Study: Crypto Exchange Fees Ranked

Crypto exchanges charge trading and withdrawal fees that can eat into your earnings. Here are the exchanges with the lowest fees.

Crypto exchanges make it easy for many new investors to start buying and selling cryptocurrencies, whether they’re trading bitcoin, stablecoins or NFTs. However, like Blockchain technology itself, the industry is still relatively new, and the fees between crypto exchanges can vary widely.

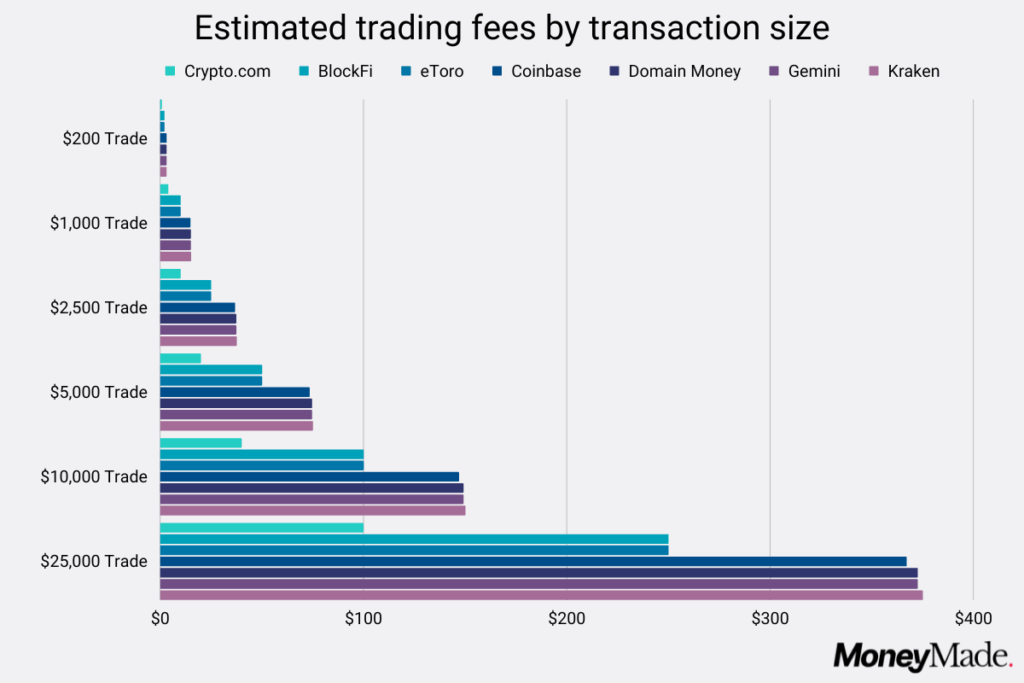

To provide realistic estimates of trade costs, we ran six scenarios using transaction sizes that ranged from $200 to $25,000.

Exchanges can charge a variety of fees, ranging from trading fees to transfer fees, and even fees for withdrawing your funds. Depending on how actively you trade cryptocurrencies, these fees can quickly snowball into a large chunk of your holdings, eroding any wealth you’re able to accumulate in these volatile markets.

We’ve gathered data from seven of the most popular cryptocurrency exchanges on their trading and withdrawal fees. We then calculated how much fees might cost you based on trade size and volume and then ranked the exchanges based on how quickly their costs added up. In this crypto exchange fees study, you’ll find everything you need to know to determine which crypto exchange is most cost-effective for your needs.

Key highlights

- Trading fees generally ranged anywhere from $2.30 to $292, while withdrawal fees ranged from a few cents to $50 per transaction.

- Trading fees as a percentage of your trade generally cheapen as your transaction size increases.

- Crypto.com charged the lowest trading fees while Kraken charged the highest trading fees amongst all transaction ranges tested.

- Gemini charged the lowest withdrawal fees on average while eToro charged the highest, although this varied depending on which coin you’re invested in.

How crypto exchange fees work

Crypto exchanges exist to facilitate transactions in cryptocurrency, whether that be in coins, tokens, or NFTs. They also can serve a number of other decentralized finance (DeFi) functions, including providing liquidity, offering margin trading and even banking services, depending on which crypto exchange you throw your lot in with.

The core capacity of a crypto exchange remains the trading of cryptocurrency. These platforms operate similarly to brokerage accounts, as they serve as the main modem through which you can buy or sell cryptocurrency, or exchange your coins or tokens for other currency pairs.

Crypto exchanges typically earn their money in the form of both trading fees and withdrawal fees, which are fees charged for buying or selling cryptocurrency on the platform and fees charged for withdrawing funds from the platform, respectively. Platforms can also charge fees for things like deposits and credit card or debit card fees, however these are less consistent among providers.

Fee structures and concessions

Most cryptocurrency exchanges offer fee concessions for larger volume trades as well as different fee structures depending on whether you’re a market maker or taker on a trade. Sometimes, you’ll see things like withdrawal fees vary between platforms due to the extra transaction cost that may be endemic to making trades on a particular blockchain (much like Etheruem’s gas fees).

For most transactions, you can expect trading fees to cost you between $2.30 and $292 depending on the size of your trade. Withdrawal fees will run you from anywhere from a few cents to $50 per transaction, with the average sitting at $16.81.

Crypto trading fee comparison at a glance

Crypto exchange(s) with the lowest trading fees: Crypto.com

Crypto exchange(s) with the highest trading fees: Kraken

| Trade Size | Lowest Cost Exchange | Trade Fee | Highest Cost Exchange | Trade Fee |

|---|---|---|---|---|

| $200 | Crypto.com | $0.80 | Kraken | $3.00 |

| $1,000 | Crypto.com | $4.00 | Kraken | $15.00 |

| $2,500 | Crypto.com | $10.00 | Kraken | $37.50 |

| $5,000 | Crypto.com | $20.00 | Kraken | $75.00 |

| $10,000 | Crypto.com | $40.00 | Kraken | $150.00 |

| $25,000 | Crypto.com | $100.00 | Kraken | $375.00 |

Trading fees were fairly consistent in terms of how they were charged. When it came to the lowest cost provider, Crypto.com’s quoted fees were the absolute lowest of the seven exchange samples we collected. Locked in the middle were BlockFi and eToro, which charged identical fees among the trade sizes we sampled.

While Kraken charged the highest trading fees based on the data we collected, both Gemini and Coinbase followed closely behind them with their trading fees differing by as much as a few dollars to as little as 1 cent depending on the trade size.

Trading fees are similar to the trade commissions charged by brokerage accounts in earlier decades. However, unlike trading commissions, which are usually charged as a fixed fee per trade, trading fees on crypto exchanges are typically charged as a percentage of your trade and scale up alongside the size of your trade. This means the more you trade, the more you pay in trading fees.

Crypto withdrawal fee comparison at a glance

Crypto exchange(s) with the lowest withdrawal fees: Gemini

Crypto exchange(s) with the highest withdrawal fees: eToro

| Coin | Lowest Cost Exchange | Withdrawal Fee | Highest Cost Exchange | Withdrawal Fee |

|---|---|---|---|---|

| Bitcoin (BTC) | Kraken | $0.31 | eToro | $155.75 |

| Ethereum (ETH) | Gemini | $1.88 | BlockFi | $28.13 |

| Litecoin (LTC) | BlockFi/Crypto.com | $0.06 | eToro | $0.32 |

| Chainlink (LINK) | Gemini | $0.09 | Crypto.com | $20.01 |

While Crypto exchanges will normally accept most deposits for free, the same can’t be said for withdrawals. The second most common way that crypto platforms collect their revenue is in the form of withdrawal fees.

There was wider variance in withdrawal fees when compared to trading fees amongst the five exchanges we sampled. Absent from our analysis were Coinbase and Domain Money, who did not provide consistent publicly available quotes for withdrawal costs. We note that eToro does not support trading in Chainlink (LINK).

We calculated the withdrawal fee as the cost to withdraw a single unit of each cryptocurrency at the market value as of June 8, 2022. This allowed us to compare withdrawal cost across exchanges with different withdrawal fee structures.

The majority of platforms charge withdrawal fees on a per transaction basis, which incorporates a standard exchange fee to complete the transaction in tandem with any additional spread the exchange decides to charge on top of the withdrawal.

eToro was the only exchange sampled that quoted a withdrawal fee that was calculated as a percentage of your withdrawal amount. Consequently, it had the highest withdrawal fee for two of the four tokens sampled. This is why the fee for withdrawing one Bitcoin is so much higher on that platform—it charges withdrawal fees as a percentage of your withdrawal amount, and withdrawing one BTC amounted to a transaction of over $30,000.

Comparatively, both Kraken and Gemini performed better in the withdrawal fees category than they did in trading fees. Their withdrawal fees for the lowest-cost tokens were dozens of dollars cheaper than the high cost provider. We also note that this did not take into account Gemini’s policy of permitting up to 10 free withdrawals per calendar month before their fees kicked in.

Fee comparison breakdown

To provide realistic estimates of trade costs, we ran six scenarios using transaction sizes that ranged from $200 to $25,000, which were viewed to be within the realm of common trade sizes for retail investors. The results of these estimates are displayed below.

To rank the crypto exchanges we sampled, we divided our fee scenarios into 3 sub-groups of transaction sizes, including small ($200 – $1,000), mid ($2,500 – $5,000), and large ($10,000 – $25,000). The fee samples for each group were averaged and the results were ranked and tallied from lowest to highest-cost below.

$200 – $1,000 Portfolio Rankings (Small)

| Exchange | $200 Trade | $1,000 Trade | Trade Cost Average |

|---|---|---|---|

| Crypto.com | $0.80 | $4.00 | $2.40 |

| BlockFi/eToro | $2.00 | $10.00 | $6.00 |

| Coinbase | $2.99 | $14.68 | $8.84 |

| Domain Money | $2.98 | $14.90 | $8.94 |

| Gemini | $2.99 | $14.90 | $8.95 |

| Kraken | $3.00 | $15.00 | $9.00 |

$2,500 – $5,000 Portfolio Rankings (Mid)

| Exchange | $2,500 Trade | $5,000 Trade | Trade Cost Average |

|---|---|---|---|

| Crypto.com | $10.00 | $20.00 | $15.00 |

| BlockFi/eToro | $25.00 | $50.00 | $37.50 |

| Coinbase | $36.70 | $73.41 | $55.06 |

| Gemini/Domain Money | $37.25 | $74.50 | $55.88 |

| Kraken | $37.50 | $75.00 | $56.26 |

$10,000 – $25,000 Portfolio Rankings (Large)

| Exchange | $10,000 Trade | $25,000 Trade | Trade Cost Average |

|---|---|---|---|

| Crypto.com | $40.00 | $100.00 | $70.00 |

| BlockFi/eToro | $100.00 | $250.00 | $175 |

| Coinbase | $146.81 | $367.03 | $256.92 |

| Gemini/Domain Money | $149.00 | $372.50 | $260.75 |

| Kraken | $150.00 | $375.00 | $262.50 |

Methodology and Caveats

We calculated all trades using assumptions obtained from publicly disclosed fee schedules, directly sourced from each platform we sampled. All calculations made assumed trading in reasonably liquid cryptocurrencies supported under each platform.

To ensure consistency in our data, we limited our sample to cryptocurrency exchange platforms that offered dedicated trading in individual tokens and coins. Excluded from this sample were platforms that focused on other value-add strategies such as those specializing in trading baskets of cryptocurrencies.

To draw fair comparisons, we limited our cryptocurrencies sampled to four of the most commonly traded and liquid transactional tokens that fluctuate with market values. Stablecoins, NFTs, and other special-function coins were excluded from our analysis.

We used the following methodologies to calculate scenarios for trading and withdrawal fees.

Trading fee methodology: We collected trading fee schedules for 7 distinct crypto platforms and identified common trade sizings based on commonly quoted ranges and crypto news sources. We then isolated six key scenarios and ran separate trials for each crypto platform across all scenarios, ranked, and tabulated the results.

Withdrawal fee methodology: We collected withdrawal fee schedules for 5 distinct crypto platforms and identified 4 of the most commonly traded and reasonably liquid cryptocurrencies across all platforms in our sample size. We then identified the market value of one unit of each cryptocurrency as of the day of the analysis (June 8, 2022), and calculated the dollar cost of withdrawing a single unit of that token.

Caveats

Differences in fee schedules may reflect differences in strategic or cost decisions made by management at each platform, and do not necessarily reflect the quality or lack thereof for its respective exchange. These differences may be offset by direct benefits offered elsewhere on each platform, which fell outside the scope of our study. For example, some exchanges may charge higher fees but might support a greater universe of crypto tokens.

Keep in mind that the volatility of crypto markets may result in all figures being substantially different from the amounts quoted. These fees were calculated based on market values as of June 8, 2022 and are meant to be a snapshot in time. However, it’s our opinion that these relationships will generally remain consistent assuming no changes to the fee schedule.

Also keep in mind that all fee schedules are subject to change based on the discretion of each respective trading platform. If these schedules change, it’s likely that the relationships identified in our study will not remain consistent.

Sources

- BlockFi Fees. (n.d.). BlockFi. Retrieved June 8, 2022

- Coinbase Exchange Fees. (n.d.). Coinbase. Retrieved June 8, 2022

- Crypto.com Fees & Limits. (n.d.). Crypto.Com. Retrieved June 8, 2022

- Domain Money Rates and Terms. (n.d.). Domain Money. Retrieved June 8, 2022

- eToro Fees. (n.d.). eToro. Retrieved June 8, 2022

- Gemini Fees. (n.d.). Gemini. Retrieved June 8, 2022

- Kraken Fee Schedule. (n.d.). Kraken. Retrieved June 8, 2022