Suit Up: What Is Litigation Finance and Is It Right For You?

Litigation finance splits the cost of a lawsuit between a group of investors who are hoping for a substantial return when the verdict comes in.

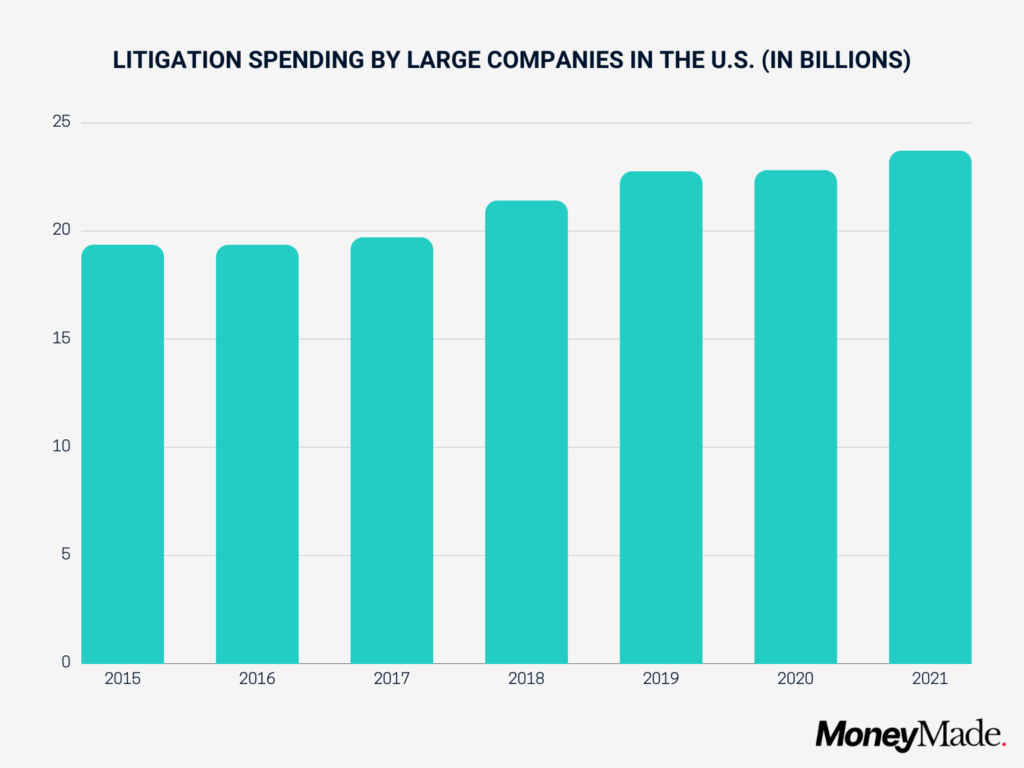

The U.S. is the most litigious country in the world, with millions of lawsuits filed each year. Litigation spending increases each year, climbing to $23.7 billion among large companies in 2021. With bigger budgets for litigation come heftier payouts—like Meta’s $3 billion legal expense budget and the $550 million settlement they paid in 2020’s privacy violation lawsuit—and you could be cashing in on some of it.

Before you get any ideas, we don’t recommend jumping in front of the next Tesla you see in hopes of scoring a healthy settlement from Elon. An easier way to get rich is by hopping aboard the litigation finance express.

What is litigation finance?

Litigation finance is when the cost of legal representation in a lawsuit is split among a group of investors. The thing about lawsuits is that the monetary gain (hopefully) makes all the time, effort, and boring legal proceedings worth it, but the upfront and ongoing costs are so high that they discourage many plaintiffs from even attempting to go to trial.

Depending on how the payout deal is structured, a win can be highly lucrative. But it can also be extremely risky.

Lawyers charge hundreds of dollars per hour, and that’s only part of it. Filing fees, expert witnesses, courtroom fees, and even a charge for each document created—it all adds up pretty quickly, no matter which side you’re on.

And after all that, you could still end up losing.

Between the excessive costs and high risk, a lawsuit is often more than a plaintiff can afford to pay on their own.

But litigation financing allows investors to share the costs and the burden of a lawsuit with the plaintiff (or, in some rare cases, the defendant). Litigation investors can pay a portion of someones legal fees to make it possible for them to proceed with a lawsuit that they would otherwise be unable to afford.

But who would do this? Why would someone want to pay legal fees that aren’t even their own? There are two main reasons:

- To financially support a person or cause you believe is just.

- Getting paid!

Let’s start with the second one.

How does litigation finance work?

If you believe there’s money to be gained by winning a lawsuit, you can buy a stake in the potential reward by agreeing to foot all or some of the bill.

Once the lawsuit is finalized, you might gain a fixed percentage of the recovery amount (agreed upon prior to the lawsuit) or a multiple of your initial buy-in. That’s on top of getting your investment back in full.

Depending on how the payout deal is structured, a win can be highly lucrative, but pursuing it can pose a lot of risk.

You get nothing if you fund a case that ends up losing. Litigation finance is a non-recourse investment, so the only collateral for payment is profit. Without a settlement or recovery, you don’t profit as a litigation investor. If that’s a risk you’re willing to take, then litigation finance might fit your portfolio.

Wait, is this a real thing?

Litigation finance might seem like some new fad in the post GoFundMe-for-healthcare world we’re living in, but it’s been a fairly common practice in commercial lawsuits for nearly 20 years. Historically, litigation finance firms have footed the bill for commercial clients. According to LexShares, there were only six of these firms before the 2008 financial crisis, while Westfleet reports there are over 40 of them now, with a combined $12.4 billion in assets.

With these astronomical increases, it’s hard to imagine why anyone wouldn’t invest in litigation finance.

Pros and cons of litigation finance

Pros

- Litigation finance can create opportunities for justice for those who may otherwise not be able to defend themselves.

- Class action lawsuits can help bring about social and structural change.

Cons

- Having multiple stakeholders in a case can pressure the plaintiff to resolve the case in a certain way.

- The relationship and trust between a lawyer and client might be difficult to maintain with litigation financiers to answer to.

As litigation finance grows, courts and bar associations will have to develop safeguards against the potential negative effects of collective funding. That means that rules around litigation investment may change in the future, like policies for disclosing investor information and limiting the influence of litigation financiers on the case proceedings. All this could make litigation investments harder to navigate.

What types of lawsuits use litigation financing?

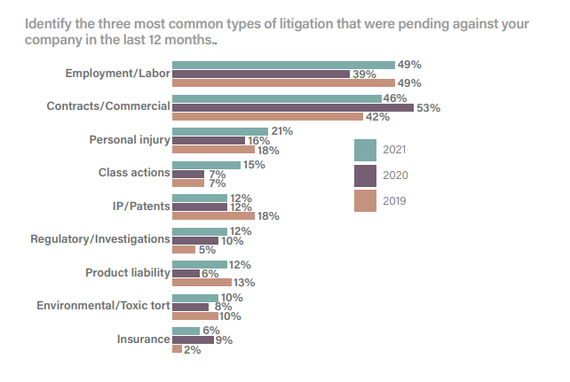

Litigation financing can fund any lawsuit, but certain types of court proceedings are more popular among litigation investors than others.

Class action lawsuits

Litigation finance is most commonly used to fund class action lawsuits. These aren’t all toxic breast implants and data breaches—class action suits could encourage using litigation finance as a vehicle for social change.

For instance, a 2015 mining incident in Brazil led to a nearly $7 billion lawsuit against the company responsible. The incident caused flooding, contamination, and destruction that amounted to what’s been called “the worst environmental disaster ever seen in Brazil.” But, even with over 200,000 people affected, the case was only made possible by litigation funding from North Wall Capital.

The case is still in progress, so the outcome will hopefully provide relief to the villagers who lost so much. This shows how litigation financing enables investors to have a direct impact by supporting those who need it rather than simply following socially conscious investing trends like the ESG strategy.

Corporate lawsuits

Next, there are the far less exciting corporate finance and patent lawsuits. Many companies find themselves amid several different lawsuits at any given time, which presents ample opportunities for litigation investors.

Corporate litigation is pretty routine and predictable. Still, it can be resource-intensive and lock up a company’s liquidity. It makes sense for many of these companies to allow traditional litigation funders to shell out cash and absorb the risk of the lawsuit. This way, if the suit doesn’t resolve in the company’s favor, it loses considerably less than it would have.

And if the company wins, it not only gets to enjoy sweet victory but also earns profits from the assets it didn’t have to lock up in legal fees. Litigation finance is also a very popular way to fund patent lawsuits for similar reasons.

And it’s not just companies that stand to benefit from litigation investors. These lawsuits often pay out, but going after someone for patent infringement can be expensive. Patent holders don’t always have enough spare cash to dish out on defending their intellectual property, so litigation finance can make all the difference in their cases.

Is litigation finance a good investment?

Anything can be a good investment if you understand where it fits in your overall portfolio and how it aligns with your values. However, litigation finance can raise some concerns—and eyebrows—about volatility and risk.

While some alternative investments carry a high-risk reputation, they’re not all bad boys. In the case of litigation finance, one of its most positive aspects is that it’s completely uncorrelated to assets like stocks, bonds and crypto. In fact, when the prices of those assets drop is when we see most lawsuits begin to pop. Lean times make for well-fed lawyers.

With most litigation finance funds being private, there’s little information out there about how lucrative these investments can be. But, we did find a few examples, including data from Burford Capital and LexShares—both litigation finance behemoths.

From 2009 to 2020, Burford Capital made 322 investments. Of the 148 cases that closed, 95 were wins while 47 were losses. There were also six draws.

Of the 95 wins, 24 were home runs that over tripled their investment, while another 39 more than doubled. The rest of the winners were far milder. Then there were the 47 losers where 100% of their investment was lost.

Overall, Burford won about two-thirds of the lawsuits they helped finance. In 2019, they invested $117.5 million into cases that closed and recovered $318.5 million—an impressive 171% gain. 2020 was a less lucrative year for them, with only $9.7 million deployed and $10.5 million returned for concluded cases—a gain of a bit over 8%.

LexShares gives us a different way to look at profitability. They boast a 70% win rate for their resolved cases and a median net annualized return of 47% as of December 31, 2020. Though exactly how much LexShares made in profit went unreported, that’s a lot of room to make a lot of money.

How to invest in litigation finance

Access to litigation financing is restricted to accredited investors in the U.S., which speaks to the risk involved in litigation investments. The bar is high because you’ll likely have to wait years for the lawsuit to resolve in court. If that long-term investment horizon doesn’t bother you, then you’ve got lots of ways to get into the litigation finance game.

Litigation finance firms

Some firms allow accredited litigation finance investors to purchase a spot in their fund, which covers the costs of various cases. On LexShares, investors can stay up to date with case details, including breaches of contract, fraud, and even whistleblowers vs. Fortune 100 companies.

The upside of litigation finance through traditional funders is that their specialized funds usually have teams of lawyers who vet cases and possibly act as counsel in them to help bring a better resolution. They also have finance teams tasked with figuring out how to structure deals in a way that’s most advantageous for the fund.

The downside is that a deal that’s advantageous to the fund can come at your expense. In other words, make sure you understand how the fee structure works and what implications it may have on your investment before sending them your cash.

The other downside is that, for the most part, the cases these firms invest in probably won’t be saving the world. There’ll be a lot of boring corporate finance, patent lawsuits, and other cases that companies could handle themselves but would rather rely on funds to remove the risk from their balance sheets.

Non-accredited litigation finance investors

Even if you’re a mere peasant like 90% of the country, you can still put your humble earnings towards litigation finance.

Yieldstreet

Yieldstreet offers a variety of equity deals and asset-backed debt investments, from real estate investment loans to fine art. The fund is open to non-accredited investors with a minimum investment of $500, part of which is invested in litigation financing.

Ryval

The key to non-accredited litigation finance might lie in the blockchain. Ryval, co-founded by attorney Kyle Roche of Roche Freedman, aims to be the “stock market of litigation finance” and open new ways for investors of all levels to back plaintiffs in cases that capture their interests or hearts.

While the Ryval market has yet to open, one of Roche’s clients provided a test case for an initial litigation offering (ILO). Apothio, a California hemp growing company, crowdfunded its suit against the Kern County Sherriff’s Department and raised almost $350,000 between October 2021 and March 2022.

This case is still in litigation, so the returns those 170+ investors will receive remains to be seen. Apothio’s pitch offered investors a multiplier that increases as the case continues—2x if the case lasts less than a year, 3x if it runs two to three years, and 3.5x if it exceeds three years. However, if the resulting recovery is too small to pay the investors, the agreement doesn’t cover their initial investment returns.

If a gamble like this sounds exciting to you, then keep an eye out for Ryval. Their web3 marketplace is said to be launching this year, which should bring litigation finance to a cryptocurrency exchange near you.

Burford Capital stock

If you’re fired up about the world of litigation finance and you want a piece of the growth now, you could consider purchasing shares in Burford Capital. Investing in BUR doesn’t have the advantage of exposure to an uncorrelated asset, but it’s another way you can benefit from the growth of litigation financing without the long wait and costly entrance fee.

While most litigation finance firms are private companies, Burford is one of a few public firms in the mix. Even though it’s headquartered in the U.K., it has offices stateside, so you can trade it on the New York Stock Exchange.

Is litigation finance a fad or the future of justice?

While litigation finance can help bring justice to those who can’t afford it, it could also help put money in your pocket. With new technologies on the way to expand access to this fast-growing asset class, litigation investing opportunities are likely to stick around and even grow. With investments in traditional assets on a rollercoaster ride over the last few years, having a truly uncorrelated asset to diversify into might be exactly what your portfolio needs.