4 Best Assets to Hold in a Bear Market

- Here are the best alternative assets to diversify your portfolio, hedge against inflation and generate income.

- Invest alongside Buffet and Gates in this $2.7 trillion market

- Investors netted over 9% annualized returns with private market loans using this platform

- Get unprecedented access to an asset class that withstood what the stock market couldn’t

They say “don’t put all your eggs in one basket,” and that goes for investing, too.

Watching your money shrink as the market plummets feels like a punch to the gut. But alternative assets can help protect your portfolio by:

- Providing returns with low (or no) correlation to the stock market

- Hedging against inflation

- Offering low volatility

- Generating income

Hedging against the stock market with alternative investments gives peace of mind and fuller baskets. In the past, most of these investments were only available to the ultra-wealthy, but now even everyday investors have access to alts.

Here are four alternative asset classes that have proven to be effective hedges against inflation and recessions.

1. Hedge against inflation with the $2.7 trillion farmland market

In 1945, at just 15 years old, Warren Buffet bought a 40-acre farm with $1,200 in savings. Almost 80 years later, 40 acres of farmland in Nebraska is worth $134,400—a 572% increase in value (with inflation). It’s no wonder that Bill and Melinda Gates have become the top farmland owners in the country, acquiring nearly 270,000 acres since 2017.

As one of the world’s oldest investable assets, farmland is also one of the most recession-proof. Regardless of the economy, we all must keep eating. This has made farmland an outstanding hedge against inflation and a stabilizer of wealth when other markets turn south. In fact, since 1991, U.S. farmland has provided average returns of 12.24%, four times the average inflation rate of 3.21% during the same period.

Farmland also has low correlation to the stock market, making it a great portfolio diversifier. If you count income and appreciation, farmland has returned an impressive 11% annualized from 1992 to 2021. Meanwhile, the benchmark S&P 500 has returned an inflation-adjusted 8%.

Chart comparing the value of $1000 investments in farmland, real estate, stocks, bonds, and gold from 1992 through 2021.

Source: farmtogether.com

FarmTogether is an investment manager that gives accredited investors access to vetted U.S. farmland. Since 2017, FarmTogether’s offerings have generated up to 19% net cash yield, with target net IRRs of up to 15%.

Join FarmTogether today to invest in some of their 911 million acres of U.S. farmland, green thumb not required.

2. Boost returns & diversify from stocks with private market loans

In 2015, Jeff Bezos invested $50 million into Fundbox, a startup that finances small business loans. And the peer-to-peer lending industry is growing fast: 30% per year according to the market research firm IMARC Group. They expect it to grow to $560 billion by 2027.

Even in a bad economy, people and companies need to finance purchases. If you can provide that financing, you can profit from it. Lending is a great income-producing asset for diversifying your portfolio. Loans are virtually uncorrelated to the stock market and can be collateralized to greatly reduce investment risk.

Peer-to-peer loan terms average between three and five years, with interest rates averaging 6.99%. Some investors earn 10% in annual average returns.

Unfortunately, most peer-to-peer lending sites aren’t equipped to properly vet borrowers and loans on those platforms are usually unsecured. That means you lose your money if the debtor doesn’t pay back the loan, except if you use Yieldstreet.

Yieldstreet works with top loan originators who only make high-quality debt from worthy borrowers. These loans are backed by assets that are less correlated to traditional markets.

Yieldstreet portfolio simulator with $15k initial investment.

Source: yieldstreet.com

With a minimum investment of $2,500, you can start earning quarterly dividends on income-generating assets, including private loans and litigation financing. As of September 2022, Yieldstreet has paid out $1.8 billion in principal and returns so far, with 9.61% average net annualized returns.

Join 400,000 investors who are diversifying from traditional markets with Yieldstreet.

3. Get passive income & price appreciation with rental properties

The Forbes 400 list of the richest Americans in 2021 featured 24 real estate investors who surpassed the $2.9 billion net worth benchmark.

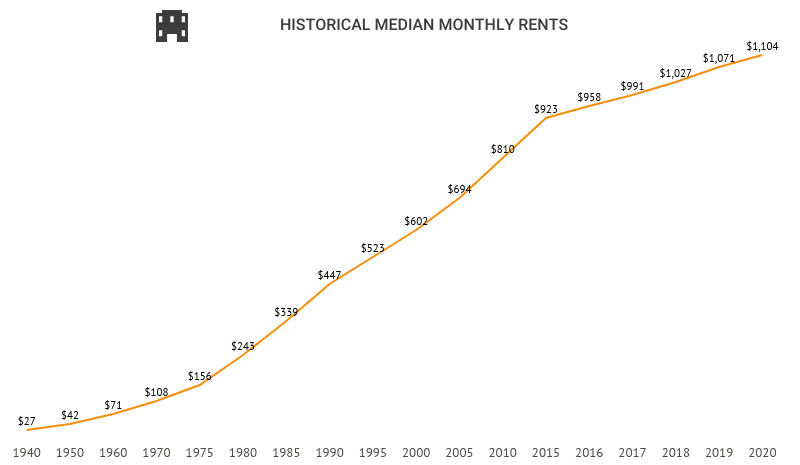

The key to protecting your portfolio and growing your investments is to put your money into assets that consistently outpace inflation. Rental real estate can keep up, according to historical data.

Inflation from 1980 through 2021 has been an average 3.21% a year, but data from iPropertyManagement shows rental rates increasing at 8.86% on average during the same period.

There are many ways to invest in rental properties if purchasing your own doesn’t fit your financial plans right now.

A chart of median monthly rents by decade from 1940 to 2010 and by year from 2015 to 2020.

Source: ipropertymanagement.com

You could try your luck in the public markets by investing in a REIT (real estate investment trust), but they won’t give you the best bang for your buck. While REITs that trade like stocks are a convenient way to gain exposure to income-producing commercial real estate, you’ll get greater returns and higher dividends by investing with fractionalized real estate platform Elevate Money.

Elevate Money lets you invest in privately-traded commercial real estate. You don’t have to be an accredited investor or invest hundreds of thousands of dollars to use Elevate Money. With as little as $100, you can build a diverse portfolio of properties—like gas stations and fast-food shops—that pay you income every month.

Join real estate investors on Elevate Money and start earning annualized monthly dividends of up to 6.5%.

4. Beat the S&P 500 with multimillion-dollar art masterpieces

Billionaire David Geffen holds the largest private art collection in America with $2.3 billion worth of fine art. That’s more than one-third of his net worth in a collection of mostly post-war American artwork by artists like Jackson Pollock and Willem de Kooning.

Contemporary art has grown significantly as an investment asset. Over the past 10 years, its value has increased 132%, with 63% of that growth during the pandemic alone. Art returns can outperform the stock market, as well.

Historically, the demand for fine art has also remained consistent, meaning the value of artwork isn’t heavily impacted by economic downturns. And over the long-run, art has shown low correlation to the stock market—auction prices took a 27% hit during the Great Recession (2007-2009), but the S&P 500 decreased 57% in the same period.

Average appreciation of asset classes during periods of monetary inflation.

Source: Masterworks.com

Compared to the S&P 500’s annualized price appreciation of 9.5%, art seems like a worthy investment.

And the payoffs can be huge. The 1983 Basquiat painting In This Case was purchased for $1 million at the time and sold for $93.1 million in May 2021 at Christie’s New York. That same month, another Basquiat—Untitled (One Eyed Man or Xerox Face) (1982)—sold for $30.2 million at Christie’s Hong Kong, or 1,306 times the 1987 purchase price of $23,100.

While jaw-dropping returns like these are rare, they’re not as uncommon as you’d think. If you’re interested in investing in fine art like a billionaire, check out Masterworks.

Masterworks is an investing platform that lets you buy and sell shares of great masterpieces by artists like Warhol, Monet, Banksy, and more. They target artists whose work has historically achieved a 9% to 15% annual return. Since 2018, they’ve acquired more than 130 artworks valued at over $500 million and generated an eye-popping 29.03% average net realized returns.

Join the 500 thousand investors who have found Masterworks as their doorway to top-tier, blue-chip art investing.

MoneyMade is not a registered broker-dealer or investment adviser. The investments identified on the MoneyMade website may not be purchased through MoneyMade; rather, all transactions will be directly between you and the third-party platform hosting the applicable investment. The information contained herein regarding available investments is obtained from third party sources. While MoneyMade generally considers such sources to be reliable, MoneyMade does not represent that such information is accurate or complete, and MoneyMade has not undertaken any independent review of such information.

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by MoneyMade or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. Any references to past performance, regarding financial markets or otherwise, do not indicate or guarantee future results. Forward-looking statements, including without limitations investment outcomes and projections, are hypothetical and educational in nature. The results of any hypothetical projections can and may differ from actual investment results had the strategies been deployed in actual securities accounts.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. MoneyMade is not a fiduciary by virtue of any person’s use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content.

The standardized performance presented herein has been calculated by MoneyMade based on data obtained from the third-party platform hosting the investment and is subject to change. No representation or warranty is made as to the reasonableness of the methodology used to calculate such performance. Changes in the methodology used may have a material impact on the returns presented. Past performance is no guarantee of future results. In exchange for using the Site, you agree not to hold MoneyMade, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.