Rich Dudes│How The 2nd Richest Shark Kevin O’Leary Grows His $400M Net Worth

Kevin O’Leary is a Canadian businessman, investor, and television personality with a net worth of $400 million from ventures like SoftKey and Shark Tank.

Terence Thomas Kevin O’Leary, AKA Mr. Wonderful, the razor-sharp Canadian businessman, investor, and TV celebrity, boasts a $400 million net worth. You’ve seen him cutting deals, and egos, on ABC’s Shark Tank and CBC’s Dragon’s Den, proving he’s as skillful an entrepreneur off-screen as he is on.

Kevin O’Leary is primarily known for being a venture capitalist on ABC’s Shark Tank, but he actually invests in a variety of assets beyond startups.

So, how did Mr. Wonderful grow his fortune from zero to hero? At 45, he hit the jackpot when he sold his software company, SoftKey (later The Learning Company), to Mattel for $4.2 billion, making him a multi-millionaire overnight.

Curious how Kevin O’Leary turned those millions into nearly half a billion? Let’s delve into his awe-inspiring investment portfolio, relishing his greatest triumphs (and fumbles), while revealing the core principles Mr. Wonderful employed to skyrocket his wealth over the decades.

Kevin O’Leary net worth at a glance:

| Net worth | $400 million |

| Born | July 9, 1954 |

| Nationality | Canadian born in Montreal, Quebec, Canada |

| Became a millionaire at | 45 |

| Occupations | Businessman, investor, and TV personality |

| Sources of wealth | The Learning Company, O’Leary Funds, and Shark Tank deals |

| Asset classes | ETFs, startups, crypto, gold, cars, real estate and collectibles |

How Kevin O’Leary made his money

Kevin O’Leary, born Terence Thomas Kevin O’Leary in 1954 in Montreal, Quebec, drew great inspiration for his business career and investment strategies from his mother, Georgette. In his personal life, Kevin is married to Linda and they have two children together.

Georgette would often set aside 20% of her paycheck into a portfolio of large-cap stocks and Telco bonds, something that O’Leary later did in his own investment portfolio. Her other smart money moves include keeping a secret bank account from both her husbands and buying classic Chanel jackets that are worth considerably more today.

Education

Initially, Kevin O’Leary dreamed of becoming a photographer and rockstar. However, following his stepfather’s guidance, he pursued higher education. He earned a Bachelor’s in environmental studies and psychology from the University of Waterloo in 1977, and an MBA from Ivey Business School at the University of Western Ontario in 1980.

The Learning Company

Kevin O’Leary skyrocketed to entrepreneurial fame in 1986 by co-founding SoftKey with business partners John Freeman and Gary Babcock. The educational software company SoftKey later became The Learning Company.

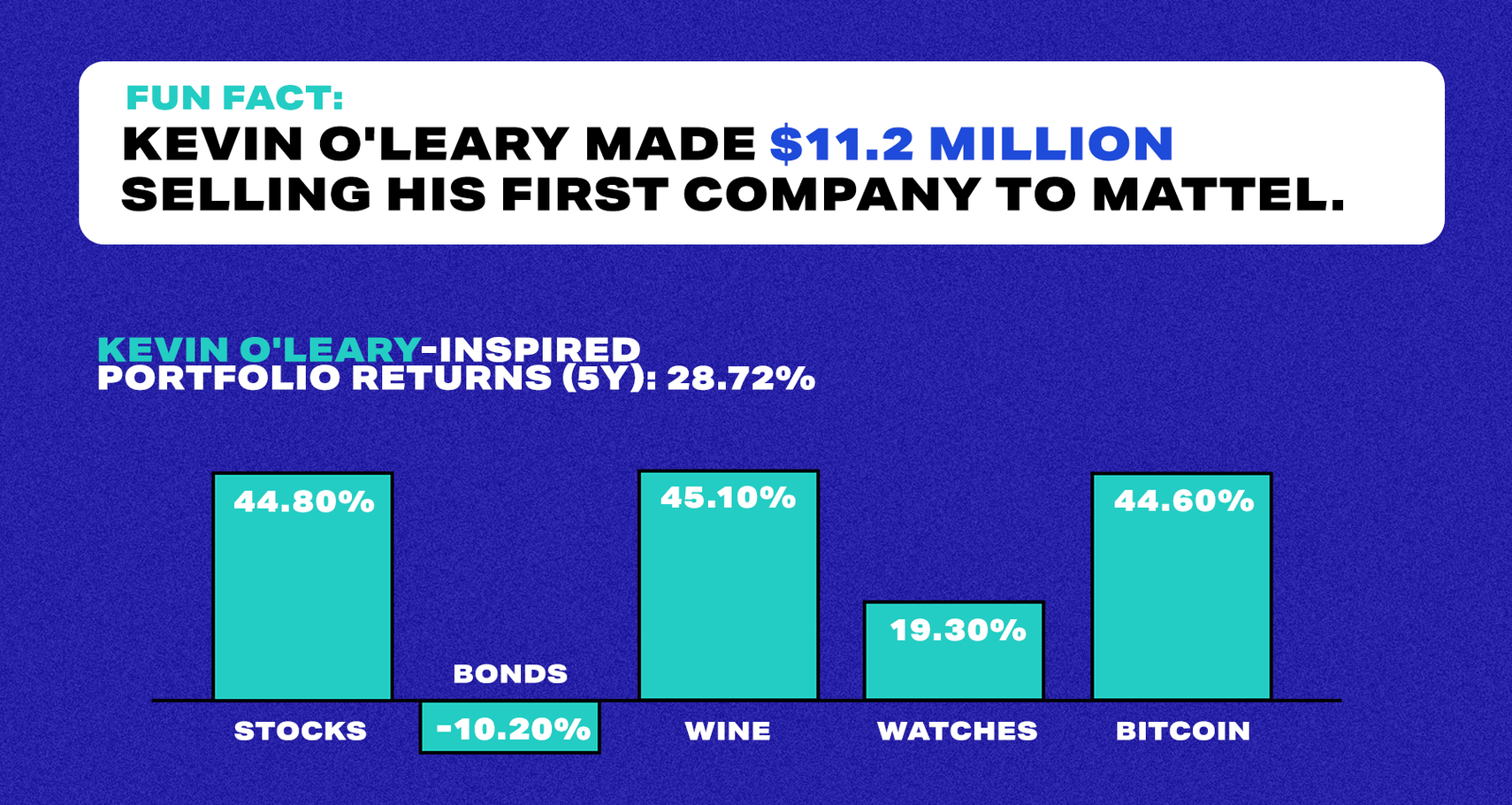

When Mattel acquired the company in 1999 for an eye-popping $4.2 billion, O’Leary pocketed a handsome $11.2 million, sealing his reputation as a top-tier businessman.

Source: @KevinOleary

O’Leary’s business prowess led him to create the O’Leary Fund, focusing on global yield investing, proving his ongoing success. His keen investment instincts solidify his global business standing.

Some of his other career highlights include:

- Investing in StorageNow, a self-storage company that was later sold for $110 million.

- Having a stake in Vintage Wine Estates—a top U.S. wine producer that sells over 2 million cases of wine annually.

- Investing $8.5 million across 40 Shark Tank deals.

- Founding O’Shares Investments, a mutual fund with $1.5 billion in assets under management as of 2022.

How Kevin O’Leary invests

Kevin O’Leary is primarily known for being a venture capitalist on ABC’s Shark Tank, but he actually invests in a variety of assets beyond startups. While we don’t know the exact composition of his $400 million portfolio, we can break down much of Kevin O’Leary’s personal wealth based on the information he’s shared.

Source: Shark Tank/NBC

Mr. Wonderful is known for his strong belief in diversification. He invests no more than 5% in one name and no more than 20% in one sector. That’s a principle he says he applies to all assets, whether that’s stocks, crypto, gold, or collectibles. No wonder the bulk of Kevin O’Leary’s net worth is in diversified ETFs.

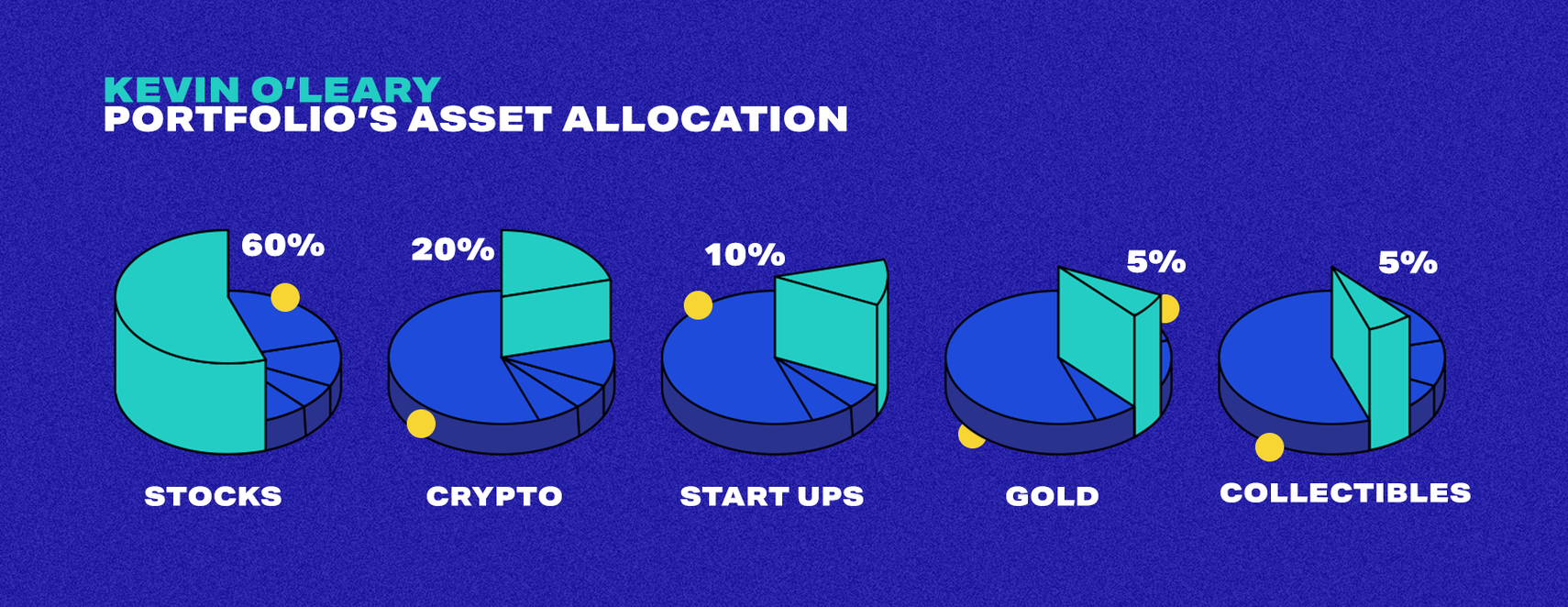

The Shark Tank investor has naturally invested in numerous startups, plus holds about 20% of his portfolio in crypto and 5% in gold.

We also know that he’s invested $8.5 million in Shark Tank deals and is an investor in other companies like StartEngine, O’Shares Investments, and Vintage Wine Estates—which also produces his wine label, O’Leary Wines.

Finally, he has several investments in collectibles like watches, guitars, cameras, and even NFTs, although he isn’t as upfront about these collections as he is about the rest of his investment portfolio.

Stocks

Kevin O’Leary is the chairman of O’Shares Investments (originally called O’Leary Funds), which focuses on balanced investments that are designed to preserve and grow wealth. If we go by the companies in O’Leary’s O’Shares U.S. Quality Dividend Index (OUSAX), we can get a sense of the types of companies that O’Leary might hold in his own portfolio.

Source: Kevin O’Leary’s Twitter

With over 100 companies in the index, it certainly fits Kevin O’Leary’s first investing principle—diversification. If you look at the top 10 holdings, you’ll see they’re all under 5% (except Home Depot, which is just above 5%). That fits with O’Leary’s belief that you should never invest more than 5% in any one company or name.

O’Shares also has two other indexes—O’Shares Global Internet Giants Index (OUSMX) and O’Share U.S. Small-Cap Quality Dividend Index (OGIGX). If we assume that Kevin O’Leary holds 20% in each index, then that means he holds 60% of his investment portfolio in stocks (though this isn’t necessarily true of his personal stock portfolio).

Crypto

Mr. Wonderful wasn’t always a fan of crypto, but over the years, he has grown to become one of its biggest advocates—slowly increasing his crypto portfolio to 32 positions and 20% of his net worth. We can also assume that Kevin O’Leary holds a 3-5% max position for each crypto.

While we don’t know every coin he holds, or if he’s sold any positions recently, he has confirmed owning the following cryptos:

Collectibles: watches, cameras, and guitars

Mr. Wonderful, has a keen interest in alternative investments, particularly collectibles like luxury watches, vintage cameras, and classic guitars and wait for it: Dinosaurs. Remember his emotion-filled TikTok video of him purchasing a six-figure Audemars Piguet Royal Oak watch?

O’Leary’s investments span across stocks, crypto, and startups, but he believes collectibles hold value as part of his investment strategy. Due to past robberies, he keeps his collection’s size under wraps. However, he includes brands like Rolex, F.P. Journe, and Omega.

Although we can’t pinpoint the exact percentage of his net worth attributed to collectibles, a rough estimate would be 20% or less. More than just assets, O’Leary’s passion for watches, guitars, and cameras showcases his dedication to diversifying his portfolio while enjoying the finer things in life. Who wouldn’t want to grow their wealth and have fun doing it?

Mr. Wonderful’s watch collection features luxury brands like Audemars Piguet, Rolex, and Patek Philippe. He particularly appreciates unique pieces, like the Patek Philippe 5711 and the Audemars Piguet Royal Oak Openworked Chronograph with a ruby-cut bezel. Additionally, the iconic diamond-encrusted Rolex Daytona “Eye of the Tiger” makes quite a statement.

Kevin’s watch-collecting strategy is guided by seven principles: interesting stories, steady value, and rarity. Did you know that O’Leary cycles through three different watches daily? He even has them shipped ahead to his travel destinations.

His collection, worth several hundred thousand dollars, showcases Mr. Wonderful’s impressive watch game, ranging from iconic status symbols to rare gems. Surely, his wrist feels truly special.

Source: Wrist Enthusiast

O’Leary’s watch portfolio ticks all the right boxes. Boasting a 113% gain in just 18 months, he clearly has an eye for valuable wrist candy. Chrono24, an AI-powered app, keeps this watch connoisseur updated on his collection’s worth in real-time.

Perhaps the most jaw-dropping of O’Leary’s interests is his desire to invest in a dinosaur. Inspired by Stan, the dino recently fetched $31.8 million, O’Leary aims to buy his own Mr. Wonderful T-Rex. His plan? To educate kids about financial literacy through their love for these prehistoric creatures. Museum tours and media company partnerships are expanding for this enterprising investor. Now that’s a roar-some investment strategy.

Books

O’Leary, an eloquent wordsmith, has penned several personal finance books, including the chart-topping Cold Hard Truth series. These literary masterpieces tackle burning topics like investment rules, financial harmony in marriage, curbing kid-spending insanity, and managing assets throughout life’s stages.

Source: skylineuniversity

Kevin O’Leary’s business and personal finance finesse has not only propelled him to entrepreneurial success but also rendered him a go-to guru for financial wisdom seekers.

Cars

Despite Mr. Wonderful’s outspoken disdain for cars, he appreciates the finer things in life, including owning a few luxury automobiles. Sometimes, exceptions can be made for high-end, limited-production vehicles that may appreciate due to their specialized nature and rarity.

Nevertheless, Kevin O’Leary’s core advice to avoid cars as investments remain relevant for most mainstream cars. It’s a classic case of “do as I say, not as I do”—though his luxury indulgences might contradict his typical mantra, it’s worth remembering that even Mr. Wonderful can make room for a little extravagance.

O’Leary enjoys the luxury of a Rolls-Royce Phantom VIII. This top-tier saloon car boasts heaps of features and comfort, powered by a 6.75-liter V12 engine. With the ability to generate 563 horsepower and 900 Nm of torque, it’s no wonder the starting price for this beauty is $460,000.

Kevin’s Mercedes-Maybach S680 parked in his garage is worth around $200,000 and comes with a 6.0-liter turbocharged V12 that churns out 523 horsepower and 830 Nm of torque. As you’d expect, the Maybach has no shortage of indulgent features, including 16-seat massagers, heated and cooled cupholders, a 64-color ambient lighting system, and a panoramic sunroof.

Overall, it’s safe to say Mr. Wonderful has quite an impressive car collection that nicely complements his successful business ventures and investments.

Real estate

Kevin O’Leary, Shark Tank star, possesses stunning properties, including a $17.6 million Lake Joseph mansion with picturesque views and a warm boathouse. He also owns splendid homes in Toronto, Boston, and Geneva.

For potential homeowners, O’Leary advises ensuring mortgage affordability even during job loss and not spending more than one-third of your after-tax salary on payments. He foresees a commercial real estate correction but remains confident. Mr. Wonderful promotes technology investment for modernized workspaces in a changing work landscape.

Kevin O’Leary investing quotes

Kevin O’Leary credits his business intuition to his mother, who encouraged his interest in money at a young age. Here are the top investing principles guiding The Shark with the Sharpest Teeth:

1. Diversify your portfolio

If there’s one lesson Kevin O’Leary often repeats, it’s to diversify. Diversification is key to the businessman’s investment portfolio. And not just with how he invests in stocks, either. O’Leary applies the same principles across all his portfolios, whether they are traditional, like stocks and real estate, or alternative assets like collectibles.

One of the toughest collectibles to break into is luxury watches. Prices for brands like Rolex and AP have soared in recent years, making them virtually unattainable for small investors without breaking the bank. For instance, the price of an AP Royal Oak A-Series “Jumbo” with a black dial ranged from $25,000 to $60,000 in 2018 but goes for upwards of $120K today.

2. Apply the 5-20 rule

Kevin O’Leary has a strict rule of investing no more than 5% in one position and never more than 20% in one sector. That’s why he has capped his crypto investments at 20% and only invests 5% of his wealth in gold. However, it’s hard to follow this rule with real estate, considering that a nice house costs most investors an arm and a leg.

3. Take calculated risks

Although Kevin O’Leary invests most of his money in indexes, he also doesn’t shy away from riskier investments. But he makes sure they’re calculated risks, meaning he does his research and never invests more than he can handle losing.

It’s not uncommon for him to start with a small sum and slowly increase his holdings as he sees how it performs, which is how he approached investing in crypto.

Investing in web3 can be tricky—not only is crypto super complicated, but you also take on a lot of risks by investing in an industry with such a short track record. That’s why investing in companies that have already proven valuable might be safer.

4. Learn from your mistakes

Mr. Wonderful doesn’t get it right every time. Sometimes he makes money, and sometimes he loses money. And sometimes, he just makes mistakes, like his exposure to the now-condemned crypto exchange FTX. But the important thing he says is to learn from mistakes, so you don’t make the same one twice.

In a nutshell, Kevin O’Leary’s juicy $400 million net worth is the fruit of his relentless entrepreneurship, charismatic TV presence, and razor-sharp investing instincts. Hailing from humble beginnings as Terence Thomas Kevin O’Leary, he’s transformed into a true financial titan, thanks to Mama Wonderful’s money know-how and his own Ivey Business School finesse.

Despite a few storms along the way, Mr. Wonderful keeps cruising – making bank from diverse investments like high-growth startups, drool-worthy collectibles, prime real estate, shiny autos, and even dinosaur-fueled dreams. Kevin O’Leary’s wealth is a testament to his unwavering commitment to strategic investing, diversification, and an appetite for calculated risks.

So, fellow wealth seekers, take notes from the man, the myth, the legend—because if you want to swim with the sharks, diving into O’Leary’s pearls of wisdom is a great place to start!