A Grape Feeling: Best California Wines to Invest In

Fine wines are can be a strategic way to grow your portfolio. Here’s how to invest in the best California wines.

You stick your nose into the glass and inhale deeply. You swirl and watch the droplets trickle down the sides of your glass. You pour it into glass decanters and use words like tannins and oenophiles (wine enthusiasts). Maybe you’re even turning into one.

Whether you fit this profile or not, investing in top-notch wines is a way to grow your investment portfolio for the long term.

If you’re concerned about performance—over the last 15 years, the fine wine asset class has had 10.6% annualized returns.

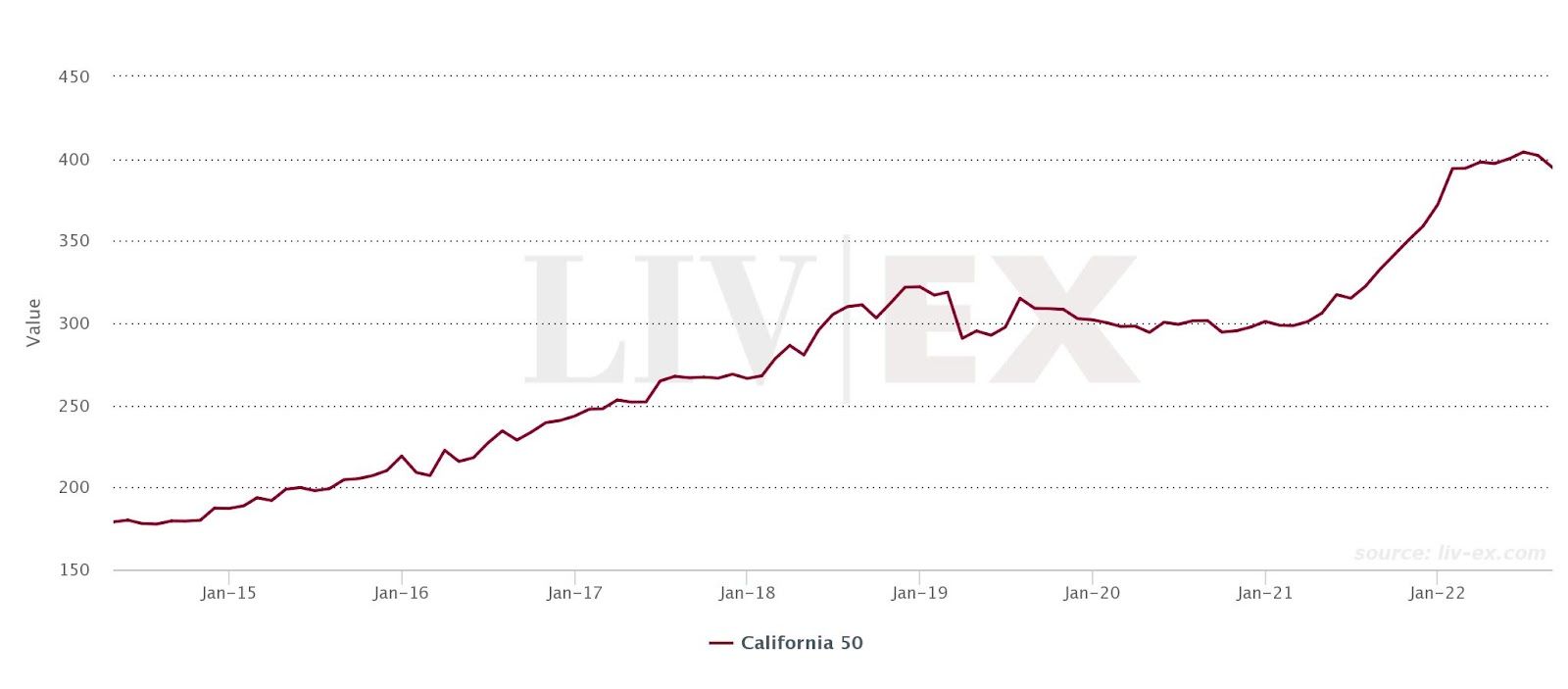

The best wines we’re highlighting come from California—the epicenter of top wineries, gobbling up a 90% market share. According to Live-ex, California wines experienced a 34% growth from 2021 to 2022 and a 59% increase in the last five years. Can you imagine if your retirement funds performed like that?

The popularity of investing in cult wines has become more accessible to everyone, especially with investing platforms like Vinovest and Vint. They help you buy and store fine wine bottles and give you the latest scoop on the best investment wines.

Chart tracking California 50 wine index from 2014 to 2022.

Source: liv-ex.com

Why invest in California wines in the first place?

As the saying goes, don’t put all of your eggs in one basket. If you mostly invest in stocks and index funds, wines could make a great addition to help diversify your portfolio.

If you’re concerned about performance—over the last 15 years, the fine wine asset class has had 10.6% annualized returns.

One crucial aspect of investing in Californian wines and other luxury spirits is scarcity—the gap between supply and demand. Factors that play into supply and demand include weather patterns for growing grapes, harvest yields, and consumer trends. And once in a blue moon, a global pandemic.

Many of these factors don’t tie into the overall stock market, which makes fine wine an excellent uncorrelated asset to invest in. From January to July of 2022, wine outperformed the S&P 500, with an 11% positive return compared to the S&P 500’s 20% dip over the same period.

Chart tracking the California 50 wine index by winery.

Source: liv-ex.com

Wine investing for the long term

From growing grapes, picking them, and aging them in special barrels, winemaking is hard work. This alone should tell you that wine investing isn’t an easy way to make a quick buck. It’s common for wine investors to hold on to bottles for years or decades before turning a profit.

Word of mouth, leading critic scores, and limited productions are all factors driving higher prices and demand for California wines.

Best California wines to invest in

Napa Valley accounts for more than half of all trading, while just a half-hour away is Sonoma, home to over 450 small to large wineries. From fruity to lush reds, crisp whites, and resilient sparklers, check out these tried-and-true California wines that have the makings of a great investment.

Screaming Eagle

- Known for: Cabernet Sauvignon

- Production supply: 6,000 to 10,000 bottles per year

- Accolades: 2018 vintage Sauvignon Blanc was a top-traded wine of Q1 2022

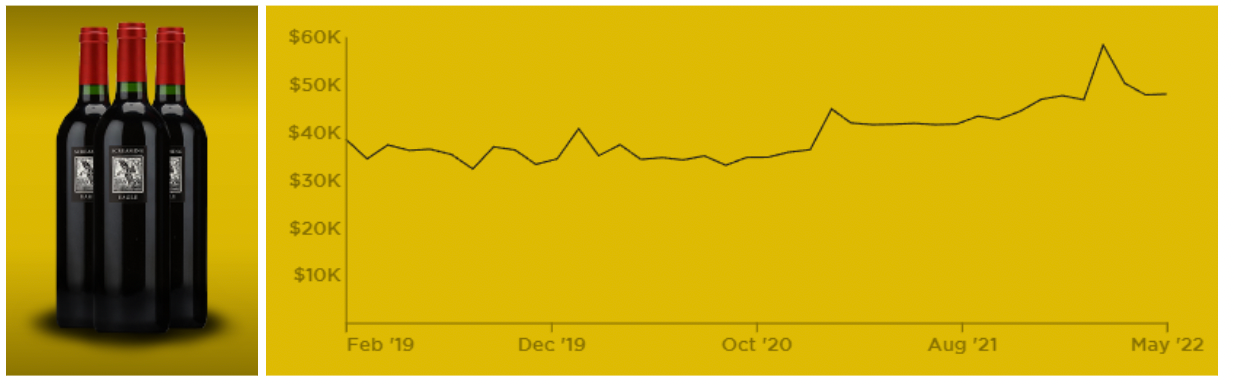

A top choice from cult wines, fetching $4,819 on average, the much-coveted Cabernet Sauvignon from the legendary Screaming Eagle winery has increased in price by 42% from 2021 to 2022. Not only that, their 2018 vintage Sauvignon Blanc was the third most traded white wine in the first quarter of 2022.

The label’s success has been driven by the Cabernet Sauvignon 2009 and 2010 vintages, which have risen 61.2% and 75.0%, respectively, over the past year.

Screaming Eagle produces 6,000 to 10,000 bottles per vintage and is based in Oakville. Their wines are known for luscious and unique chocolate, oak, and vanilla blends.

Chart tracking sales of 2016 Screaming Eagle [12 bottles].

Source: rallyrd.com

Dominus Estate

- Known for: Bordeaux-style

- Production supply: 7,000 cases per year

- Accolades: Winner of 2021’s Wine Spectator Wine of the Year award

Dominus Estate comes in a close second to Screaming Eagle, rising in value almost as fast. Dominus consistently releases wines mostly from Cabernet Sauvignon grapes, a classic in California cult wines.

The Napa Valley winery also won 2021 Wine of the Year from Wine Spectator for Dominus Estate Napa Valley 2018, further driving up price and demand.

With an excellent track record for aging, Dominus Estate is known for keeping true to Bordeaux-style winemaking processes.

Opus One

- Known for: Bordeaux-style blend

- Production supply: 25,000 cases per year

- What to note: Price increases of bottles vary wildy

Opus One was once the most expensive Californian wine ever, fetching $50 a bottle in 1984. In 2013 a buyer from China paid $165,000 for a 100-case collection from Sotheby’s.

While that sale made headlines, Opus One, which produces about 25,000 cases a year, has experienced its share of variations in increases. In 2007, the average bottle was $138. Eleven years later, it rose to $394—a 185% increase. More recently, however, the average price only went up by about 4%, from $396 per bottle in 2019 to $413 in 2021.

Opus One is known for its iconic blend of five grapes—Cabernet Sauvignon, Cabernet Franc, Merlot, Malbec, and Petit Verdot.

Harlan Estate, Napa Valley

- Known for: Bordeaux-style blend

- Production supply: 1,200 to 2,000+ cases per year

- Accolades: Harlan 2009 is a top performer in the California 50 index

The first Harlan Estate vintage of 1990 was released in 1996 for $65 per bottle. These days, a case trades for more than $14,700. At the 2022 Naples Winter Wine Festival, a 10-year vertical collection of 2000 to 2009 vintages sold for $550,000.

In the last year, the Harlan 2009 vintage was a top performer in the California 50 index, which rose 24% the previous year, compared to just 7% for the Fine Wine 50. The average annual production of Harlan estate varies and ranges from 1,200 to slightly over 2,000 cases.

Their Bordeaux Blend, made from Cabernet Sauvignon, Cabernet Franc, Merlot, and Petit Verdot grapes, produces a fruity, fresh, and well-balanced wine.

How to invest in the best California wine

You can purchase wine in both primary and secondary markets. Within primary markets, wine mostly moves from producer to the public through wholesale distributors who sell to retailers.

The secondary market is where most collectors and investors buy wine. These are done through auction houses, exchanges, and wine brokers.

If you buy wine through a commercial auction house, you’ll pay a buyer’s premium ranging from 15% to 25%. Christie’s, for example, charges 25% on top of a winning bid.

Wine investment platforms

Wine is a physical product that needs to be properly stored, free of harmful environmental factors like light, humidity, temperature, and vibration. Without proper storage, your wine can age prematurely or go bad.

While you’re unlikely to have a wine cellar or wine refrigerator, you shouldn’t let that stop you from investing. This is where wine investment platforms can be useful.

These companies make wine investing more accessible to the masses by offering low investment minimums, expert guidance, insurance, and storage services. Wine investment platforms help you:

- Time the market for maximum ROI

- Gain insight into the wine industry

- Access fine wine collections that most investors don’t know about

Like auction houses and brokers, these platforms aren’t free, so shop around and compare fees and offerings. Here are a few to get you started.

Vinovest

Vinovest can help you create a well-rounded wine portfolio. They charge a 2.85% yearly fee or 2.5% for portfolios over $50,000. You need a minimum of $1,000 to get started.

What’s included:

- Buying and selling wines

- Storage

- Insurance

- Wine fraud detection

- Portfolio management

- Easy wine delivery for gifting to others or sending it to yourself

Vint

The team at Vint prides itself on leveraging extensive market research to develop each collection.

Unlike Vinovest, Vint doesn’t have any minimums or management fees to get started. Instead, Vint takes an 8% to 10% sourcing fee from the purchase cost of the wines.

What’s included:

- Buying and selling shares in wine collections

- Storage

- Insurance

- Collections curated by experts

Wineries that don’t sell to the public

Let’s say you’re ready to pull the trigger on buying wine. You don’t want to use a broker, private seller, or platform because you’d rather avoid fees. You also have a plan for how you will store the wine.

If you reach out directly to wineries and inquire about buying, prepare yourself for waitlists. This is especially true for wineries that don’t sell to the public. In this case, you simply have to wait in line.

The downside? It can take years. Some oenophiles waited three years to buy a few bottles from Bryant Estate.

Pro tip:

Buy the maximum quantity of bottles you can. Otherwise, you may move down the list for future wines they produce, or the winery may even remove you from the list. This isn’t a written rule but more of an unspoken one.

While there’s no super effective way to get around this barrier, wine investment firms might be a way to gain exposure to exclusive Californian wines without waiting years to buy bottles.

Are California wines a good investment?

California wines can be lucrative, but wine investments typically have a medium- to long-term horizon. Rising demand for California wines in the secondary market, global expansion to international markets, and low volumes in production have influenced price increases and steady gains.

The California 50 index returned 28.2% compared to -10.62% of the S&P 500 and consistently outperformed the Live-ex 1000 index over the last five years.

Furthering the cult-like mania, California wines also achieved more perfect 100-point critic scores than any other region in 2021.

All of these factors contribute to steady growth and, because of its low correlation to the S&P 500, show that fine wine can be an appealing low-risk alternative asset.

Though margins for growth seem promising, there’s risk involved and no guarantee you’ll turn a profit—like any other investment. Wine can also be expensive because physical assets can easily incur higher costs than traditional investment vehicles. You need to consider expenses like storage and shipping costs when you decide to sell.

Ready for wine time?

Maybe your friends have investments in other types of alcohol, like scotch or bourbon, and their claims to fortune have piqued your interest in this market. Or perhaps investing in wine feels more attainable than Bitcoin.

Whatever your reason, make sure to talk to friends and check out platforms like Vinovest and Vint. Sip happens, but you’ll avoid pour decisions by fully understanding what it takes to invest in wine.