Is Investing in Rental Properties Right for You?

Investing in rental properties is appealing because of the potential appreciation plus rental earnings, but this income is usually far from passive.

Real estate investing is a tried-and-true way to diversify your portfolio, hedge against inflation, and build wealth over time. Whether you purchase a property on your own or invest in a REIT or eREIT, putting money into real estate can help you shelter your portfolio from a storm.

If you love the idea of investing in rental properties but don’t want the hassle and large expense, then there are plenty of ways you can gain exposure.

Purchasing your own home is a common method of real estate investment that earns you money through appreciation of the property’s value. But investing in rental properties opens up a second avenue for earnings: rental income.

If compounding interest is the 8th wonder of the world, using someone else’s rental payment to pay for your property has got to be the first. Move over, pyramids. Rental properties are the next big thing.

Investing in rental properties for beginners

Now that we’re in the post-lockdown, I-don’t-want-a-roommate-anymore economy, occupancy rates are up, and rental properties as investments are looking more attractive than ever.

Rental property investing is appealing because you can leverage a 20% down payment into an appreciating asset that someone else pays off for you. If you can find the right property and location and manage it well, you might enjoy a healthy ROI as your property value appreciates over time. But there are risks, as there are with any investment, and returns aren’t guaranteed.

Pros and cons

| Pros | Cons |

| Cash flow | High vacancy |

| Tax benefits | Costly maintenance |

| Property value appreciation | No guaranteed income |

| Control over investment | Landlord responsibilities |

Real-estate investors have enjoyed positive returns even in the face of the S&P 500’s bearishness in 2022. And if you’re renting out a property, there’s a good chance you raised your rates, as the average rent on single-family homes rose an astounding 13% in the first half of 2022.

Investing in rental properties for beginners is easier than ever with real-estate apps and platforms like Arrived Homes and HoneyBricks. Both of these allow real-estate investors to collect passive income with professionally managed rental properties.

There’s more to it than gathering returns and roses, of course. Investing in rental property usually requires research, preparation, and due diligence to ensure that your investment pays off.

Finding the best rental property investment

There’s no guarantee that investing in rental properties will yield the returns you’re dreaming of. But we put together some best practices to help you choose the right investment property for your portfolio.

Here’s what to look for in a good rental property:

- Growing demand. Find a neighborhood where prices appreciate faster than the national average.

- Easy access. It can be an added challenge to manage a property if you aren’t around to check in on it.

- Low crime. The risk of break-ins and vandalism stresses you and your tenants and costs you more in vacancy rates and insurance premiums.

- The right price. If times get tough, be certain that you can still cover your normal expenses.

- The 1% rule. If you can’t charge at least 1% of the purchase price in monthly rent, it’s unlikely you’ll make money on the deal.

- A good match. Know what you’ll do with the investment property before buying it.

Tips for investing in rental properties

Despite the fancy title, being a landlord is more than lounging on your throne and expanding your cape wardrobe. Actually, it’s none of that at all. So before you commit to purchasing a rental property, be sure you’re making the best moves for a profitable and manageable experience.

1. Remember that it’s not passive income

Property management takes work. Whether you’re renting out a house or a strip mall, your tenant relies on that property to stay functional and safe. Unless you hire a management company, a 3 a.m. call about a burst pipe is coming to a phone near you.

There’s also a person at the other end of this transaction and a complicated system of rights and laws you must follow. Property management can get messy.

2. Set prices wisely

When deciding on rental rates, you must consider the purchasing costs, property insurance, management-company fees, utilities you may cover, maintenance, costs of finding new tenants, landscaping, taxes, your time and travel, and so on.

The rental market is a cash-flow game. But the rent you set has to be in line with similar properties in the area, or you’ll struggle to fill your vacancies.

3. Factor in vacancy

Don’t forget that your rental units won’t always be occupied. Always remember that the real-estate market can change quickly, and vacancies can last longer than expected.

4. Consider the costs

When you’re buying a rental property, the down payment is just the beginning. Income-producing properties need ongoing investment and upkeep. There are also the costs of hiring a local property manager, especially if you have a vacation rental and your primary residence is not close by.

How to invest in rental properties

Investing in real estate requires a ton of research on different cities, neighborhoods, and individual properties. Talking to other local property owners, creating relationships with real-estate agents, and consulting a few lenders will help you better understand your options when buying your first property.

But if you can’t get the financing to purchase a property or don’t want the responsibility of being a landlord, there are still ways to get into this kind of real-estate investing.

REITs

Real-estate investment trusts (REITs) let you invest in commercial, residential, and even farmland properties as easily as you purchase shares on a stock exchange.

Streitwise lets investors access a diversified portfolio of rental properties. Dividends are paid quarterly, and they’ve hit their target return range with payouts of over 8% for the past 17 quarters.

Arrived Homes

For an even more affordable way into real-estate investing, Arrived Homes allows you to sort through individual properties in their portfolio and invest in the ones you like with as little as $100 per share.

Arrived researches and buys the homes, makes improvements, finds long-term tenants, and manages the properties for you. Arrived charges a standard 1% fee on your investment funds and 8% of the monthly rent as a property-management fee.

Is a rental property a good investment?

With interest rates increasing and a possible recession looming, property values in some markets are starting to dip. If we head into a lasting recession, the never-again-roommate trend could end just as quickly as it started. And that could reduce your pricing power in a hurry.

It’s not all bad, though. Buying when interest rates are higher usually means prices are lower. And it might put you in a great position to refinance and drastically reduce your payments if the Fed drops rates again. Plus, those rates dropping will likely send your property values up.

Also, with the current housing shortage, it’s unlikely that anyone putting a 20% down payment on a house would find themselves underwater with the bank any time soon.

There’s a lot to consider when getting into the real-estate market these days. If you think buying a rental property is the best move for you, paying a little under your budget might be smarter since you’ll have a cushion if the environment changes again.

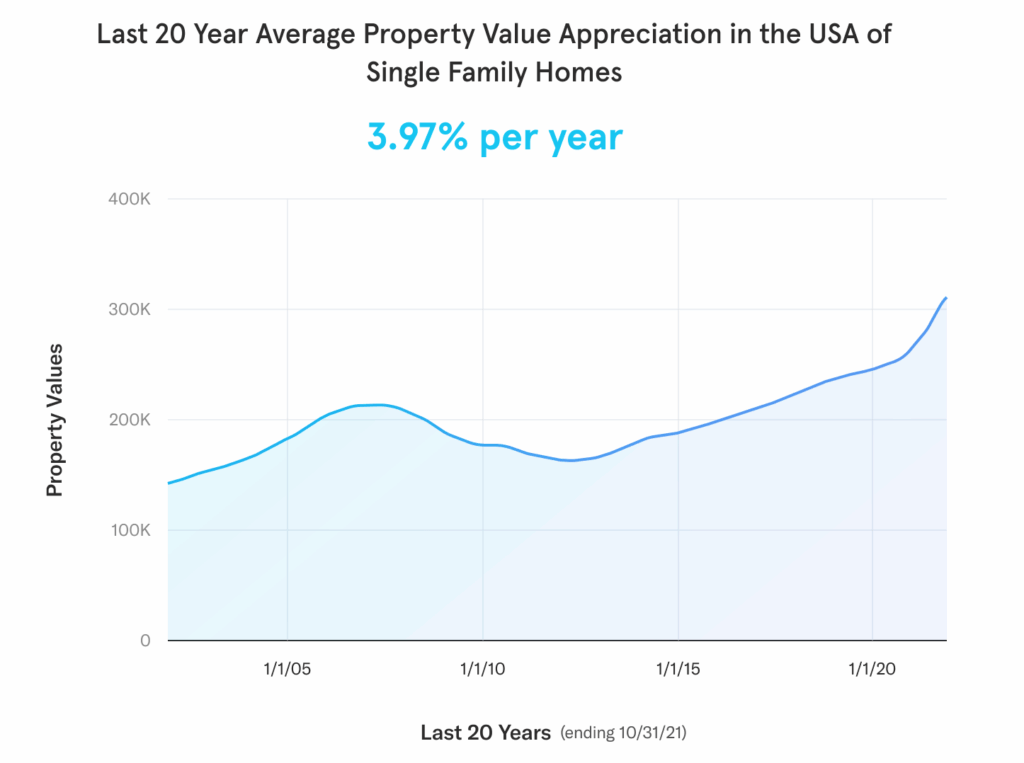

If you’re properly set up to weather the short-term storm, chances are that, in a few years, housing will do what it’s done since the dawn of time and keep trending upward.

Source: arrivedhomes.com

In a 2021 study, Arrived Homes looked at historical investment returns in single-family homes over 20 years. They found that leveraged investments in single-family homes would have yielded an 11.7% annual ROI from property-value appreciation and rental dividends combined. To compare, the S&P 500’s annualized return over the same period was 9.43%.

Rental property investments might grow on you

If properly funded and planned, rental properties are a great wealth-building investment. You can buy a home and have someone else pay your mortgage while enjoying both rental income and reliable appreciation over time.

It’s not a stroll down Easy Street, though. Buying a property is a major investment—that isn’t very liquid. Plus, managing a property can be expensive and unpredictable, and it demands you deal with real humans.

If you love the idea of investing in rental properties but don’t want the hassle and large expense, then there are plenty of ways you can gain exposure. Investing in shares on Arrived Homes or buying REITs are just two ways of the many you could consider.