Masterworks Review: Put a Picasso in Your Investment Portfolio for $1k

Fine art isn’t stuffy anymore—but it’s still lucrative.

Of all the high-end alternative investments in the world, fine art has shown long-term returns that rival that of bonds. For the past 15 years, contemporary art sold at auction houses has appreciated in value at an overall annual rate faster than the S&P 500.

But how is the average person supposed to invest in a $6 million Van Gogh or a $9 million Picasso? Enter Masterworks: a unique way to invest in art without having to spend millions of dollars on original art masterpieces. Founded in 2017 by entrepreneur and art collector Scott Lynn, the platform was made to help everyday people stop missing out on the solid risk-adjusted returns of blue-chip art.

In this detailed Masterworks review, we’ll walk you through what this art investing platform offers, how to get started, its features, annual appreciation, and much more.

Borrow our cheat sheet

| 1.5 | 10% |

| Medium | Invest in artwork by the top-selling artists |

Pros and cons of Masterworks

Pros

- Low minimum investment for fine art

- Personal advisor that can help with any questions or concerns upon request

- Easy access the fine art market for beginners

- Storage, transportation, appraisal, insurance, and other services overseen by Masterworks

- All artwork is are pre-vetted

- Masterpieces are stored securely in a climate-controlled facility

- Historically low correlation with the stock market

- Access to unaffiliated secondary market that can provide liquidity

- Unique opportunity to view investment in person at museum or gallery through Masterworks on View initiative

- Access to exclusive art events in your area and informative webinars where you can meet some of the MW team and learn about different artist markets

Cons

- 1.5% annual fee, 20% commission on profits, and 10% premium on the purchase price of each work to cover the cost of buying, transporting, and storing fine art

- You must conduct a phone interview with a representative of RIA-affiliate Masterworks Advisers to finalize your account

- May be a waitlist to join

- Founded in 2017, giving it a fairly short track record

- 3 to 10 year targeted waiting period to see ROI

- Investment opportunities can be scarce and hard to nab

What is Masterworks?

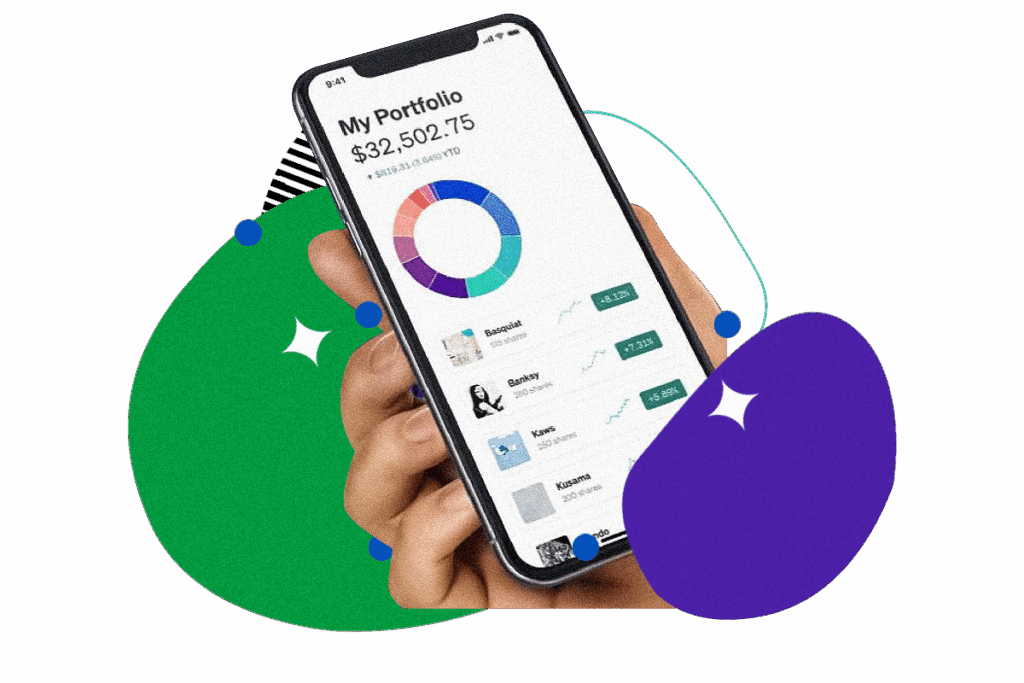

Masterworks is an art investment platform that lets you benefit from partial investment of masterpieces by artists like Andy Warhol, Claude Monet, Banksy, and others. This is achieved by letting users invest in Class A stock shares on the platform.

Founded by Scott Lynn in 2017, Masterworks makes blue chip art more accessible, whereas before it’s only ever been available to elite investors and collectors through art auctions or expensive brokers. Lynn, an active collector of contemporary art himself, started the platform to make pieces by, say, Jean-Michel Basquiat or Pablo Picasso, more in-reach for DIY investors looking to diversify.

Masterworks builds transparency into the user experience, with a user education portion to its website. Masterworks claims that its proprietary pricing database contains more than 70 years of data and 60,000 data points which help collectors value pieces and view historical appreciation. These elements align with Masterworks’ aim of making blue-chip art investment transparent and accessible to all.

How does Masterworks work?

Here’s how this online fine arts investment platform works:

- Masterworks sources works of art from all around the globe, aggregating pieces from collectors, advisors, galleries and dealers. The platform’s buyers are looking out for specific investment criteria, such as the size and engagement of the artist’s collector base, the average appreciation rate for artwork of that style, and demand for the paintings.

- The artwork is then registered with the SEC (Securities and Exchange Commission). Shares are issued at $20 per share.

- Investors start buying, with a $15,000 minimum investment for first-time investors and $500 for returning users. An individual investor can hold up to a 10% share of any one specific work before they have additional tax reporting responsibilities.

- Once an artwork is sold, the pro rata proceeds get divided among investors.

Who can invest with Masterworks?

With a minimum investment of $15,000 for first-time investors (subject to waiver), anyone can invest through the Masterworks platform—though there is a short phone interview required with a representative of RIA-affiliate Masterworks Advisers. The phone interview consists of evaluating fitness for art investing, suitability questions, and confirmation of your identity. The platform is ideal for investors who want to benefit from art investments without having to drop a ton of dough on expensive paintings.

Masterworks is therefore great for DIY investors who don’t want help from investment brokers to diversify their portfolios. There may be a waitlist to join Masterworks, so eager art lovers should apply sooner rather than later.

Where Masterworks gets it right

Blue-chip art at your fingertips

On no other platform can you gain access to modern masterpieces in the $500,000 to $10,000,000 range. Masterworks makes the works of world-class artists—including Pablo Picasso, Joan Mitchel, Ed Ruscha, and Yayoi Kusama—super accessible. There’s no need to worry about acquisition, transportation, and storage of the artwork, and you can get started without having to spend hundreds of thousands of dollars.

Helpful price database

Masterworks’ price database includes historical market and auction house data—and this perk is available for free for investors. With the enterprise plan, users can go a step further and search art market gains by artist and by artwork. Results let users read up on the artist and view historical metrics such as purchase and sale price(s) and appreciation of each painting.

SEC filings of each artwork

Thanks to this new Class A stock sharing system, investors can more easily view the SEC filings of each artwork on the Masterworks website. These filings include the artwork’s SEC offering circular, current reports, and Form K-1.

Easily linked to your bank account

Users can quickly link their bank accounts to the Masterworks website after creating their account. The process is simple and takes care of all the necessary forms to start investing.

Where Masterworks could do better

Longer time horizons than other fintech options

Traditionally, art investments have a 3 to 10 year holding period to get the most out of your return on investment. With secondary market access, powered by North Capital, investors can look to sell their shares earlier, but this platform is still best for those with medium-to-longer time horizons.

Art is speculative

There’s not much Masterworks can do about this pain point. The fact is, artwork by living artists could devalue quickly depending on an artist’s reputation (social media is tough). Art in general can be super subjective. That said, every piece of art listed on Masterworks is blue-chip (think Picasso, Warhol, and Banksy). So while speculative, this world-class artwork does a better job in holding consistent value over time.

High initial premiums and other fees

Okay, Masterworks is great and makes art accessible—but the fees are still enough to make you do a double take. You’ll pay a 1.5% annual management fee, and Masterworks takes a 20% commission on sales. There’s also a 10% premium added to the purchase price of artworks, but this covers all the cost involved in buying fine art, from appraisal, restoration and auction fees to transportation and storage. Of course, if your painting sells for millions, they may feel negligible. And if you want to go the DIY route and invest in art on your own, you’ll have to take care of those costs, which can add up to as high as 45%.

Can you really make money on Masterworks?

In short, don’t sleep on making money from art. Fine art can outperform the S&P500. To provide an example, a recent sale on the Masterworks platform returned 32% net IRR to investors in under 12 months. Again, because art is speculative by nature, the platform is best suited for DIY alternative investors—but if you have the risk tolerance it may make sense to dive in.

How do I make money with Masterworks?

When you invest with Masterworks, you invest in shares of artworks the platform has acquired. If the work you invest in appreciates in appraised value, the unrealized value of your shares goes up as well. Although liquidity cannot be guaranteed, you can look to sell those shares on their unaffiliated secondary market and perhaps turn a profit, or you can wait until the platform sells the artwork—you’ll earn a portion of the profit from that sale that’s proportional to your investment less any platform fees and commission.

Your investments aren’t guaranteed to go up in value, and exact returns will depend on the pieces you choose to invest in and the overall performance of the art market. To give you some context, let’s take a look at the historical performance of art and the Masterworks platform.

How art as an asset class has performed

The average annual appreciation of art was 11.2% between 2000 and 2025.

How Masterclass as a platform performs

Unfortunately, Masterworks doesn’t publish reports on its performance. Masterworks sends out quarterly investor reports on the state of the art market and often their collection. And since it was only founded in 2017, there’s insufficient historical data to evaluate its longevity and performance.

How do I cash out with Masterworks?

If you want to get out of your investment, like if your artwork isn’t selling or you’ve decided to configure your portfolio differently, Masterworks has your back with the Secondary Market option. With access to the Secondary Market trading platform, investors can look to buy and sell artwork shares that they own with other Masterworks users, all without Masterworks’ involvement.

So if you bought three shares of a Banksy painting and decided one year later to get out of your position, you can sell your shares on the secondary market, although liquidity cannot be guaranteed. And for returning investors who want shares without the minimum $500 investment, they may be able to find a lower share price using the secondary market option.

This feature is available to U.S. and international investors. The secondary market is unaffiliated with Masterworks and is powered by North Capital.

Masterworks vs traditional investing

Art as an investment category has the potential for large gains, but you can’t discount the risks either. Even a painting by a top artist loses value occasionally. Some of them may lie unsold for years. You can’t really compare art investing with passive forms of investing such as index funds, which deliver returns comparable to market performance steadily. And compared to dividend-delivering stocks, be prepared to wait. Masterworks has a targeted time horizon to sell somewhere around three-to-ten years. You can, in this respect, see Masterworks as comparable to investing in bonds.

Perhaps most similar to Masterworks is buying and selling NFTs on primary and secondary marketplaces. However, the Class A structure is distinct because it splits investment up between multiple buyers. This kind of structure is available within NFT smart contracts, but the ease of use with Masterworks is unique. There’s no crypto wallet or advanced coding knowledge required to participate in the Masterworks secondary marketplace. And while buying and selling NFTs gives you freedom and flexibility, the Masterworks team takes care of showing your art and finding a buyer—meaning there’s less responsibility on you.

Use Masterworks to diversify your portfolio when you have a solid foundation of passive funds making up the bulk. Alternative investments like artwork are a type of hedge that operates independently of the stock market. Consider Masterworks the icing on the cake, but make sure you have fully utilized retirement accounts such as IRAs and 401(k)s.

What other people are saying about Masterworks

People like Masterworks for giving them the opportunity to own a piece of art history. A crowd favorite is the artist biographies and historical auction data that come with the enterprise plan and help users make super well-informed decisions. They also give members access to private art tours, webinars, and the opportunity to see the painting they’ve invested in a museum.

In addition, the platform itself is reportedly easy on the eyes with streamlined features.

The biggest complaints are that you have to sign up for this platform with an onboarding phone interview with a representative from RIA-affiliate Masterworks Advisers—you can’t do it fully online. Some customers have said this leads to more annoying phone calls from customer service representatives, which is unexpected in an increasingly digital era.

Most online reviews also mention confusion around Masterworks’ fee structure. There’s also some speculation on Twitter and other social media threads that the historical data for fine art’s ROI are just too good to be true. For the average American investor who has until now been unable to participate in fine art investments, it’s easy to see why the idea of paintings outperforming the S&P 500 might raise an eyebrow. Yet, well-informed alternative investors who understand the risks still stand to gain from this approach to fine art investing

Are there other apps like Masterworks?

Art has always been admired by many and owned by few—but that hasn’t stopped humans from collecting in our own little ways throughout the course of history (anyone remember Pokémon cards?)

But today’s options for valued art and collectibles have exploded, particularly with the rise of blockchain and non-fungible tokens (NFTs).

While Masterworks is the first and largest platform making blue-chip art—the kind of artwork you learned about in art history class—accessible via Class A shares, there’s nothing stopping anyone from buying digital collectibles with a minimum investment of $0.

Alt is a low-fee platform that lets you purchase, trade, and auction off sports cards. Similar to Masterworks, Alt also offers tools to help users understand valuation and price history, including a comprehensive database and a proprietary analysis tool. There’s a few selling options to choose from, and sellers can benefit from immediate payouts and ownership transfers. Experience immediate payouts, transfer of ownership within seconds and hassle-free happiness.

Meanwhile, Rarible lets digital artists and creators create (mint), sell, and trade the blockchain-verified unique crypto assets known as NFTs. While anyone can get started investing in NFTs today, we recommend learning about blockchain and cryptocurrency first, as this ecosystem is still volatile. The potential to earn (for both investors and creators) is high—but there are no guarantees.

Our hot take on Masterworks

We’re happy Masterworks aims to make blue-chip art more accessible. Transparency in art sales has always been a hurdle for both collectors and artists alike. Anyone who’s ready to venture into alternative investing and has a medium time horizon will love Masterworks, even though the fees are a little wonky and the concept of blue-chip art for all is still new.

I’m in! How do I sign up for Masterworks?

1. Log in to or create a MoneyMade account.

Visit our Masterworks platform page and log in to your MoneyMade account.

2. Open a Masterworks account.

This can be done through your MoneyMade account or directly with Masterworks.

3. Request an invitation to join Masterworks.

Masterworks is invite-only, but luckily invitation requests are often approved automatically.

4. Wait for your phone interview.

Your onboarding phone interview will consist of basic questions about your investing style, goals, risk tolerance, and how much you’d like to invest.

5. Wait for your sign up link.

Once your phone interview is complete and you are cleared by an Adviser, you should receive a sign up link shortly thereafter.

6. Sign up by following instructions.

The sign up process is mostly complete at this point, so your account should be ready to go in minutes. From here, you can fund your account with a bank transfer, debit card, or credit card and start investing.

7. Return to MoneyMade and link accounts to track everything in one place.

By linking your Masterworks account to your MoneyMade account, you’ll be able to track your investments all in one place and get a personalized risk score that will help you move closer to your money goals.

FAQs

Is it worth investing in Masterworks?

Investing in art can be a great way to diversify your portfolio and protect your wealth against inflation and market downturns. However, art should make up a small percentage of your overall investments (less than 10% of your assets), so keep that in mind when deciding whether or not it’s worth investing in Masterworks.

What are Masterworks fees?

Masterworks charges investors a 1.5% annual management fee. There’s also a 10% initial premium on all the art the platform buys, and when art is sold, Masterworks charges a 20% commission on the resulting profits. That said, investing in art on your own can be very costly—between transportation, storage, appraisal, restoration, auction, and legal fees, you can end up paying up to 45% in additional fees. Masterworks takes care of all these logistical concerns and the fees associated with them.

How many people use Masterworks?

According to Masterworks, over 250,000 members have signed up through the Masterworks platform. As of October 2021, around 15,000 members have invested through the Masterworks platform by purchasing shares of the available artwork.

How long has Masterworks been around?

Masterworks was founded in 2017 by Scott Lynn as a way to provide a wider range of investors with access to fine art investments.

DISCLAIMER: Moneymade receives cash compensation for referring potential investors to Masterworks through this page. Masterworks reviewed the copy for factual accuracy but did not offer editorial input. Investing involves risk. Past performance not indicative of future returns. See Important Regulation A Disclosures at masterworks.com/cd.