Rich Dudes│How Barry Sternlicht Made His $4.3B Fortune In Real Estate and Hotels

Barry Sternlicht’s $4.3 billion net worth has a captivating story behind it. Learn how his focus on real estate and the hospitality industry propelled him to billionaire status.

Barry Sternlicht is a renowned American billionaire and an influential figure in the world of real estate and investment. As the co-founder, chairman, and Chief Executive Officer of Starwood Capital and Starwood Property Trust, Sternlicht has built a highly successful career and amassed a considerable fortune.

Under Sternlicht’s leadership, the firm has managed to accumulate over $60 billion in assets.

With over $38 billion in assets under management, including the publicly listed Starwood Property Trust, Sternlicht’s successful career has made him an impressive fortune for Sternlicht.

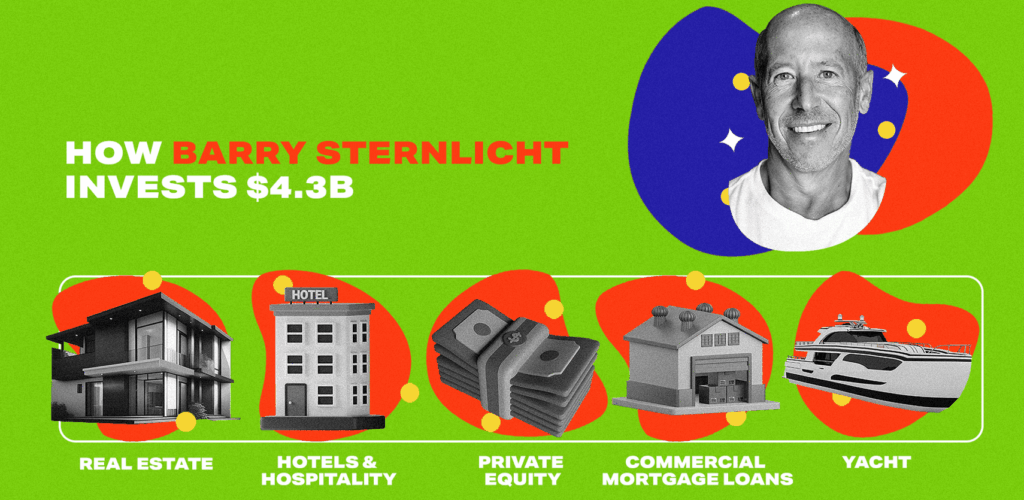

Barry Sternlicht net worth at a glance

| Net worth | $4.3 billion |

| Born | November 27, 1960 |

| Nationality | American born in New York City, New York |

| Became a millionaire at | 32 |

| Occupations | Real estate investor and entrepreneur, co-founder, chairman, and CEO of Starwood Capital Group and Starwood Property Trust |

| Sources of wealth | Starwood Capital Group, Starwood Property Trust, W Hotels, 1 Hotels & Homes, Baccarat Hotel, and Treehouse |

| Asset classes | Real estate, hotels & hospitality, private equity investments, and commercial mortgage loans |

Who is Barry Sternlicht?

Sternlicht was born in New York City in 1960 and grew up in Stamford, Connecticut, with a father who was a Holocaust survivor from Poland and held a position as a plant manager, and a mother from New York with Russian immigrant parents, working as a stockbroker.

After graduating magna cum laude with honors from Brown University in 1982, Sternlicht began his career as an arbitrage trader on Wall Street. He later got his MBA from Harvard Business School before landing his first gig in real estate at Chicago-based JMB Realty.

He became known for founding the W hotel chain and for sponsoring five SPACs since 2020, including one which took senior care provider Cano Health public in June 2021. In 2004, Institutional Investor Magazine honored Barry Sternlicht as “America’s Best Lodging CEO.”

Sternlicht also holds positions on the board of directors for various organizations, including the Estée Lauder Companies, Baccarat Crystal, Robin Hood Foundation, Dreamland Community Theatre, the Juvenile Diabetes Research Foundation’s National Leadership Advocacy Program, and the Business Committee for the Arts.

Earlier, he served on the boards of directors for the Pension Real Estate Association and the Real Estate Roundtable and was a trustee of his alma mater, Brown University. Barry Sternlicht wife ‘s name is Mimi Riechert and they share three children.

Sternlicht is known for his intense and impetuous style and serves as the chairman of SH Group, a company he founded to create innovative luxury and lifestyle brands for hotels and residential developments.

The 1 Hotels brand embodies the principle that we are all part of one world, highlighting the ethical responsibility we share with each other and our environment.

How Barry Sternlicht made his money

Barry Sternlicht’s wealth is primarily attributed to his real estate investments and his role as CEO of Starwood Capital Group and Starwood Property Trust Inc (formerly Hotel Investors Trust).

His keen eye for lucrative investment opportunities, combined with a strong business acumen and strategic approach, has allowed Sternlicht to create and manage successful ventures across multiple areas within the real estate sector.

Ultimately, his real estate investment in apartment buildings and hotel brands made his estimated net worth $4.3 billion.

Real estate investment company

One of the key drivers behind Sternlicht’s success is his ability to establish and build successful real estate investment companies. These companies, spearheaded by Starwood Capital Group, secure valuable property acquisitions, facilitate financing, and manage various commercial and residential assets.

By effectively leveraging a wide range of investment strategies, Sternlicht has been able to identify and capitalize on profitable moments in the ever-changing real estate market.

Private equity

At the heart of Sternlicht’s success is his involvement in private equity, where he has focused on numerous high-value real estate transactions through Starwood Capital Group. Sternlicht became Chairman and Chief Executive Officer of Starwood Capital after stepping down as CEO of Starwood Hotels in 2004.

Sternlicht founded Starwood Capital in 1991 to buy apartment buildings that were being liquidated by the federal government due to the savings and loans crisis. With over $120 billion in assets passing through the investment firm, Starwood Capital Group ranks among the world’s top real estate investors.

The investment firm has since developed into a global powerhouse, boasting expansive portfolios that encompass residential units, hotels, retail outlets, office spaces, and land development projects. Sternlicht’s work as chief executive officer of the firm has solidly bolstered his net worth.

Starwood Capital Group

Founded in 1991, Starwood Capital Group is a private equity firm primarily focused on real estate investments. Under Sternlicht’s leadership, the firm has managed billions of dollars in assets.

Starwood Capital Group’s diverse portfolio includes residential units, hotels, office spaces, retail outlets, and land development projects. By successfully navigating the volatile real estate market, the company has established itself as a global powerhouse in the industry.

Sternlicht has played a pivotal role in both the founding and growth of other impressive ventures, including the W hotel chain and Starwood Property Trust, one of the largest mortgage REITs. As the chairman and CEO of SH Group, Barry established innovative luxury and lifestyle brands dedicated to hotels and residential developments such as 1 Hotels & Homes, Treehouse, and Baccarat.

Apart from his entrepreneurial endeavors, Sternlicht is actively involved in philanthropic organizations, including the Robin Hood Foundation, Dreamland Community Theatre, and the Juvenile Diabetes Research Foundation’s National Leadership Advocacy Program.

In addition to its impressive portfolio, Starwood Capital takes pride in being a carbon-neutral entity. Operating with a focus on sustainability, the firm has implemented energy-efficient practices within its offices and invested in renewable energy projects.

Starwood Capital’s partnership with organizations such as The Nature Conservancy further demonstrates its dedication to promoting conservation efforts and resource protection, solidifying its commitment to responsible investing and sustainability.

Private equity is a popular investment for high-net-worth individuals and institutional investors and it stands out as an alternative asset class that offers potentially high returns. Private equity firms acquire funds through raising or borrowing capital to hold an equity ownership position in smaller companies with significant growth potential.

Over a 20-year period ending on June 30, 2020, private equity managed to produce an average annual return of 10.48%, outpacing both the Russell 2000 and the S&P 500. However, it is crucial to recognize that success in private equity markets, especially across different time frames, requires a high degree of risk tolerance and the ability to handle considerable illiquidity.

Real estate

At the core of Sternlicht’s impressive portfolio is real estate. His extensive experience and knowledge of the property market have allowed him to take advantage of numerous opportunities, fueling his meteoric rise in the realm of investments.

Starwood Property Trust

As the chairman of Starwood Property Trust, one of the largest mortgage REITs in the United States, Sternlicht oversees the management of commercial mortgage loans and other commercial real estate assets. The impressive track record of Starwood Property Trust has solidified Sternlicht’s status as a leading commercial property executive.

With over $37 billion in capital deployed since its inception, Starwood Property Trust is the largest commercial mortgage REIT in the U.S. and operates as the largest commercial mortgage special servicer in the U.S. through its subsidiary, LNR Property, LLC. The company’s core business focuses on spreads and risk management, encompassing the combination of yield on its investments alongside debt interest expenses and equity costs.

Barry Sternlicht holds at least 1,425,494 units of Starwood Property Trust Inc stock, valued at more than $25 million. Over the past 19 years, he has sold stock totaling over $313 million and currently earns $4.55 million as the company’s chairman and CEO. Sternlicht’s largest trade occurred on March 22, 2017, when he sold stock worth over $152 million.

Publicly traded REITs provide a viable way to include real estate in one’s investment portfolio, potentially offering higher dividends than other stocks. Nevertheless, it is important to understand the differences between publicly traded and non-traded REITs and consider the potential risks and benefits associated with investing in REITs.

Hotels

The hotel industry has also played a significant role in Sternlicht’s wealth accumulation. He is credited with establishing iconic hotel brands such as W Hotels, 1 Hotels & Homes, Treehouse, and the Baccarat Hotel. Through innovative branding, sophisticated design, and luxury services, Sternlicht successfully redefined the hospitality industry.

Barry Sternlicht joined Starwood Hotels in 1995 and reorganized it from a real estate investment trust to a private equity firm. Under Sternlicht’s leadership, the company acquired resorts brands and hotels such as the Westin Hotel Company and the Sheraton Hotels.

In September 2016, Marriott International acquired Starwood Hotels and Resorts in a groundbreaking $13 billion deal, establishing the largest global hotel company consisting of 30 brands and more than 5,700 hotels at that time. But Barry was no longer involved by then, having left in 2005 to pivot his focus onto Starwood Capital.

Investing in hotels can be a profitable opportunity for investors aiming to diversify their portfolios and generate passive income. Hotels offer adaptability and potential for revenue growth through renovations and operations while providing endless possibilities to increase property value with upgraded amenities, renovated rooms, and wow factors.

Despite economic dependencies, competition, and location risks, hotel investments can serve as a smart choice for those seeking diversification and passive income, particularly during times of economic uncertainty.

As the world reopens, the hotel industry’s ability to adapt to challenges and increased bookings prompts a promising outlook for investors in hotel properties.

Barry Sternlicht’s impressive wealth accumulation can be attributed to his strategic focus on real estate and the hotel industry. His leadership at Starwood Property Trust and his innovation in the hospitality sector have solidified his status as a prominent property developer and investor in luxury hotels and resorts worldwide.

Yacht

Barry Sternlicht owns a 189-foot yacht named Halo, which was built by Feadship in 2015. The yacht features designs by Harrison Eidsgaard and interiors by Bernardi + Peschard.

Source: superyachtfan.com

Halo is valued at $60 million and can accommodate 12 guests in six cabins and has a crew of 14. It has a top speed of 16 knots with its two MTU engines.

Barry Sternlicht investing quotes

Barry Sternlicht’s net worth and achievements are a testament to his keen investment strategies, ambitious attitude, and exceptional business acumen. His success in various sectors of the property market, ranging from private equity to hospitality, showcases the power of determination, innovation, and strategic thinking.

Sternlicht’s success in the investment world can be attributed to a combination of factors, including risk-taking, a strategic mindset, and a relentless drive for success.

Sternlicht’s story serves as an inspiration for aspiring investors and entrepreneurs to pursue their dreams and take calculated risks.

1. Create a positive feedback loop

2. Acknowledge your environmental impact

3. Get the most bang for your buck