Diamond Standard Review: Disrupting the Diamond Industry with $100 Digital Investments

Diamond Standard provides a more accessible route into the massive $1.2 trillion diamond industry.

Considering investing in diamonds? The $1.2 trillion diamond industry is renowned for its connection with wealth and lasting value. Yet, penetrating this high-end market is often complicated and elusive for many. Enter Diamond Standard. This change agent has redefined the narrative by making investing in the diamond industry more straightforward and accessible.

Diamond Standard is transforming the investment scene. Their unique products, including Carats, Coins, and Bars, allow investments from $100, making the diamond market accessible to many. Their items offer swift liquidity options, too. This shift changes diamonds from luxury goods to valuable digital assets.

Diamond Standard redefines access to this traditionally exclusive market with the only regulator-approved diamond commodity and a record of solid performance.

Borrow our cheat sheet

| Zero | $100 |

| 10% | Low |

Invest now to enjoy free custody services for 1 year |

Pros and cons of Diamond Standard

Pros

- Invest as low as $100

- Swift liquidity

- Promotes a diversified portfolio via physical diamond assets, lessening potential risk

- High regulation ensures transparency and trust with diamonds independently graded by trusted entities like GIA or IGI

- Free investment guide

- Zero cost conversion

Cons

- Choosing the right diamond to invest in is complex and requires in-depth knowledge, much like investing in unique art pieces

What is Diamond Standard?

Diamond Standard, a pioneering New York-based startup, is reshaping precious stone trading. Their innovative wireless computer chip technology aims to turn diamonds into a tradeable digital asset. Diamond Standard is revolutionizing diamond investing with various products:

- Coins: Independently graded fungible commodities containing 0.18 to 0.75-carat diamonds. Buy or sell on the Spot Market and redeem with tokens.

- Bars: Ten times the value of coins, containing 0.76 to 2.05-carat diamonds, with the lowest custody fees. Also available for token exchange.

- Diamond Standard Fund: A private placement opportunity for accredited investors.

- Carats Commodity Token: A zero-cost conversion from Coins and Bars, offering a digital-to-physical diamond trade.

- Diamond Standard Futures: Approved futures contracts offering a regulated avenue to diamond commodities trading.

Diamond Standard’s platform provides flexibility, especially with the Coins, Bars, and Carat Tokens, allowing token-for-diamond or diamond-for-token trading. Their blockchain tokens, Diamond Standard Carats (DIAM), represent part-ownership of their Commodity offerings and can be exchanged for physical diamonds.

Each Bar also houses an optional embedded BCB blockchain token, useful on their platform if stored with their approved custodian, DS Admin Trust.

How does Diamond Standard work?

Diamond Standard operates as a unique platform that simplifies and democratizes investment in the diamond industry. Here’s how it works:

Firstly, Diamond Standard procures natural diamonds from recognized global vendors, particularly those approved by the International Gemological Institute (IGI) and the Gemological Institute of America (GIA) through their Exchange. They follow a competitive bidding process for authenticity and quality assurance.

Diamond Standard secures diamonds and crafts them into distinctive products: Diamond Standard Coins and Diamond Standard Bars. These commodities conform to a consistent statistical index factoring in key diamond attributes such as carat weight, color, and clarity. This involves employing advanced technology for precision, giving high-quality, uniform products every time.

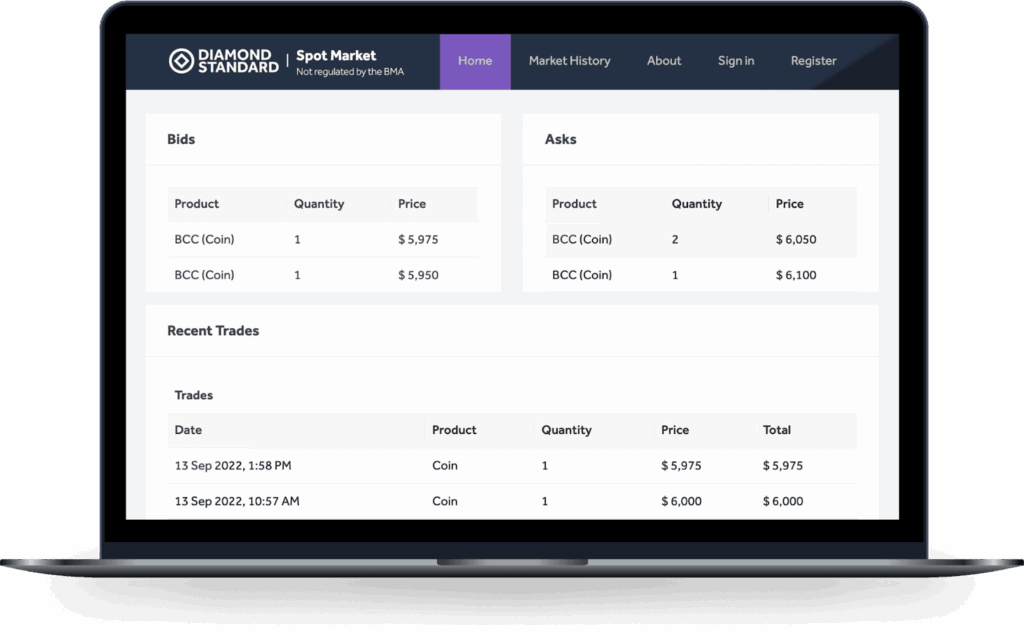

Diamond Standard uses historical diamond prices to set fair market value (DIAMINDX) on platforms like Bloomberg. Their Spot Market ensures quick liquidity of Diamond Standard Coins and Bars, aiding efficient investment management.

You can invest in a Diamond Coin or Bar with a starting price of around $4,000. Alternatively, you can buy Carats—tokens available for just $100. For accredited investors, investing in their Fund is also an option. Plus, they offer the ability to lease diamonds.

How is Diamond Standard different?

Using natural and lab-grown diamonds, Diamond Standard opens doors to a market typically reserved for trading precious metals under Bermuda Monetary Authority regulations.

Their focus? Turning diamonds—previously considered exclusive luxuries—into accessible investments. With a low entry point of just $100, this innovative company opens diamond investments to a broader audience.

Diamond Standard’s unique offering, Carats, allows investors to redeem tokens for physical diamonds, erasing conversion costs. Whether it’s gold, silver, or platinum you’re used to trading, their seamless blending of digital and physical assets revolutionizes precious stones investment.

Their pioneering Diamond Standard Exchange, backed by comprehensive data, ensures every detail is readily available. You’ll be able to navigate their services easily. This commitment accelerates the whole trading process, shedding the stereotype of diamonds as a hard-to-reach asset, one token at a time.

Who can invest in Diamond Standard?

Investing in Diamond Standard is generally open to most retail and institutional investors, except those in OFAC countries (Cuba, North Korea, Iran, Syria, Sudan, Crimea Region, and others).

Before investing, checking eligibility criteria and regulatory requirements per product is crucial. Diamond Standard offers this information through its platform or customer support channels.

Where Diamond Standard gets it right

Low barrier to entry

Diamond Standard shines in accessibility. With a $100 minimum investment in products like Carats, it welcomes a vast investor pool into the $1.2 trillion diamond industry.

Instant liquidity

Diamond Standard’s Spot Market allows investors to buy and sell Diamond Standard Coins and Bars with minimal spreads, ensuring instant liquidity. This feature addresses a common concern in the diamond industry, where physical assets can be challenging to sell quickly.

Innovation

Carats, an innovative commodity token, allows instant redemption for physical diamonds, eliminating conversion costs and simplifying investment.

Transparency and trust

Diamond Standard bolsters trust by having all its diamonds independently graded by reputable bodies like GIA or IGI, which adds to the platform’s credibility.

Democratization of luxury assets

By combining traditional luxury assets like diamonds with modern investment principles, Diamond Standard transforms diamonds from exclusive luxury items into practical and inclusive investment opportunities. This approach aligns with evolving investment trends and preferences.

How do I make money with Diamond Standard?

With Diamond Standard, profits come from appreciation in the value of diamond commodities in their products. As Carats, representing diamonds, grow in value over time, selling them at a higher price than your purchase can yield potential profits.

Owning Diamond Standard Coins or Bars allows you to profit from any increase in the value of the contained diamonds. Sell them on the Spot Market when ready to capitalize on returns. Accredited investors can explore the Diamond Standard Fund, co-sponsored with Horizon Kinetics, offering exposure to the diamond industry for potential profit opportunities.

Ultimately, the potential for making money with Diamond Standard lies in the performance of the products you choose. However, like all investments, risks are involved, and profits are not guaranteed.

Conduct thorough research, evaluate your investment goals, and assess your risk tolerance before participating in Diamond Standard’s offerings. Engaging the services of a financial advisor could prove instrumental in charting a sound investment path.

How do I cash out with Diamond Standard?

Simply sell your Coins, Bars, or Carats on their Spot Market to cash out from Diamond Standard. Set your sale price, wait for a match, and complete the transaction. The net proceeds, after fees, hit your account. You can then transfer these funds to your linked bank account.

Diamond Standard vs traditional investing

Diamond Standard shakes up traditional investing with its unique approach focusing on tangible assets—diamonds. Making diamond investing accessible attracts those who may not have large capital to invest in traditional stocks or real estate.

With its high liquidity, Diamond Standard’s Spot Market allows swift buying and selling of Coins and Bars, addressing the diamond industry’s typical liquidity challenge. However, it comes with risk tied to market dynamics and the economy, just like traditional investing, where stocks can be volatile, and bonds may return less.

In essence, it widens choices for investors, offering an alternate path to wealth accumulation.

What other people are saying about Diamond Standard

“Diamond Standard has created the fundamental unit, the coin and the bar, that allowed diamonds to become a truly investment-worthy product for capital looking for diversification in a portfolio.” — Greg Kwiat, CEO, Kwiat and Fred Leighton.

Investors are taking notice of Diamond Standard for its promising features. Its unique property of being the world’s only regulated diamond commodity instills a sense of trust. Additionally, diamonds being 600x more value-dense than gold enhances its appeal as it’s easier to store and transport.

Offering instant liquidity and leveraging computer science breakthroughs for the traceability and fungibility of assets, Diamond Standard embodies innovative and practical investment solutions.

Our hot take on Diamond Standard

Diamond Standard is breaking barriers by providing digital access to diamonds—a low entry point and quick cash-outs are strong points attracting investors.

Diamonds have a real, lasting value, which means they can grow your investment. Just be sure to learn as much as possible before jumping in. With the right knowledge, your diamond investments could pay off big.

I’m in! How do I sign up for Diamond Standard?

1. Register and create an account.

Visit their website, sign up, provide the required information, and complete the verification.

2. Choose a product.

Explore the range of Diamond Standard products, including Carats, Diamond Standard Coins, and Diamond Standard Bars. Each product has its characteristics and minimum investment requirements. Select the one that aligns with your goals and budget.

3. Fund your account.

To invest, simply fund your Diamond Standard account by following the easy deposit steps on the platform.

4. Purchase a product.

After depositing funds, you’re one step away from buying your desired Diamond Standard product. Follow the prompts, double-check your order, and finalize the purchase.

5. Hold and monitor your investment.

Once you’ve purchased a product, you can track your portfolio’s performance directly via the platform’s dashboard. It allows you to follow your investment’s value over time.

6. Diversify your portfolio.

Manage risk wisely by diversifying. While Diamond Standard offers various products, mixing in other asset classes broadens your portfolio.

7. Cash out.

To cash in profits, simply list your Diamond Standard Coin, Bars, or Carats on the Spot Market for sale. It operates like a peer-to-peer marketplace. Once it sells, requesting a withdrawal is easy. Always remember investing comes with risks. It pays to be informed and seek advice if unsure.

FAQs

What is Diamond Standard?

Diamond Standard offers regulated diamond commodities in the form of Coins and Bars that can be transacted on a blockchain. For investors seeking alternative options, they also provide a fund option and will soon introduce a futures product.

Is Diamond Standard legit?

Diamond Standard Ltd. is a licensed Digital Assets Business (license number 53943) offering regulated diamond coins and bars with standardized GIA-certified diamonds. They provide investors with a regulated platform to invest in tokenized diamond assets, operating within the regulatory framework set by the Bermuda Monetary Authority.

What types of investments are available on Diamond Standard?

Diamond Standard offers three primary investment vehicles: Diamond Standard Coins and Bars, a Reg D 506 C Fund for accredited investors, and Carats for fractional ownership. Carats are tradable on the Hedera network, allowing investors to participate in the diamond market with ease.

How does Diamond Standard work?

Create an account with two-factor authentication for enhanced security. Choose from Diamond Standard Coins, Bars, or Carats as investment options. Submit your payment securely and complete the KYC process. Once confirmed, Diamond Standard will mint your diamonds and ship them to your desired location or store them in a secure vault.