Make Passive Income as a Crypto Validator On These 5 Blockchains

Validator nodes are the backbone of blockchain, and they make money whether the crypto market moves up, down or sideways. Do you have what it takes to become one?

Traditional investors earn dividends from stocks or collect rent on real estate properties, right? Well, there are many ways for crypto investors to generate passive income too, from lending crypto and staking crypto to running a validator node—with the latter being one of crypto’s most tried-and-true money makers.

In this article, we’ll explore exactly what a validator node is and which crypto projects offer the best opportunity for earning passive income as a validator node.

What is a validator node?

A validator node is a type of node that stores a copy of the blockchain’s history and verifies new transactions. Now if that dry definition doesn’t really excite you, let me explain the “why” behind validator nodes.

Source: nodes.com

Becoming a validator is a complicated topic, but we can boil it all down to three steps: choosing a blockchain network, acquiring the right hardware and software, and running and maintaining your node.

The key feature that makes blockchain technology so revolutionary is decentralization. In other words, public blockchains aren’t controlled by a central server but a group of servers called nodes. Now for decentralization to work, users have to be sure that all network transactions are valid. The more globally distributed these nodes are, the harder it is for an attacker to double spend tokens, reverse transactions, or shut the system down.

But requiring a group of servers to process every transaction introduces another problem: How do they all agree on a transaction’s validity? This process is called “achieving consensus.”

The original consensus algorithm is Bitcoin’s proof-of-work (PoW). Over the years, however, proof-of-stake (PoS) has come to be the most dominant consensus algorithm in use. When it comes to comparing proof-of-work vs proof-of-stake, PoW requires computers to solve energy-intensive puzzles to confirm transactions, while PoS only requires nodes—better known as validators—to lock up or “stake” tokens as collateral. These validators are, in turn, randomly selected to verify transactions.

And to make this system more democratic, most PoS networks let users (i.e. delegators) choose the nodes they want to validate the next block by adding tokens to their staking pools. This way, both validators and delegates share in the network’s block rewards.

Now onto some specific examples of running validator nodes on popular blockchain protocols.

The top 5 cryptos for validator nodes

A quick disclaimer before we dive into the list: The nitty-gritty details of running a validator node are way beyond the scope of this article. So for simplicity’s sake, we’ll only compare the challenges and rewards of setting up a single validator node for each network, according to their minimum specs. In other words, we’re not factoring in other requirements like internet subscriptions, security tools, backups, IT support, marketing and so on.

It’s also worth mentioning that the networks below share similar staking features, which I won’t be reiterating. These include:

- Making it permissionless to run a validator

- Automatically distributing rewards to validators and delegates

- Being trustless for delegates, so validators can’t steal their funds

- Randomly selecting nodes to validate the next block (though having a larger stake improves your odds)

- Incentivizing users to stake—otherwise, their holdings get diluted over time due to inflation

- Letting validators set their own fees

With that out of the way, let’s shine a beacon on the first network.

Ethereum ($ETH)

Key details:

- Total staked: $24,512,913,525

- Staking ratio: 10.28%

- Validators: 390,112

- Reward Rate: 1-18%

- Inflation: <1%

- Minimum stake: 32 ETH ($62k)

- Lockup: At least 365 days

- Slashing: Yes

*Accurate as of 5/25/2022

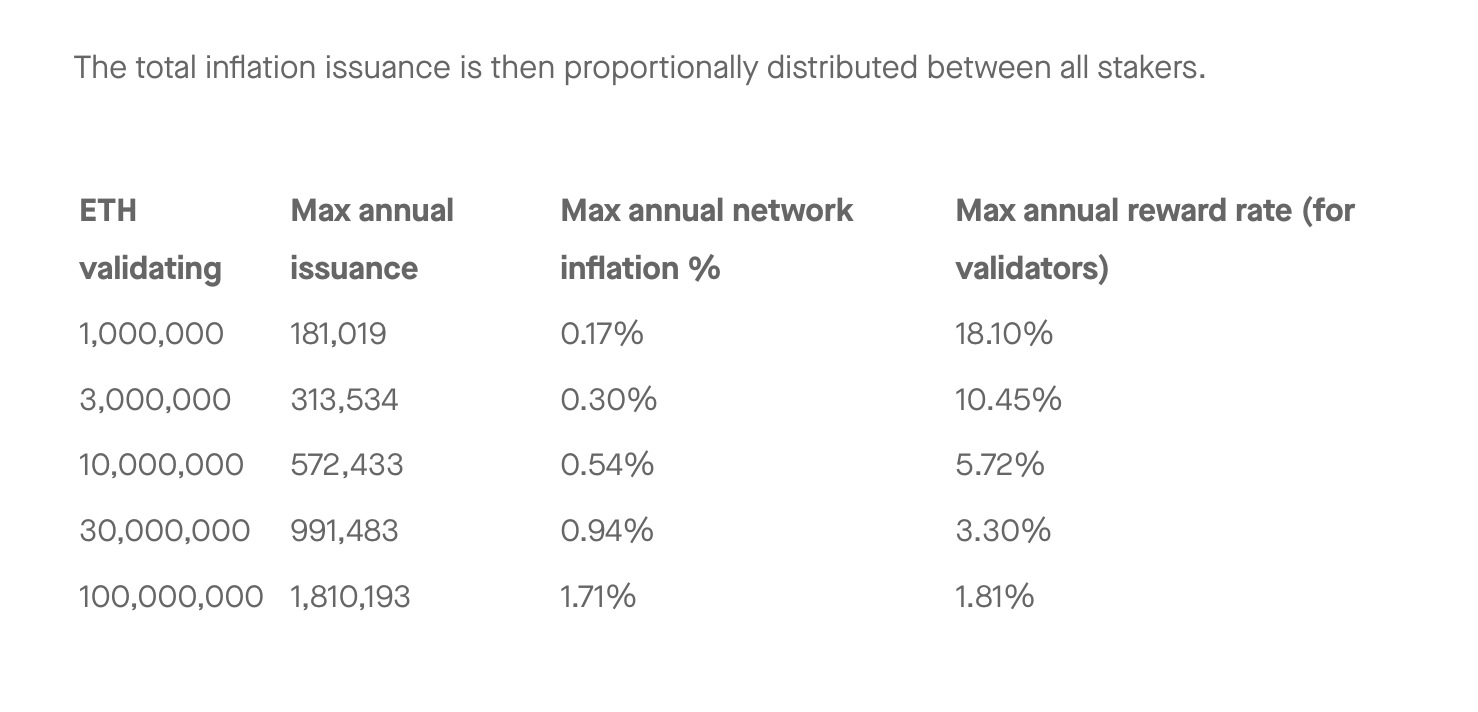

Source: Ethereum Github. There are 13M ETH validating as of 5-25-22.

Running an Ethereum validator node is unique for a number of reasons. For starters, depositing ETH on the Beacon Chain will make them inaccessible until the network completes its proof-of-stake upgrade, starting with the Ethereum merge. The Beacon Chain also prevents any one validator from having too much power by limiting their maximum stake to 32 ETH ($62k).

Applying to become a validator takes a while though, with a per-day activation limit of a few thousand. As of writing this, there are 5,090 pending validators.

Prysm, a software for accessing the Ethereum network, recommends these minimum hardware specifications for Beacon Chain validators:

- Operating System: 64-bit Linux, Mac OS X 10.14+, Windows 64-bit

- Processor: Intel Core i5–760 or AMD FX-8100 or better

- Memory: 8GB RAM

- Storage: 20GB available space SSD

- Internet: Broadband connection

With slashing enabled, validators also have to be wary of their uptime. Fortunately, Ethereum’s documentation states that a validator should be net profitable as long as their uptime is greater than 50%. However, if a large number of validators go offline or coordinate attacks, they stand to lose up to 50% of their stake and ultimately get ejected from the validator pool (which they can’t re-join).

Solana ($SOL)

Key details:

- Total staked: $18,830,901,912

- Staking ratio: 74.02%

- Validators: 1779

- Reward Rate: 5.59%

- Inflation: 8.43%

- Minimum stake: None

- Lockup: 5 days

- Slashing: Coming soon

*Accurate as of 5/25/2022

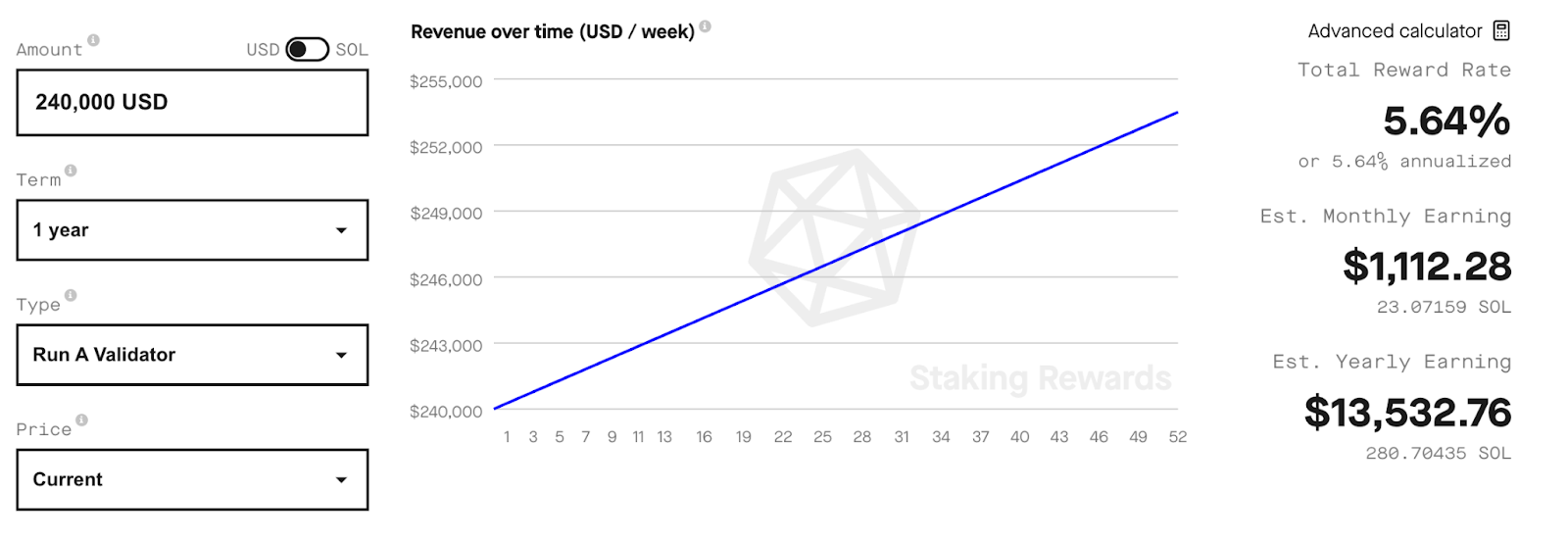

Source: Solana Staking Rewards

One thing that immediately stands out about running a validator on Solana is that it doesn’t require a large minimum stake. Only enough to vote on each block, which can cost up to 1.1 SOL (with the price of SOL currently at $45) per day. Some validators do, however, recommend staking 5k-50k SOL (well into the hundreds of thousands to millions of dollars) at 10% commission to break even on your validator node—assuming you have good marketing.

And speaking of costs, Solana documentation warns that running a validator node in the cloud might not be cost-efficient over the long term. But whether you choose to go with virtual machines or bare metal, here are Solana’s minimum hardware recommendations. These requirements are, by the way, very much on the high end of the spectrum for PoS blockchains:

- CPU

- 12 cores / 24 threads, or more

- 2.8GHz, or faster

- AVX2 instruction support (to use official release binaries, self-compile otherwise)

- Support for AVX512f and/or SHA-NI instructions is helpful

- RAM

- 128GB, or more

- Motherboard with 256GB capacity suggested

- Disk

- PCIe Gen3 x4 NVME SSD, or better

- Accounts: 500GB, or larger. High TBW (Total Bytes Written)

- Ledger: 1TB or larger. High TBW suggested

- OS: (Optional) 500GB, or larger. SATA OK

- GPUs

- Not strictly necessary at this time

- Motherboard and power supply specced to add one or more high-end GPUs in the future suggested

Source: Solana documentation

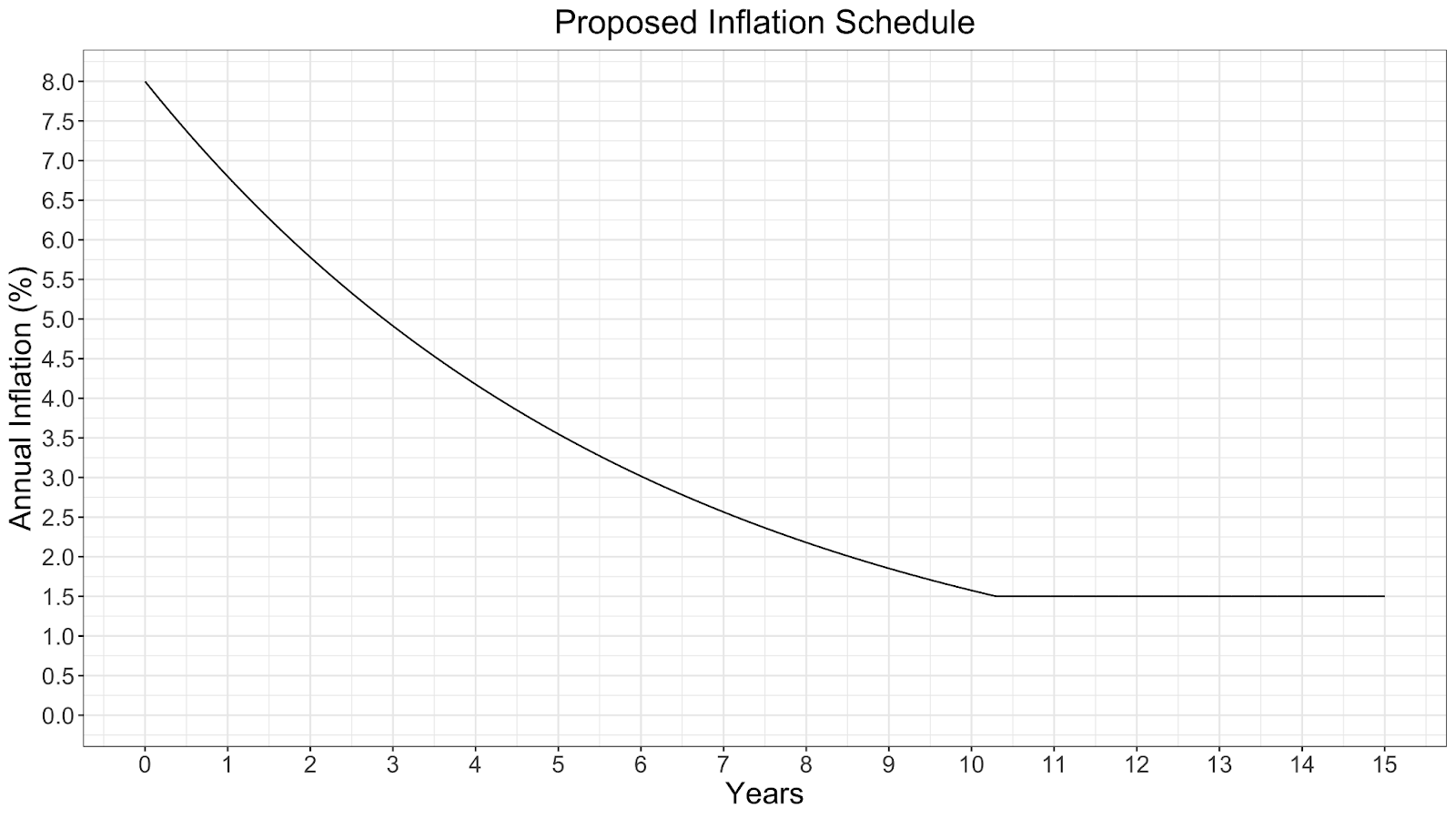

Finally, Solana currently has a target inflation rate of 8%, which is projected to decrease at an annualized rate of 15% until it reaches 1,5%. It’s wise to keep such high inflation rates in mind when calculating a validator’s real return on investment.

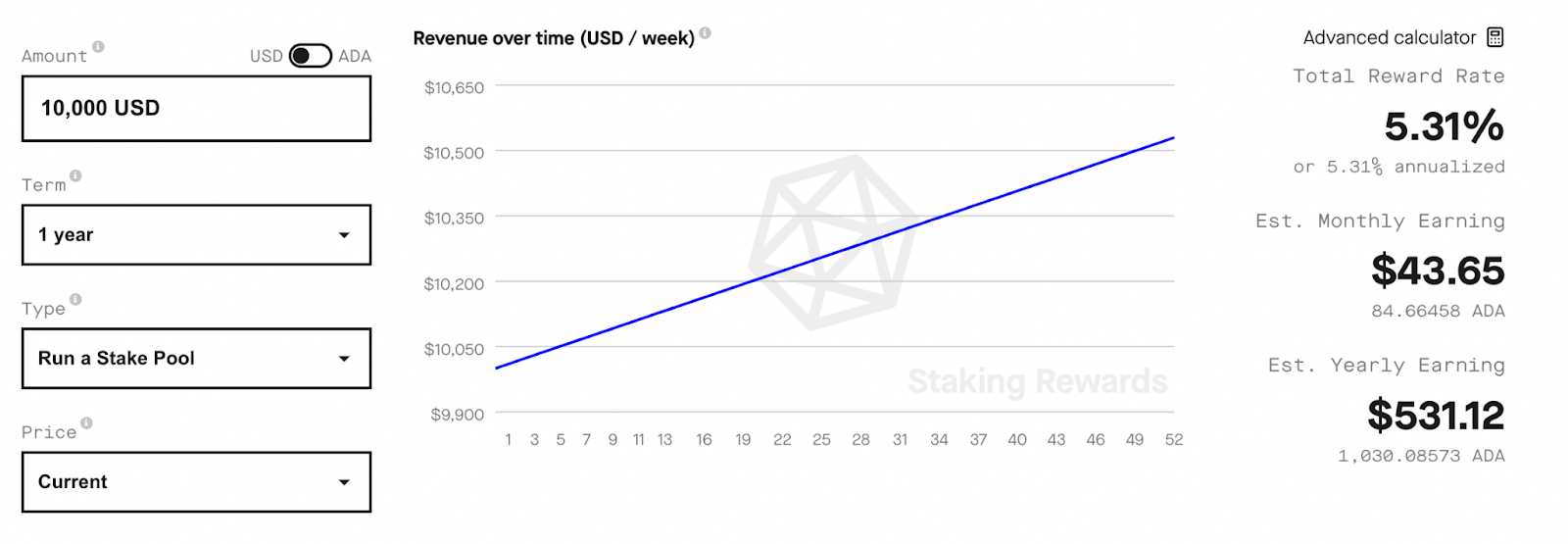

Cardano ($ADA)

Key details:

- Total staked: $12,737,009,902

- Staking ratio: 71.84%

- Validators: 2,994

- Reward Rate: 5.26%

- Inflation: 1.96%

- Minimum stake: None

- Lockup: None

- Slashing: No

*Accurate as of 5/25/2022

Source: Cardano Staking Rewards

Next to Ethereum, Cardano seems to be the most decentralized project in terms of validator count (though this isn’t a perfect measure). The network also rewards validators proportional to their stake weight up to a certain threshold (64 million ADA). In the case of a saturated stake pool, token holders are then incentivized to delegate to smaller validators and further increase decentralization.

Similar to Solana, Cardano doesn’t have a strict minimum stake (also known as a Pledge). However, the more a validator pledges, the higher the pool’s reward rate will be. Another difference between Cardano and others is that the network automatically deducts a minimum fixed pool cost of 340 ADA ($147) per epoch that goes to the validator.

Lastly, Cardano has one of the lightest minimum hardware requirements on this list. Here’s what the Cardano Node Installation & Configuration Guide recommends:

- 2-3 Linux servers (1 block producing node + 1-2 relay nodes)

- Min 2 vCPU – 1.6GHz or faster (2GHz or faster for a stake pool or relay)

- Min 12GB of RAM (16GB Recommended)

- 70 GB of disk space (Ideally SSD)

- Good internet connection (at least 10Mbps)

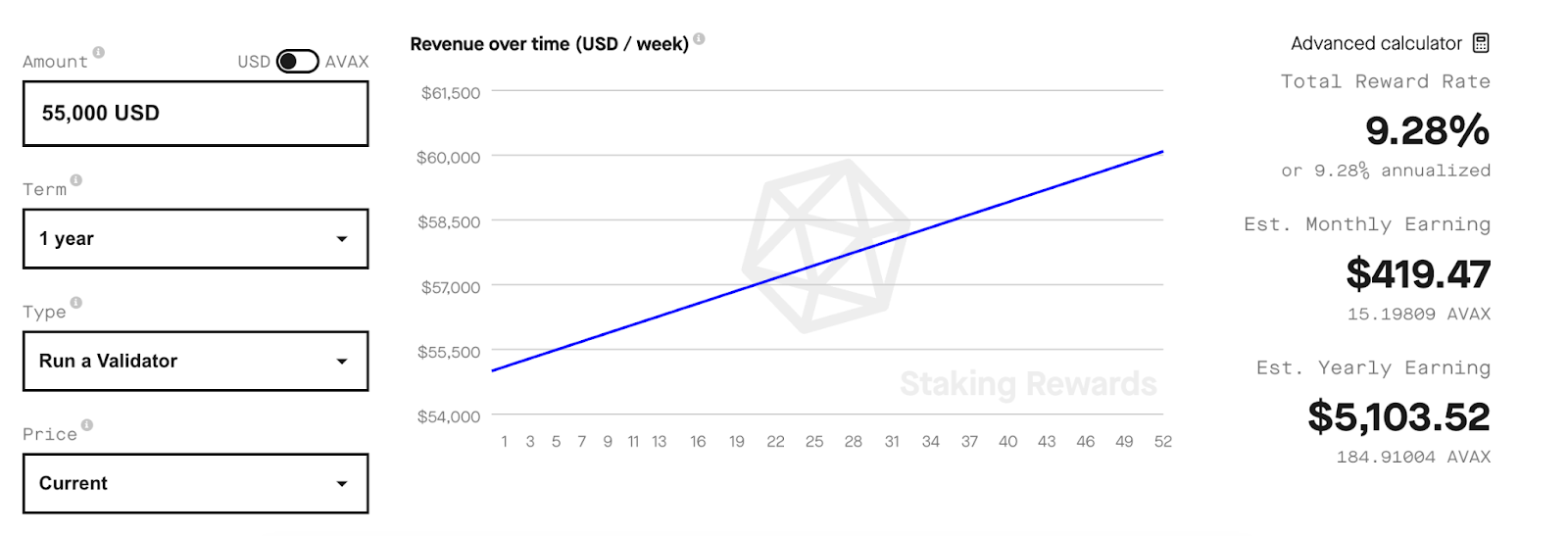

Avalanche ($AVAX)

Key details:

- Total staked: $7,259,752,336

- Staking ratio: 65.3%

- Validators: 1,474

- Reward Rate: 9.28%

- Inflation: 26.07%

- Minimum stake: 2,000 AVAX ($55k)

- Lockup: 14 days

- Slashing: No

*Accurate as of 5/25/2022

Source: Avalanche Staking Rewards

It’s no wonder that Avalanche has a high staking ratio, since token holders who don’t stake are being diluted by a colossal 26% per year. But on the bright side, all Avalanche fees are burned to offset some of this inflationary pressure. But with validators required to put up a minimum stake of 2,000 AVAX ($55k), becoming a node ain’t cheap.

Unlike most other networks that allow token holders to stake their funds in perpetuity, Avalanche tokens can only be staked for fixed periods, ranging from 2 weeks to 1 year. A bit inconvenient if you ask me.

Avalanche also caps each validator’s stake weight to 3 million AVAX ($82 million), which is a plus for decentralization. In terms of uptime, Avalanche validators will receive staking rewards as long as they are online more than 80% of the time.

Much like Cardano, Avalanche doesn’t support slashing and is lightweight enough to run on commodity hardware. At least up until a node surpasses 100k staked AVAX. Here’s the minimum specs:

- OS: Ubuntu 18.04/20.04 or MacOS >= Catalina

- CPU: Equivalent of 8 AWS vCPU

- RAM: 16 GB

- Storage: 512 GB

- Network: sustained 5Mbps up/down bandwidth

Polkadot ($DOT)

Key details:

- Total staked: $$6,285,358,098

- Staking ratio: 52.79%

- Validators: 715

- Reward Rate: 14.74%

- Inflation: 9.99%

- Minimum stake: 350 DOT ($3,458)

- Lockup: 28 days

- Slashing: Yes

*Accurate as of 5/25/2022

Source: Polkadot Staking Rewards

When it comes to running a validator node, Polkadot has three good things going for it. The first is that Polkadot has the highest fixed reward rate among the projects on this list. The second positive for validator nodes is that Polkadot’s 350 DOT ($3,458) minimum stake is relatively affordable. Thirdly, delegators (also known as Nominators) may choose up to 16 validators to stake to — a plus for decentralization.

Now onto the negatives. Polkadot’s reward rate is significantly reduced by its 9% inflation rate. Polkadot is also far behind in terms of validator count, with the network expected to max out at 1000 validators. Validators that misbehave also risk having 1-7% of their stake slashed. What’s more, Polkadot has a few wonky design choices around rewards, like requiring users to manually collect payouts and making unclaimed rewards unavailable after 84 eras (84 days).

This next one could be a positive or a negative depending on your perspective. Polkadot’s stalking system pays equal rewards to validators regardless of their stake weight, which is good for decentralization but bad for profit maximization.

Finally, Polkadot doesn’t recommend anything too crazy in terms of minimum hardware specs. Here’s a summary of what you’ll need:

- CPU: Intel(R) Core(TM) i7-7700K CPU @ 4.20 GHz

- Storage: NVMe solid state drive starting at 80GB-160GB for the first six months; will need to re-evaluate every six months

- Memory: 64GB ECC

Is running a validator node worth it?

Whether or not running a validator node is worth it really depends on your recurring costs and learning curve. Becoming a validator is a complicated topic, but we can boil it all down to three steps: choosing a blockchain network, acquiring the right hardware and software, and running and maintaining your node.

Now if you’re still unsure as to which network you may want to use, here’s a quick reference:

| Most decentralized: | Ethereum, Cardano |

| Highest reward rate: | Polkadot, Ethereum |

| Safest (i.e. no slashing, quick access): | Cardano, Solana |

| Most affordable: | Cardano, Polkadot |

| Least inflationary: | Ethereum, Cardano |

For the required hardware, you can run a node on your local device (which requires a lot of disk space and RAM) or instead host a node in the cloud via a provider like Amazon Web Services.

There are a bunch of guides that show you how to get a validator set up, but that’s honestly not even half the battle. Keeping your node up and running long-term requires a decent knowledge of computer networking, cybersecurity, troubleshooting and the inner workings of your chosen blockchain protocol.

That’s why some people choose to outsource those day-to-day operations to blockchain node providers like Allnodes or StrongBlock. But even this isn’t entirely passive, as you need to keep monitoring your node provider to ensure it’s secure and profitable.

After all this, you still need to market your stake pool effectively in order to make it financially worth your while. Now this isn’t to discourage you from running a validator node, but just be aware of the effort, capital and risk (e.g. slashing) involved.