Asset Battle: How Crypto Real Estate Works and Why to Invest in it

Cryptocurrency and real estate are two popular investment vehicles. But what happens when we combine them?

You’ve probably heard “buy the dip” or “don’t wait till you buy real estate. Buy real estate and wait.”

Bitcoin and real estate are vastly different creatures, and both asset classes are significant allocations in the portfolios of top investors. They each have their own unique benefits and drawbacks, and investors take a lot into consideration before buying them.

With its decentralized nature, crypto real estate offers investors the potential for high returns and diversification, as well as access to a wide range of markets that may not be accessible through traditional investments.

In this article, we’ll compare the age-old asset class of real estate and the not-so-new kid on the block, cryptocurrency. We’re not saying you should trade your house keys for private keys, but rather how a diverse portfolio of tangible and digital assets can enable your portfolio to weather any storm.

Let’s explore the possibilities between buying a house and buying a bitcoin, and how you can combine them to form a comprehensive investment strategy.

Investing in cryptocurrency vs. the real estate market

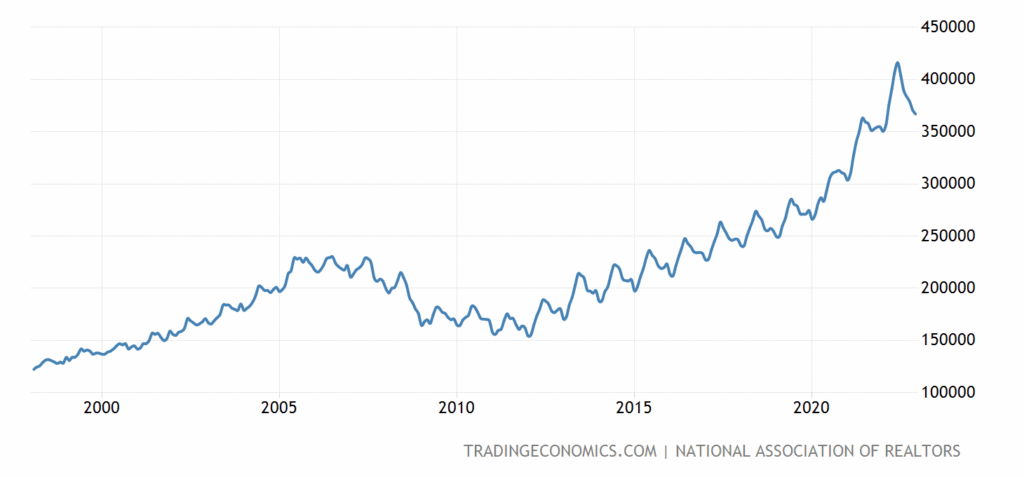

Real estate and bitcoin prices have changed dramatically in the last five years. The median home price was $313,000 at the beginning of 2017. Despite some ups and downs in the years that followed, it has steadily increased since the pandemic began, rising from $322,600 in April 2020 to $404,700 by July 2021.

It took bitcoin eight years since it first launched to surpass the $1,000 threshold in 2017. It has since had a series of surges and collapses until reaching an all-time high of approximately $69,420 in November 2021. A closer look reveals an asset that contains the potential for extremely large profits despite its erratic and speculative nature.

A five-year market view shows that, overall, investing in bitcoin has produced greater returns than buying real estate. Meanwhile, the median price of Manhattan condos and co-ops fell to $1.1 million, a 5.5% decline from a year earlier and a 4.7% drop from the previous quarter. The number of sales fell 28.5% from a year earlier and 31% from the previous quarter to 2,546.

California is expected to lead the market in 2021, with median property prices breaching $1 million in four cities. When it comes to real estate, San Francisco, Fremont, San Jose, and Irvine are at the top of the list. Despite returns ranging from $226,900 to $440,020, they still have a long way to go if they want to beat the returns on bitcoin.

Additionally, in markets where down payments was far less than the $10,000 threshold, such as Detroit, Michigan, bitcoin outperforms real estate in terms of financial returns. Despite the 88% rise in the typical home price, those who put down as little as $6,552 in 2017 realized real estate returns of about $28,000. In contrast, putting the same money into bitcoin would have generated a profit of $420,570.

Source: Tradingnomics.com

Cryptocurrency

The crypto market is incredibly volatile and changes daily, which can lead to potential profits. In crypto, transactions can be made quickly and easily, without worrying about hidden fees or taxes. Additionally, cryptocurrency is decentralized, meaning it is not tied to any specific government or organization and is not subject to any regulations.

Cryptocurrency does, however, pose a few risks. Because of its volatile nature, the value of cryptocurrency can quickly drop, leaving investors with the potential for large losses. Additionally, because cryptocurrency is still largely unregulated, it’s a popular front for hackers and scammers.

Real estate

When it comes to real estate, the pros and cons are quite different. On the positive side, real estate is much less volatile than cryptocurrency and can be an excellent long-term investment. Additionally, all transactions are heavily regulated, so buyers and sellers have fewer risks when dealing with property. Furthermore, real estate can be used as a type of collateral, providing an extra layer of security.

On the downside, the process of buying and selling real estate can be slow and cumbersome. Real estate transactions can involve high costs and taxes, as well as hidden fees. Typically, it takes a long time before you see a return on your real estate investment.

Comparison of the real estate industry and crypto

When it comes to investing, it’s important to compare the pros and cons of each asset.

Difficulty and accessibility

Cryptocurrency is relatively simple to access and can be purchased from various exchanges. On the other hand, real estate is much more difficult to access, as buyers must go through the process of finding a property, getting financing, and completing all the paperwork. Additionally, the buying and selling process is much slower than the process of buying and selling crypto.

Volatility

Cryptocurrency is highly volatile and can experience sharp drops in value within seconds. This means that investors are at risk of large losses if the market suddenly drops. On the other hand, real estate is much less volatile and can provide more stability for long-term investments.

Cryptocurrency is still not as secure as traditional investments, as it’s vulnerable to hackers, theft, and other security threats. On the other hand, real estate is typically more secure, as it’s backed by physical assets and regulations.

On the downside, the process of buying and selling real estate can be slow and cumbersome. Additionally, real estate transactions can involve high costs and taxes, as well as hidden fees. In some cases, it may take months or even years before seeing a return on your real estate investment.

Tax implications of real estate transactions

Cryptocurrency isn’t subject to property taxes, so it’s typically not taxed unless you sell and take profit or losses. On the other hand, real estate investments can be subject to capital gains, transfer, and property taxes. These taxes can significantly reduce your overall returns, so it is important to factor these costs into your decision.

Liquidity & risk tolerance

When it comes to liquidity, cryptocurrency is a crowd favorite because it can be sold quickly and easily. As with any investment, it’s important to consider your risk tolerance when deciding to invest in crypto or real estate. Cryptocurrency is a highly speculative asset and can be extremely volatile, while real estate investments are typically more stable. Therefore, it’s important to consider how much risk you’re comfortable with when choosing an asset to invest in.

Crypto vs real estate

Ultimately, the decision between investing in crypto or real estate is a personal one and depends on your individual goals and risk tolerance. It’s crucial to research both assets and understand their risks and rewards before making an investment. By doing your due diligence and making an educated decision, you can ensure that you take the best path for building your portfolio.

Kevin O’Leary has made a lot of money investing in various crypto companies and digital assets. After the recent bear market, reports suggest his portfolio may have taken a hit following the FTX incident. Ouch.

Chamath Palihapitiya is another notable investor and certified rich dude who made a $20 million mistake by choosing real estate over bitcoin. Chamath bought his Silicon Valley home using bitcoin in 2014 worth $1.6 million at the time. But by 2021, the same amount of BTC was worth $27.5 while the house stood at less than $7 million.

This shows how cryptocurrency and real estate are two very distinct asset classes that can have wildly different performance over the same timespan. But what happens when we combine both of them?

This is where crypto real estate comes in.

What is crypto real estate?

You’ve heard of “buying the dip,” but have you ever considered buying a crypto-condo?

Crypto real estate is quickly gaining traction as an alternative to traditional real estate. With its decentralized nature, blockchain real estate offers investors the potential for high returns and diversification, as well as access to a wide range of markets that may not be accessible through traditional investments.

Crypto real estate utilizes blockchain technology to offer investors a different path toward property ownership. Unlike traditional real estate, crypto real estate allows investors to purchase properties digitally, and with the use of cryptocurrencies such as bitcoin. This new asset class has the potential to offer investors higher returns and diversification, while also allowing them to access a wider range of markets.

Crypto real estate works similarly to traditional real estate in that it involves purchasing and selling real estate property, but the difference is that investors can use cryptocurrencies like bitcoin to purchase property instead of with traditional fiat currencies.

Pros and cons of crypto real estate

Pros

- Greater Liquidity

- More diversification

- Lower cost of entry

Cons

- Increased Volatility

- Less regulatory protections

- Introduces security risks

How real estate cryptocurrency work

Depending on the platform you decide to go with, the process is pretty much the same.

- Finding a property: Investors can search for properties on crypto real estate platforms that accept digital currencies as a form of payment. These platforms typically have a user-friendly interface that makes it easy for investors to find and view properties.

- Making an offer: Once an investor has found a property they’re interested in, they can make an offer using digital currency. The offer is typically made through the platform and is subject to acceptance by the seller.

- Closing the deal: Once the offer is accepted, the investor will typically need to transfer the digital currency to the seller’s digital wallet. The transaction is recorded on the blockchain, which serves as a public ledger of all transactions.

- Tokenization: Some real estate platforms use tokenization, which is the process of converting a real-world asset into a digital token. This allows investors to purchase a fraction of the property rather than the entire property. It means that the cost of buying a property is reduced and also allows for more opportunities for smaller investors.

- Title transfer: Once the digital currency has been transferred, the title to the property is transferred to the investor. The process is similar to traditional real estate transactions, but it’s conducted entirely using digital currency.

HoneyBricks is a platform that investors can use to purchase shares in real estate properties using cryptocurrency. It uses blockchain technology as a secure and transparent way to track and transfer ownership of property shares.

Another platform that has similar crypto real estate offerings is Lofty, which lets you buy fractional shares of real estate on the blockchain for as little as $50. Loft investors earn rental income daily and can cash out using the Algorand blockchain at any time.

Is crypto real estate a good investment?

Real estate continues to offer promise as an alternative investment. Combining real estate with blockchain technology and cryptocurrency can offer new opportunities for investment and diversification. The decentralized nature of crypto real estate allows for greater access to global markets and the potential for higher returns.

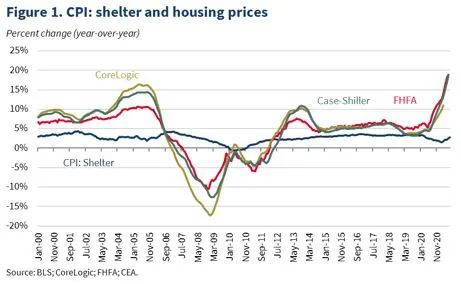

One approach to protect against inflation is through real estate investing. Real estate investments might help you secure your money because housing values typically rise faster than inflation. For example, while inflation climbed by only 8.5% between July 2021 and July 2022, the Case-Shiller US National Home Price Index increased by 16.1%.

Source: whitehouse.gov

Despite the 2022 bear market, investors continue to earn returns from real estate.

What does the future of crypto real estate look like?

Investors are beginning to recognize the potential of this asset class. Investing in crypto real estate presents investors with the potential for significant capital gains, liquidity, and access to global markets.

When it comes to investing, it’s always important to compare the pros and cons of different asset classes. For many investors, the choice between real estate and crypto real estate can be daunting. On one hand, real estate offers stability and long-term gains, while crypto real estate provides access to a fast-paced and ever-evolving market.

Ultimately, the decision of whether to invest in crypto or real estate is a personal one. However, investors should be aware of the risks, challenges, and security measures associated with both asset classes.

Crypto real estate can be a lucrative investment, but it’s important to remember that with great rewards comes great responsibility. With the right research and due diligence, investors can make educated decisions and reap the rewards of investing in the exciting world of crypto real estate.