Best Platforms for Investing in Collectibles in 2023

Whether you’re a passionate collector or a curious investor, we’ve got the 5 best platforms for finding collectible investments to diversify your portfolio.

Everything changes with time. Well, everything except the things we choose to collect. Whether it’s fine wine or sports cards, we try to keep these wonders, trinkets, and memorabilia as perfect as the day they were made. But just because the collectibles aren’t changing doesn’t mean collecting isn’t evolving.

Sports cards are the quintessential collectible investment, but there’s a whole world of luxury items and one-of-a-kind assets to invest your money in.

With very low correlation to traditional assets and inflation hedge potential, collectibles have left the realm of just a hobby and are now fully-fledged alternative investments. The merge of the hobby with tech and finance has changed everything. Between fractionalization, group buying, real-time data, and collateralization—if you’re not using these new methods, you’re likely falling behind.

We put together a list of the five best platforms for collectible investments so you can find the right alts for your portfolio.

Collectable: a platform that averages 60% returns on exited positions? Sign us up!

- Established: 2020

- Available on: Mobile & Desktop

- Collectibles: Trading cards and sports memorabilia

- How investors make money: Value

- Assets managed: $50 million

There’s a joy in being a collector that transcends price. Collectors will often pay top dollar for what they want, no matter what’s happening in the stock market. With collectible investments, there’s profit to be made on that passion—even when it seems like the whole world is working against your portfolio.

And if you invest through Collectable, you can also say you own a slice of some incredible sports memorabilia.

While Collectable is now branching into categories like luxury watches, comics, and art, the company’s DNA is rooted in sports collectibles.

Collectable curates a collection of some of the most important pieces of sports history and you can buy shares of them starting at just a few dollars. Once you own those shares, you can hold them, trade them on their secondary market, or take home a hefty return if they find a buyer.

Considering they’ve only been around since 2020, their collectible investments have had some eye-popping returns on exit. Like a 104% return on a tri-panel Topps basketball card featuring Larry Bird, Dr. J, and Magic Johnson from 1980. One of only 24 PSA Gem Mint 10s, the card more-than-doubled its $352,000 IPO after four months on the platform.

Source: collectable.com

They’ve also produced a 117.4% return on a 2017 Jayson Tatum Panini Flawless basketball card and a staggering 177.8% return on a 1955 Topps Sandy Koufax baseball card—Collectable shareholders accepted a $100,000 buyout offer in March 2021—only two months after its $36,000 IPO.

With over $50 million of assets under management, Collectable still has plenty of potential for tremendous gains. Some of the irreplaceable pieces on their platform you can invest in right now include a PSA-8 1952 Topps Mickey Mantle and a Babe Ruth minor league card valued at over $8 million.

Source: collectable.com

If you’re new to collecting and not sure which piece to start with, take a look at the Collectable 25 Index. It features 25 of their most important pieces all together in one place, which have generated up to 104% returns upon exit. Sign up for Collectable if you want the bragging rights of owning some of the most important collectibles in the world and a shot at huge returns.

Rally: show off your Lambo without looking for parking

- Established: 2016

- Available on: Mobile & Desktop

- Collectibles: Classic cars, comic books, luxury watches, sports memorabilia, fine spirits, rare literature, NFTs, vintage video games, dinosaur bones, and more.

- How investors make money: Value

- Assets managed: $15 million

Sports cards are the quintessential collectible investment, but there’s a whole world of luxury items and one-of-a-kind assets to invest your money in.

While shares in trading cards are accessible, Rally offers many unique investment opportunities in collectibles beyond sports memorabilia. They started by offering shares in classic cars, but their collection grew more like an eccentric billionaire’s private museum. Their investment assets include everything from Joe Dimaggio’s Rolex to fine Bordeaux wine to a historic broadside of the Declaration of Independence. You can even purchase shares in a fossilized Triceratops skull.

Source: rallyrd.com

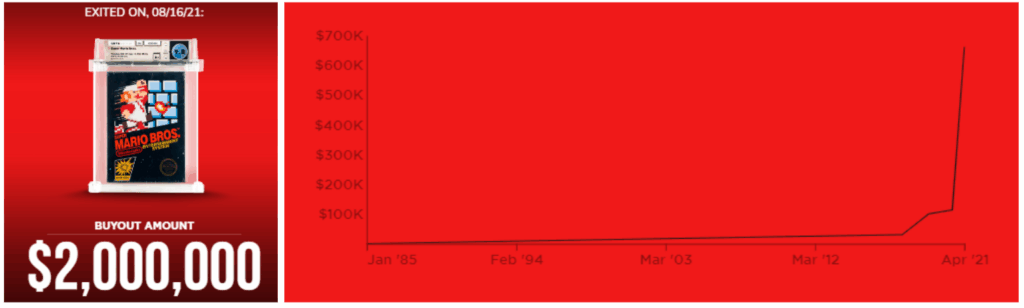

But perhaps the most impressive asset was a sealed NES copy of the original 1985 Super Mario Bros., purchased for $150,000 in August 2020. It was then sold for $2 million just one year later. The 1333% return in just 360 days on Super Mario Bros. makes a Royal Oak and Porsche Speedster look like children’s playthings.

If epic returns on collectibles like video games interest you, but keeping up with the collectibles market is too much work, then you should check out Rally. They have plenty of alternative investments that you’ve probably never thought to put your money behind, and many collectibles have low correlation to the stock market.

Plus, they’re a FINRA approved secondary trading platform, which means they offer greater liquidity than regular collectible investments.

Goldin: collectible investments you can (literally) hold onto

- Established: 2012

- Available on: Desktop

- Collectibles: Sports cards, comic books, pop culture memorabilia

- How investors make money: Value

- Assets managed: $500 million

While some collectible investing platforms aim to bring in casual investors and newcomers, Goldin is by and for passionate collectors.

Ken Goldin created the platform to share his love of collecting and to help other investors enjoy profitable returns. Over the course of his career, he has sold more than $1.3 billion of historical, sports, and pop culture memorabilia. The team he assembled at Goldin are equally dedicated and enthusiastic collectors who make sure that assets on auction are high quality and have strong profit potential.

Instead of offering shares in collectible investments, Goldin brokers auctions and sales of alternative assets, from baseball cards and comic books to sports history—like Babe Ruth’s Brooklyn Dodgers uniform—and pop culture memorabilia, like Darryl’s motorcycle from The Walking Dead television show.

The company handled over $100 million in sales in 2021. And with Goldin’s team of avid collectors managing the assets and sales, their collectibles have brought impressive gains for sellers.

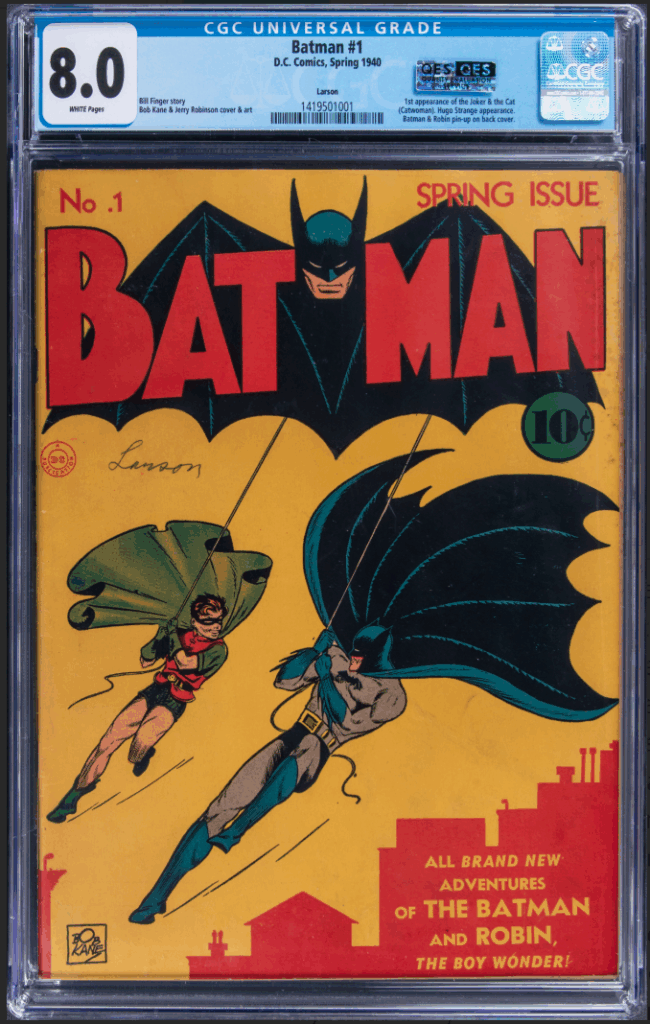

For example, an auction of a CGC-8 1940 DC Comics Batman #1 opened with a starting bid of $250,000 and closed with a final sale price of $1.44 million in September 2022.

Source: goldin.co

Higher-grade versions of the same comic book are on eBay for six figures.

Goldin can also manage your bidding for you, so you won’t have to camp out to wage a bidding war. With max bidding, you’ll tell Goldin your maximum bid amount. The system will automatically bid on your behalf in increments and email you when you’re outbid, so you can choose to keep bidding or call it quits. With Goldin’s huge and ever-growing inventory, you’re bound to find things to grow your collection.

For sellers, Goldin is a one-shop stop. They’ll handle storing, selling, and shipping your items and can even have collectibles graded if they aren’t already.

If you’d rather own a piece yourself or if you’re interested in selling collectibles, check out Goldin. Their robust collection of rare items and positive reputation over the past decade make them a promising place to invest in collectibles.

ALT: Collateralize your card collection

- Established: 2021

- Available on: Mobile & desktop

- Collectibles: Sports cards

- How investors make money: Value

ALT supercharges your sports card portfolio in a way that was unimaginable just a few years ago.

Are you already an investor in rare trading cards but worried about storing them? Or maybe you’re looking to free up some liquidity from your collection without selling? Well, this is where ALT shines.

ALT’s features ensure your baseball cards are stored and pampered as the valuable collectibles they are. Some of these features are:

- The ALT Vault: Free storage for your graded sports cards that’s fully insured, including transportation. Once they arrive, your cards are scanned into your public (or private) digital collection, so you can flip through them whenever you want.

- Instant transfer: You can buy, sell, auction, and trade your vaulted cards with others without ever having to deal with shipping or taking physical possession.

- No fees for buyers: The cards you purchase don’t have premiums or sales tax—the price you see is the price you get.

- Asset-backed loans: ALT will lend you cash against your vaulted cards. You can use the loan to expand your collection, diversify into cheap stocks, or pay some bills.

ALT is more than a place to buy, sell, and store your cards. They have a built-in market data platform that no collector should go without. Use it to analyze pricing trends and player and season data, get real-time card pricing, and find the absolute best price on a card—even if it’s not on their platform. ALT tracks everything and makes it available for you to be a better collector and more successful investor.

Public: collect assets and advice

- Established: 2017 (formerly Otis)

- Available on: Mobile & desktop

- Collectibles: Sneakers, art, sports memorabilia, rare books, NFTs, vintage video games, and comic books.

- How investors make money: Value

Public has built themselves around, well, the public. The platform is unique because it enables you to invest in every kind of asset, from traditional to alternative. They offer stock and crypto trading but also let you invest in art, luxury goods, NFTs, and other collectibles.

Public is a registered broker-dealer and doesn’t sell order flow to third parties. This means their investors are their only customers, which incentivizes them to do what’s best for you as their user.

Public provides unique market data and analysis to their members, as well as educational material to help you become a better investor. It’s not just an investing platform, though. Public is a social platform that allows you to learn from each other and see how others invest.

In addition to those opportunities for growth and learning, Public offers three ways for investors to make money on their fractional alternative asset shares:

- Selling shares on the app’s secondary market

- Making returns when an asset sells

- Distributed cash flow for income-generating assets (e.g., loaning artwork for display)

Since acquiring Otis in March 2022, asset sales at Public have generated hefty returns for investors. In May 2022, a CGC-9.4 issue of Avengers #1 was bought out for $200,000, a 100% return on the drop price and a 33% gain on the last traded price. And a copy of a CGC-9.6 Daredevil #1 brought in a 174% return for investors that same month.

What are the best collectible investing platforms?

Collecting no longer requires digging through dusty boxes at flea markets or hunting down a rare item based on hearsay and local legends. The world of collectibles seems to grow as technology advances. That’s why taking advantage of these advancements might make investing in collectibles easier and more profitable for you.

Whether you’re looking for fractionalized shares of rare items or the best place for auctions, now you know the best collectibles platforms that could have the treasure you’re seeking.