How to Invest Like the Largest Sovereign Wealth Funds

Investing an impressive $10 trillion in assets, sovereign wealth funds can pass for the world’s 3rd largest country. Here’s where the largest sovereign wealth funds put their money.

Sovereign wealth funds (SWFs) are financial powerhouses, managing more than $10 trillion in assets. That’s enough money to make them the third-largest country in the world by GDP. With stacks of cash like that, you’d think they’d have a garage full of sports cars. But no, these state-owned investment funds put it in a different kind of vehicle.

In 2008, the world’s sovereign funds managed a combined total of $3.4 trillion. By the end of 2015, that number had ballooned to a staggering $7.2 trillion.

In 2021, SWFs invested a combined value of $120 billion into 450 mega deals, with America and India receiving most of the money. But it’s not just the big markets like stocks and bonds that get to enjoy the sovereign wealth. Alternative energy like solar, wind, and geothermal had an equally amazing year, with SWFs investing a stimulating $9 billion.

India made out big with foreign investments into e-commerce giant Flipkart, retail giant Reliance Retail, Paytm, and Unacademy.

Despite the occasional breach of diplomatic protocol, sovereign wealth funds hold a unique mix of global companies and ventures, and their financial muscles are flexing harder than ever in 2023.

With a strong track record of investments, a large asset base, and a commitment to sustainability, SWFs have earned more than their due.

What is a sovereign wealth fund?

Sovereign Wealth Funds are a special kind of investment fund that is owned and managed by governments of resource-rich countries. The funds usually come from trade revenue and nationalized industries like oil.

Interestingly, the first-ever SWF was established over a century ago by the state of Texas in the United States. They called it the “Permanent School Fund” and it funded public education. Though this fund was small compared to modern SWFs, it set the stage for the current trend.

Source: visualcapitalist.com

The oldest and largest of all known sovereign funds is the China Investment Corporation, with a total asset value of over $1.35 trillion. But the first fund established for a sovereign state was the Kuwait Investment Authority, a commodity SWF created in 1953 from oil revenue before Kuwait gained independence from the United Kingdom. This wealth fund is estimated to hold assets worth $600 billion.

Sovereign Funds are amazing instruments that give governments the opportunity to strategically invest money in a global market, receive high returns, grow the federal reserve, and fund important public services and projects such as public pension funds. That’s what makes them so special.

But what about central banks? Well, sovereign funds and central banks are two different entities with distinct roles in the economy. Central banks are the cornerstone of their respective country’s financial systems. Central banks are tasked with managing the currency and monetary policy of their respective economies. They are responsible for controlling inflation, setting interest rates, issuing currency, and acting as a lender of last resort. Central banks also regulate the banking system and manage the federal reserve.

Why sovereign wealth funds invest in financial markets

SWFs contribute to public pension funds by investing in financial markets to generate wealth for future generations, diversify their country’s economy, and protect the federal reserve surplus from risk.

But why stop there? These funds also invest in alternative investments like hedge funds and private equity. After all, why settle for traditional investments when you can have a piece of the latest unicorn? Plus, investing in stock and bond markets in developed economies gives the funds access to deep, well-developed markets—which is certainly a plus. Exposure to emerging markets means higher potential long-term returns.

These funds can be used for a variety of purposes, ranging from providing financing for government projects to stabilizing the economy or investing in foreign countries.

The most popular type of SWF is the Stabilization Fund, which is used to protect a country’s economy from potential shocks and unforeseen events. Stabilization funds may be invested in a variety of asset classes, such as local currency, stock markets, bonds, and commodities to ensure a return that protects the value of the fund in times of economic instability.

Future Generation Funds are also popular, as they provide intergenerational savings and help finance a nation’s future pension obligations. The funds can be invested in a variety of asset classes in order to generate a return that will ultimately help fund future projects.

Federal reserve Investment Funds are a common type of SWF that offsets economic instability and inflation and helps balance the national budget. These funds are invested in asset classes that can potentially generate higher rates of return, such as stock markets, bonds, and commodities.

Lastly, Pension Reserve Funds are public pension funds used to finance a country’s pension system and ease the burden on government budgets. These funds are invested in asset classes that offer higher-yielding returns, such as stocks and bonds, to help ensure a secure pension system over time.

There are no set capital allocation requirements or rules as to when a nation can dissolve or create an SWF. Instead, it’s up to the government to decide when is the best time to make investments or rebalance portfolios. SWFs are crucial components of most nations’ economies that help ensure financial stability.

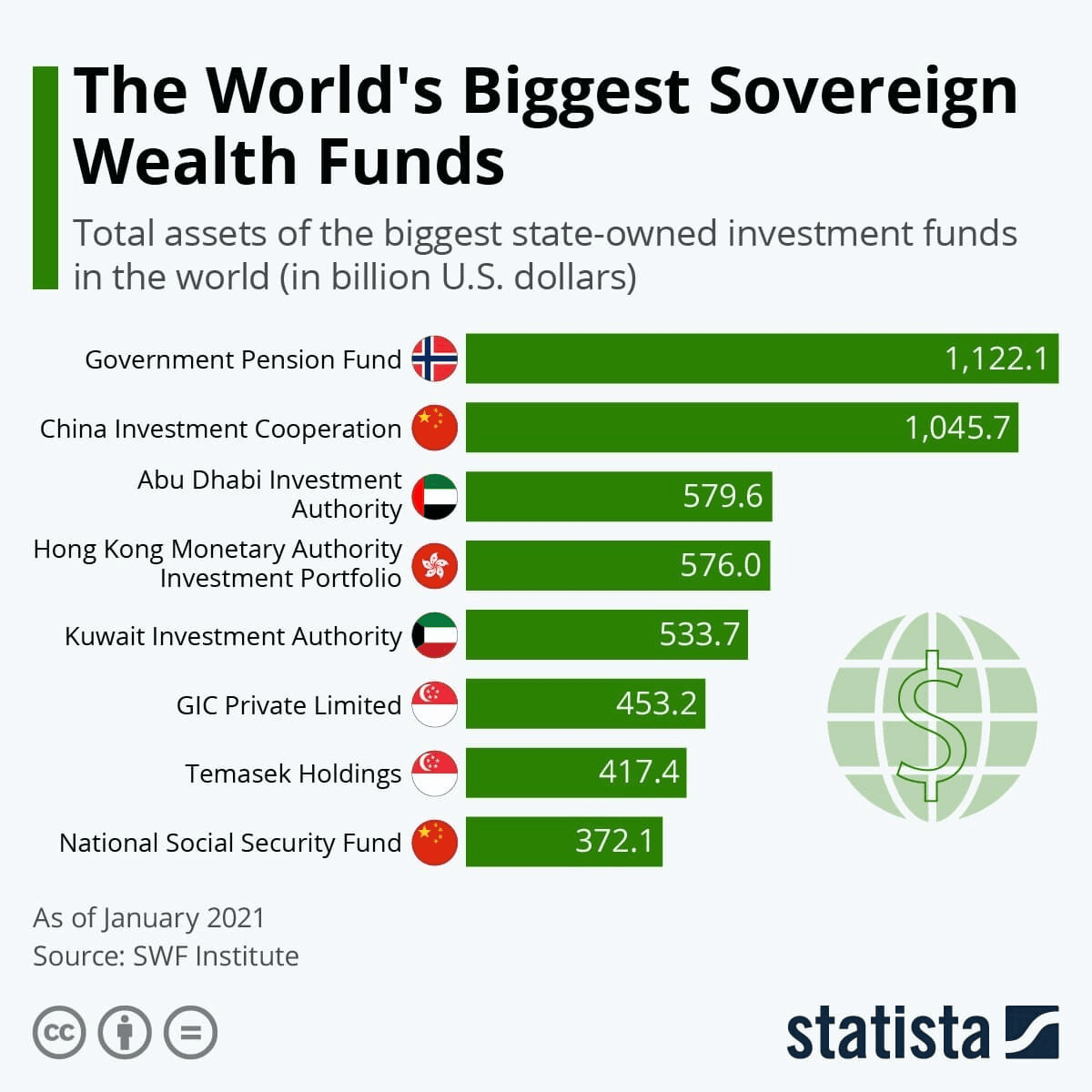

Source: Statista/SWF institute

Clearly, sovereign funds have embraced financial markets with open arms and it’s easy to see why. With the potential for long-term returns and diversification, these funds are in a great position to maximize returns and stabilize global economies.

Sovereign Wealth Fund Institute

The Sovereign Wealth Fund Institute (SWFI) is like a team of Sherlock Holmes-style detectives, only they investigate the mysterious world of sovereign funds, pensions, endowments, and other long-term institutional investors instead of crime.

Since 2008, the SWF Institute has been using its sleuthing skills to uncover the latest trends and insights in the financial world. SWFI is all about analyzing publicly-owned asset holders such as the world’s sovereign wealth funds, public pensions, and central banks. They provide services like research and consulting to elite investors and publish Sovereign Wealth Quarterly.

And if that wasn’t enough, they also keep track of global mega deals made by sovereign funds and landmark moments such as (dun dun dun) Norway’s sovereign wealth fund crossing the $1 trillion mark in assets in 2017. They even have a special Transparency Index rating these institutions on a ten-point scale, celebrating those with great transparency, and providing ‘constructive’ feedback to everyone else.

Whether it’s generating rich data feeds, facilitating elite events, or tracking grand-scale milestones, The SWF Institute is a one-stop shop for all the latest news and figures in the world of nationalized asset management. So if you ever find yourself wondering “oh, what’s going on in the world of sovereign funds and other long-term institutional investors?” The kind folks at SWFI got you covered.

Largest sovereign wealth funds

It’s time to talk about the big swagger and bling. In the sovereign fund world, let’s sail through the heavy hitters that show the rest who’s boss. Find out how these state owned investment vehicles are making mega deals and deploying their surplus revenues.

We’ve combed every region in the world, from Norway to China and more, to uncover the largest SWFs as well as what makes them the most successful in the game.

So hold on tight as we navigate the largest sovereign wealth funds on the globe.

1. Norway’s Norges Bank Investment Management

- Size: $1.34 trillion AUM

- Biggest investment: $806 billion in equities

- Biggest loss: $250 billion plunge in the value of its tech stocks

- Strategy: Sustainability

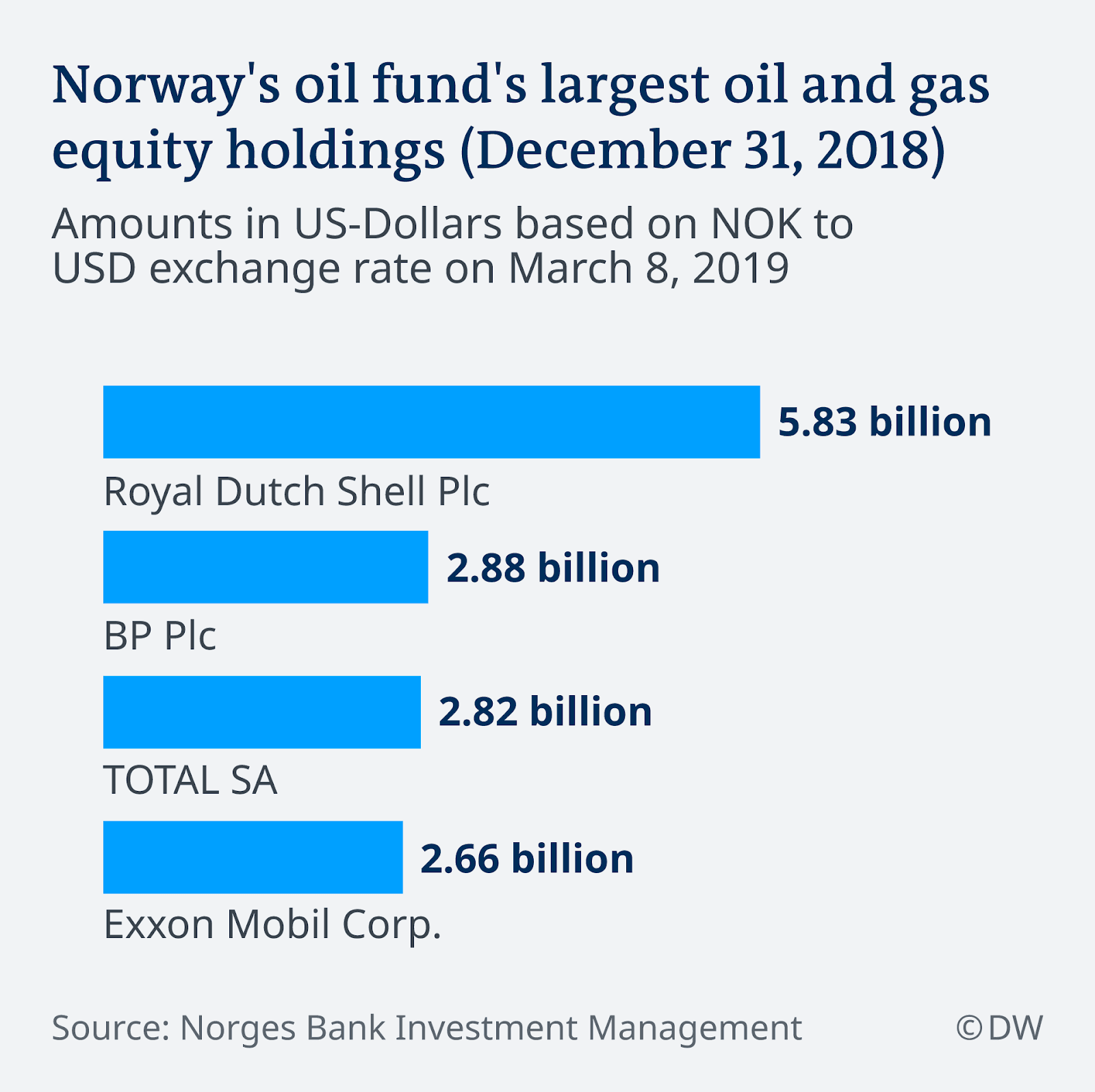

The Norges Bank Investment Management Fund, AKA Government Pension Fund Global, is worth a whopping $1.34 trillion (13.278 trillion Norwegian Kroner) and growing. This behemoth of an investment fund has been around since 1969 when Norway discovered oil in the North Sea and it’s been collecting money since 1996 when the first transfer to the fund was made.

In terms of asset allocation and government spending, it’s got 68.5% of its money in equities ($806 billion or 7.986 trillion kroner), 28.3% in fixed-income investments ($333 billion or 3,304 billion kroner), 3.0% in unlisted real estate ($35 billion or 354 billion kroner), and 0.1% in renewable energy infrastructure ($1.3 billion or 13 billion kroner).

Source: Deutsche Welle/Norges Bank Investment Management

In terms of performance and resource revenue, Norway’s sovereign wealth fund has been doing pretty well. It’s achieved a net annual real return of 3.62% and outperformed its benchmark index by 0.27 percentage points since 1998. In 2021, its relative return was 0.74 percentage points higher than its benchmark index.

And with investments spread across more than 70 countries and a 1.3% average stake in over 9,000 companies worldwide, it’s safe to say that Norway’s Norges Bank Investment Management is the sovereign fund to reckon with.

2. Saudi sovereign wealth fund

- Size: $620 billion AUM

- Biggest loss: $249 billion in 3 years incurred from foreign asset investments

- Strategy: methodical investing

The Public Investment Fund of Saudi Arabia is a global impactful investor, with a world-class portfolio of investments that focus on sustainability. They’ve got big plans, and they’re ready to make them happen.

Let’s take a look at their performance to date: 71 companies created, 13 strategic sectors, over 500,000 jobs created, and a mind-boggling $620 billion AUM (as of the end of Q1 2022).

Source: Financial Times

The fund was established in 1971, and since then it has grown from a financial support fund to one of the world’s largest funds. Now, it’s a key player looking to achieve big objectives by 2030.

Locally, it’s driving strategic diversification and supporting key sectors by investing in private companies. Internationally, it’s diversifying investments across a range of asset classes and has invested in some of the world’s most innovative companies. It has investments in North America, Europe, Asia, Latin America, and Africa, across healthcare, technology, real estate, infrastructure, consumer services, transportation, and other strategic sectors.

By 2025, PIF is aiming to surpass one trillion dollars worth of assets under management, with a 21% share of assets in new and growth sectors, 1.8 million direct and indirect jobs created, 60% share of local content including PIF and its portfolio companies, 24% share of assets in international sectors, and $320 billion cumulative non-oil GDP contribution.

The Public Investment Fund of Saudi Arabia is on a mission to achieve big goals for its future generations, and it’s clear they’re serious about making it happen.

3. Singapore sovereign wealth fund

- Size: $690 billion AUM

- Biggest investment: $255 billion in nominal stock and bond markets and cash

- Biggest loss: $41.6 billion in 2008 resulting from drops in equity investments and property valuations

- Strategy: Disciplined, long-term value investing

GIC is the ultimate investment juggernaut of Singapore. Established in 1981, it was the brainchild of Dr. Goh Keng Swee and has been a pioneer in the sovereign fund game ever since. With a global presence across 11 offices, 1900 employees worldwide, and $690 billion in assets under management invested in over 40 different countries, GIC is an unstoppable force when it comes to investments.

Speaking of investments and government spending, GIC has an impressive portfolio made up of six core asset classes—10% in Real Estate, 14% in Developed Market Equities, 37% in Nominal Bonds and Cash, 16% in Emerging Market Equities, 6% in Inflation-Linked Bonds and 17% in Private Equity—each with a different risk and return profile. This diversified portfolio has allowed GIC to remain resilient under all conditions while generating positive long-term returns regardless of rising inflation.

And the performance? Over the 20-year period that ended 31 March 2022 GIC achieved an annualized rate of return of 4.2% above global inflation, while other sovereign wealth funds fell. That’s right, GIC has nearly doubled the international purchasing power of the foreign exchange reserves it manages, which is quite an impressive feat considering the global financial markets have been anything but calm during that time.

Source: Bitcoinist

Coming from one of the most resource rich countries, GIC has also been responsible for some of the biggest investments in the U.S., including a $200 million investment in the equity of Stuyvesant Town and Peter Cooper Village. It also threw 11 billion Swiss francs in a 7.9% stake in UBS and $6.88 billion for a 9% stake in Citigroup.

In short, the Singapore sovereign wealth fund is a forward-thinking, resilient, and bold investor with a long history of success accumulating the best-performing assets. They are positioned for long-term and flexible growth across asset classes and will potentially continue to diversify their portfolio as long as there’s new stuff to invest in.

4. Qatar sovereign wealth fund

- Size: $475 billion AUM

- Biggest loss: $12 billion from equity investments in 2015

- Strategy: four-step process (origination, evaluation, execution, and active management)

Qatar Investment Authority (QIA) is like that rich uncle that has plenty of money and just wants to share it with his family. Established in 2005, QIA has grown to become one of the largest and most impressive sovereign wealth funds in the world. Supporting the Qatar National Vision of 2030, QIA’s current assets under management sits at $475 billion.

QIA has been establishing itself internationally through strategic investments in a multitude of sectors, such as technology, media and telecommunications, healthcare, retail and consumer goods, real estate, infrastructure, financial institutions, industrials and materials. On top of traditional investments, QIA is looking to invest in human capital, regional projects, and partnerships—no wonder it’s so popular.

The Authority is always on the lookout for reliable partners, such as its 6.87% stake in the Credit Suisse Group and its collaboration with the CITIC Group Corp to launch a $10 billion investment fund in China. QIA also had the opportunity to acquire the former London headquarters of Royal Dutch Shell and stakes in companies like Sainsbury’s and Fisker Automotive.

Qatar’s SWF is an example of a successful business venture that’s building resource revenue and driving profits. It currently holds a 12.7% stake in Barclays, a 17% stake in Volkswagen Group and Porsche, a 4% stake in Total, a 6% stake in EADS, a 5% stake in Vinci SA, and others—the list is virtually endless.

Source: Dan Kitwood/Getty Images News

QIA’s investment strategy isn’t based on any set global capital allocation requirements. All investment initiatives are proposed by management, okayed by the Board, and ultimately blessed by the Supreme Council for Economic Affairs and Investment (SCEAI).

Management over at the QIA loves to get down to the nitty-gritty, especially when it comes to the development of their long-term plan. They don’t mess around with their process for allocating assets—they’ve got a top-down approach they’ll never budge on.

They don’t want any loose ends or unexplored avenues in the process—you know, the good old “we won’t know until the Supreme Council for Economic Affairs and Investment says so.” With their Reference Portfolio in hand, QIA strategizes the annual and medium-term investment plans that take full advantage of their competitive advantages.

So there you have it, folks. QIA’s in it for the long haul, and they’ll take all the measures necessary to get there. It’s clear why QIA is so successful—its sharp eye for investment leaves no stone unturned.

5. UAE sovereign wealth fund

- Size: $790 billion combined AUM

- Biggest loss: $183 billion from global equities in 2008 due to the global economic crisis

- Strategy: ADIA Wide-Planning (AWP)

If someone asks “what business is Abu Dhabi Investment Authority in?” Your answer probably shouldn’t be “making money.” But that’s exactly what ADIA, the biggest UAE sovereign fund, has been doing for the past 40 years.

This SWF is an investment institution based in Abu Dhabi that holds around $790 billion in assets managed and has investments in some of the world’s biggest markets. Whether it’s developed or emerging equities, government bonds, credit, alternatives, real estate, private equity, and even up to infrastructure and cash— ADIA has investments just about everywhere in the world, with a 45% to 60% exposure in North America, 15% to 30% in Europe, 5% to 10% in developed Asia, and a 10% to 20% exposure in emerging markets.

Looking at its portfolio by assets, the sovereign wealth heavyweight has a diversified long-term strategy to invest 32% to 42% in developed market equities, 7% to 15% in emerging market equities, 1% to 5% in small-cap equities, 7% to 15% in government bonds, and 2% to 7% in credit vehicles.

But that’s not all as ADIA plans to also maintain an investment range of 5% to 10% in financial alternatives, another 5% to 10% in real estate, 7% to 12% in private equity, and 2% to 7% in infrastructure, leaving 0% to 10% in cash.

ADIA is no newcomer to the investment game—in fact, it dates back to 1976. Since then, ADIA has managed to use its long-term investment strategy to achieve significant returns across a wide range of asset classes and geographies. But it’s not just a financial institution—ADIA is also a cultural smorgasbord. Over 65 nationalities make up its diverse workforce, and its global network extends to the world’s leading investment institutions.

Just recently, despite all the turbulence in the past year, ADIA experienced strong returns in 2021, with a 20-year and 30-year annualized rate of return of 7.3%—which just goes to show that with so much experience and big money in financial assets, ADIA is indeed an investment powerhouse that will only continue to make waves in the investment world.

6. U.S. sovereign wealth fund

- Size: $74 billion in combined value

- Biggest investment: $55 billion in U.S. equities and fixed-income securities

- Strategy: APFC employs a combination of internally managed direct investments alongside externally-managed fund investments.

It’s true, the United States doesn’t have a federal sovereign fund. But that doesn’t mean there isn’t loads of wealth to be had there. Unlike other countries, the U.S. has a number of funds from state owned investors leveraging government revenues, with the granddaddy of them all is the Alaska Permanent Fund.

This fund is managed by the Alaskan Permanent Fund Corporation (APFC) and was founded in 1976 by Governor Jay Hammond. Since then, the fund has grown from a seemingly humble beginning of a mere $734,000 to a whopping $74 billion in the combined value of assets managed.

This phenomenon is due in part to the APFCs clever investing strategy, which includes a mix of investing in public equities, fixed-income, private equity, real estate, infrastructure, absolute return, and risk parity strategies to potentially outperform the inflation rate plus 5% or better and compete with peers and market index benchmarks.

Its Earnings Reserve Account (ERA) has $3.8 billion available for spending and disbursement of the Permanent Fund Dividend. In 2018, the dividend was $1,600, which rose to $1,606 in 2019—a solid return for Alaskan citizens. That figure fell to $992 in 2020 and was disbursed earlier than usual due to the pandemic.

It’s not all fun and games, though. We have to take a closer look at how they invest to really understand where it’s coming from. The fund primarily focuses on the United States, investing about $55 billion of their funds in U.S. equities and fixed-income securities.

That’s followed by $6.5 billion in Europe, $3.9 billion in Central and South America, $3 billion in Asia, and $2.1 billion in the U.K. But let’s not forget the other parts of the globe—they still left room in the budget to invest in Africa, Australia, and their icy neighbor to the north.

Clearly, the Alaska Permanent Fund is doing something right. With their well-diversified investment approach, they’ve consistently produced returns of about 7.91% over the past five years despite inflation. They also recently established the Alaska Future Fund in 2019—a $100 million fund capitalized by the APFC Earnings Reserve—which is run by Barings, one of the leading financial services companies in the world.

7. China sovereign wealth fund

- Size: $1.35 trillion AUM

- Biggest investment: Purchased Logicor for $13.49 billion

- Biggest loss: $21.2 billion on its overseas investment in 2018 due to a global economic downturn and trade disputes with the U.S.

- Strategy: CIC employs a methodical decision-making framework

China Investment Corporation (CIC) was founded back in 2007 with a clear mission: maximize returns while keeping risk at an acceptable level. Since then, it has become a global powerhouse of a sovereign wealth fund, managing over $1.35 trillion in assets globally.

For the last 15 years or so, CIC has sought to grow, diversify, and invest with a long-term horizon in mind, utilizing its Reference Policy Actual portfolio framework and balance of public equities, bonds, alternative assets, and cash products in between. Such a strategy has paid dividends over the years, as evidenced by an overall net annual return of 14.27% on its overseas portfolio in 2021.

Having gobbled up assets and stakes in some of the world’s largest companies since its establishment in 2007, CIC isn’t afraid to branch into different elements of finance and commerce. From public equity and bonds to real estate and infrastructure, and even a $2 billion stake in the Russian potash fertilizer company Uralkali in 2013, CIC is a force to be reckoned with.

CIC’s risk management investing philosophy is independent of any global capital allocation requirements and is truly admirable! After all, what’s the point of investing if money can’t be maximized to its potential? CIC has a comprehensive risk management system set up in order to maximize the interests of shareholders.

It’s like a superhero team of risk management systems—managing market risk, credit risk, operational risk, liquidity risk, country risk, and strategic risk—all working together to ensure the orderly operation of investment activities within an acceptable risk range. It’s almost like the Justice League of risk-monitoring vigilantes on the lookout for all possible threats to form an impenetrable force against downside.

And CIC performs. With a 10-year investment horizon, a 10-year net return standing at 8.73%, and cumulative net return since inception of 7.22%, the dragon’s financial fire already shows no signs of dampening.

They’ve certainly conquered their share of the financial sector, and we can expect to see a lot more growling from the dragon as it continues to gobble up more assets.

8. Malaysia sovereign wealth fund

- Size: $35.8 billion AUM

- Biggest investment: $21 billion in Malaysia’s public markets

- Biggest loss: $2 billion in 2018 across all assets due to a severe global market dip

- Strategy: A long-term investment approach to deliver sustainable risk-adjusted returns.

Khazanah Nasional Berhad, or “Khazanah” for short, is Malaysia’s sovereign fund and has been making strategic investments since the 1990s. Originally set up to stabilize the Malaysian economy, Khazanah now has an asset base of $35.8 billion and reported an operating profit of $158 million in 2021.

It set aside a special portfolio worth over $3 billion in combined value, including a developmental asset portfolio worth $1.06 billion and the Dana Impact portfolio equalling $1.4 billion.

If you were to take a closer look at Khazanah’s impressive portfolio, you’ll find a diverse range of investments across many sectors.

- Communications services (Astro Malaysia Holdings Berhad, Axiata Group Berhad, Telekom Malaysia Berhad, TIME dotCom Berhad)

- Consumer staples (Farm Fresh Berhad)

- Consumer discretionary (Themed Attractions Resorts & Hotels Sdn Bhd), financials (Bank Muamalat Malaysia Berhad, CIMB Group Holdings Berhad, Sun Life Malaysia Assurance Berhad, Sun Life Malaysia Takaful Berhad)

- Healthcare (IHH Healthcare Berhad, ReGen Rehabilitation International Sdn Bhd), industrial services (Cenviro Sdn Bhd, Cement Industries of Malaysia Berhad (“CIMA”), UEM Edgenta Berhad)

- Transportation & logistics (Malaysia Aviation Group Berhad, Malaysia Airports Holdings Berhad, PLUS Malaysia Berhad)

- Real estate (M+S Pte Ltd, UEM Sunrise Berhad, Iskandar Investment Berhad, Southern Marina Development Sdn Bhd, Sunway Iskandar Sdn Bhd)

- Renewable energy (Cenergi SEA Sdn Bhd)

- Utilities (Tenaga Nasional Berhad).

Khazanah takes a firm-wide approach to sustainability, covering everything from how it behaves as an investor to how the organization goes about its daily work in collaboration with the monetary authorities. Plus, its approach isn’t just concerned with the impact on the environment—it strives for an equitable portfolio and value creation opportunities.

Khazanah ensures that the portfolio is managed with ESG in mind and has begun integrating ESG considerations into all investment activities. As a sustainable organization, it empowers its employees to advocate for responsible behaviors, while continuing to catalyze positive change in its environment.

On top of these investments, Khazanah has proven to be an industry specialist that supports youth-led social impact projects. Talk about a major helping hand. Even with the pandemic, the SWF’s Net Asset Value (NAV) grew from 79 billion RM in 2020 to 86 billion RM in 2021, which is a compounded annual growth rate of 5.8%.

How to invest like a sovereign wealth fund

Now we’ll share with you some valuable advice on how to put your money to work like the world’s sovereign wealth funds regardless of all the turbulence and major economic uncertainties. If you’re ready to invest like a government with surplus revenues, here are some tips to help you get started.

1. Develop a clear strategy

Sovereign funds typically have a long-term strategy and look to make substantial investments with a low- to moderate-risk profile. They develop a clear strategy that includes the type of assets they will invest their oil revenues and natural resource funds, as well as their timeline.

2. Examine risk-reward ratio

Before striking mega deals, the world’s sovereign wealth funds examine the risk-reward ratio carefully to determine which investments offer the greatest potential for realizing their targeted return.

3. Savings equals wealth

It’s not just a catchy phrase—savings really does equal wealth. If you can learn to invest those savings in the proper assets, you’ll be sure to see your wealth begin to grow steadily over time.

Take a look at these figures from the Sovereign Wealth Fund Institute—In 2008, the world’s sovereign funds managed a combined total of $3.4 trillion. By the end of 2015, that number had ballooned to a staggering $7.2 trillion.

That’s well over double the total of all hedge funds and private equity funds worldwide. Plus, the majority of these are funded by oil revenue money, taking advantage of the high resource prices when they can.

4. Cash over credit

You know the drill—you always want to use cash payments instead of going into debt, especially if you’re charged more interest than what you’re earning. This is exactly how the world’s sovereign wealth funds are managed as well.

Due to the drop in oil prices, the values of many sovereign wealth funds fell in 2015 and the total value of all the funds during that period shrunk for the first time in eight years. Funds that relied heavily on oil revenue money saw their values drop by a $34 billion total. Yikes.

This is due to a few factors ‑ some counties are having to withdraw from their SWFs to cover their expenses, and the lower oil prices are resulting in a smaller inflow of funds. So, it’s best for them to use their cash savings instead of going into debt.

5. Long-term planning

No matter the situation, even as financial markets continue to face global market recession, these state owned investment vehicles always remain focused on the future, even generations down the road. They have their long-term plans and they stay the course.

Likewise, individual investors should also be thinking along the same long-term lines. Don’t let the volatility of the markets and the temptation to make short-sighted decisions distract you from your plans because long term investors win in the end.

6. Diversify, diversify, diversify

Most SWFs do not put all their eggs in one basket. You won’t see them just investing government revenues and oil funds in property or gold alone—they’re diversifying by investing in stock and bond markets, infrastructure, logistics properties, and real estate worldwide. Watch out, Pitbull.

The same goes for individual investors. Don’t just limit yourself to one asset class—spread your investments everywhere, across stock markets, bonds, real estate.

7. Diversify markets

Sovereign wealth funds invest in both mature and emerging markets to spread risk and increase diversification. Their main focus is on value and investments that will yield solid returns, such as undervalued assets or those that present a buying opportunity. For example, startups have yielded huge ROIs when they succeed.

So there you have it, fellow citizens—everything you need to know to invest like a sovereign wealth funds. Remember that there are no capital allocation requirements set in stone. If you want to go hard like an SWF, you must be ready to go big or go home.

Think long-term, invest in cash and equivalents, fixed-income securities, public equities, and alternative investments like private equity, venture capital, and real estate. Remember, stabilize your portfolio. Don’t be afraid to hedge your currency, and don’t sell when the stock and bond markets go down. And finally, acknowledge your biases—think of your investments as your own mini country, and aim to make it an unstoppable superpower.