Rich Dudes│Kevin O’Leary’s 8-Figure Crypto Portfolio & Investing Principles

Kevin O’Leary may be the “Shark with the sharpest teeth.” But the 2022 market crash took a massive bite out of his crypto portfolio.

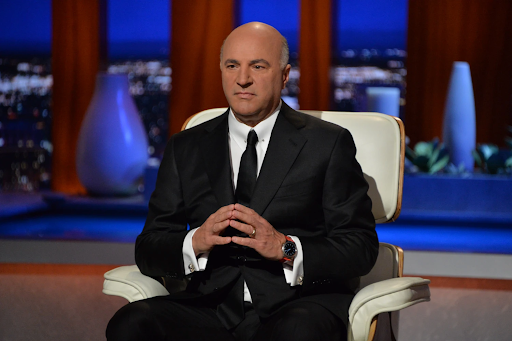

Kevin O’Leary, AKA Mr. Wonderful, is a Canadian entrepreneur, investor, and media personality best known as the brutally honest (and sometimes plain mean) star of Shark Tank.

According to multiple celebrity net worth trackers, the 67-year-old is worth around $400 million. Tracing back the history of his fortune, some of his notable wins include:

- Selling The Learning Company (TLC) to Mattel for $4.2 billion (and pocketing $11.2 million).

- His stake in Storage Now, a self-storage company that was acquired for $110 million.

- Founding O’Leary Funds Inc., a mutual fund company that had $1.2 billion in assets under management in 2012.

- Closing 40 Shark Tank deals, collectively worth $8.5 million.

Over the past year, Kevin O’Leary has told multiple media outlets that 20% of his investment portfolio is held in blockchain companies and cryptocurrencies.

In 2019, Kevin was as anti-crypto as they come—going so far as telling CNBC that Bitcoin was worthless. Fast forward a few years, and Kevin O’Leary is now actively promoting crypto and has made it a whale-sized portion of his investment portfolio.

Itching to know just how much?

Below you’ll find the estimated value of Kevin’s crypto portfolio, his largest token holdings, and how these investments have performed in 2022. Stick to the very end, and we’ll even break down the crypto investing principles Mr. Wonderful swears by.

For those reasons, you’re in.

Source: Shark Tank

Kevin O’Leary’s crypto portfolio

Now, before we dive into the real numbers, a few disclaimers. We don’t actually know:

- Every single crypto Kevin is holding

- How much of his portfolio is in tokens vs equity

- His exact position sizes

- Whether he’s sold any of his disclosed positions

Hell, even his supposed $400 million net worth might be false or outdated. Still, we can make some educated guesses based on the details Kevin revealed in his interviews.

Over the past year, Kevin O’Leary has told multiple media outlets that 20% of his investment portfolio is held in blockchain companies and cryptocurrencies. After some back-of-the-napkin math, that comes out to $80 million (sheesh). Kevin also mentioned that he holds 32 positions, none of which take up more than 5% (or $4 million) of his crypto portfolio.

The only names Kevin O’Leary has verified holding are:

We can already glean some insights from this limited data. For one, Kevin O’Leary prefers to invest in Layer 1’s (BTC, ETH, SOL, AVAX, HNT, HBAR) over Layer 2’s (MATIC) or DApps (SRM). And in terms of his blockchain preference, it’s an equal split between Ethereum (incl. ETH, FTX, Polygon) and Solana (incl. SOL, FTX, Serum).

Position sizes

Now, how do we figure out Kevin O’Leary’s individual position sizes so we can estimate his 2022 crypto returns? It’s simple.

Since Kevin is a fan of index investing, he probably mainly invests in large-cap cryptos that track the performance of the entire market and have the most liquidity.

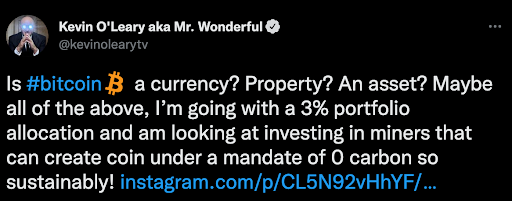

Source: Kevin O’Leary’s Twitter account

Next to that, we’re going to make the following assumptions:

- Each crypto’s maximum position size is 5%.

- The minimum position size is 0.6%, ’cause math (20% allocation / 32 positions = 0.625%).

- His Bitcoin position never goes below 3% of his crypto portfolio.

While we don’t have a ton of hard proof to back this up, the position sizes in Kevin’s O’Shares Global Internet Giants Index (OGIGX) do fall within our range of assumptions.

O’Shares Global Internet Giants Index Top 10 Holdings

Source: O’Shares Investments

Kevin O’Leary’s crypto performance 2022

Based on all the above-mentioned assumptions, we can guesstimate that Kevin’s crypto holdings returned anywhere from -4% to -28% in 2022. But as with everything in life, the real answer is probably somewhere in the middle, perhaps -16% (e.g. -$12.8 million).

*cue sad trombone*

Source: MoneyMade

His worst performing crypto investment was Helium (-78.12%), while his best performing—but still negative—crypto investment was FTX (-20.35%).

I can already hear the critics: what about the performance of his 23 other positions? Fair point. But since these 9 tokens are probably his largest holdings, they account for the vast majority of his portfolio’s returns.

Here’s another gem for ya. Kevin recently mentioned that, since the market crashed, his crypto holdings now represent 16% of his net worth. This could only mean one thing: his other investments appreciated by an average of 8% to make up for his crypto’s -16% median losses. In the industry, we call those inflation hedges.

Some of those hedges might include his fine wine via O’Leary Fine Wines and luxury watches like Rolexes and Pateks (accessorized with red watch bands, of course).

Kevin O’Leary’s crypto investing principles

Here are Kevin O’Leary’s top 5 crypto investing principles, learned through his decades of experience as a stock market investor and venture capitalist.

1. Develop your own point of view

Kevin O’Leary sees the crypto sector differently than others. In his view:

- Cryptocurrencies should be judged as software and not as tokens.

- Crypto will become the S&P 500’s 12th sector within a decade.

- Bitcoin mining can help transition the world to renewable energy.

2. Invest in blockchains that solve problems

Kevin only invests in Web3 companies that are solving problems with real economic value. He’s confident in investing in Polygon (MATIC), for instance, because it’s focused on reducing gas fees.

3. Don’t go all in on one thing

According to Kevin, nobody knows who’s going to win the battle of ETH vs SOL vs AVAX and so on. So instead of guessing, he just owns them all. Not to mention, Kevin (as well as most crypto VCs) believe that just one or two winning investments will pay for all your losers.

4. Limit your position sizes

Since the S&P 500 currently has 11 sectors, Kevin recommends putting no more than 20% of your portfolio in any one sector, and no more than 5% in any one position.

5. Don’t be a crypto cowboy

Kevin O’Leary has admitted to consulting with regulators before investing in digital assets just to see “what is possible and what isn’t,” legally speaking.

In the words of Mr. Wonderful: “I have no interest in being a crypto cowboy and getting anybody unhappy with me because … I have so many assets in the real world that I’ve invested in already that I have to be compliant.”

A moment of silence for all the XRP holders out there.