Rich Dudes│Barbara Corcoran’s Net Worth, a Rags-to-Riches Fairy Tale

With a high school transcript full of Ds, Barbara Corcoran didn’t have the makings of a future millionaire. She climbed to the top in New York City real estate and has $100 million to prove it.

Barbara Ann Corcoran is an investor and TV personality known for her work on NBC’s Shark Tank and Millionaire Broker, a show she hosts on CNBC. Worth an estimated $100 million in 2023, Corcoran founded her first successful business in 1973.

Corcoran has invested in apps such as Calm [which] raised $75 million and had a valuation of $2 billion

Her road to riches was unconventional, to say the least. Corcoran grew up in Edgewater, New Jersey, right across from New York City, the second eldest of nine siblings. Far from showing early promise, Corcoran has gone on the record about her dyslexia and lack of academic prowess in her early years. Her high school transcript is full of D’s, and she worked at 22 different jobs before turning 23.

None of these things stopped her from cultivating a successful career in real estate and, later, investments. The famous television personality is now a trusted expert in her field. Today, Corcoran credits her wisdom and good choices to her early failures, hardships, and rejections.

Barbara Corcoran net worth at a glance

| Net worth | $100 million |

| Born | March 10, 1949 |

| Became a millionaire at | 28 |

| Occupations | Television personality, author, and investor |

| Sources of wealth | The Corcoran Group, CNBC’s Shark Tank, public speaking, book royalties, investments |

| Asset classes | Franchises, real estate, stocks, and startups |

How Barbara Corcoran got rich

Real estate mogul and business genius Barbara Corcoran has a net worth that reflects her success. From her initial step into the real estate industry as a broker, Corcoran quickly established herself with a reputation that garnered much attention in the New York real estate market. Using a $1,000 loan from her then-boyfriend, she co-founded the Corcoran Group, a real estate company that became an empire in the industry.

By the time she sold her billion-dollar business to NRT Incorporated, a subsidiary of the National Realty Trust, in 2001, Barbara Corcoran’s net worth had peaked significantly.

Irish American Barbara Corcoran was raised in an Irish Catholic household in Edgewater, New Jersey. After high school, Barbara Corcoran graduated from St. Thomas Aquinas College in 1971 with a degree in education. Barbara demonstrated her business acumen early on by turning a $1,000 loan into the successful Corcoran Group real estate firm.

Barbara Corcoran became a millionaire broker, making headlines in the New York Daily News and other outlets. Following her success as a broker, she became a Shark on the hit TV show Shark Tank alongside fellow entrepreneurs, including Kevin O’Leary and Kevin Harrington.

Barbara Corcoran has established an aptitude for spotting future trends throughout her career. She shared knowledge gained from her real estate career through her annual Corcoran Report on the New York real estate market, and her expertise in turning dying businesses around was showcased in her Corcoran Simone television series. She reshaped and redefined her portfolio to further increase her net worth.

Barbara Corcoran’s personal life has also been a source of public interest. Her marriage to Bill Higgins, a retired Navy captain, former FBI agent, and their children help humanize this industry titan. Despite personal challenges like ending her relationship with business partner Ray Simone (Corcoran Simone), Barbara has always bounced back. This resilience is detailed in her book Shark Tales.

Even in her downtime, Barbara Corcoran managed to increase her net worth. She engaged in various business ventures, from investing in Calm to advising homebuyers on how they should react to soaring home prices.

Source: corcoran.com

Despite the occasional failure, such as Bee-Free Honee, Barbara has consistently achieved success with her investments in Daisy Cakes, Pork Barrel BBQ, and Cousins Maine Lobster, culminating in headline-making profits.

Those searching ”Barbara Corcoran net worth” may be surprised that the figure is around $100 million. And with an ongoing role on Shark Tank, the businesswoman’s fortune is set to continue to soar.

This analysis of Barbara Corcoran’s net worth details her impressive list of assets and successful business that solidifies her place in the pantheon of entrepreneurs. Whether it’s on her podcast “Business Unusual with Barbara” or through her real estate firm, this self-made millionaire broker with Barbara Corcoran is still a power broker in the real estate sector.

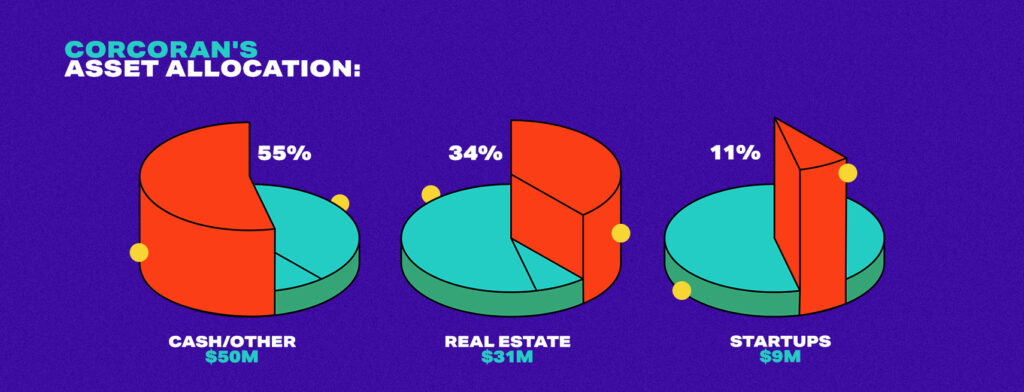

How does Barbara Corcoran invest?

Corcoran’s first major source of wealth was her brokerage film. She sold the Group for $66 million in 2001 and benefitted from NRTs staff of 38,000 brokers when this sale was finalized. She owned about half the company, and an estimated tax impact of 50% puts her net profits at $16.6 million. That’s a pretty good return on a $1,000 investment.

She also co-founded Barbara Corcoran Forefront Venture Partners. Its investment portfolio includes apps and businesses such as Calm, Boundless, and Social Rewards. While not everything on her investment portfolio is public, many of Corcoran’s investment wins (and misses) are on television for the world to see.

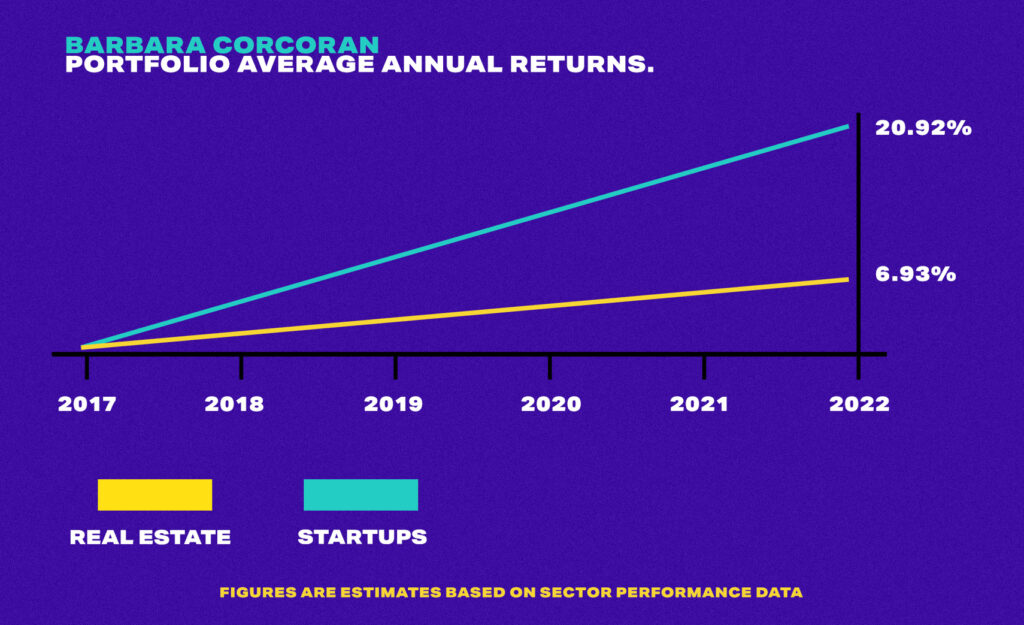

Startups

Corcoran has invested in apps such as Calm, Paycom, Bring Me That, and Inkshares. These are all innovative in their fields and solve problems their competitors don’t address. Not all these investments are flashy, but they don’t all have to be.

In December 2020, TechCrunch reported that the Calm app raised $75 million and had a valuation of $2 billion. Not all apps announce IPOs, let alone become a billion-dollar business, but this sets Corcoran up to benefit should Calm decide to take this step.

Real estate

Real estate is Corcoran’s bread and butter. As a broker, Corcoran’s expertise continues to be sought after in the real estate market. In March 2022, Corcoran advised homebuyers on how they should react to soaring home prices. She correctly surmised that increasing rents were creating a more competitive market for homebuyers, and potential rate increases would only affect potential buyers.

Corcoran has also invested in businesses such as AptDeco (that lets people buy and sell used furniture), NoiseAware, Movr, Remoov, and All The Rooms. All these companies are tied to renters, ensuring comfortable noise levels, moving, and short-term rental price assessments. While she has gone on the record about being slightly down on her Zillow investment, it isn’t as clear what personal properties Corcoran owns.

Food and restaurant industry

On top of startups and real estate investments, some of Corcoran’s assets are in the food and restaurant industry. Not all of these projects succeeded. For instance, Bee-Free Honee was an innovative mock honey created especially for vegans and people with honey allergies. Though the company had great reviews, it formally shut down in 2019.

Other investments Corcoran made in the food and beverage industry were able to meet or exceed expectations, such as Cousins Maine Lobster, Pork Barrel BBQ brand, and Daisy Cakes.

First, Corcoran invested in Daisy Cakes and had a 25% share in the online cake ordering and delivery service worth around $300,000 today. Second, Corcoran owns 50% of Pork Barrel BBQ, a barbeque restaurant with average annual revenue of $122,000. Since the company is worth around $300,000, her share is worth about $125,000—a 250% return on a $50,000 investment.

Source: CNBC/Cousins Maine Lobser

Finally, Corcoran’s investment in Cousins Maine Lobster, a nationwide lobster food truck business, is her best performing one in the food industry. She has a 15% share in the $20 million company, making her stake worth $3 million. That makes her share worth more than 50x her initial $55,000 investment.

Barbara Corcoran’s portfolio returns

Corcoran doesn’t publicize everything about her investments, revenue, or other activities. This is an estimate of Corcoran’s portfolio returns based on public data.

Invest like Barbara Corcoran

Corcoran’s street smarts, emotional intelligence, and risk tolerance are key to her success. Now a wealthy TV personality, growing up in poverty taught her to value potential along with a willingness to prove oneself.

These days, it’s easier to start small as an investor before going big. Success in real estate requires hard work, ambitions, and an uninhibited entrepreneurial attitude. It took Barbara Corcoran years to cultivate the things that made her a millionaire, but there are steps you can take today to get closer to the finish line.

Barbara Corcoran investing quotes

Here are some of her strategies for making smart investments and having a sustainable business.

1. Teamwork makes the dream work

Corcoran told Farnoosh Tarabi that most successful companies she’s invested in are run by two people. This includes food truck Cousins Maine Lobster, Pipsnacks, and Daisy Cake, to name a few.

2. Focus on solutions, not complaints

Even the best investors and business people make mistakes, so it’s important to think on your feet and take failures in stride. As she grew her empire in the early days, Corcoran devised a way to figure out whether potential employees might be complainers. She also weeds complainers out of her portfolio and puts her energy into mentoring and investing in ambitious people.

3. Don’t waste time worrying

Stress never leads businesses to success, so there’s no time to waste worrying about trivial matters. Don’t be proeccupied with what’s going wrong. Your energy is better spent solving problems and overcoming obstacles.

4. Be patient

In 2014, Corcoran told Business Insider that it took four years to finally profit from her first investments in the Tank. That’s how long it can take to turn great ideas into a profitable long-term business. She also admitted that she only generated profits on her very first investments in her fourth year on the show. Don’t be afraid to invest early and wait a few years.

5. Know when and how to take risks

Risk-taking gets a bad rap, but it can pay off if you learn from any mistakes you learn along the way. Corcoran wasn’t initially hired to be a cast member on Shark Tank, but an email to the producer persuaded the show to hire her. Another example of her risk-taking? Corcoran has invested in businesses, ventures, and strategies that didn’t always pan out. These include a failed marketing campaign that cost her an estimated $70,000.

Frequently asked questions

What is Barbara Corcoran’s net worth?

Barbara Corcoran’s net worth is $100 million. She made most of it from selling her real estate company for $66 million.

What is Barbara Corcoran’s Shark Tank salary?

Members of Shark Tank are paid approximately $50,000 per episode. Cast members invest their own money once they commit to signing off on a pitch. Corcoran also charges approximately $70,000 for speaking engagements and is an author.

What is Corcoran’s most successful Shark Tank investment?

Corcoran told MarketWatch that her best investment thus far has been The Comfy. She explained that none of the other cast members wanted to invest in the idea. However, she saw something special and invested $50,000. The Comfy is now worth $30 million.