Groundfloor Review

Groundfloor Review: Diversify Your Portfolio By Funding Loans for Real Estate Projects

Published Feb 18, 2022•Updated May 1, 2025

Passive Income

Lending

Real Estate

Groundfloor provides an affordable way for non-accredited investors to diversify into real estate debt instruments. With a minimum investment of as little as $100, you can fractionally invest into a pool of loans Groundfloor makes to real estate developers. Since 2013, more than $1.7 billion has been invested into Groundfloor and investors have earned an average of 10% annualized returns.

Borrow our cheat sheet

MoneyMade member rating

4.2

Fees

Zero

Minimum to invest

$100

Returns

100%

Risk

Medium

Bonus offer

Enjoy the benefits of fractional real estate investing!

Pros and cons

Pros

Low minimum investment and no accreditation requirement

Investors receive weekly interest payments

Nominal fees and hyper fractionalization

Cons

There is a risk of defaulted loans

Your money will be tied up for a while

Mixed customer reviews

What is Groundfloor?

Groundfloor is a real estate investing platform allowing everyone to invest in short-term residential real estate loans. It was founded in 2013 by Brian Dally and Nick Bhargava, and it was one of the first real estate crowdfunding apps to provide SEC-qualified offerings to non-institutional investors under Reg A.

How does Groundfloor work?

Groundfloor makes three types of loans to real estate investors:

- Fix and flip loans to renovate and resell properties

- Renovate to rent loans which allow developers to purchase and upgrade rental properties

- Property rental properties, which provides loans for real estate investors to buy "rent-ready" properties

Groundfloor then packages these loan to investors who can fractionally invest with as little as $100 through the Flywheel Portfolio product, which offers instant diversification by spreading your initial investment amount across 200-400 loans. Because investors are instantly diversified and fractionalized across so many projects, they receive interest payments weekly as borrowers complete their projects

Investors receive interest payments from the time of the initial investment until the loan is repaid in full, so long as the portfolio of loans is still open. If the borrower defaults, investors may receive additional default interest. There is a 0.5 to 1.0% management fee assessed at the time of the disbursement, but keep in mind the 10% historical returns are inclusive of this fee.

Who can invest with Groundfloor?

Anyone can invest with Groundfloor as long as you can provide a Social Security Number and bank account information. The minimum investment is just $100, and there is no requirement for investors to be accredited. International investors must have a $5,000 minimum and contact customer service to get set up.

Where Groundfloor gets it right

It's easy to get started investing

Groundfloor allows you to start investing with as little as $100. This low minimum investment means almost anyone can afford to start fractionally investing in real estate loans. And you do not have to be an accredited investor, unlike with many competitor sites that give you exposure to real estate.

Investors can earn weekly interest payments

Unlike some other investments which can take years to pay off, you'll begin earning weekly payments due to the hyper fractionalization and diversification built into the Flywheel Portfolio. This mitigates overall risk because you are not “putting all your eggs into one basket.” This allows for more liquidity and true set-it-and-forget-it passive investing.

Only nominal fees

- Historically, Groundfloor did not charge fees to its investors.

- With the launch of the Flywheel Portfolio in October 2024, because of its industry-leading fractionalization and diversification opportunities, there is now a nominal fee for investors that is paid through your account’s repayments.

- There are no upfront fees to invest in the Flywheel Portfolio. Instead, the Flywheel Portfolio administers a management fee of 0.5% to 1.0%, assessed at the time those funds are disbursed back to you along with your share of the interest.

- It’s important to remember that Groundfloor’s historical performance has yielded 10% across its portfolio. Thus this fee is still just a small amount to access these types of private real estate returns.

Where Groundfloor could do better

Offer some lower-risk investment options

Groundfloor's only investment offering is notes backed by loans made to real estate developers. These loans are for fix and flips, renovate to rent, and rent-ready property rentals. Fix and flips and renovation loans are risky, as borrowers could fall behind on construction and begin to miss payments.

Provide more liquidity

Unlike some other investments that provide exposure to the real estate market, such as real estate ETFs, you do have to tie up your money with Groundfloor. While you’ll see some weekly disbursements, you are still making a commitment that you can't get out of for a period of time. That said, platforms like Groundfloor provide more direct exposure to real estate markets.

Offer a more consistent user experience

Trustpilot reviews show investors have have had mostly positive experiences with Groundfloor. The overall rating as of early 2025 is 3.4 stars (average) with 63% reviews leaving 5/5 stars.

Can you really make money on Groundfloor?

Groundfloor indicates investors have earned 10% returns to date. It is definitely possible to make money with the platform thanks to its hyper fractionalization, diversification and solid loan volume.

How do I make money with Groundfloor?

Groundfloor’s default investment offering is called the Flywheel Portfolio. This product was rolled out in October 2024 based on years of investing experience across thousands of different loans and understandings of investor behavior. The Flywheel Portfolio is qualified by the U.S. Securities and Exchange Commission. Structurally, it is a REIT but comes with many benefits that are not traditional for most REITs.

The Flywheel Portfolio combines 200 – 400 short-term real estate loans into a single investment portfolio. This approach greatly reduces risk and offers more stable and consistent returns. With the Flywheel Portfolio, investors get the added benefits of:

- Weekly disbursements as loans repay

- Instant diversification into hundreds of loans

- Set-it-and-forget-it, real estate investing

The makeup of the Flywheel Portfolio consists of a variety of Groundfloor’s loans, which they originate and asset-manage internally. Most of these loans are issues to experienced developers who are flipping homes, building new construction homes or refinancing for long-term holds or rentals. Importantly for investors, Groundfloor usually is in first-lien position on these loans, meaning they are backed by the underlying asset of the home itself. This lowers the default risk for individual investors, and if and when there are defaults, the return on that property can actually even be higher than agreed upon terms.

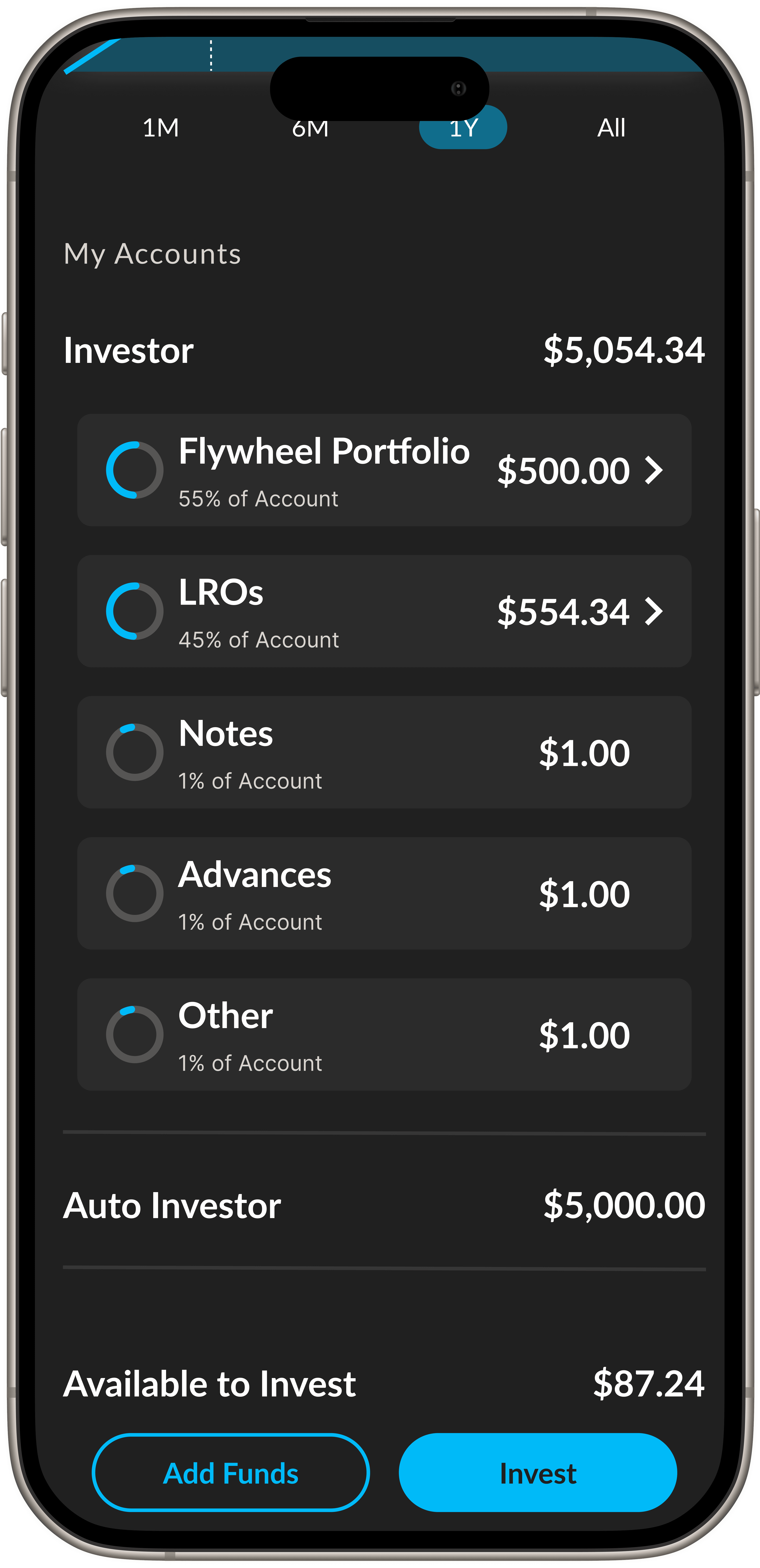

The main point for everyday investors who want a passive income strategy is that Groundfloor is doing all the work for you. Each Groundfloor investor’s funds are automatically diversified meaning you can invest $100 and have those funds dispersed into hundreds of projects at once minimizing your risk and maximizing your diversification. Because you're invested into so many projects at once through your Auto Investor account you’ll also start to see repayments weekly.

And if you’re still stuck on how this is different from a traditional REIT, the Flywheel Portfolio offers consistent cashflow, higher-yields, shorter-terms, planned liquidity, a closed structure, low minimum, and thorough diversification.

More than $1.7 billion has been invested through Groundfloor at the time of this writing.

How do I cash out with Groundfloor?

You'll receive weekly disbursements through the Flywheel Portfolio and can easily monitor your progress through their dashboard.

You can withdraw any cash balance in your Groundfloor account to your bank account at any time or can choose to use the money to fund other projects. They offer automatic reinvesting as well.

Groundfloor vs traditional investing

Groundfloor can produce higher returns than other fixed-income investments such as bonds or CDs, but you take on more risk. Groundfloor is different from investing in stocks because you have to tie up your money for a period of time and can't just trade assets whenever you want. However, you make steady passive income with Groundfloor, not just when you sell stock.

The returns you can earn vary based on the loans you are invested into. However, the trading platform indicates it has produced 10% returns to date, which is similar to the returns the S&P 500 has produced over the long term.

What other people are saying about Groundfloor

Groundfloor has mostly positive reviews.

One reviewer on Trustpilot reported they've been "investing with them extensively for over 2 years," and have earned "overall decent returns." However, even this investor's positive review indicates that some of the foreclosure deals are "sketchy."

Are there other apps like Groundfloor?

Fundrise also allows you to invest in real estate, just as Groundfloor does—and both platforms don't require accreditation. Both are fixed-income investment products as well, although Fundrise allows you to invest through eREITs rather than real estate debt instruments. Fundrise is also designed for investors willing to make a five-year commitment, while Groundfloor loans typically mature in 6-18 months with weekly disbursements so you don't have to make such a long-term commitment.

Roofstock is another option for those looking for real estate exposure, but its investment requirements are much more difficult to meet. You'll need to be an accredited investor and must have a minimum of $5,000 to get started—which is far above the $10 Groundfloor requires. However, while Groundfloor allows you to invest in real estate debt instruments, Roofstock gives you more direct exposure to real estate. The platform allows you to build equity by purchasing investment properties of your own or obtaining fractional shares in fully-managed properties.

Groundfloor | |

|---|---|

Fees | Zero |

Minimum investment | $100 |

Average returns | 100% |

Risk Level | Medium |

Available on | |

iOS | |

Android | |

Review | — |

| |

Our hot take on Groundfloor

Groundfloor's low minimum investment and the absence of accreditation requirements make the platform an ideal choice if you're interested in getting some exposure to real estate debt investments. If you're comfortable using the simple trading platform and have a $100 minimum investment, then this app is worth giving a try.

I’m in! How do I sign up for Groundfloor?

1. 1. Sign up for an account at MoneyMade.

Real estate debt can be part of a diversified portfolio, but you'll likely want many other investments as well including in stocks and bonds. If you start by signing up for an account at MoneyMade, you can explore all different types of investment platforms, find the right ones for you, and access all of your information from one convenient dashboard.

2. 2. Visit Groundfloor and click "Sign Up".

You can click through from MoneyMade to Groundfloor to visit the real estate trading platform and get signed up for an account with a few simple clicks. Once you're on the site, click the green "Sign Up" button on the page.

3. 3. Provide some basic details about your investment account.

You'll be asked to provide some simple information including: whether you want to invest as an individual or business, the country you reside in, the zip code where you live, and whether you are an accredited investor

4. 4. Input your personal identifying information.

You will have to provide Groundfloor with your first and last name; a telephone number; an email address; a password; your Social Security number; and your bank information.

5. 5. Fund your account

Money can be transferred from your bank account directly to Groundfloor and then the funds are instantly deployed and diversified. You also have the option to set up automatic transfers. It can take three to five business days for your transfer of funds to clear depending on your bank.

6. 6. Monitor your investment

After signing up for Groundfloor, , you can easily track your progress through their app or web dashboard.

FAQs

Explore Assets

Click an asset to learn more