High Octane: Everything You Need to Know About Investing in Cars

Earning a return on an investment car isn’t as easy as it sounds. We cover the numbers and logic behind why car investments are far from passive.

Cars are not an investment for the faint of heart. You’ve probably seen rare barn finds and vintage car restorations on TV, but, in reality, classic cars have traditionally been a niche market for connoisseurs, the well-to-do, and high-net-worth individuals who can afford the costs of entry.

A well-kept classic complete with original keys, owner’s manual, and even its original tire jack can round out the kit of a collector who doesn’t just want the car, but its entire history as well.

As wealth grew over the decades, so has the popularity of classic, antique, and vintage cars. Classic cars are quite unlike any other collectible because they require maintenance and mechanical expertise to keep them in tip-top shape. Unlike comic books or sports cards, it’s not enough to simply slip them behind a plastic film and forget about them for years.

However, with a bit of knowledge, some elbow grease, and a heavy dose of cash, you, too, can invest in a classic car. At a minimum, you’ll have a proper portfolio diversifier that puts a smile on your face every time she purrs. If you’re lucky, you’ll earn yourself a healthy return.

Why invest in cars?

Those with the capital and knowledge can earn substantial returns from an investment car. If you’re an automotive aficionado who isn’t afraid of the incremental costs of restoring and preserving your investment, then classic cars might be a worthwhile asset.

Most of the time, our unrequited love of gorgeous vehicles is reason enough for any enthusiast to buy a classic. Let’s highlight the key benefits of putting money behind the best investment cars.

Appreciation

While new cars can lose up to a third of their value after leaving the lot, many mature “classics” have reached the bottom of their depreciation curves over the past few decades. That means that, unlike new cars, the value of classic cars relies more on influences like supply and demand, geography, automotive performance, and notoriety than the rate of depreciation.

In fact, if preserved and kept in good working condition, classic cars may actually appreciate. As depreciation ceases to be a concern, factors like rarity and nostalgia can take precedence, especially as collector tastes change over time.

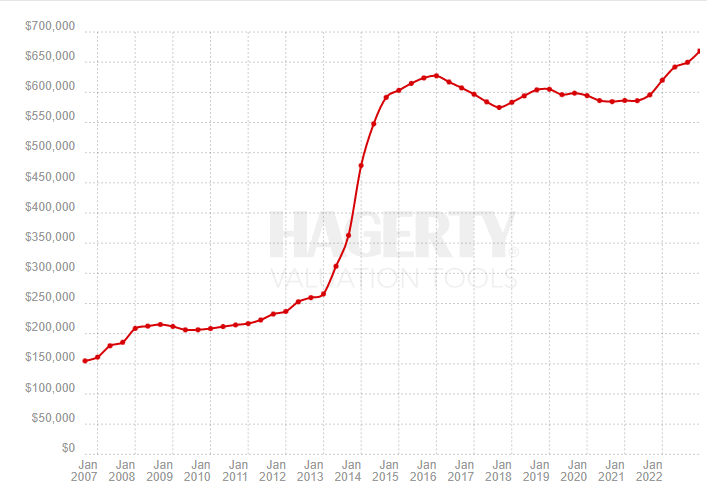

Obviously, not every classic vehicle will appreciate—there might be a bull market in some brands, while the demand for others may flatline. For example, had you bought and held the Hagerty German Collectibles index from January 2012 through January 2022, you would’ve seen an annualized return of 10.47% per year. Over that same period, the Hagerty 1950s American Index only saw a 2.31% annualized growth rate.

Chart of post-war German collectible cars index from 2007 to Jan. 2022.

Source: hagertyagent.com

You shouldn’t let a lack of appreciation potential deter you from closing a deal on your dream car. However, you’ll need to be discerning if you intend to purchase a vehicle for the main purpose of earning a return. A car’s brand, model, vintage, and even trim level can drastically impact its future value.

Diversification

Classic cars investments add a unique diversifier to your portfolio that isn’t perfectly correlated with traditional asset classes. Diversification allows you to spread out your portfolio’s risk exposure. This can be done either across asset classes (e.g. stocks, bonds, real estate), or within an asset class itself (e.g. different stock positions across a broader equity portfolio).

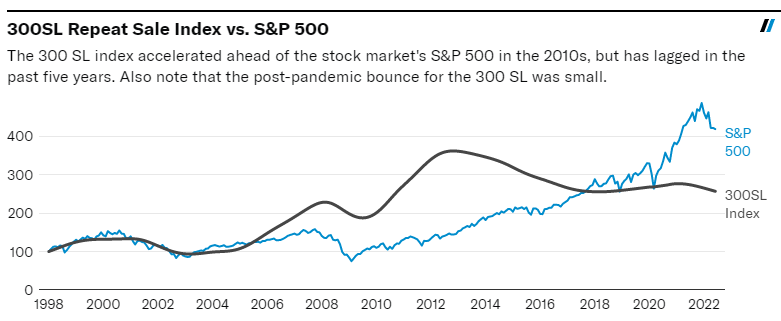

The value of classic car investments are correlated with equity returns, but they don’t correspond perfectly. For example, the 1954-1964 Mercedes-Benz 300SL index has generally followed the S&P 500 over the past 5 years, but its performance has been more stable and less subject to wide swings in valuation. Where we’ve seen double-digit swings in the S&P (both up and down), the value of the 300 SL Repeat Sale Index has kept within a much more stable band over that same period.

Chart comparing the Mercedes-Benz 300SL Repeat Sale index with the S&P 500.

Source: hagertyagent.com

Classic cars are somewhat correlated with the broader traditional investment assets but are still insulated as an individual asset class. This imperfect correlation with other assets can help reduce volatility when paired with a diversified asset portfolio.

How to find the best investment cars

You should also expect some impact from broader economic factors like interest rates, supply chains, and consumer demand on your investment car. Demand can and does dry up during recessionary periods for classic vehicles.

This makes intuitive sense because recessions may financially pressure collectors to sell their holdings for what they can get, while collectors in higher income brackets can sometimes afford to wait out the corresponding bear market. These pricing pressures can and do show themselves in the record of auto sales.

We’ll break down some generational divides in the classic car market. However, remember that this is only an introductory asset class breakdown. There are dozens of ways to slice the pie when categorizing classics, aside from age alone. To truly understand what each sector offers, you’ll need to dig deep and get your hands dirty.

Classic cars

- 1976 Volkswagen Golf GTI

- 1986 Buick Grand National

- 1991 Acura NSX

- 1994 Toyota Supra A80

- 1998 Dodge Viper GT2

“Classic” is the technical term covering cars built up to the year 2000 and earlier—either in original condition, or restored to their original manufacturer specifications. Generally, this includes most vehicles built prior to the dot com bubble but after the Arab Oil Embargo of the 1970s.

This segment includes “modern classics,” as well as many of the JDM drifters and European Hot hatches that gained popularity among Gen-Xers and older Millennials in the 80s and 90s.

Classics make for a decent ‘entry-level’ category for enthusiasts. Most of these vehicles were manufactured with modern electronic components and many parts are still produced today by both manufacturers and after-market suppliers. This makes diagnosing repairs and maintenance work easier on these than earlier car generations. Many serviceable classics are still available today at (relatively) affordable prices

Antique cars

- 1964 Aston Martin DB5

- 1963 Chevrolet Corvette Stingray C2

- 1945 Jeep CJ-2A

- 1966 Ford GT-40

- 1948 Ferrari 166MM Barchetta

Antique cars encompass vehicles manufactured prior to 1975, either original survivors or cars restored to their original manufactured specifications. This includes all vehicles manufactured around World War II to the decades leading up to the Arab Oil Embargo.

This generation is hallmarked by some of the most famous racers of Le Mans fame, the earliest pre-Chrysler Jeeps, as well as the golden age of American muscle, among others. Many antique car models marked the golden age of the auto industry and gained widespread traction among legions of baby boomers at the prime of their lives.

Antique cars require a more serious and knowledgeable automotive enthusiast to afford their hefty price tags and work on their older designs. For one thing, you’ll probably need to understand how to work on a carburetor, and those who can’t handle a stick shift need not apply. Due to the heavy demand from baby boomers at the peak of their wealth, expect cars of this vintage to sit on the high end of their pricing curves.

Vintage cars

- 1934 Packard Twelve Dietrich

- 1935 Duesenberg SSJ

- 1929 Ford Model A Roadster

- 1920 Rolls Royce Phantom

- 1926 Bugatti Type 41 Royale

Popular with the historically inclined, the “vintage” tag covers cars manufactured prior to 1930 and includes both surviving cars and those restored in accordance with their original manufacturer’s specifications.

This category includes the early years of the automotive golden age and the decades leading up to World War II. Featuring the original granddaddy Roadmasters and Roadsters of the greatest generation, cars from this category in many ways defined luxury as we know it today.

Not for the faint of heart, pre-war vintage cars attract automotive aficionados of serious taste. In this era, ash and mahogany wood slats were commonplace on cars sporting 12 and even 16 cylinder engines.

Meticulous attention to detail is required when preserving these historic gems, and custom metalworking may be required when OEM (original equipment manufacturer) parts cannot be found. While more common models can be found at reasonable prices, expect price tags of the cream of the crop to be in the millions, with access limited to top accredited investors.

Risks of investing in cars

Yes, making money from an investment vehicle is possible, but there are significant barriers to entry. For one, the prices of many popular collector cars can start in the low six figures and rise to the millions of dollars for exquisite rarities. This puts classic car investing out of reach for everyday investors.

Add to that the enormous carrying costs of owning a classic, including maintenance, preservation, insurance, parts, and labor, and you could be looking at a five figure bill each year, depending on what vintage you own.

Even between trim levels of the same model year, the small differences can often result in prices tens of thousands of dollars apart. If you don’t have the eye for detail, fail to grasp its history, or don’t have a good nose for what matters mechanically, it’s all too easy to pick up a dud that ends up burning a bottomless pit in your wallet.

In real life, many classic car owners who sold their vehicles at a profit reported that up to 25% of their sales price was eaten up by maintenance, upkeep, insurance fees, and taxes incurred over the years. These factors are not accounted for in most sales indices, and would likely result in substantially lower total return calculations if they were.

What determines value of the best investment car?

Classic cars are deceptively difficult for the untrained eye to value. Prices on different years, trims, and options packages of a single model can vary by tens of thousands of dollars.

On top of that, the prospect of inspecting a vehicle for aesthetics, mechanics, and authenticity is a mammoth undertaking that can require years of study and experience working with the vehicle in question—like the archeological unearthing of the past through dinosaur bones. Collectors often pay trained professionals large sums in consulting fees to find a collector’s edition of their dream car.

Condition

Determining the condition of a car requires a keen eye and solid understanding of the underlying mechanics. While some things are obvious when comparing a rusty barn find to a garage-kept showpiece, this requires a more nuanced touch when reviewing restorations.

Particularly when dealing with classics, it’s important to inspect the condition of a vehicle’s frame, body, and mechanical parts. Some defects aren’t visible on the outer body, and may require the use of special cameras or other measuring tools to detect. In some cases, they may be impossible to determine without partially disassembling a car (something that most car owners loathe, even on a good day).

While repairs can be made to restore a vehicle to its former glory, its condition may determine whether it’s worth restoring or if it’s a money pit that’s better abandoned. While 90% of cars look good on first pass, it’s the last 10% of vehicles kept in pristine condition that really command top dollar.

Originality

Stock versions of cars with factory-original parts are highly prized in the collector community. You’ll often hear the term “numbers-matching” thrown around by veteran car-buyers, which is a way to verify the authenticity of a vehicle’s chassis, engine, and transmission.

Aftermarket upgrades and other modifications to a car, no matter how expensive or well-done, do not necessarily add to the value of the vehicle. In most cases, collectors typically value authenticity over mechanical improvements. While there’s certainly a budding market for modernized classics, or “restomods,” that has gained traction over time, don’t expect that new intercooler to add anything to your car’s value.

With older vehicles, the inevitability of parts failing means that some restoration work will obviously be required. As time passes, the availability of all-original parts grows less likely as manufacturers close and firms discontinue production. Inevitably, you may be forced to substitute functional alternatives or modern replicas for OEM parts, particularly if you don’t have the means to repair the original.

The faithfulness of the restoration to its original manufacturer specs will be important to determining the value of the vehicle in question, so it can pay to shop local swap meets for serviceable parts.

Ownership & documentation

Generally, the fewer owners and the lower mileage a car has, the better its value proposition. The logic here is simple: cars with fewer owners are generally easier to track from a record-keeping perspective when it comes to things like maintenance schedules, repair history and even accident records.

If you’re able to furnish an authenticated record of a car’s maintenance work, those can be worth their weight in gold. A well-kept classic complete with original keys, owner’s manual, and even its original tire jack can round out the kit of a collector who doesn’t just want the car, but its entire history as well.

Historical significance

Famous previous owners, appearances in pop culture, or significant strides in mechanical advancement are all factors that can add to the notoriety, and value, of a car.

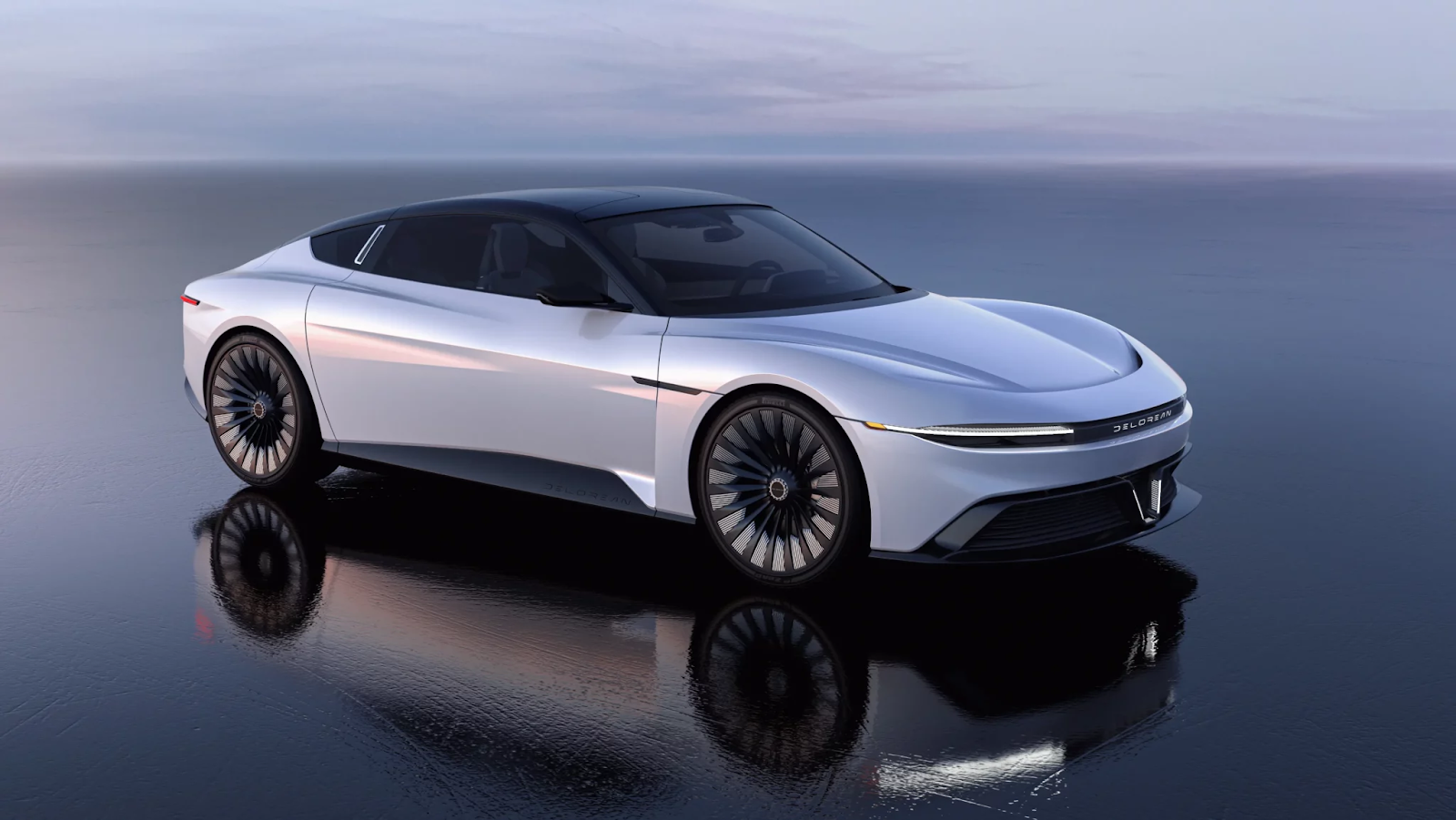

In some cases, a car’s mere appearance in pop culture can introduce a vehicle to the zeitgeist. The classic case being the 1982 DeLorean DMC-12 of Back to the Future fame. The Delorean Motor Company’s short-lived production run lasted from 1981-1982 before they shut their doors. However, the popularity of the film brought back the vehicle from relative obscurity, even leading to a brand revival in the form of an electric car.

DeLorean Alpha5 revealed by the DeLorean Motor Company in May 2022.

Source: delorean.com

In some cases, having verifiable evidence of a previous celebrity owner can add multiples to the value of a car, beyond what other comparable examples are worth on the market. Now, we’re not saying Jon Voight’s 1989 Chrysler Lebaron will have you rolling in cash, but it certainly helps if the previous celebrity owner was a gearhead.

Exclusivity

Exclusivity refers to the rarity of your car. This is simply the laws of supply and demand at play—comparing your car with however many refined examples of it remain on the market.

Changes in tastes, natural declines in supply due to the passage of time, or even manufacturer-induced shortages—as is the case when companies release special edition versions of cars in limited supply—can result in value spikes.

For instance, take sports car manufacturers like Ferrari and Lamborghini, who purposefully limit the number of cars they produce each year. This creates an artificial supply cap on every luxury sports car, which maintains their exclusivity and brand value.

Compare their supply to the number of mass-market cars by companies like Stelantis or General Motors, who sell millions of vehicles a year, and it’s easy to understand the pricing difference.

How to invest in cars

If you’re looking for the best investment cars, you’ll need to start by studying hard if you don’t plan to rely on a professional car buyer service. This means reading up on the history, specs, model types, and appreciation potential of investment cars you’re interested in.

Financially, the best investment car isn’t just about the upfront cost of purchasing it. Carrying costs of annual repairs, maintenance, and preservation must be considered, too. Don’t forget to factor in both insurance and vehicle storage as well as capital gains tax on your profits.

Depending on the investment car you buy, don’t expect to hit it out of the ball-park when it comes returns, if any. The more common your vehicle is, the less likely it is to appreciate significantly in the near future. Just because you’re able to pick up a serviceable classic for $20,000 doesn’t necessarily mean you’ll earn anything more than a modest return over the next few years, especially not after factoring taxes and upkeep.

Buy at auctions

If you understand the risks and are willing and able to accept the concurrent costs, you’ll have plenty of options to shop from. There are reputable auction houses that operate nationwide, both online and off, specializing in the sale of collectible cars. These include both regional and national names, like Barrett-Jackson, Bonhams, and RM Sotheby’s, as well as well-known online auction sites like bringatrailer.com.

Buy local

For those willing to do a little more footwork, local periodicals and craigslist listings might be a good place to dig for diamonds in the rough. Just be aware of the local market for your investment cars. Depending on your location, you may even be able to find local dealerships that specialize in the sale of used cars. However, you may need to manage your expectations when it comes to pricing.

Buy piecemeal

If you’re a little apprehensive about the carrying costs of car ownership, the easiest alternative to owning a classic car is buying shares in one. Didn’t think this was possible? The investment platform Rally securitizes cars, splits them into shares, and sells those shares to investors.

A relatively new business model, companies like Rally enable you to gain exposure to some of the most coveted investment cars on the market, without having to cover the full cost of ownership and maintenance. Sign up for Rally to see what kind of cars, collectables, and other assets they have available for investment.

If you’re interested in buying an actual classic car for investment purposes, make sure you manage your expected investment returns, as they incur significant carrying costs that will likely erode the overall value of the investment.

Ultimately, it’s better to approach cars from the automotive enthusiast’s perspective rather than an investor’s. At the very least, you’ll have the pride of owning a true automotive classic and a fun car to ride in.