Handle With Care: The Ups and Downs of Investing in Vintage Concert Tickets

Vintage concert tickets can yield high returns, but there are several challenges to investing in this highly illiquid asset class.

During the pandemic lockdown, interest in hobbies and collectible items skyrocketed. Idle hands cleaned out closets and found treasure troves of forgotten cards, antiques, and toys. We were bored and nostalgic, and our going-out money was stacking up. What better opportunity to finally complete that Pokémon collection?

If you haven’t been collecting and saving tickets and stubs, you’re probably not going to stumble across a buried treasure in your junk drawer. But people do get lucky.

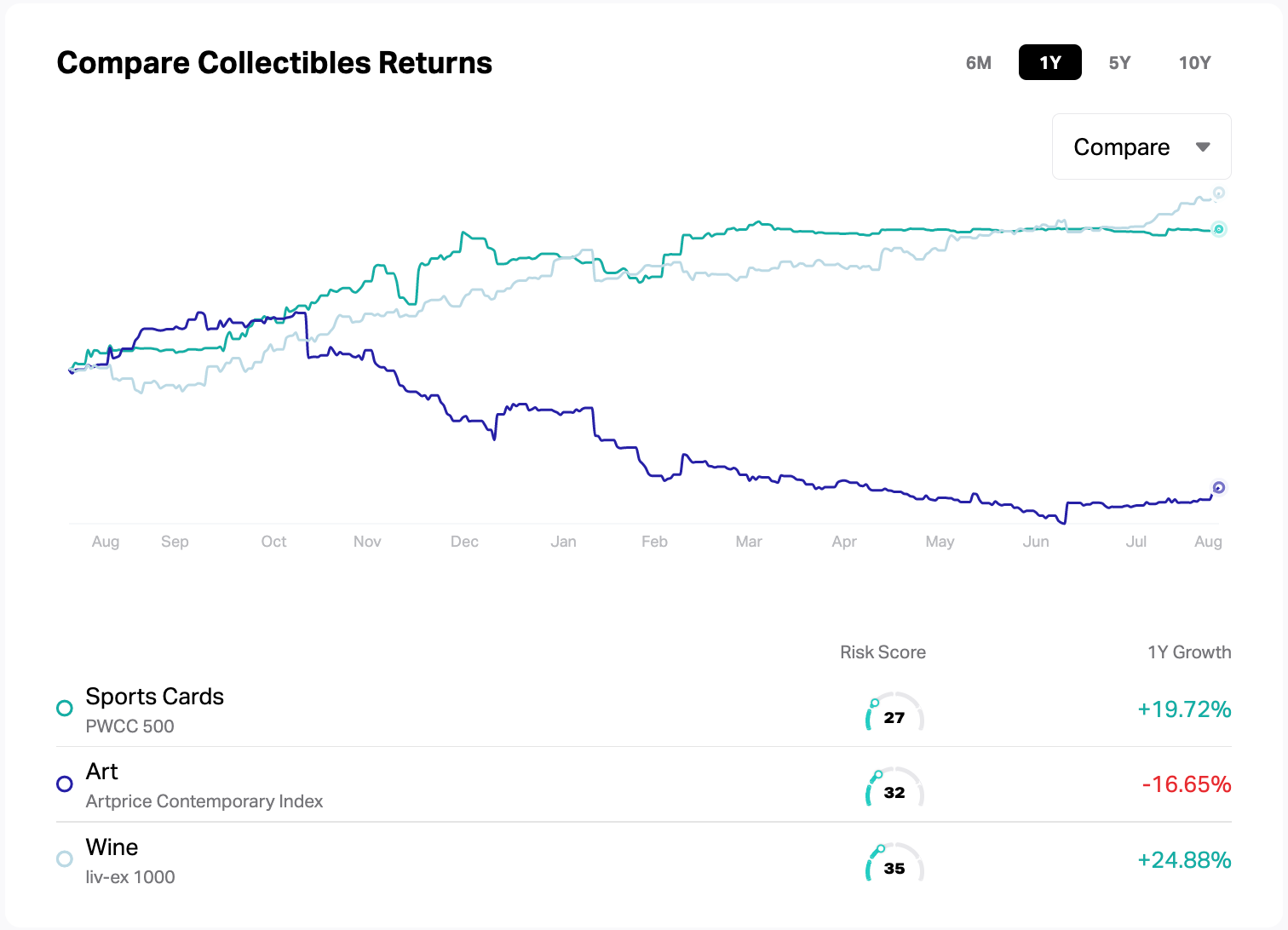

At the same time, the stock market, crypto, NFTs, and real estate were all booming, which meant investors were looking for ways to diversify and put those new gains to work. Alternative investments like wine and sports cards picked up steam. With daily headlines about the record prices of artwork or collectibles, vintage music memorabilia wasn’t going to be left out.

Buying and selling music nostalgia isn’t new, but this market (like other collectibles) is having a moment. Among vintage posters, photos, clothing, and setlists saved by avid fans, one of the standout categories has been vintage concert tickets. With some of these tickets spiking up to $30,000, it’s worth asking if vintage concert tickets are a good investment.

How much will someone pay for a vintage ticket?

You might not score a big return right out of the gate. Remember that, as with any item you decide to collect, investing in vintage concert tickets takes time and research. If you search vintage ticket categories on eBay or other platforms for selling memorabilia, you’ll see a wide range of price tags and bids. A ticket could cost you a couple of bucks, or a couple thousand. But that investment price could yield a healthy payout.

The current record for the most expensive vintage ticket sold at an auction, according to Heritage Auctions, belongs to a ticket to Jackie Robinson’s historic debut game in 1947. The ticket sold for $480,000 in February of 2022, an impressive appreciation from the original price of $1.75 (about $24 adjusted for inflation).

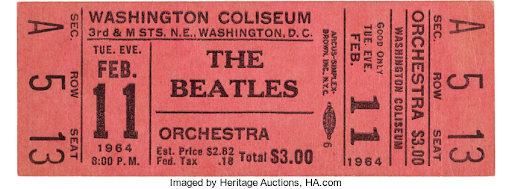

Vintage concert tickets have made staggering gains, as well. A ticket to The Beatles’ first U.S. concert—which cost the ticketholder $3 in 1964 (about $23 in 2014) and sat unused in an envelope for 50 years—fetched $16,488 on eBay in February of 2014.

That’s a 71,686% return over 50 years. A return like that makes dogecoin gains look like pocket change.

Source: ha.com

Of course, not all vintage concert tickets can bring in the big bucks. Historical importance, cultural significance, and condition are some of the factors that determine the price buyers will pay for such pieces of memorabilia.

What makes vintage tickets valuable?

As the old saying goes, an item is only worth what someone else is willing to pay for it.

While it’s impossible to say what that price might be on any given day, we can look at general metrics of what makes something go up and down.

Historical signifance

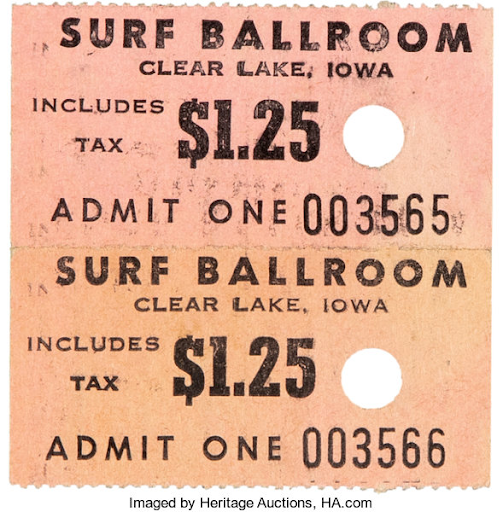

Buyers are usually willing to pay more for tickets that have some historical significance. Bids on tickets to the final performances of Buddy Holly, Ritchie Valens, and The Big Bopper have increased dramatically over the past two years, climbing from around $2,000 in 2019 to $17,000 in 2021.

Source: ha.com

Finding historical information behind a ticket can add to its value, even if it’s not a memento of a first or final performance. If you have a good story (and can provide information that it’s true), you can increase a ticket’s value. An otherwise run-of-the-mill ticket could be worth more if you attach it to a historic date, the first live performance of an iconic song, or a milestone in the artist’s career.

Current cultural significance

Historical relevance is only one piece of a vintage concert ticket’s worth. The value can also increase when current events or trends boost public interest in the performer.

For instance, a ticket stub for Michael Jordan’s first NBA game sold at an auction for $264,000 in 2022. While this sale set a record and left many basketball fans and memorabilia collectors in awe, it also set the stage for an even bigger sale.

Mike Cole saw the news of the auction and realized that he had an unused ticket to the same game, an $8.50 gift from his father in 1984 (approximately $24 adjusted for inflation). When he reached out to auction houses about selling the ticket, he was told that between the sensational news of the last auction and The Last Dance docuseries leaving audiences hungry for information on the team and memorabilia, now was the time. Cole’s ticket pulled in $468,000—over 200k more than the one that sold just months earlier.

Condition

The condition of the ticket plays a major role in its value. Similar to collectible toys, accessories, and cards, items that have preserved their original beauty fair best. Scratches, faded text, and bent corners can all lower the value of even the most sought-after tickets. Event tickets used to be torn by the ticket collector, leaving you with a stub (and limited future prospects). Because of this, unused tickets that are still intact are considerably more valuable than tickets that got someone into the audience of an actual concert.

That Beatles ticket that sold for over $16,000 was a well-maintained, unused ticket. Another ticket to the same concert with a slightly torn edge went for $1,842.

A good story from the original owner can sometimes add to the value of a collectible. But in the case of event tickets, an unused ticket usually brings in more value.

How to invest in vintage concert tickets

If you’re not in a rush and have some money to play with, vintage concert tickets might be an interesting business to explore. Here are some ideas for ways you can start investing in this asset class.

Look out for hidden gems

If you haven’t been collecting and saving tickets and stubs, you’re probably not going to stumble across a buried treasure in your junk drawer. But people do get lucky, like the holder of the Michael Jordan ticket.

For the rest of us, there’s the good old-fashioned flea market and its digital cousin, eBay. You might also consider Heritage Auctions, a marketplace for collectibles that offers authentication services. Both virtually and IRL, you’ll need to do quite a bit of digging in search of authenticated, decent-quality, potentially valuable vintage concert tickets. But you may come across something worth your while, like the flea market thrifter who paid $15 for a ticket stub from Mickey Mantle’s first game and sold it for $2,100.

Source: ha.com

Make the grade

Not all tickets are valuable, even if it seems like they would be. In addition to wear and tear, there are fakes that appear impressively real and tickets that are too common to be big earners.

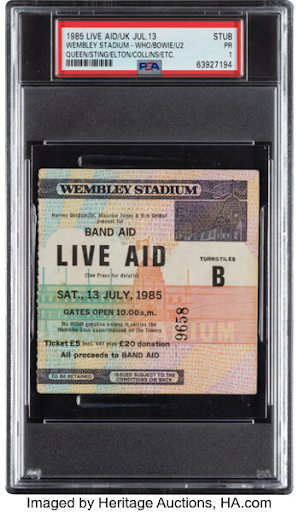

This is why authenticating and grading collectibles is so important for buyers and sellers alike. The Professional Sports Authenticator (PSA) ticket grading system rates the condition of vintage concert tickets across several categories on a scale of 1–10, with 10 being the coveted Gem Mint status. The criteria for vintage ticket grading includes the sharpness of the corners, the fading of the ink, the presence of marks or stains, and any holes or perforations.

PSA also verifies and authenticates vintage tickets by consulting with credible sources to gather expert narratives, documents, records, and pricing facts. Grades and statements of authenticity reassure buyers of a vintage ticket’s value and protect sellers from claims of fraudulence.

Buy a share

If bidding in an auction or paying thousands of dollars for a collectible is a bit too much for you, Rally offers an alternative approach to investing in memorabilia. Similar to the platform’s approach to classic cars and luxury watches, Rally is offering shares of a ticket to Elvis’s last performance in 1977. Investors can purchase a portion of the $40,000 Elvis ticket for just $8 a share.

Rally purchased the ticket from Heritage Auctions at $34,800, an expenditure they’ve nearly recouped after two months of selling shares. It remains to be seen if this piece of music history makes it to the value set by Rally, but given the alternative—a ticket stub to the same concert that sold for $8,750 on Heritage Auctions—an $8 share might be a friendlier way to invest.

Are vintage concert tickets a good investment?

While you might not see payouts as big as the most monumental sports tickets, flipping vintage concert tickets can rake in cash. But does that make it a good investment? If you could replicate it, you’d be the next Warren Buffett. But without a time machine, a good return is mostly just a stroke of luck.

The thing that ends up valuable is almost never the piece of memorabilia with the shiny hologram and the stamp that says “Collector’s Edition.” These wildcard payouts come from items that no one ever expected to matter.

No one watching Jordan’s first game knew that he’d be a global icon that transcends basketball and pop culture. Collectibles that gain astronomical value are often so unassuming that no one thinks to save them. And then, years later, something happens that generates incredible demand for that ultra-rare memorabilia and turns it into a slam-dunk investment.

So, to answer the question of whether vintage concert tickets are a good investment, we need to see beyond the lottery wins and look at the pros and cons.

Why investing in vintage concert tickets is difficult

Here’s a breakdown of the five obstacles you’ll likely face when investing in vintage concert tickets:

1. No income

Concert tickets aren’t companies. They don’t have revenue; they don’t provide a dividend, and you’re not going to rent your vintage ticket out. The only way to make money on concert tickets is to buy low and sell high.

2. Very illiquid

If you need to free up your capital, you won’t be able to just hit the sell button like you could with a stock. In fact, in some cases, it might take you months or even years to find the right buyer—if you ever find one at all.

3. Lack of fundamentals

Ticket values are at the whim of the market and there’s no reliable way to predict them. While it’s true that you can’t see the future of any asset, the beauty of investing in more traditional assets, like stocks, is that you can calculate their intrinsic value.

4. Unpredictable appreciation

There’s no track record that helps us understand the rate of or reasons for appreciation. Even expert appraisers in high-end auction houses give wide ranges of what they think something will sell for, and they’re often wrong.

5. Lightning doesn’t strike twice

Finding a winner isn’t a duplicatable strategy. This means your wins need to be big to move the needle, so you could end up sinking your time into a waiting game with a low likelihood of significant ROI. If you buy a $10 ticket and sell it 2 years later for $18, that’s great. You made a profit, but it’s not much of an investment win. And if you decide to get really good at making those modest profits, your investment strategy quickly becomes a full-time job.

Despite the numerous challenges, there’s one huge positive to consider: concert tickets are limited items. Each show only ever sold so many tickets, and most aren’t in great shape. So, if you can get your hands on an intact ticket and can verify that it’s from a memorable and meaningful concert, then you may possess a scarce and highly valuable asset.