Mar. 8 Markets Report: Everything Sucks…But Hey, There’s a New Batman Movie?

Crypto is struggling to separate from the stock market, mortgage rates are yo-yo-ing like crazy, we might be getting our meds in the Metaverse soon, and the release of The Batman proves there’s always an appetite for the classics. Check out the highlights below and click through to the full report to get all the details.

We’re nearly two weeks into the Ukraine invasion now, and that begs the question: what is the long-term economic fallout of this war going to be? Let’s take a look at the CNBC Rapid Update, a tracker that averages different Wall Street forecasts for the U.S. economy.

Analysts are now expecting the U.S. GDP to grow 3.2% this year, which is just a tad bit lower than last month’s forecast. Inflation, on the other hand, is expected to rise 4.3% this year. And that is without factoring in how a Russian oil embargo will affect the U.S. economy. Still, the fact that the U.S. is #1 oil producer in the world should help cushion the blow of an oil shock.

Europe, on the other hand, won’t be so fortunate, since Russia supplies about 40% of the EU’s natural gas imports. And with all the economic sanctions they’re currently imposing against Russia, Europe’s economy could be heading for a recession. Russia is even worse off, with JPMorgan expecting a 12% decline in the country’s GDP over the coming year.

In the midst of this macro bearish sentiment, how are different investments performing? Check out the details and get updates on more of your favorite asset classes below.

Crypto

Bitcoin and other cryptos have been struggling to sustain their rallies, given the macroeconomic conditions. After a brief run up to $1.9 trillion, crypto’s total market cap came tumbling back down to $1.65 trillion.

I think I speak for all the crypto enthusiasts when I say that it’s been disappointing to see safe haven assets like Gold rising while Bitcoin (a.k.a. Digital Gold) remains stagnant. As much as I hate to say it, Bitcoin and the crypto market are still tightly coupled to the stock market. For now, we’re still stuck in a range, waiting for a break above $46K to resume the bull run. That is, if we don’t dip below $34K first.

Blockchain analytics tool Glassnode showed that investors have been pouring hundreds of millions of dollars into the Grayscale Bitcoin Trust (GBTC) since December 2021.

This tells us that despite crypto’s mediocre performance this year, it continues to garner adoption from institutions:

- The Swiss city of Lugano has partnered up with Tether to make BTC, USDT, and Lugano’s LGVA Points token legal tender.

- Financial services company Charles Schwab recently submitted filings for their own crypto exchange-traded fund (ETF).

- Billionaire Kevin Griffin, a former crypto hater, announced that his company Citadel is planning to offer crypto services to other institutions and their investors.

- Through March, every customer who buys something at Shake Shack with a Cash App debit card will get a 15% refund in Bitcoin.

- Brazil’s central bank has picked nine projects (including Aave) to develop a central bank digital currency (CBDC).

That’s all well and great. But this week also brought us some bad news. Andre Cronje, The Godfather of DeFi, recently announced that he was leaving the crypto space. In case you don’t know, Andrew Cronje is an influential developer who’s had a hand in massively successful DeFi projects like Yearn (YFI) and Fantom (FTM).

Sad to see you go man.

Real Estate

This year, the 30-year fixed mortgage surged to a 3-year high of 4.19%. But last week, mortgage rates saw a massive 6.6% decrease over the course of two days — the biggest rate swing we’ve seen since 2020. This unusual volatility is largely due to all the uncertainty surrounding the Ukraine invasion.

And while this rate drop won’t do anything to dampen surging home prices, it does give homebuyers more purchasing power. Keep in mind though, that since mortgage rates tend to follow the U.S. 10-year Treasury note, rates could climb back to previous highs if bonds go up.

Speaking of home ownership in times of war, Airbnb is temporarily waiving guest and host fees for bookings in Ukraine. This way, Ukrainian homeowners are incentivized to offer shelter to those in need since they get to keep more money off each rental. Smart thinking.

According to Dolly Lenz, a big shot residential broker in New York, wealthy Russians are trying to offload their U.S. real estate out of fear of having their properties seized. Apparently, a Russian oligarch called Sergey Grishin is trying to sell the Scarface mansion for $40 million before the U.S. government says hello to his little friend.

Stocks & Bonds

Stocks briefly rallied last Wednesday, but proceeded to plummet amid rising commodity prices and worries of a Russian oil embargo. The S&P 500 and Nasdaq fell by 3.7% and 5.9% respectively.

Bank stocks, particularly European ones, were among the biggest losers. But even U.S. bank stocks weren’t safe, with The KBW Nasdaq Bank Index (BKX) down over 7% and big names like Citigroup (C) shedding 5%.

On a more curious note, Bed, Bath & Beyond (BBBY) soared over 85% from $16.18 to $30.05. The catalyst? GameStop Chairman Ryan Cohen mentioned that he had a nearly 10% stake in the retailer. I guess the GameStop Apes are still as strong as ever.

On Friday, the Labor Department’s Bureau of Labor Statistics reported that nonfarm payrolls grew by 678,000 in February and the unemployment rate declined to 3.8%. The benchmark 10-year Treasury note has been in a downtrend since mid-February, but it has been slowly inching up after this strong jobs report. Let’s see what happens when and if the Fed begins to hike interest rates this month.

NFTs & Metaverse

According to Google Trends, worldwide search interest for the keywords “metaverse” and “NFT” have been dropping since December 2021. Should we be worried? DappRadar’s February 2022 Dapp Industry Report says no.

The report shows that the Dapp industry has grown 385% since February 2021, with NFTs doing over $10.6 billion in trades. The Terra ecosystem was also highlighted for growing to $20 billion in LTV (Total Value Locked), second only to Ethereum.

“Wen metaverse?”

Well according to Dan Rabinovitsj, VP of connectivity at Meta, cellular networks need to go through some massive upgrades before they’re ready for the metaverse.

The metaverse experiences that we’re all hyped for require super low latency, and high upload/download speeds. The global average download speed, for example, is 29.60 Mbps. But experts estimate that the metaverse would require at least 100-200 Mbps.

In theory, 5G networks could meet these technical requirements. Fortunately, AT&T Executive Vice President David Christopher said that 5G is being deployed at a rapid rate — faster than 4G was.

No wonder CVS just filed trademarks to offer pharmacy services inside the metaverse.

Commodities

Gold firmly broke above $2,000 last week, as many predicted would happen due to the ongoing war. Will Gold continue inching higher? That’s largely going to depend on next week’s Fed meeting. If the Fed hikes interest rates (which most analysts are expecting) then investors might sell gold for interest-bearing assets.

Well, it finally happened. Crude oil prices have officially reached an all-time high due to fears of supply disruptions. With the possibility of a Russian oil ban looming, the U.S. oil benchmark WTI soared to $120 per barrel.

The international benchmark, Brent crude, spiked even higher than that at $125. Just this Sunday, the national average price for a gallon of gas hit a 14-year high of $4 with no signs of slowing down. Could we see $5 a gallon in the coming months?

Comics

“I’m vengeance”

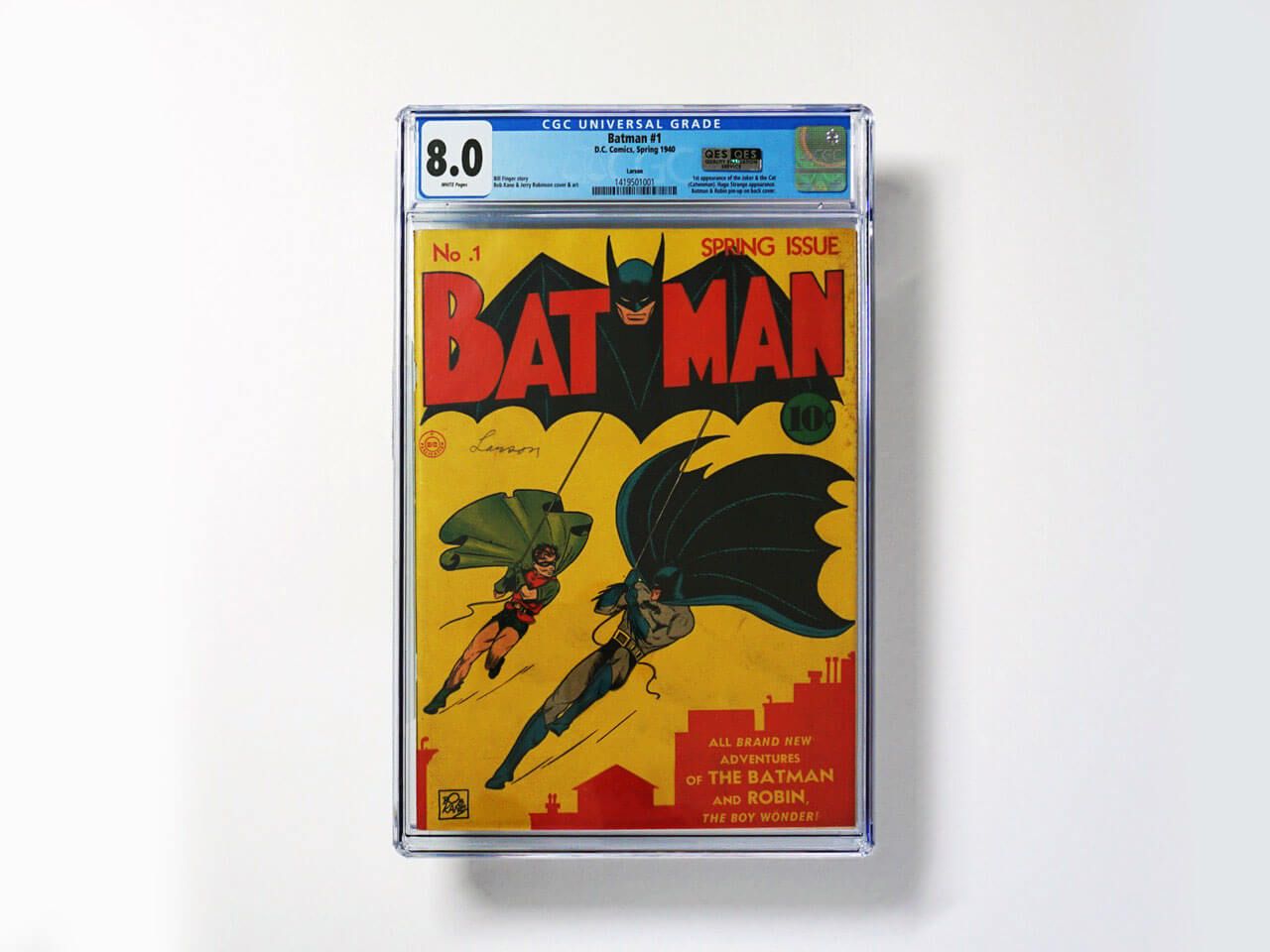

DC Comics’s newest film “The Batman” has generated $250 million at the global box office over the weekend, with one of the highest opening weekend sales in the post-COVID era. Leading up to the release, Batman collectibles have been selling for mouth-watering figures.

Case in point: investment app Rally announced that they acquired Batman #1 CGC 8.0 for $1.36 million. In case you’re unfamiliar, Rally is a company that buys authenticated collectibles like classic cars, comic books and rare documents.

Once they acquire an asset, they split it into equity shares and issue an “Initial Offering”, where all types of investors can buy shares and get exposure to that collectible. To that end, Rally is planning to issue a $1.8 million Initial Offering of Batman #1 CGC 8.0. So stay on the lookout for that. Unless, of course, there’s a “price for your blind eye”.

Startups

Funding for EU startups has reached a grinding halt. According to Crunchbase, there were $2.66 billion worth funding rounds in Europe for the first three weeks of February. That works out to about $886 million per week. This past week though, EU companies only pulled in $250 million. So, is the European startup scene being snuffed out by the war? To all my European startup founders: “Do not go gentle into that good night”… You know the rest.

On a lighter note, Charli D’Amelio, the biggest TikTok star in the world, just launched a VC fund called 444 Capital. With $25 million in funding, 444 Capital is aiming to back women- and minority-led consumer brands in fintech, healthcare, insurtech and more. From TikTok star to reality TV star and now venture capitalist, Charli D’Amelio has come a long way from filming dance challenges and lip-synching jokes.

If you’re looking to invest in startups yourself, checkout some of the funding campaigns happening on StartEngine. Examples include:

- Rentberry, a global home rental platform that already has $7.3 million in funding

- Legion M Entertainment, an entertainment company that is built to be owned by fans with $3.5 million in funding so far.

Who knows, you might just find the next unicorn there.