Rich Dudes│How Dave Ramsey Weathered Storms For a $200M Net Worth

Learn from Dave Ramsey’s journey to financial freedom—a personal finance expert with a net worth of $200 million from investments in real estate, and startups, and his ‘7 Baby Steps’ plan.

Personal finance expert, author, and radio show host David Lawrence Ramsey is no small-time content creator. Dave Ramsey’s net worth has surpassed the $200 million mark.

He didn’t inherit it from a wealthy ancestor but made a fortune through his books, radio shows, financial seminars, and speaking engagements. He’s also the founder and CEO of Ramsey Solutions, a company that offers financial education and products.

In November 2021, Ramsey Solutions acquired a fintech startup, Apay Financial, that helps people pay back their student loans.

Dave’s written several best-selling books, including The Total Money Makeover and Financial Peace. One of Dave’s largest contributions to personal finance is the 7 Baby Steps plan designed to help people get out of debt, build wealth, and invest for the future.

Overall, Dave’s message is simple—live debt-free and invest for the long term to achieve financial success. His story of going from bankruptcy to building wealth inspires millions to take control of their finances.

Dave Ramsey net worth at a glance

| Net worth | $200 million |

| Born | September 3, 1960 |

| Nationality | American born in Antioch, Tennessee, USA |

| Became a millionaire at | 26 |

| Occupations | Entrepreneur, finance consultant, radio host, author, and motivational speaker. |

| Sources of wealth | Ramsey Solutions, The Ramsey Show, Ramsey Investments, Inc. |

| Asset classes | Real estate, startups |

How Dave Ramsey made his money

Coming straight from the horse’s mouth, we’ll let you in on the journey of the financial guru Dave Ramsey. Spoiler alert: it’s a wild ride of ups and downs in the quest for financial prowess.

Dave has had a rather unusual view of the world since his early life. His wife, Sharon Ramsey, even endorsed his weirdness.

By 26, Dave had a net worth of over $1 million, raking in a serious $250,000 yearly with up to $4 million tied up in real estate. But with too much short-term debt hanging over him, the financial storm brewing overhead spelled big trouble.

Fast forward two and a half years of battling debt, and what did Dave get? Served with a complete loss of everything. It turns out low-key living would have been ideal.

Little did he know that brokenness loomed beneath the appearances of “perfect” couples like Barbie and Ken. That’s when Dave realized that broke people and financial advice simply didn’t mix.

Pulling himself up by the bootstraps, Dave went on a quest (cue Indiana Jones music) to unravel the mysteries of money: how to control it, master it, and regain his confidence. He soaked up every scrap of information, grilling wealthy folks who had kept their riches.

What did he find out? Well, his journey led him straight to the mirror. That reflection staring back at him was responsible for his money troubles. The path to financial victory meant looking into those eyes and managing the person he saw.

Dave got back on track with newfound wisdom (and a dash of humble pie). Returning to his roots in real estate, he climbed out of debt and started helping others do the same. The millions that thrived thanks to his journey are living proof of his legacy.

The Dave Ramsey Show

In 1992, Dave founded Ramsey Solutions, a financial education company that offers various products and services such as online courses, coaching programs, and live events. Aiming to ease people’s suffering under crushing financial stress, he packaged lessons learned from his missteps into the book Financial Peace.

Car trunk in tow, he sold his books, and it wasn’t long before he and a friend co-hosted a local radio show called The Money Game—now the nationally syndicated radio program called The Ramsey Show. Today, the Dave Ramsey show reaches millions of ears.

Dave’s impressive record of best-selling books spanning esteemed publications like the New York Times and Wall Street Journal exemplifies a man on a mission. With more than 1,000 team members aimed at achieving financial goals, Ramsey Solutions forges ahead full steam.

What sets Dave and his company apart? You might think it’s the cash rolling in. Think again. Ramsey Solutions measures its success by lives transformed: people conquering debt, learning to save $1,000, and graduating from Financial Peace University. Turns out, lending enough people a helping hand will bring money anyway.

So, folks, there you have it. The theme of Dave Ramsey’s saga is learning from your mistakes, staring adversity in the face, and helping others soar to new financial heights. Dave also has two children—Denise and Daniel Ramsey.

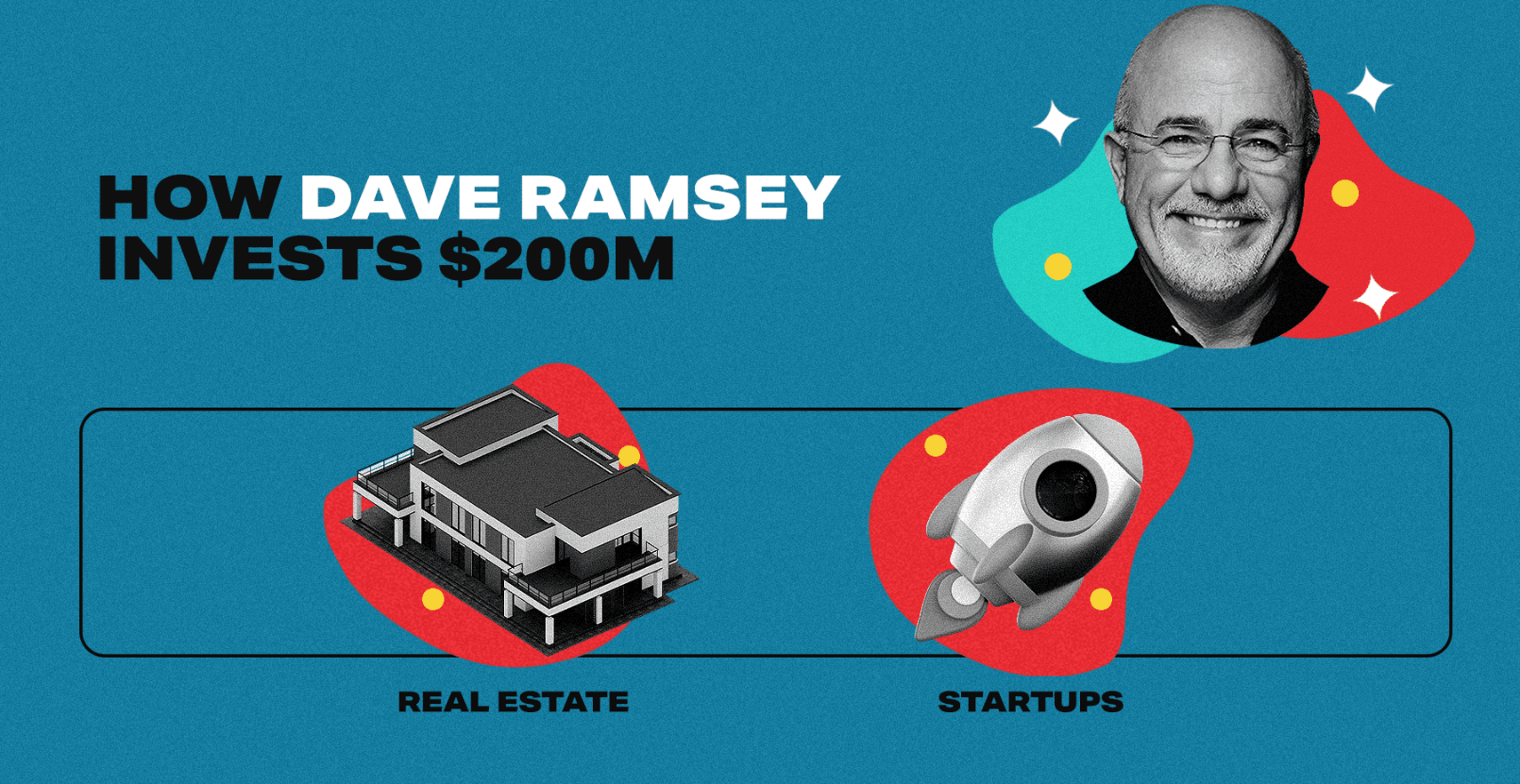

What Dave Ramsey invests in

Dave invests his money like a true pro and recommends putting not more than 15% of household income into long-term investment vehicles. The finance guru diversifies his portfolio by investing in four types of mutual funds: growth, growth and income, aggressive growth, and international—he’s got his eggs in different baskets.

Now let’s explore what asset classes Dave Ramsey’s net worth is invested in.

Real estate

In the not-so-distant past of 1986, financial superhero Ramsey had built a remarkable portfolio valued at over $4 million from real estate. But as we all know, with great wealth comes great upheaval. The Competitive Equality Banking Act of 1987 stirred the pot, causing several banks to change ownership.

So, what happened next? Well, these banks went all Scrooge McDuck on Dave and demanded he repays his $1.2 million loans and lines of credit. As it turns out, being over-leveraged under such circumstances wasn’t ideal. Sadly, Dave found himself cornered with no way to wiggle out of the quagmire.

Like a comic book plot twist, our protagonist faced a considerable setback. In a move that must have felt like Kryptonite to his ambitious soul, he filed for bankruptcy in 1988. But, as they say, what doesn’t kill you makes you stronger—the ultimate crucible for the forging of a legend.

Today, the evangelical Christian finance guru’s real estate investment philosophy involves acquiring properties with cash. The man who is more allergic to debt than dust listed his Tennessee mansion for $16 million in 2021 but eventually sold 5.05 acres of the property for $10 million. The grand plan? To build another home with the proceeds without taking out a mortgage.

Source: realtor.com

And let’s not forget RamseyTrusted, which offers vetting and coaching for real estate agents through his Endorsed Local Providers (ELP) Program for a reported monthly fee of $3,000. Dave also charges a referral fee of up to 28% whenever an agent closes a deal.

Startups

Dave Ramsey makes moves in the world of startups, too. The New York Times best-selling author founded Ramsey Solutions in 1992 to bring financial literacy to the masses. Today, it’s grown to over 1,000 team members and boasts an impressive reach.

Ramsey Solutions has left an impact with The Ramsey Show entertaining 20 million weekly listeners and over 5 million people completing Financial Peace University.

Source: ramseysolutions.com

Additionally, over 10,000 schools offer their Foundations in Personal Finance curriculum. Expert speakers like Rachel Cruze and Ken Coleman cover diverse topics, creating an ocean of valuable lessons on financial independence.

In November 2021, Ramsey Solutions acquired a fintech startup, Apay Financial, that helps people pay back their student loans. Ramsey Solutions seems to also focus on acquiring fintech startups that help people manage their finances and become debt-free, which aligns with Dave Ramsey’s mission.

Dave Ramsey investing quotes

1. Trust is key in business

2. Live on less, invest more

3. Action is the best wealth-building tool