Time Market: How Investment Watches Can Bling Out Your Portfolio

Have you invested in a timepiece? Here’s what you must know before wrapping a rolly on your wrist.

Luxury watches have become one of the hottest collectibles as every youtube investor and crypto millionaire adds new timepieces to their collection. Many collectors put a lot of emphasis on the precious metals they’re made of and which Swiss brand is better than other Swiss brands—but this isn’t what sets watches apart from other investments.

The best way to make a profit on a Rolex investment is to look toward where collectors’ attention is headed.

When it comes to collectible watches, sales numbers come down to constrained supply, AKA scarcity. Supply and demand dictate that if the buyers’ list grows but supply doesn’t, then prices will go up. And up they did. Luxury watch sales saw an uptick beginning in 2019 and a dramatic increase in sale prices came the following year. Here’s how you can capitalize on investment watches.

Investing in collectors watches

The luxury watch market has boomed as the average Rolex price has gone up nearly 20% in the secondary market last year according to the Timepeaks index tracking used Rolex prices. Rolex watches historically led the investment watch market, but some watches from other luxury brands like Audemars Piguet and Patek Philippe have proven to be a good investment, too.

For example, prices for the stainless steel version of the Audemars Piguet Royal Oak Jumbo rose sharply into the six-figures last year after its discontinuation was announced.

Investing in Rolex watches

Leading the luxury watch market is Rolex, a Swiss brand that has garnered global demand for its world-class craftsmanship. Rolex is best known for its signature stainless steel sports watches, particularly diving watches like the Rolex Submariner and racing watches like the Rolex Daytona. One thing that makes Rolex a good watch investment is the historical significance and narrative around the brand.

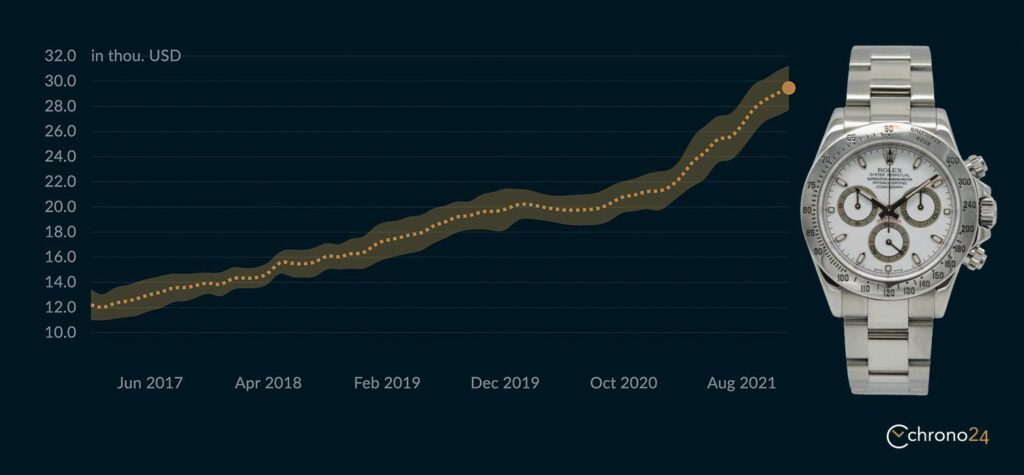

Generally, new watches tend to be worth less than older watches that are the same Rolex model, but some newer watches can also be good investments. For instance, the Rolex Daytona in-house automatic winding chronograph movement saw exceptional price-performance thanks to its popularity among collectors. The historical significance of the in-house chronograph elevated prices for particular stainless steel Cosmograph Daytona watches in 2021.

Another solid indicator that a Rolex watch could be a good investment is if it’s vintage, which usually means older than 30 years. A vintage watch tends to be worth more because it was produced for a limited time and has steadily become scarce. A great example of this is the Rolex GMT-Master ref. 1675 pilot watch with a blue and red bezel. The classic GMT-Master was a collaboration with Pan America Airways and older generations of this watch have seen great returns over the past decade.

Are Rolex watches a good investment?

Put bluntly, some Rolex watches are better investments than others. Not every Rolex watch can be sold for markup since it’s not guaranteed to have high demand on the market. The best way to make a profit on a Rolex investment is to look toward where collectors’ attention is headed. Rolex watches that are in demand to collectors are most likely to be a good investment since it’s the best indicator of future performance.

In terms of past performance, some specific Rolex models have outperformed others simply due to aesthetic preference. For instance, stainless steel releases of the Rolex Explorer line have recently seen a 30% price increase, which is an even sharper price bump than other entry-level models like the Rolex Submariner or Datejust. Rolex watches are not an affordable luxury, so you want to ensure your watch is from a popular line that can sustain its desirability.

It can be difficult to assess the real market value of new watches since the retail price of a Rolex doesn’t always reflect what it’s worth to collectors. This is why it’s not always safer to buy luxury watches at retail price than it is to aim for more coveted Rolex watches that are no longer produced. A well-timed investment in the right Rolex watch may perform better than most stock market index funds as it could be worth double in just a year or two.

Best investment watches

As the watch market boomed following the pandemic, prices of watches from other luxury brands like Patek Philippe and Audemars Piguet have performed extremely well. This shows that Rolex isn’t the only company and that the new generation of collectors are investing in watches made by other brands. Rolex has some excellent entry-level watches, but a comprehensive collection isn’t complete without niche brands like Omega and IWC.

One watch to have on your radar is the stainless steel Patek Philippe Nautilus. The green dial and blue dial versions of the Nautilus performed astronomically with an approximately 500% price increase over five years. The Patek Philippe Aquanaut and AP Royal Oak lines are a couple of must-haves for the most avid sports watch collectors, while budget watch investors can choose from less opulent brands like Breitling or Hublot.

One thing in Rolex’s line that hasn’t garnered as much hype is dress watches. If you’re going for a classier look, then watches like the Cartier Tank or Vacheron Constantin Overseas could be more appropriate timepieces for your collection. Dress watches aren’t as trendy, but the old-school style is battle-tested to endure the rapid undercurrent of fashion. After all, vintage timepieces are resilient ones that withstood the test of time so, naturally, they would be better to invest in.

How to invest in watches

If you want to dip your toe into the waters of watch investing, then try Rally.

Rally is an app for investing in collectibles. One asset listed on the platform is a 1999 Omega Seamaster that was the prop worn by Pierce Brosnan when he played James Bond. That’s just one of the hundreds of collectibles listed on Rally. Sign up for Rally to access the most diverse marketplace for trading collectibles.