Getting In On the Groundfloor: How To Invest In Pre-IPO Companies

How can you invest in pre-IPO firms like SpaceX, Stripe, and TikTok? We have the answers.

There’s lots of action in the stock market, but there might be more action outside of it—specifically, on the windy path that turns a small business into one of the thousands of publicly-traded companies.

“Though the world of pre-IPO investing is certainly more intimidating than, say, the stock market, there’s plenty of reasons why people might want to get their hands on pre-IPO shares.”

That’s because private companies, which trade in private financial markets, are where most of the growth action is at. According to Crunchbase, over half a trillion dollars went into VC-backed firms, helping early- and late-stage ventures raise funds to grow and scale. Think of the startups like plants—and the billions of capital as the water and sunlight to make it grow.

While many of these companies do fail, some of the plants grow big stalks: think companies like SpaceX, Instacart, Brex, Carta, and Discord. And depending on when you get into a private company, you might be well aware of what you’re signing up for. But, other times, you might sign up for a risky ride bundled with high hopes that a private firm will find its windy path to an initial public offering.

So what’s all the hubbub about pre-IPO firms, and how can you get a piece of that action? Before we explore your options, let’s determine if pre-IPO companies are worth investing in.

Should I invest in private companies?

There are a few reasons why investing in pre-initial public offering companies may be a no-brainer for those with solid financial resources, a good temperature for risk, and a high enough net worth. One of the biggest is the sheer amount of money going into pre-IPO firms from private equity, venture capitalists (VC), and individual investors.

According to Crunchbase, venture capital investments totaled over $339 billion in 2020. In 2021, that number nearly doubled to $651 billion.

The jury’s still out in 2022, but venture capitalists were filling their coffers to write even more checks, even after a paltry first half of the year. In America, venture capitalists have hauled in over $137 billion, according to Pitchbook.

Source: pitchbook.com

As you can imagine, there’s only one place that venture money will go—private companies.

So, why are investors cutting checks and raising funds to buy these pre-IPO stocks? Simply put, it’s the returns. According to private investment firm Cambridge Associates, the top 25% of investment firms in VC have annual returns from 15% to 27%.

But most investors should know that those returns are not without their risks. In spite of all its excitement and growth, the venture market is not like your tried-and-true S&P 500 index fund. After all, companies only go public after they’ve proven that they can scale, grow, and compete.

You have higher odds—especially as an early investor—of investing in a dud instead of a unicorn. Data from the U.S. Bureau of Labor Statistics shows that 20% of privately-owned firms fail in the first year. Broadly speaking, as many as 90% of startups will die within five years. Private equity experts and venture capitalists call this “infant mortality.”

But even with those duds, picking a few unicorns—the ‘successful 10%’—more than makes up for the trouble. Your winners could cover your losses from the losers and leave you with a nice pot of gold at the end of the proverbial venture rainbow.

Research from the National Bureau of Economic Research shows that among companies that exit (either get acquired or go public), the average return is almost 700%. That’s like investing in a stock at $1 while the company is private and then selling it at an IPO price of $70.

Those returns are hard to achieve as is, but they’re a world apart from the returns you’d get in your bank account, bonds, or stock market trades.

What are the risks of pre-IPO investing?

You’ve probably discovered that early investors aren’t always winners by now. Many companies fail, taking your money down with them. In that sense, pre-IPO investing is an all-or-nothing kind of game. There are plenty of risks involved—but the rewards can be great if you’re willing to weather those hazards. Let’s take a closer look.

Picking winners

Due diligence is crucial in all investment decisions, especially when investing in private companies. The stage of the company, its financial health, and its plan for the future are all key takeaways you should digest before jumping aboard.

Almost every private company will raise money to scale up and gradually increase its valuation with every fundraising round. Jumping onboard in the early stages—the Angel round, Seed round, and sometimes even Series A—is riskier but yields greater rewards if they succeed.

That said, the risk of a private firm gradually diminishes as it matures, raises more money at a higher valuation, and graduates to become a late-stage startup. Once in the later stages—Series B, C, D, and beyond—a startup is derisked. There are no guarantees that you’ll get a return—the company is still a pre-IPO stage venture—but your capital is likely productive (and safe) if the company stays private.

The risks of losing

However, even though more funding usually means more confidence from investors and more money coming in, there have been famous exceptions. Take Fast, for example, the “easy checkout startup” that burned through over $100 million of investor money before shutting down in 2022. The company revealed it made less than $1 million in revenue in 2021, all while burning through $10 million per month.

More dramatically, think back to WeWork. The coworking office company was once valued at over $47 billion before its expected IPO, which exploded fantastically after the company released details about itself to the public. It ultimately canceled its IPO and was made to go public in a less-desirable way. Today, it’s a fraction of what private investors paid for it.

That’s all to say that investing early means risk, but you’re always early when you’re a private investor—and the allure of hype, demand, and growth might be deceiving.

Market Conditions

The COVID-19 pandemic turned pre-IPO investments into something of a phenomenon. Practically everyone wants to be a venture investor now—individual investors must compete with other potential investors like venture capitalists and hedge funds.

In response to the demand, many companies have simply raised bigger rounds at higher valuations. In the last five and a half years, the number of unicorns—companies worth over $1 billion—has risen by 4.5x to 743, according to consultancy firm PwC.

Unfortunately, because the market has been hot, the number of illegitimate unicorns might be higher than ever. That means higher paper returns for investors in the near term, but ones that might not last. After all, to get actual returns, companies have to exit.

Illiquidity

Many venture investments are illiquid, which means you have limited options to sell your stock. As mentioned earlier: these are not your cash, bond, or stock market returns. However, they bear some irredeemable elements—which means giving up the benefit of selling at any time.

Loss of capital

Naturally, the inability to time the market might mean that you invest in some companies that grow but eventually collapse—that means losses. Fortunately, if you invest in a diversified portfolio of companies, you should be able to weather those losses. However, the fact that you cannot pull your money out means you’re along for the ride, whether or not you want to be.

Fund fees

Last, but certainly not least, are fund fees. If you invest in a fund managed by other investors, you might pay fees to participate in their fund or special purpose vehicle. If their investments don’t bear fruit, you might be stuck paying sky-high fees for diminished returns.

How to invest in pre-IPO companies

Though the world of pre-IPO investing is certainly more intimidating than, say, the stock market, there’re plenty of reasons investors might want to get their hands on pre-IPO shares.

The two primary ways to invest in pre-IPO companies are with a platform or fund that offers exposure to private firms or by investing directly in startups. That said, the latter might be cost-prohibitive because of accredited investor laws.

Pre-IPO investing platforms

Investors who want to dip their toes into private investments might start with crowdfunding platforms like StartEngine, Republic, and Propel[x]. These platforms enable you to take your pick of pre-IPO companies that’re raising money and are often in the earlier stages of a business. That means it’s unlikely you’ll recognize many brand names raising funds on these platforms—which may make them riskier.

Pre-IPO investing through special purpose vehicles

Alternatively, you can try a platform that allows you to invest in late-stage ventures before they go public—you’re in early if you pick up shares of high-profile businesses like SpaceX, Stripe, TikTok, or Epic Games before they head to market, right?

If you’re an accredited investor, your first stop for fielding high-profile pre-IPO stocks should be Dizraptor.

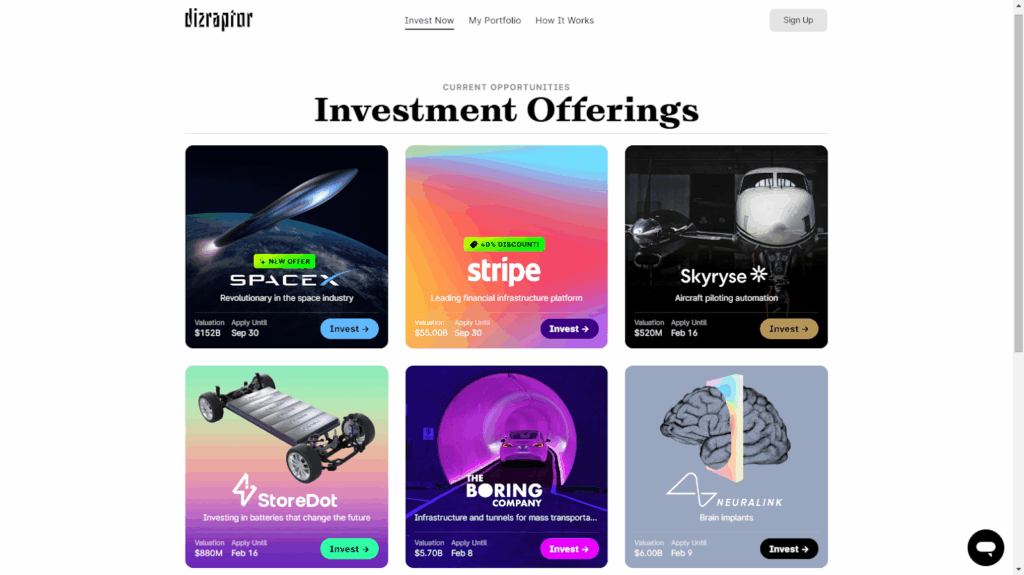

Dizraptor is platform where investors can purchase shares in privately-traded companies before they go public or in already-public companies below their IPO price. This is made possible by special purpose vehicles and funds which want to sell shares—and Dizraptor picks these up and offers them to users.

Source: Dizraptor

Accredited investors can invest in the numerous companies Dizraptor has up for grabs with as little as $1,000.

Buying pre-IPO stocks on secondary marketplaces

One alternative to investing in a special purpose vehicle is using a secondary marketplace like EquityZen or MicroVentures, which are both restricted to accredited investors. These platforms enable institutional investors or employees of valuable private firms to offload shares on their terms. Users generally utilize these platforms to order shares of a specific private company—like SpaceX, Airbnb, Chime, or Uniswap—from employees or investors looking to exit their positions.

That said, it’s competitive to find those kinds of offerings, even on marketplaces designed to help connect buyers and sellers. And even if you do find shares available, you’ll have to consider whether it’s a fair price to pay. After all, overpaying for a company’s stock pre-IPO might mean being underwater come the time of an actual initial public offering. For those reasons, you should only look at these marketplaces if you know what you want (and are fairly well-versed in the company, market, and private investing).

Gaining exposure to pre-IPO companies through alternative investment funds

We’ll start with the easiest option—handing the job of due diligence, research, and investing to a company that invests in pre-IPO companies and other alternative investments. Titan and Fundrise’s Innovation Fund are two platforms that do precisely that. You simply deposit money and they allocate your funds. In short, you turn the job of investing over to other investors, who deposit the returns into your account.

Your options for liquidity might vary from platform to platform, as is often the case with alternative investments. Before investing, it’s a good idea to familiarize yourself with how your money is invested and when you should expect to actualize your returns.

Shopping rolling funds, syndicates, or managed funds on AngelList

We’ve already reviewed AngelList—how useful of a resource it is for accredited investors can’t be underscored enough. It might be the most versatile option for high-net-worth individuals looking for a passive investment that puts them on the ground floor of pre-IPO firms.

AngelList offers several ways to get pre-IPO exposure: you can join a rolling fund, a syndicate, or invest in a managed fund. These options are something of a high-rollers club because the platform expects you to write hefty checks in many cases.

However, for people not wanting to sink the research and time, the AngelList Access Fund might be the lowest-maintenance way to access professional fund managers who invest in high-quality pre-IPO firms.

Source: AngelList

Ultimately, the sky is the limit with AngelList, so familiarize yourself with all the options before making an investment decision.

Last thoughts on pre-IPO investing

Like stock-picking, choosing real estate to invest in, or buying individual bonds, the world of pre-IPO investing is only as much as you make of it. It’s a high-risk, high-reward space—but don’t mistake the risk for speculation or gambling. The aforementioned tools and resources offer unparalleled opportunities, especially for accredited investors, to invest in growing businesses and generate wealth. However, they are only as resourceful as the person using them.