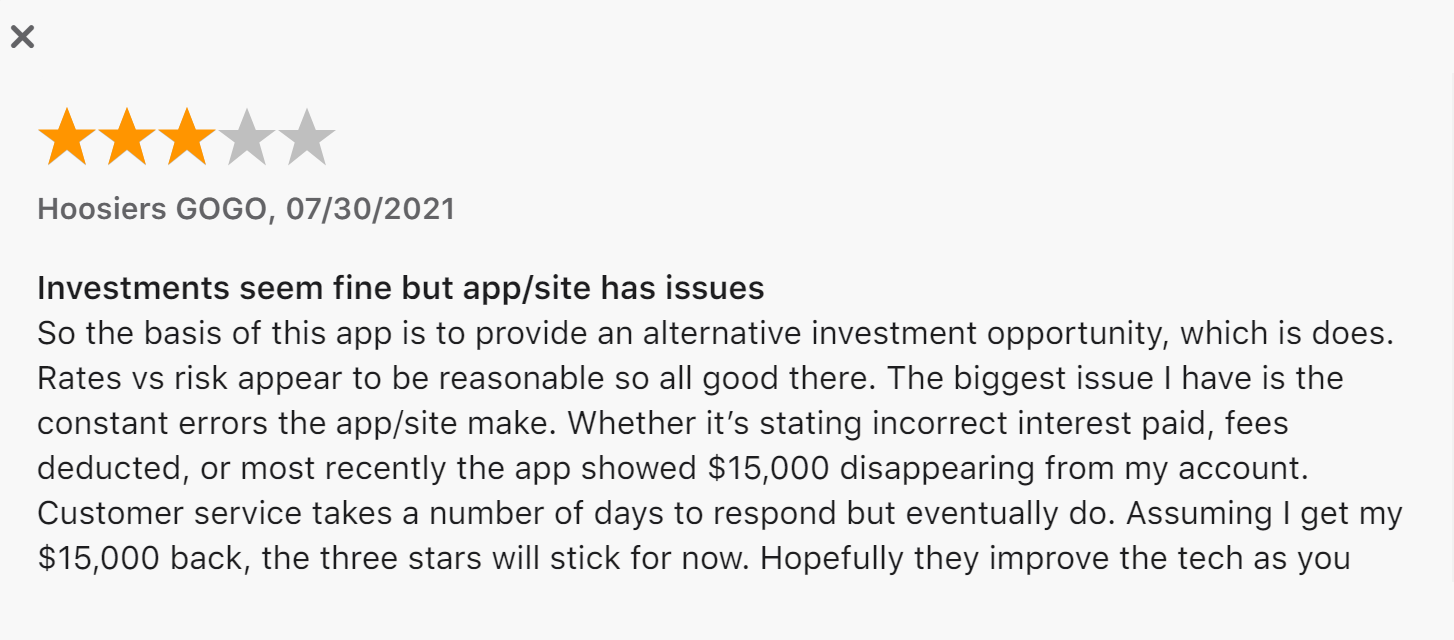

When it comes to what people are saying about Yieldstreet, the comments are all over the board—some love it and some have issues. One frustration that several customers seem to share is with the Yieldstreet app and website. It appears there were still some bugs to be worked out to ensure a more seamless and user-friendly experience. That said, these comments are over a year old, so they may have fixed these issues.

On a more positive note, many users have commented positively on Yieldstreet's ease-of-use, particularly for a platform that gives investors access to litigation financing, a notoriously complicated asset class.

Are there other apps like Yieldstreet?

There are other apps that are similar to Yieldstreet. Examples of other alternative investment platforms that allow you to generate passive income include Percent and GROUNDFLOOR.

Yieldstreet and Percent both offer investors the opportunity to invest in alternative assets. They also both offer a low minimum investment of $500 (for Yieldstreet Prism Fund).

However, the two platforms also have several differences. First, Yieldstreet charges a management fee ranging from 0 to 2%. Percent does not charge investors fees. Unlike Yieldstreets Prism Fund, Percent does not provide any investment options for unaccredited investors. Finally, Percent offers more short-term investment opportunities whereas Yieldstreet investments are longer-term.

Those that want to get into alternative investing for an even lower minimum investment of only $10 can check out GROUNDFLOOR. This platform is focused on real estate investing and offers short-term real estate loans to builders and developers.

Similar to Yieldstreet, GROUNDFLOOR is open to both accredited and non-accredited investors and you make money through interest payments. Unlike Yieldstreet, your money will typically be tied up for a shorter term (around 12-months or less).

Yieldstreet | |

|---|---|

Fees | Avg 1% |

Minimum investment | $2500 |

Average returns | 3% |

Risk Level | Low |

Available on | |

iOS | |

Android | |

Review | — |

| |

Our hot take on Yieldstreet

For investors interested in diversifying their portfolios with alternative investments that generate passive income, Yieldstreet is worth checking out. Yieldstreet provides an opportunity for investors to participate in alternative investments that have largely been restricted to those with a very high net worth through its Prism Fund. While Yieldstreet provides a lot of interesting investment opportunities, there is definitely risk involved. It is possible for your loan to go into default and you could lose your principal investment. As with any investment, it’s important for investors to carefully research the risks and rewards associated before investing their money.

I’m in! How do I sign up for Yieldstreet?

1. Create a MoneyMade account.

If you haven’t already, sign up for a MoneyMade account, and then you can access an account with Yieldstreet. This will connect your Yieldstreet account directly to your MoneyMade account.

2. Create a free Yieldstreet account.

To create a Yieldstreet account you will need to provide your name, email, and create a password.

3. Verify your identity.

Once you verify your email, you will then be asked about how you intend to invest on Yieldstreet – individual account, Yieldstreet IRA, or entity account. Then you will be asked to verify your identity using a piece of government ID.

4. Link your bank account.

Once you’ve verified your identity you will need to link your bank account for withdrawing and distributing funds. Your bank account needs to be ACH-compatible.

5. Verify your accreditation (for accredited investors only).

Accredited investors will be asked to verify accreditation status. Non-accredited investors don’t have to worry about this step. Accredited investors can verify their status in three ways: third-party source (have your lawyer, CPA, or financial advisor verify on your behalf), income, or net-worth.

6. Review offerings.

Once you are all set up, you can review Yieldstreets’ offerings. When you find an investment that you are interested in, you can go ahead and invest by clicking “Invest Now”.

7. Finalize payment.

You can choose to pay for your investment using your bank account or your Yieldstreet Wallet.

8. Come back to MoneyMade.

If you want to track all of your investments in one place, return to your MoneyMade account so you can track your investments in one place.

FAQs

Explore Assets

Click an asset to learn more