Rich Dudes│The $84.5B Net Worth of Fashion Mogul Amancio Ortega

From Zara to real estate and stocks, learn how Amancio Ortega became one of the world’s richest billionaires with a net worth of $84.5 billion.

Amancio Ortega Gaona is the founder of Zara and one of the world’s wealthiest men, with an estimated $84.5 billion net worth.

He owns 59% of Inditex, one of the world’s largest clothing retail brands. He invests in startups, stocks, and real estate properties across Madrid, London, Miami Beach, and New York City.

In 2015, Ortega briefly became the world’s richest man with a net worth of $80 billion, surpassing Bill Gates, but eventually returned to being the second-richest person in the world. Despite his immense wealth, Ortega is a very private individual and rarely gives interviews to the press.

Ortega created Pontegadea in 2001 to invest the annual million-dollar dividends he receives from Inditex…In December 2022, Pontegadea Inversiones bought a residential skyscraper in Seattle for $323 million

As Amancio once expressed to the Spanish financial press, “Success is never guaranteed.” But you might wonder how the Spanish businessman built such immense wealth. We’ve got it all laid out in this piece, so read on to get the inside scoop on how Amancio Ortega has grown to $84.5 billion in net worth as of April 2023.

Amancio Ortega net worth at a glance

| Net worth | $84.5 billion |

| Born | March 28, 1936 |

| Nationality | Spanish born in Busdongo de Arbás, Leon, Spain |

| Became a millionaire at | 40 |

| Occupations | Businessman, entrepreneur |

| Sources of wealth | Inditex, Zara store, Pontegadea Inversiones S.L. |

| Asset classes | Real estate, startups, and stocks |

How Amancio Ortega made his money

Amancio Ortega, the founder and former chairman of the fashion giant Inditex, was born in Busdongo de Arbas, León, Spain, in 1936.

The youngest of four children, he spent his childhood in Tolosa, Gipuzkoa, and moved to A Coruña at 14 due to his father’s job as a railway worker. Ortega left school, working as a shop hand at a local shirtmaker Gala where he learned clothes-making by hand.

Speaking of the Ortega family, the billionaire was born to Antonio Ortega Rodríguez and Josefa Gaona Hernández. Amancio tied the knot with Rosalia Mera Goyenechea in 1966 and welcomed two children, Marcos and Sandra Ortega Mera—the relationship concluded with a divorce in 1986. His daughter Marta Ortega Pérez comes from his second wife, Flora Pérez Marcote.

In 1963, Ortega founded Confecciones Goa to sell quilted bathrobes. However, it was the establishment of his first Zara store with his then-wife Rosalía Mera in 1975 which made him a billionaire. Zara’s success was based on fast fashion, a business model that allows clothing companies to quickly produce and sell affordable clothing that follows the latest trends.

Under Ortega’s leadership, Zara grew rapidly and became part of Inditex, which included other popular brands such as Massimo Dutti, Oysho, Zara Home, and Pull and Bear. By 2021, the world’s largest clothing retailer Inditex operated over 6,400 stores and had grown to 165,000 employees worldwide by 2022. Ortega now owns 59% of Inditex.

Aside from his success in the fashion industry, Ortega has also invested in other ventures such as real estate, stocks, and startups. Through his investment company, Pontegadea, he owns properties worth billions of dollars, including the Torre Picasso skyscraper in Madrid, the Haughwout Building in Manhattan, and the Epic Residences and Hotel in Miami, Florida.

The pandemic significantly affected Ortega’s wealth, with a reported $10 billion loss in 2020. The Amancio Ortega Foundation focuses on improving people’s quality of life by supporting education and social welfare initiatives.

What Amancio Ortega invests in

Amancio Ortega’s net worth is diversified in his global real estate and energy investments, moving away from the retail sector as Inditex’s shares face a decline. The majority shareholder of Inditex has also made several high-profile investments in commercial and residential properties.

The business mogul leases land to tech giants and owns office buildings, historic properties, and hotels. Ortega’s impressive property investments are worth millions of dollars and have accumulated over decades.

Now let’s dig into the portfolio of the Spanish entrepreneur and see how he invests all that money.

Stocks, startups, and private equity

Inditex founder Amancio Ortega invests in startups focusing on sustainability and digital transformation. Inditex invested $3.1 billion in its online business in 2020 to develop a proprietary technology platform that enhances the customer experience.

In addition to investing in its own business, Inditex was also part of a 2022 Series B funding round that raised over $30 million for circular textile waste company Circ, which breaks down textile waste to create new materials to replace the need for virgin materials. The fast-fashion giant joining the round marks its first VC investment in a clean technology company as interest in textile recycling grows.

In 2018, Pontegadea acquired 10% of Telxiu—a major telecommunications infrastructure operator—making it the third-largest shareholder of the company at the time behind Telefónica (50.1%) and KKR (40%).

Ortega also invested $17 million in Kering and Conservative International’s Regenerative Fund for Nature joint venture in 2021.

Inditex began preparing for a potential economic downturn in 2022 by increasing production and stockpiling supplies. The company is concerned about potential supply chain issues, rising raw material and production costs, and increased price sensitivity among consumers.

The billionaire entrepreneur has been investing in stocks of various companies such as Redes Energéticas Nacionais (REN), Red Eléctrica de España (REE), Enagas Renovable, and Repsol Wind Farm.

Through his family office Pontegadea Inversiones, Ortega acquired a 12% stake in REN, making him the company’s second-largest shareholder after China State Grid. REN operates electricity and gas transmission grids and a gas distribution network in Portugal.

Ortega also recently bought a 5% stake in REE, the company that manages the energy network in Spain.

Moreover, Pontegadea has invested in Enagas’s renewable and hydrogen unit Enagas Renovable in partnership with Hy24, a joint venture between Ardian and FiveT. Pontegadea owns a 5% stake in Enagas and has bought minority stakes in energy infrastructure companies such as Red Electrica de Espana.

Ortega also invested €245 million in a wind farm operated by Repsol. He holds a 49% stake in the Delta wind farm in northern Spain which boasts a capacity of 335 megawatts.

In addition to energy sector investments, Pontegadea manages a real estate portfolio and holds a 59.29% stake in Inditex, Zara’s parent company. These investments demonstrate Ortega’s dedication to diversifying his portfolio and enhancing his environmental and social responsibility commitments.

Historically, startup investments flourish after economic downturns, as seen in the 12x TVPIs surge between 2010 to 2012 following the Global Financial Crisis. Venture capital investors can expect strong performance three to four years post-downturn, with top quartiles possibly generating 4.0+ TVPIs. Smart investment strategies may lead to attractive returns for investors in 2023.

Real estate

Ortega has grown his real estate portfolio through Pontegadea Inversiones SL, a holding firm he founded in 2001 to consolidate his real estate properties and manage his investments in Spain’s energy infrastructure.

Established to invest the annual million-dollar dividends he receives from Inditex, Ortega has added more assets over the years, transforming Pontegadea into a giant presence in the markets for real estate, energy and telecommunications infrastructure, and renewable energy.

The company’s assets are in Madrid and Barcelona for the most part, with properties on the main business streets of both cities. Pontegadea also owns properties in major European capitals, including Paris, Berlin, Rome, Lisbon, and London.

In December 2022, Pontegadea Inversiones bought a residential skyscraper in Seattle for $323 million. He purchased this property sometime after investing $500 million in a 64-story luxury apartment building in New York City.

In April 2021, the firm also acquired an office building in Glasgow for approximately $237 million and the Royal Bank Plaza in Toronto for $916 million.

At the start of the second quarter of 2021, Pontegadea Inversiones SL had a real estate portfolio valuation of $17.2 billion. Amancio Ortega’s strategic investments in real estate have contributed to his strong portfolio performance and immense riches.

Anticipated home price growth in 2023 is a robust 5.5%, signaling a lucrative return on investment for property mavens. While the market may begin the year on a subdued note, expect an uptick in volume as it progresses, fostering more stability for real estate investments.

Heightened rental property demand is poised to boost investors’ ROI, sweetening the deal and paving the way for a profitable year in real estate.

Cars

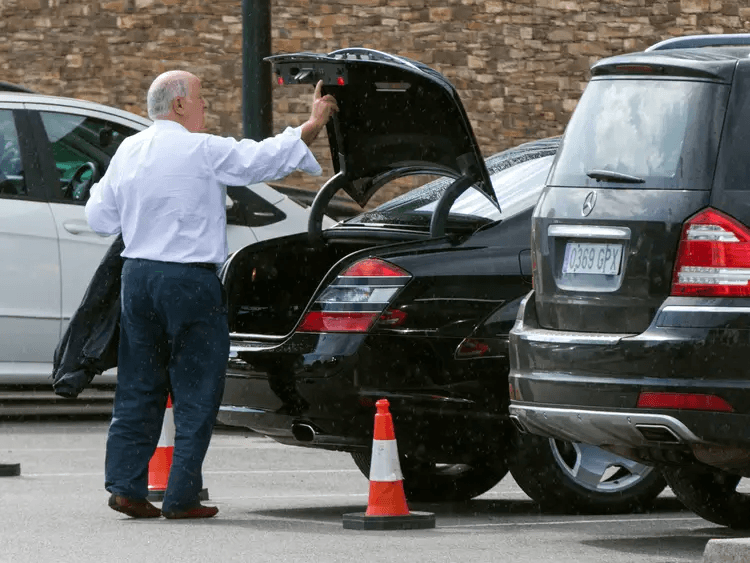

Ortega sure loves his Mercedes-Benz cars. His collection boasts a Mercedes-Benz S Class, a slick GLS, and a powerful E Class with a three-liter V6 engine.

Source: 21motoring

With the S Class priced at $115,000 and the GLS at $89,995, he’s got quite an impressive lineup of luxury rides.

Amancio Ortega investing quotes

1. Build a customer-centric business

2. Self-improvement is a life-long journey

3. Maintain a strong identity