Top 3 Ways To Generate Passive Income In The Metaverse

Gain insights on earning passive income in the Metaverse through virtual real estate, NFTs, and DeFi.

The digital realm of the metaverse is rapidly expanding and continually reshaping how we interact, work, and entertain ourselves. Alongside this growth, the metaverse is also revolutionizing the investment landscape by opening new avenues for making passive income.

This article is first-come-first-serve with insights into passive income opportunities in the virtual space, so hurry up before the digital goods are gone.

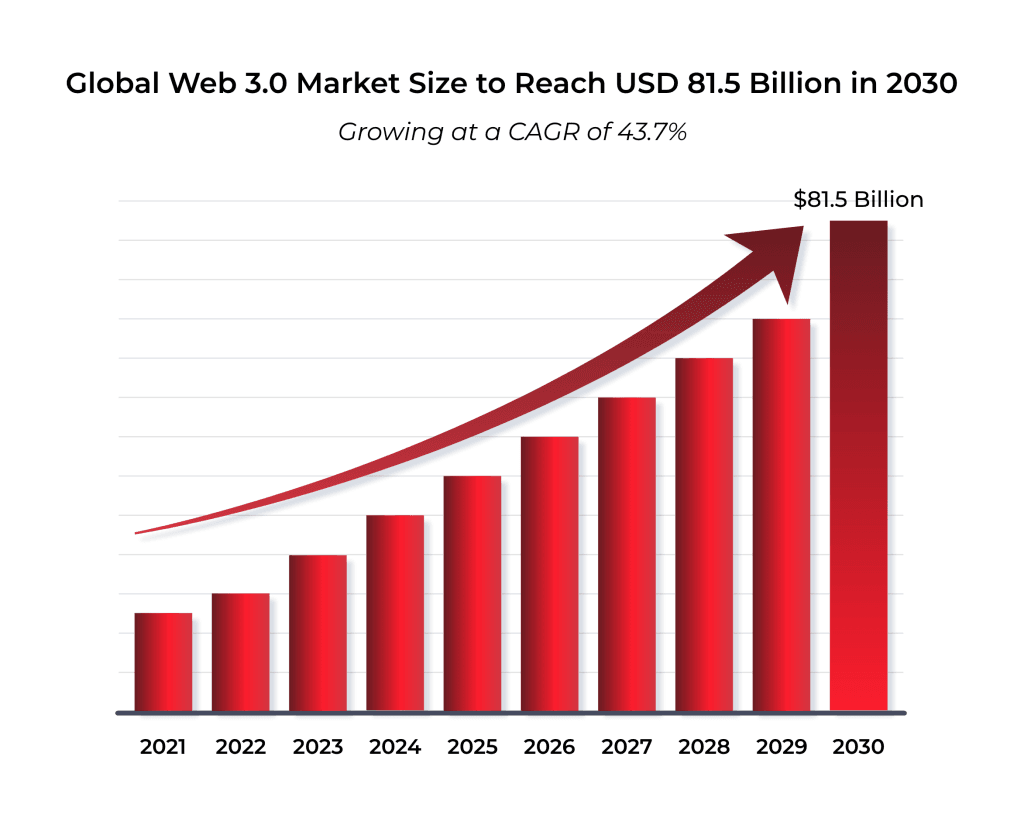

Projected to hit $81.5 billion by 2030, the global Web3 market emphasizes the expanding investment potential in this cutting-edge internet domain.

Understanding the metaverse’s potential for passive income

The metaverse is a vast, interconnected virtual universe where people engage with one another, attend virtual events, work, and play games just like the physical world. It exists through numerous digital platforms, each with unique features, user bases, and ecosystems.

As the metaverse continues to develop and evolve, the opportunities for generating passive income within this digital space are also increasing. Investors can benefit from virtual real estate investments, non-fungible tokens (NFTs), and metaverse tokens.

Investing in virtual commercial ventures

Virtual worlds, such as Decentraland, The Sandbox, and Axie Infinity, are teeming with opportunities for investors. Users can buy and sell virtual properties, create and trade digital collectibles, and even start small businesses within these platforms. Some popular ways to generate income and growth in the metaverse include:

- Virtual real estate: Metaverse landlords can purchase and either develop or lease virtual land to other users, benefiting from popular virtual locations’ potential appreciation and rental income.

- Non-Fungible Tokens (NFTs): The growing interest in digital art, collectibles, and virtual items offers opportunities for creating, trading, and investing in scarce, unique digital assets with provable ownership.

- Web3 and cryptocurrency: Profiting from staking, liquidity provision, and yield farming strategies within decentralized finance (DeFi) platforms and blockchain networks can provide passive income and help support the growth of the digital economy.

Understanding the factors driving the value of alternative investment assets within the metaverse can help investors identify promising opportunities:

- Scarcity and utility: Assets with inherent scarcity and functional value within the virtual community tend to command higher price tags.

- Platform popularity: Virtual properties on established and thriving platforms can attract more user interest, potentially increasing their value.

- Brand partnerships: Collaborations with renowned brands, celebrities, or organizations can boost a platform’s appeal, translating to greater investment value.

1. Virtual real estate

Virtual real estate provides an intriguing opportunity to generate passive income in the metaverse. Here’s what you should know:

- Appreciation potential: High-demand virtual properties can appreciate significantly, yielding substantial returns for investors. Like physical real estate, the value of metaverse land can be influenced by factors such as location and the platform’s popularity.

- Rental income: Renting out virtual land to advertisers, game developers, or business tenants can offer a steady stream of passive income. Rental fees are usually based on the estate size, the number of visitors, or the lease duration.

- Platform selection: To ensure stable demand for virtual real estate investments, focus on popular metaverse platforms with active user bases and thriving virtual economies. To make informed decisions, perform thorough research on the platform’s user demographics and future developments.

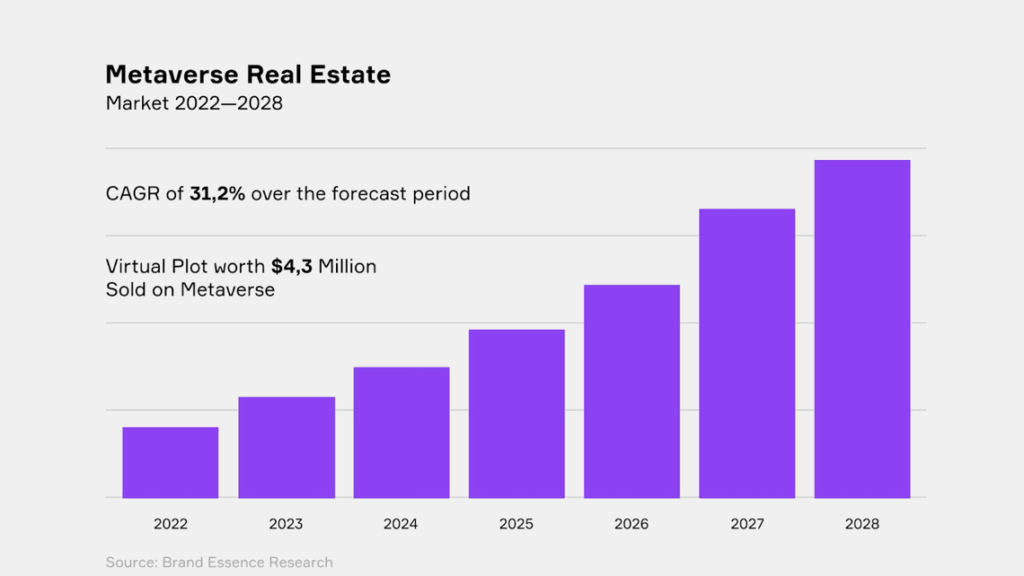

Source: brandessenceresearch

2. Non-Fungible Tokens (NFTs)

The rise of NFTs introduces another avenue for investors to explore within the metaverse:

- Ownership and scarcity: NFTs provide provable ownership and scarcity for digital assets, including artwork, collectibles, and virtual land. Each NFT represents a unique and irreplaceable digital item, granting it inherent value in the marketplace.

- Trading opportunities: Efficient trading and selling NFTs on online marketplaces translates to increased liquidity. Platforms such as OpenSea and Rarible facilitate the buying and selling NFTs, allowing for potentially quick returns on investment.

- High-return potential: In the volatile NFT market, some assets have fetched millions of dollars, showcasing their potential for exceptional returns. Investors must carefully assess the risks associated with NFT investments and prepare for potential losses.

3. Web3

Projected to hit $81.5 billion by 2030, the global Web3 market emphasizes the expanding investment potential in this cutting-edge internet domain. With Web3 powered by blockchain technologies, a vast array of passive income opportunities arises within the metaverse landscape:

- Staking Cryptocurrency: Locking up cryptocurrencies as collateral to support blockchain networks can earn investors a share of network rewards. This process, known as staking, generates passive income and contributes to the stability and security of the underlying blockchain.

- Liquidity Provision: Providing liquidity to Decentralized Exchanges (DEXs) in return for fees enables investors to facilitate trades and earn passive income. By adding assets to liquidity pools, investors help support a more seamless and efficient trading environment for users of the decentralized marketplace.

- Yield Farming: By participating in yield farming strategies, investors can earn rewards from DeFi protocols. Yield farming involves depositing funds into DeFi platforms or lending protocols in return for rewards in the form of interest, tokens, or fees.

Source: quytech.com

Balancing risks and rewards in the metaverse

Just like any other investment, it’s crucial to identify and manage the risks linked to alternative assets, such as:

- Volatility: Digital currency markets are often volatile, with prices varying due to market sentiment, news, and technological breakthroughs. Investors should be ready for the possibility of considerable losses.

- Liquidity: While you can effortlessly exchange numerous NFTs, some digital assets might need help to sell or convert back into conventional currencies, which might restrict their liquidity and exit strategies.

- Regulation: The regulatory landscape for digital assets and virtual reality investment platforms is constantly changing, potentially affecting some investments’ value and legality.

Comparing alternative investments like virtual real estate, NFTs, and cryptocurrencies to traditional investment options such as stocks, mutual funds, and tangible real estate is essential. Consider the following:

- Risk profile: Examine the inherent risks associated with each asset class, considering potential losses, volatility, liquidity, and regulatory issues.

- Return potential: Investigate traditional and alternative investment assets’ historical performance and future growth prospects to gauge their potential for capital appreciation and passive income generation.

- Portfolio diversification: Assess the role of each asset class within your investment portfolio, considering the possible advantages of diversification, such as risk management and better fitting your financial objectives.

Getting started with metaverse passive income investments

To increase the likelihood of success in the metaverse, investors should consider the following factors:

- Research and education: Delve into virtual platforms, digital currencies, and blockchain technologies to better understand their potential benefits and risks.

- Community participation: Engage with users and creators within the metaverse, gaining insights into trends, demand, and emerging opportunities.

- Creative investments: Think outside the box when exploring investment assets. Consider supporting artists, developers, and small businesses, providing services or funding that can generate returns while contributing to the growth of the virtual community.

- Monitor and manage your investments: Keep track of your passive income streams and the performance of your investments, and make necessary adjustments as the metaverse evolves.

The verdict on metaverse passive income

The metaverse presents numerous opportunities for investors in virtual assets and emerging markets. Investors can capitalize on this digital revolution by staying informed and evaluating risks, rewards, and potential.

Metaverse platforms to invest in:

- Decentraland: A decentralized virtual world where users can create, explore, and trade virtual properties and other assets. Decentraland has seen plots of virtual land selling for six-figure sums.

- The Sandbox: A user-generated gaming platform where participants can buy and sell virtual land and assets using NFTs. The Sandbox has collaborated with the likes of Snoop Dogg, creating revenue-generating virtual experiences.

- Axie Infinity: A play-to-earn game where users collect and train virtual creatures called Axies, which are used in battles to earn in-game tokens. Some players have reported earning several hundred dollars monthly in passive income from Axie Infinity.

As the metaverse continues to expand, investors who take the time to research and participate in this new arena may find themselves reaping substantial rewards.