Rich Dudes│The Story Behind Larry Ellison’s $108B Net Worth

Oracle founder Larry Ellison is one of the world’s richest entrepreneurs with a $108 billion net worth. Here’s how he made his fortune.

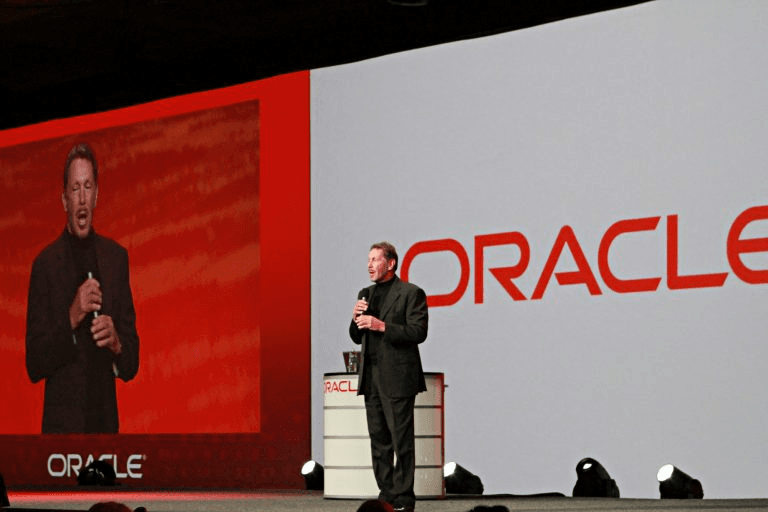

Lawrence Joseph Ellison—or Larry as his friends call him—is the pioneering co-founder of Oracle, the company that revolutionized the database software and business application industries.

As Oracle’s biggest shareholder, Ellison is one of the richest and most successful men in the world with a net worth close to $108 billion. Despite stepping down as Oracle’s CEO after 37 years at the helm, Ellison still serves as board chairman and chief technology officer.

According to the Bloomberg Billionaires Index, Ellison is ranked the seventh wealthiest person on the planet, directly behind former Microsoft CEO Steve Ballmer and just ahead of Larry Page, co-founder of Alphabet.

In 2012, Ellison reportedly spent $300 million to purchase 98% of the Hawaiian Island of Lanai.

According to Forbes’ Real-Time Billionaires rankings, Larry Ellison is the fourth richest billionaire in the world as of March 17, 2023. So all things considered, Ellison is solidly in the top ten on the money leaderboard.

The American business magnate also owns a stake in Tesla, an impressive real estate portfolio that includes property on Hawaii’s Lanai island, a professional sailing team, and even a tennis tournament. He also made a name for himself with his aggressive acquisitions strategy and sheer ingenuity as a tech entrepreneur.

Larry Ellison net worth at a glance

| Net worth | $108 billion |

| Born | August 17, 1944 |

| Nationality | American born in New York City, New York. |

| Became a millionaire at | 42 |

| Occupations | Entrepreneur, business executive, businessman, investor, software developer |

| Sources of wealth | Oracle, Tesla, Netsuite |

| Asset classes | Startups, stocks, real estate |

How Larry Ellison made his money

Larry Ellison sure knows how to make money—he’s a bonafide cash machine. From founding a tech company in the 70s with only $2,000 to becoming the world’s highest-paid executive in 2000 with an eye-watering $1.84 billion in total compensation, Ellison has some impressive money-making credentials.

Starting at Ampex Corp where he worked as a coder for companies and government agencies (including the CIA), Ellison spotted the huge potential of relational databases to transform businesses, so he founded Software Development Laboratories in 1977 with his former Ampex colleagues Ed Oates and Bob Miner—mustering starting capital of just two grand.

From there, the company exploded and made huge profits, especially after they won a hefty $50,000 contract from the CIA in 1978 before creating the first commercial relational database released in 1979 (called project Oracle). In 1983, Ellison renamed Software Development Laboratories to Oracle after the name of the CIA contract.

After taking software giant Oracle public in 1986, Ellison fearlessly navigated the company through troublesome waters. The company began to sink after experiencing its first quarterly loss in 1990, and then controversy surrounding deceptive sales accounting practices blew its share price into oblivion.

But the skies cleared in 1992 with the release of the popular Oracle 7 database software, a real winner that captivated everyone. Banks, corporations, retailers, airlines, automakers, and governments all came to depend on Oracle 7.

In the late 1990s, Oracle achieved dominance amid competition from the rising Microsoft SQL Server. In 2005, Oracle’s CEO Larry was handsomely rewarded for his leadership by receiving a base salary of $975,000, plus a $6.5 million bonus.

But Ellison wasn’t done there—he further cemented Oracle as a tech sector champion by expanding into new markets through strategic software acquisitions and by anticipating the impact of the internet on business.

In 2010, Oracle hired Mark Hurd as co-president. The lucky and smart folks who invested in the company early must’ve been counting their cash when Oracle’s market capitalization reached an unbelievable $98 billion in 2009—it’s at today.

Ellison is still raking in the big bucks. Thanks to his 42% stake in Oracle, the billionaire has a fortune that makes small nations jealous. But Ellison didn’t stop there—he’s got an interest in the EV pie with 15 million Tesla shares, plus stakes in Netsuite and Leapfrog Enterprises.

How Larry Ellison invests

Larry Ellison’s net worth is a result of entrepreneurship and smart investment decisions over the years. Ellison has invested extensively in several asset classes, including software, technology, luxury real estate, and sports to name a few.

In addition to his share in the U.S. software maker Oracle, Ellison also owns stakes in other database companies, educational platforms, luxury real estate, and more—all of which have made him very wealthy.

He became well known when his partially-funded BMW Oracle Racing team won the America’s Cup in 2010, and then again when his Oracle Team USA defended the America’s Cup in 2013.

Startups and acquisitions

It might not sound as exciting as pulling off a heist, but Larry Ellison is quietly earning a pretty penny from his investments. You see, the 78-year-old venture capitalist is making most of his fortune from his stake in Oracle. According to the company’s September 2022 proxy filing, Ellison owns more than 42% of the business.

Source: thepinnaclelist.com

Known as the man who’ll take risks on anything, Ellison has been an investor in all kinds of startups. First, Evan Goldberg’s business-management software firm NetSuite skyrocketed after receiving a $125 million investment from Ellison.

Many years later, CEO Zach Nelson negotiated the sale of the company to Oracle for a total of $9.3 billion, resulting in Ellison raking in $3.5 billion in profits for his stake.

Then there’s also Knowledge Universe, a for-profit education company into which Ellison pumped $500 million initially. Like a wizard, Ellison cast his spell—acquiring PeopleSoft for $10.3 billion in 2004, Siebel for $5.9 billion, BEA for $8.5 billion, and Sun Microsystems for $7.4 billion. To top it all off, Oracle also spent $28.3 billion to acquire the electronic health records company Cerner.

The startup ecosystem has been buzzing over the past decade, with post-money market values climbing 239%. Despite venture capital financing declining in 2022, many startups have taken the novel approach of pursuing mergers and acquisitions as a form of funding instead. Watch out for metaverse startups as experts predict the market could reach the dizzying heights of $1.6 trillion by 2030.

Stocks

Larry Ellison is no stranger when it comes to investing in stocks—he’s been doing it for years. He was an early investor in Tesla and owns around 15 million shares. Between 2018 and 2021, his Tesla investment grew by more than 1,400%.

As for NetSuite, he already had a 41.3% stake in the company before Oracle ended up acquiring the cloud giant. Ellison even put $2 million into a little company called Salesforce founded by his former protege Marc Benioff.

But Larry Ellison doesn’t limit his investments to tech companies. He also wrote a $117 million check to LeapFrog Enterprises, a company making toys and video games for children, that went public in 2002. Most recently, he wrote a $1 billion check to Elon Musk to help him buy Twitter.

Real Estate

With an investment portfolio nearly as grand as his success with Oracle, Larry Ellison has been busy when it comes to real estate—busy indeed.

From San Francisco to Malibu to Newport on the east coast and across the Pacific to Hawaii and Japan, the billionaire certainly has his fair share of properties.

Ellison first bought his $3.9 million home in San Francisco’s Pacific Heights neighborhood in 1988. Fast forward to 1995, Ellison went deep into designing and renovating his sprawling 23-acre Woodside, California, estate which he acquired for $12 million. The estate, modeled after a 16th-century Japanese imperial palace, reportedly cost him upwards of $200 million and took nine years to complete.

He also owns as many as two dozen properties in Malibu, where his total spending clocks in at $200 million to $250 million. The business mogul also acquired the Epiphany Hotel in Palo Alto for $71.6 million and the beachfront Casa Malibu Inn for $20 million (which he transformed into a Japanese-themed hotel called Noble Ryokan Malibu).

Staying on the west coast, Ellison also bought the Malibu Racquet Club for $6.9 million, the Indian Wells Tennis Garden for $100 million, and the Cal Neva Resort in North Lake Tahoe for $35.8 million. Perhaps he’s kicking it with Phil Mickelson and Dustin Johnson.

On the east coast, he can now call the Beechwood Mansion in Newport, Rhode Island, home after shelling out $10.5 million for the estate and spending over $100 million to transform it into a world-class art museum. He also bought three surrounding properties on nearby Bellevue Avenue before acquiring the nearby Seacliff for $11 million in February 2023.

Ellison’s historic garden villa in Kyoto, Japan, is said to have been listed at $86 million. In 2012, he allegedly purchased 98% of the Hawaiian island of Lanai for $300 million.

Investing in real estate is a great way to make your money work for you. Experts predict that by 2028, the market size of real estate will have grown to $7.9 trillion with a compound annual growth rate of 1.8%. Now could be a good time to lay the foundation for your real estate portfolio.

Sports

Larry Ellison lives for adventure, luxury, and sport. Though his main business is in the tech sector, he doesn’t hesitate to diversify. He has investments in the Oracle Team USA sailing team, sailboats, and the Indian Wells Tennis Garden facility in California’s Coachella Valley, which he purchased for $100 million.

Source: indianwellstennisgarden.com

Planes, yachts, and automobiles

Ellison has spent over $194 million on new yachts in three years, including a 58-meter Ronin, the 75-meter Katana (now dubbed Zeus), and the 138-meter Rising Sun (which he sold to billionaire David Geffen for $590 million). He also owns a $75 million Gulfstream G650 private jet, a Bombardier Global Express jet, a Cessna 525 Citation.

He takes luxury to the next level with his car collection, including an Audi R8 with an estimated $142,000 price tag, a $400,00 Lexus LFA, a McLaren F1, and an Acura NSX worth about $100,000. He even gifts cars as an annual surprise to his friends.

The luxury sector looks set to be a lucrative investment option over the next few years, with revenue in the luxury goods market already amounting to $354 billion this 2023. Experts forecast that the market can make potential gains of 3.38% annually between 2023 and 2028.

Larry Ellison investing quotes

Larry Ellison’s story is one of ambition, success, and hard work. From a meager $2,000 investment to a net worth of $108 billion, Ellison is like a real-life Tony Stark. His investments, from software and technology to luxury real estate and sports teams, have enabled him to build a portfolio that almost seems fictional.

His story stands as an inspiration to those who want to make it big in the business world. With his acumen and vision for the future, Larry Ellison is an example of how far one can go when they don’t give up on their dreams.

1. Trust your intuition

2. Success breeds ambition

3. Spark change through innovative thinking