Study: Could Investment Wine Be a High Return, Low Risk Unicorn?

Our study found that wine outperformed most other assets included while offering less downside risk and lower volatility.

The goal of investing is simple: maximize returns and minimize loss. Investors do this by diversifying their holdings, allocating a percentage of their portfolio to assets that provide growth and another percentage to assets that protect them against loss. But what if one asset could do both?

Over the last year, wine outperformed every other asset included in this study by a significant margin.

These high return, low risk ‘unicorns’ are rare. They’re assets that offer consistent long-term growth with minimal volatility. They maintain value during market crashes, protecting your portfolio against loss in a recession. They have a low downside risk as well, meaning it’s unlikely your investment will crash suddenly and lose significant value.

Investing in wine has become more prevalent in recent years thanks to platforms like Vint, which allows everyday investors to buy shares of fine wine, and Vinovest, which gives you the opportunity to invest directly in wine without the work of sourcing and storing it. Platforms like these have made fine wine as an asset class that much more accessible. And in recent years, wine has proved itself a worthy investment.

When we look at our data on over 20+ alternative asset classes, wine comes out as the 2nd best-performing asset class over the last year. Oil takes the no. 1 spot, but oil is also extremely volatile, whereas the price of fine wine tends to remain stable. Could it be that fine wine is where investors can find competitive returns without all the risk?

We compared wine to traditionally high growth assets like stocks and cryptocurrency as well as traditionally low risk assets like gold and bonds. Here’s what we found.

Adam Lapierre, Director of Wine at Vint, on fine wine as an asset class:

Highlights

- Wine remained stable during the COVID-19 recession and produced returns of nearly 11% during the first half of 2022 when almost every other asset suffered significant losses.

- Since the COVID-19 recession began in February 2020, wine has returned 41%, outperforming the S&P 500 and every other asset we examined aside from Bitcoin.

- Wine has outperformed every other asset we studied over the last year, and every asset other than Bitcoin over the last five years.

- Wine had one of the lowest maximum drawdowns of the assets studied over the last five years, indicating a low downside risk. It also had one of the lowest standard deviations, second only to bonds, indicating relatively low volatility.

- Of three sample portfolios studied, those that incorporated wine performed better over the last year and five years than those that did not.

Performance of wine during recessions

Wine has performed particularly well during recent market downturns, largely holding its value or even increasing in value.

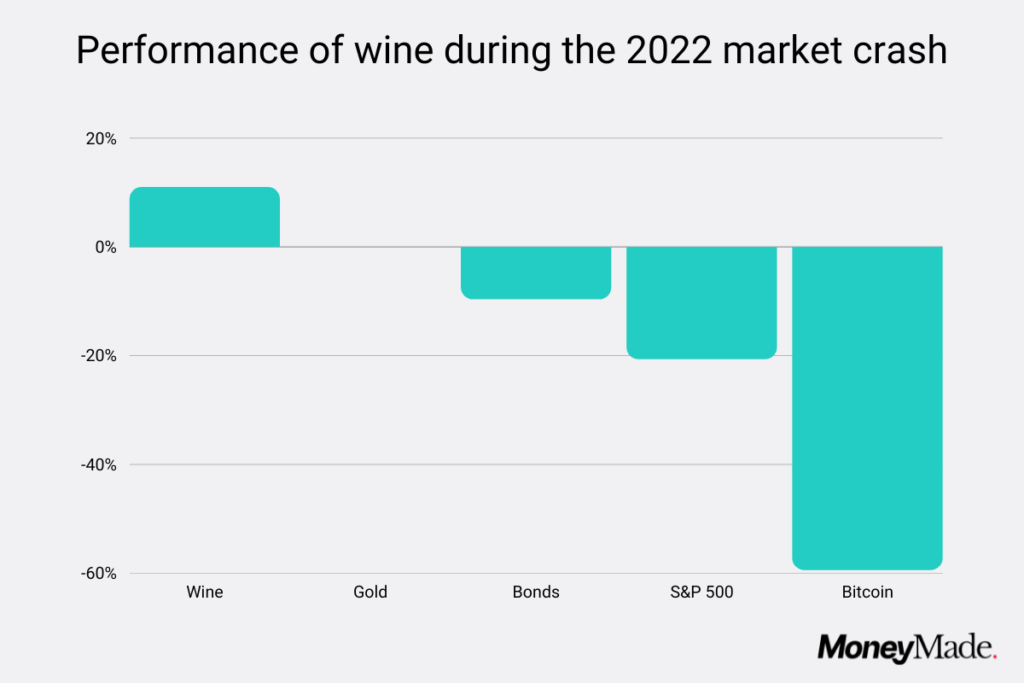

We looked at the first half of 2022 (Jan. 1 to July 1), during which the S&P 500 returned an abysmal ‑20%. At the same time, wine offered nearly 11% in positive returns, not only beating the market by a wide margin but also offering returns that significantly outweigh the high inflation we’ve experienced this year.

Wine also outperformed other traditional stores of value and inflation hedges. Gold stayed at the same value all year, and bonds fell by nearly 10%. And while crypto has been touted as a potential store of value in the past, we all know what happened to the crypto market during the first half of 2022. Bitcoin, for example, lost 59% of its value from January to July in 2022.

During the COVID-19 recession, which began in February 2020 and ended in April 2020, the S&P 500 fell by nearly 20%. Bitcoin crashed even harder than the stock market, losing 31% of its value. Meanwhile, wine fell by just 1.74%. Both wine and gold mostly maintained their value.

The only asset that performed well during the COVID-19 recession was 7-10 year Treasury bonds, which rose over 6% while most other assets either stayed stable or lost value. However, long-term returns of bonds are less impressive.

While the stock market bounced back fairly quickly after the COVID-19 recession was announced, the economy has seen its fair share of ups and downs and continues to struggle two years later. Zooming out to look at the overall performance of various assets since the COVID-19 recession began can give investors a better understanding of the returns wine can offer over longer periods of economic instability.

From February 2020 to the start of July 2022, the stock market returned just over 17%. Wine, on the other hand, returned a whopping 41%. In other words, if you’d taken $10,000 out of the stock market when the recession began and invested that money into a diversified portfolio of fine wine, you’d have $14,116 now. If you’d kept it in stocks, you’d have just $11,773.

During this same period, bonds lost significant value, returning ‑7.89%. Gold offered modest returns of 10%. Bitcoin came out on top, delivering returns of 133% since the COVID-19 recession began, but with far more volatility than any other asset we looked at.

Long-term performance of wine

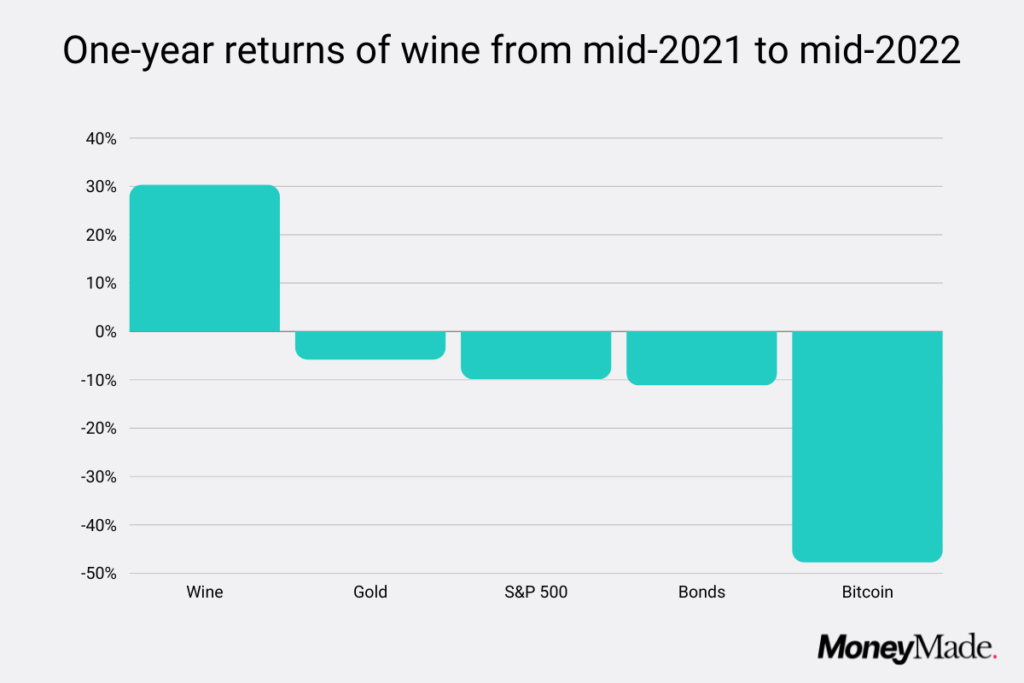

Over the last year (from July 2021 to July 2022), wine outperformed every other asset included in this study by a significant margin. Wine offered returns of over 30% while all other assets produced negative returns, with gold returning ‑5.71%, the stock market returning ‑9.74%, and bonds returning ‑11.02%. Bitcoin returned ‑47.63% during this period.

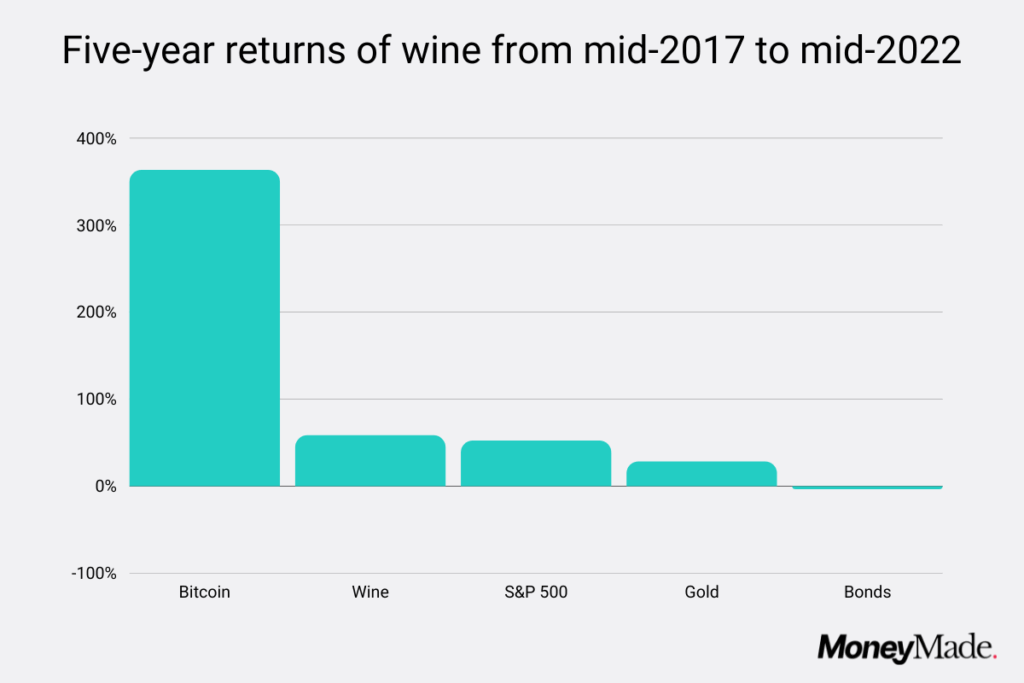

Investment-grade wine has outperformed the S&P 500 over the last five years as of mid-July 2022. The asset class returned a generous 58% as compared to the stock market’s 52%. Gold barely returned half that, at 28%, and bonds actually lost value, returning ‑3% over the last five years.

Bitcoin was the only asset to outperform wine over this five-year time horizon. But again, crypto’s stellar performance is not without risk. At any point over the past five years, you could have taken your money out of a fine wine investment without risk of losing much value. During most time periods, you’d be exiting your investment at a gain. However, there are plenty of times over the past couple of years during which converting your BTC to USD would’ve resulted in significant loss.

Risk and volatility when investing in wine

Anthony Zhang, Founder of Vinovest, on why fine wine has performed well:

In addition to offering generous returns during periods of economic uncertainty and competitive long-term returns, wine also provides a stable store of value due to its low downside risk and low volatility.

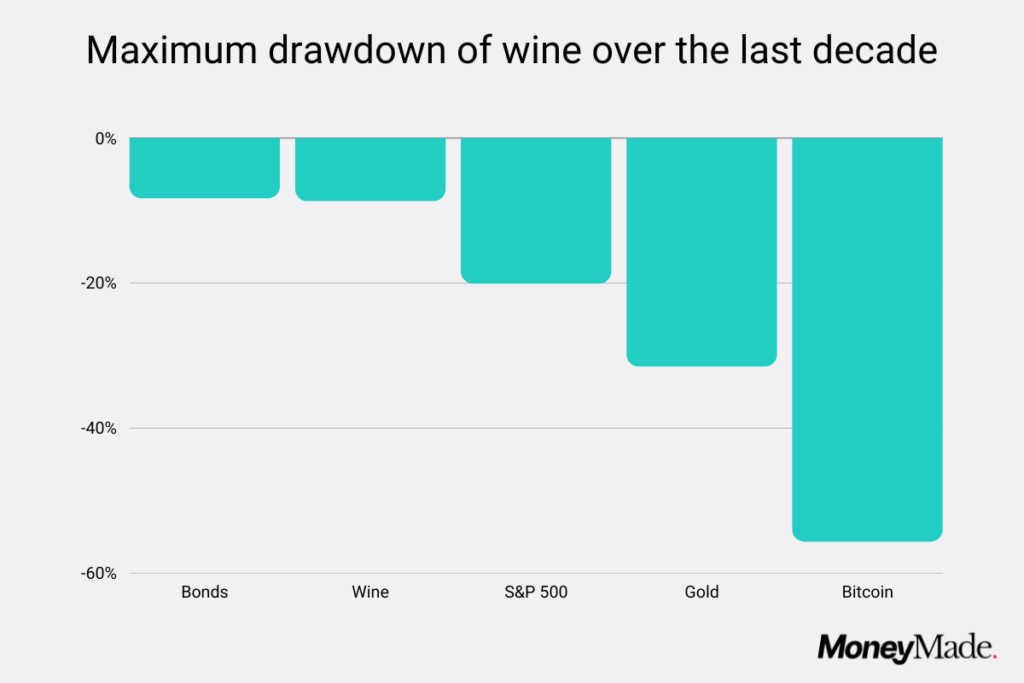

One popular measure of risk in investing is an asset’s “maximum drawdown.” This is the maximum loss an asset has taken from its peak to its trough. In other words, it measures the downside risk of investing in said asset.

When you look at wine over the last decade (2011 to 2021), its maximum drawdown was 8.63%. This dip began in November 2019 and lasted through March 2020. The maximum drawdown of the S&P 500 over that same decade was 20%, a dip that occurred roughly over the same time period. In other words, the downside risk of wine is much lower than that of the stock market.

The downside risk of bonds was on par with that of wine, with a maximum drawdown of 8.26% over the last decade. Of course, as we saw in the previous section, the upside of bonds is much lower than that of wine.

Gold presented a significant downside risk—its maximum drawdown over the last decade was 31%. Bitcoin, unsurprisingly, presented the highest downside risk by far, with a maximum drawdown of over 55%.

Five-year standard deviation of wine

| Asset | Standard deviation |

| Bitcoin | 404 |

| S&P 500 | 11.47 |

| Gold | 11.19 |

| Wine | 10.10 |

| Bonds | 5.31 |

Standard deviation is another popular way to gauge risk in investing. This number measures volatility by looking at how much an asset’s returns deviate from its average. The higher an asset’s standard deviation, the more volatile it is. While high volatility can result in an investor earning outsized returns, it can also result in significant loss.

Of the five assets studied, wine had the second to lowest standard deviation from 2017 to 2021, making it one of the least volatile assets. While bonds displayed significantly less volatility, we saw above that bonds also produced negative returns over the same period, whereas wine returned 58%.

Both gold and stocks were notably more volatile than wine. Bitcoin, the only asset to outperform wine over the last five years, had a standard deviation about 40x greater than that of wine, making it an extremely volatile asset.

Performance of investment portfolios that include wine

Below we look at the performance of three different sample portfolios over the last year (from mid-2021 to mid-2022) and the last five years (from mid-2017 to mid-2022). These portfolios compared a traditional 60/40 portfolio to a traditional portfolio with wine incorporated and a growth-oriented portfolio that uses wine as a hedge against loss.

We used an initial investment of $100,000 in these examples and then calculated how much an investor would have in their portfolio now if they’d invested that money one year ago and five years ago.

Portfolio A: Traditional 60/40

60% in stocks, 40% in bonds

| If you’d invested $100,000… | You’d have this much now… |

| 1 year ago | $89,748 |

| 5 years ago | $130,000 |

Portfolio B: Traditional with wine

60% in stocks, 30% in bonds, 10% in wine

| If you’d invested $100,000… | You’d have this much now… |

| 1 year ago | $93,873 |

| 5 years ago | $136,100 |

Portfolio C: Growth with wine

60% in stocks, 20% in bonds, 15% in wine, 5% in crypto

| If you’d invested $100,000… | You’d have this much now… |

| 1 year ago | $94,105 |

| 5 years ago | $157,450 |

All three sample portfolios lost money in the last year due to the negative returns produced by three of the four assets included. Portfolio C, the portfolio that allocated the highest percentage to wine, saw minimal losses despite including an allocation to Bitcoin, an asset that performed worse than most others over the last year. Portfolio A, the traditional 60/40 portfolio which allocated nothing to wine, suffered the biggest losses.

Over a five-year period, Portfolio C, the one that allocated the most to wine as well as a small percentage to crypto, performed the best, followed by Portfolio B, the traditional portfolio with a wine allocation. Once again, the 60/40 portfolio with no allocation to wine or other alternatives performed the worst over the last five years.