The Ultimate Tax Lien Investing Guide

With $21 billion in delinquent property taxes annually, tax lien investing is a lucrative opportunity. Learn how to turn unpaid property taxes into profits by buying tax lien certificates.

Ever heard of tax lien investing? It’s a high-stakes game of rewards and risks where savvy investors can potentially score big returns on delinquent property taxes.

Let’s dive into the world of tax liens and tax lien certificates, exploring the pros and cons, successful strategies, and the importance of understanding state laws and local regulations. So buckle up and prepare to embark on an alternative investment journey that could lead you to hidden treasures in the real estate market.

Understanding tax lien investing

When property owners fail to pay property taxes, the local government may slap a tax lien on their property as a legal claim to recover the unpaid taxes. Enter the world of tax lien investing, where investors like you can purchase tax lien certificates—documents representing the tax lien—and collect the overdue property tax, other liens, penalties, and interest from the property owner.

Sounds intriguing. But before you dive head-first into tax lien investing, it’s essential to understand the basics.

What is a tax lien?

A tax lien is the government’s way of saying, “You owe us” when a property owner fails to pay their property taxes. This legal claim helps the government recover unpaid taxes and allows investors to collect interest payments from the property owner. If the property owner doesn’t pay up, tax lien investors may initiate foreclosure proceedings to recover their investments, although many owners settle their tax bills before it comes to that.

Getting into tax lien investing involves purchasing delinquent tax liens on properties and requires upfront capital and patience for returns. The pros include a low capital requirement, standard rate of return, and lump-sum payment. However, the cons include a need for recurring income, subsequent liens, competition, and neglected properties.

The process typically begins with learning about tax lien investing, targeting areas with potential, scouting properties, placing bids in auctions, notifying homeowners, and collecting money or property. Diversifying investments, establishing financial goals, and considering alternative investment strategies are crucial. Tax lien investing could yield 12% to 18% returns, but do your homework to read up on guidelines and regulations to grasp the intricacies of this investment.

What are tax lien certificates?

Tax lien certificates, the golden tickets of tax lien investing, represent a property’s tax lien issued by local governments in response to unpaid property taxes. With over $21 billion in delinquent property taxes annually, tax lien certificate investing can be a lucrative venture.

As an investor, you’ll want to find auctioning states and jurisdictions, participate in auctions, win certificates, pay taxes and fees, and then wait for property owners to redeem their liens or possibly foreclose. This investment approach offers low costs, diversification, and guaranteed returns but comes with risks such as non-redemption, lengthy waiting periods, and property-related concerns.

To succeed in this realm, conduct comprehensive research on properties and jurisdictions while being mindful of the risks involved. This low-capital alternative in real estate investing necessitates a keen eye and a thorough understanding of the ins and outs of the market.

The tax lien auction process

Tax lien certificates are typically sold at auctions, either online or in person. During the auction, investors compete to purchase tax lien certificates by bidding on the interest rate or the premium they are willing to accept. The highest bidder takes home the full property tax bill and lien certificate, and the property owner is then obligated to repay the tax debt, plus the winning interest rate or premium, to the investor.

But remember, tax lien investing is not a game of chance. It requires thorough research and due diligence before placing your bids. Savvy investors often analyze the property, its liens, and any other relevant information to assess the potential risks and rewards associated with the tax lien certificate.

And, as with any investment, it’s crucial to stay disciplined and patient, as the redemption period can sometimes take months or even years to complete.

Bidding on tax liens

Bidding on tax liens involves competing with other investors at auction to purchase tax lien certificates. Investors can either offer a cash amount above the base price set by the municipality or bid the lowest interest rate they are willing to accept. Typically, the highest bidder wins the tax lien certificate and gains the right to collect the overdue taxes, penalties, and interest from the property owner.

If the property owner fails to repay the property tax debt, the investor can initiate foreclosure during the redemption period to recoup their investment.

Online vs. in-person auctions

Choosing between online and in-person tax lien auctions depends on your preferences and investment strategy. Online auctions offer a larger bidder base and often require less time and expense, but they may lack the personal touch and face-to-face interaction of in-person auctions.

On the other hand, in-person auctions provide an authentic experience, allowing you to interact with fellow investors and get a better feel for the auction process. However, they may be more time-consuming and costly compared to online auctions.

Pros of tax lien investing

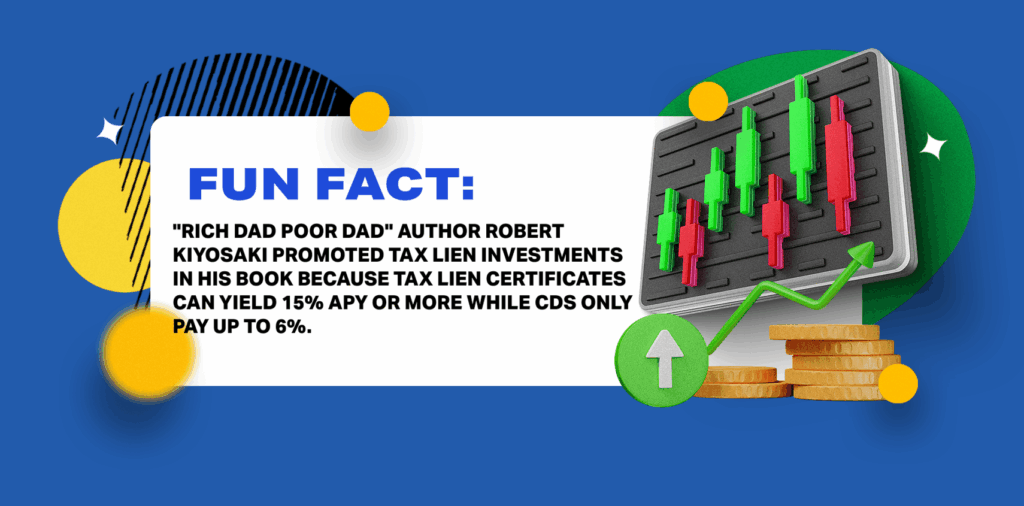

There’s no denying that tax lien investing can be an attractive alternative investment strategy, offering many potential benefits. High returns, low correlation to the stock market, tangible assets, diversification, and the possibility of acquiring properties below market value are just a few of the perks of tax lien investing.

Tax lien investing is a great way to diversify your portfolio and earn higher returns than traditional investments. Understanding how tax lien investing works also offers the potential to acquire properties at a discount, which can be a great way to build wealth.

- High rate of returns: Investors can earn substantial return on their investment through interest payments, with interest rates on tax liens ranging from 8% to 30%

- Uncorrelated to the stock market: Tax lien investing is independent of market and economic conditions that drive stocks, helping to reduce overall investment risk

- Backed by tangible assets: Tax liens are secured by legal claim on real property, providing a level of security for investors

- Diversification: Investing in tax liens across different properties and locations can spread investment risk and increase chances of finding profitable investments

- Acquiring properties below market value: If the property owner fails to repay the tax lien during the redemption period and the tax lien investor forecloses, they may acquire the property at a hefty discount

Pros and cons

Pros

- High interest rates: Offers attractive returns compared to other fixed-income investments

- Diversification: Low correlation to the stock market, acting as a hedge against market volatility

- Predictable income: Interest payments and penalties set by local governments offer income stability

- Asset-backed security: Secured by underlying real estate to minimize the impact of defaults

- Acquisition of property: Opportunity to acquire property at a fraction of its market value if the owner does not redeem lien

Cons

- Limited liquidity: Challenging to sell and may require holding until the property owner pays or the lien expires

- Default risk: Risk of the property owner not paying taxes, potentially resulting in loss of invested principal

- Lengthy redemption process: Time delay in receiving returns due to the property owner’s specified redemption period

- Time-consuming research: Extensive due diligence is required for researching property, lien priority, and local regulations

- Property management responsibilities: Acquiring a property may require handling property maintenance, taxes, and other expenses

Cons of Tax Lien Investing

As with any investment strategy, tax lien investing has its fair share of potential pitfalls. Default risk, illiquidity, long-term investment, property management responsibilities, and a lengthy due diligence process are just a few of the challenges investors may face when breaking into tax lien investing.

Investors must be aware of these potential risks and take the necessary steps to mitigate them. Researching the local market, understanding the legal process, and working with experienced professionals are all important.

- Default risk: The possibility of property owners failing to repay the tax lien could result in a loss

- Illiquidity: It might be challenging to sell tax lien certificates quickly, as they are not easily traded on the open market

- Long-term investment: The redemption period for tax liens can take months or years, requiring patience and a long-term outlook from the investor

- Property management responsibilities: If an investor forecloses on a property, they might have to manage property-related duties such as finding tenants and property maintenance

- Lengthy due diligence process: Extensive research and understanding of properties, local regulations, and potential risks before investing in tax liens is required. This could be time-consuming and require a significant amount of effort from the investor

Strategies for success in tax lien investing

To maximize the potential rewards and minimize the risks associated with tax lien investing, it’s essential to employ a set of proven strategies. These include conducting thorough due diligence, getting professional advice, staying updated on local regulations, diversifying investments, and remaining disciplined and patient throughout the investment process.

By following these strategies, investors can ensure that their investments are sound and that they can maximize their returns. Additionally, it is important to remember that tax lien investing is a long-term investment strategy and that patience and discipline are important.

1. Conduct thorough due diligence

Research is the cornerstone of successful tax lien investing. This involves identifying the property, its liens, and any other relevant information to assess the potential risks and rewards associated with the investment.

Investors can make more informed decisions and avoid pitfalls by carefully analyzing each tax lien opportunity.

2. Get professional advice

Seeking professional advice from experienced investors or real estate professionals is crucial for navigating the complexities of tax lien investing. These experts can help you understand the ins and outs of the tax lien auction process, local regulations, and potential risks and rewards.

By leveraging their knowledge and experience, you can make more informed decisions and increase your chances of success in tax lien investing.

3. Stay updated on local regulations

Staying updated on local regulations is essential for ensuring compliance and being aware of any changes that may impact your investments. This includes researching the rules and regulations governing tax lien investing in your target investment areas and signing up for notifications from local governments.

By staying informed, you can make more informed decisions and avoid potential pitfalls related to regulatory changes.

4. Diversify across properties and locations

Diversifying your tax lien investments across multiple properties and locations can reduce risk and increase potential returns. By spreading your investments across various tax lien properties and markets, you can minimize the impact of any single investment failing and create a more balanced overall portfolio.

This diversification strategy can be particularly beneficial in tax lien investing, where the potential risks and rewards can vary significantly from one property to another.

5. Stay disciplined and patient

Patience and discipline are crucial for long-term success in tax lien investing. The redemption period can sometimes take months or even years, and investors must be prepared to wait for their returns.

By remaining disciplined and patient throughout the investment process, you can increase your chances of achieving your desired returns and minimize the potential risks associated with tax lien investing.

State laws and regulations

It’s important to note that state laws and regulations regarding tax lien investing can vary widely, with some states allowing tax lien sales and others opting for different methods for collecting delinquent property taxes.

As a result, investors must research the specific laws and regulations governing tax lien investing in their target investment areas before diving in.

Tax lien states

Some states, however, use alternative methods for collecting delinquent property taxes, such as tax deed sales or foreclosure proceedings. Investors must understand the specific rules and regulations governing tax lien investing, including the delinquent taxes and tax lien procedures, in their target investment areas before getting started.

Local regulations

In addition to state laws, local regulations can also vary between jurisdictions, making it essential for investors to research and understand the rules in their target investment areas. This can include examining the local auction process, redemption periods, interest rates, and any other relevant information.

Staying informed about local regulations can help investors avoid potential pitfalls and maximize their chances of success in tax lien investing.

Passive vs. active tax lien investing

When it comes to tax lien investing, investors can choose between passive and active investment strategies. Passive investing involves investing in tax lien investment funds managed by professional fund managers, while active tax deed investing involves directly purchasing and managing individual tax lien certificates.

Each approach has advantages and disadvantages, depending on the investor’s preferences, risk tolerance, and investment goals. Passive investors must make sure to have all their ducks in order, so tax lien newbies may find an active approach more effective while learning the ropes.

Tax lien investment funds

Tax lien investment funds offer a more passive investment and approach to tax lien investing, allowing investors to gain exposure to a diversified portfolio of tax liens managed by a professional fund manager. This can be an attractive option for investors who prefer a hands-off approach and want to diversify their portfolio without actively researching, purchasing, and managing individual tax lien certificates.

However, the returns from tax lien investment funds may be lower than active investing, as the fund manager’s fees and expenses are deducted from the overall returns.

Direct ownership

Direct ownership involves actively purchasing and managing individual tax lien certificates, which requires more time and effort from the investor. This approach can be more rewarding for investors who are willing to put in the work to research properties, local regulations, and potential risks, as well as manage the redemption process and any potential foreclosures.

However, direct ownership also carries a higher level of risk, as the investor is responsible for managing their investments and navigating the complexities of tax lien investing.

Are tax liens a good investment?

So, dabbling in tax lien investing—hot or not? It’s like asking if pineapple on pizza is good. The answer? It depends on your taste buds, or in this case, your investment appetite, risk threshold, and your knack for research and playing the long game. You see, tax lien investing could be your golden goose, offering handsome returns, a jazzy way to diversify your portfolio, and the thrilling chance of scooping up properties on the cheap.

But it’s not all rosy. Like that adventurous road trip with no GPS, there are a few potholes along the way—risks of default, liquidity equivalent to maple syrup, and a due diligence process longer than a sloth’s Sunday stroll. So, strapping in for a tax lien journey does require some mettle.

Like heading into a maze, you need to conduct your due diligence—get comfy with the fine print and maybe even phone a friend (read: seek professional advice). Keep a keen eye on local regulations—no one likes nasty, surprise detour signs. Spread your bets (your investments, rather) to avoid putting all your eggs in one basket. And remember, just like that perfect Instagram pic, timing is everything—staying poised and patient can be the best strategy.

Cutting to the chase—if you don’t mind a bit of a thrill, you could find tax lien investing an exciting detour off the beaten investment track. It’s like daring to try that exotic dish on the menu. It’s not for everyone, but for those with the right appetite, it could just become a new favorite.

Frequently Asked Questions

Is tax lien investing risky?

Tax lien investing isn’t without its risks, however. Investing in tax liens can be complicated and involves the risk of being unable to recoup your investment if the homeowner pays the debt or files for bankruptcy. Nevertheless, it could also be a great way to make money if you understand the potential risks and have done your due diligence.

However, tax lien investing can be a great opportunity with the right knowledge and preparation.

What are the pros and cons of tax lien investing?

Tax lien investing offers the potential for high returns, but it also carries some substantial risks. On the positive side, buying tax liens will typically have low purchase prices and allow investors to receive interest payments from delinquent taxpayers.

On the downside, tax lien investments can be difficult to liquidate, and there’s no guarantee of a return on your investment. Ultimately, if you do your due diligence and understand the risks, you may find that investing in tax liens can yield attractive returns.

Is tax lien investing easy?

Tax lien investing may seem like an attractive way to make money, but it’s not as easy as one might think. It requires a lot of research and dedication before you even make it to the auction. Plus, it’s out of the question if you’re not in one of the select states that allow private investors to bid on tax liens.

Bottom line: investing in tax liens can be rewarding but not easy.

Is lien a good investment?

Considering the potential returns and low-risk profile of tax lien certificates, it could be an attractive investment option for those well-versed in real estate investing.

With a careful assessment of the investment opportunity, a lien could be a good bet to reap impressive profits with minimal risk.