Going Long: Gaining the Edge With Your Crypto Hedge

Investing in crypto isn’t easy—and hedging it isn’t much easier. Here’s a few ways you can mangle the many risks that come with digital assets.

In the decade since the advent of Bitcoin, there’s one aspect of digital assets that has proven to be pervasive: volatility. The crypto market has seen four bear markets—past performance proves that there’s some truth to the statement “the higher they rise, the harder they fall.”

Investments in assets such as Bitcoin, Ethereum, and Solana have doubled again and again each cycle, but their subsequent falls from grace have proven that no amount of management, research, and capital can help you avoid succumbing to the occasional crypto bear market.

Despite what crypto investors and investment professionals might say, there’s no easy way to fully hedge any asset capable of the kind of volatility that digital currencies are.

The 2022 crypto crash is perhaps the best example that nobody is safe. Millions of new retail investors and dozens of institutional crypto funds faced their match as the market collapsed and erased hundreds of billions of dollars of value. Not only that, but the cryptocurrency market also took many firms down with them. Crypto exchanges such as Voyager Digital and Zipmex, crypto lender Celsius, and cryptocurrency hedge fund Three Arrows Capital all bit the dust.

Source: TradingView.com

That’s probably why you’re here—to gain a sense of how you can manage your exposure to the perilous world of cryptocurrency whilst avoiding the bite of its chaos. Thankfully, you have more than a few options at your disposal.

How can you hedge crypto with crypto?

Despite what crypto investors and investment professionals might say, there’s no easy way to fully hedge against any asset capable of the kind of volatility that digital currencies are.

And a word for the wise: if you’re the kind of investor who worries about investing, then the best crypto hedge for you might be to stay out of the crypto market until you form an investment strategy.

But by now, an investor who is familiar with the risk profiles of stocks and crypto should be gainfully aware of what they’re signing up for. So that said, how can you hedge crypto risk with crypto?

There are three main crypto hedging options for investors that want to stay pure—that’s crypto-on-crypto action for you maxis out there. Let’s dive in.

Hedging against rampant stupidity

If there are any huge lessons to take away from any crypto crash, it’s learn your risk tolerance, invest responsibly, and weigh risks before trading. Here are two very common forms of risk among degenerates—I mean crypto investors. Oops.

Storage

The first one is kind of obvious: where you store your funds. You’ve probably heard the phrase “not your keys, not your Bitcoin.” While this maxim is very pedantic and we’re kind of tired of hearing it, there’s some truth to it.

Every crash has its losers, and the 2022 crash continues to prove (sadly) that management is lackluster within several crypto firms. The collapse of Three Arrows Capital, a multi-billion dollar crypto hedge fund, caused ripples and fallouts throughout the crypto market. It indirectly led to the collapse of the Voyager Digital crypto exchange and the crypto lending firm Celsius.

Naturally, the first to lose are the thousands of customers that entrusted these so-called ‘institutional investors’ with their money. Though consumer protections remain limited, some depositors will not get their money back in full. That’s why it pays—if you have significant capital invested in crypto—to spread your assets across numerous crypto exchanges, software wallets, and hardware wallets.

You might not think of this as a crypto hedge, but it’s a hedge against a form of pervasive stupidity that’s endemic to many companies setting up shop in the web3 or crypto space.

Use leverage responsibly (or not at all)

The second is another all-too-common cautionary tale. Many investing newcomers misunderstand the impact leverage can have. Let’s just say there’s a reason why the idea that leverage is dangerous is such a widely distributed piece of investing advice.

This is important to underline, especially since many crypto-specific hedging opportunities enable investors to accidentally enter into leveraged positions—whether in DeFi or the perplexing world of crypto derivatives and futures.

You can make responsible leveraged trades, such as taking out an overcollateralized loan against a ‘blue-chip’ digital asset like ETH. For example, Maker allows you to deposit a portion of the value of your digital assets into a digital vault and, in return, mints an equal part of that balance in the DAI stablecoin. You can then use this DAI loan to generate additional yield while maintaining a long ETH position. That said, it’s important to understand when you’re taking on high risk versus when you’re responsibly executing a crypto hedging strategy.

Overall, the takeaway is simple: you’re an investor, not a hedge fund. If you don’t know what you’re doing, then stay away from leverage and find an alternative hedging approach.

Hedging crypto by generating yield with DeFi

Let’s be upfront: not all hedges are without their risks.

Interacting with DeFi can be daunting for newcomers. That’s why a number of crypto lenders such as Celsius entered the space, and why their collapse should serve as a cautionary tale for unseasoned investors in the world of digital assets. But DeFi can be a worthwhile investment of your time (and funds) if you want to generate additional income and gain access to some trusty crypto hedging opportunities.

You could deposit assets to farm in liquidity pools, use a yield aggregator such as Beefy to avoid most of the learning curve, borrow stable assets against your cryptocurrency funds using Maker or QiDao, or exercise a combination of strategies. All in all, DeFi is your oyster—the extent to which you can make it work for you as a viable crypto hedging opportunity comes down to researching and being fairly studied on how it works.

Source: Beefy.Finance (screenshot)

If you’re unwilling to do that research, then you might choose to take your assets to a platform like Nexo to generate yield through lending. You’ll have less visibility into how that yield is generated, and your money will be subject to famously opaque asset management, but the concept is all the same: generate yield to offset potential losses. That’s a crypto hedging strategy.

Hedging using options or futures

If you’re a well-studied investor, another option for crypto purists are options and futures.

In the off chance that you’re already well-versed in how options work with stocks and bonds, then you might enjoy the benefits of using crypto exchanges that offer some variation of these sophisticated products like Kraken, or Binance.

Options and futures strategies can be utilized to generate passive income, hedge against downside risk, and safeguard your capital. However, the key is being well-versed in how they work. Before investing in these risky products, do your own research on how to responsibly use them to hedge against your crypto exposure.

Hedge against crypto with other asset classes

Let’s face it: the only 100% effective crypto hedge is not owning any crypto at all. That doesn’t mean it’s time to sell the farm and run for the hills, though. You can be a crypto king and preserve your capital using other asset classes.

There are two main ways to do this: You can optimize for yield or gain exposure to a non-correlated asset. Both are attractive options for investors with money to spend, that aren’t shy about trying out new kinds of investments, that want to gain access to “unconventional” markets, or dream of buying a multi-million dollar property in the country-side (with those weird-ass gargoyles added for effect).

However, liquidity—what enables you to quickly turn an investment into cash—is a major decider of which hedging strategy you ultimately go with. Here are some options to consider:

Optimizing for yield with investing platforms

If crypto-on-crypto action isn’t optimal for hedging against crypto downside, here are three other ways you can do it: toss your money into a roboadvisor, invest in real estate or farmland, or tap into lending platforms.

These are all desirable alternatives to using DeFi, crypto lenders, crypto options, and other blockchain-native ways to hedge against crypto. It’s not just because these assets benefit from the same kind of liquidity, but because they aren’t actually all that distant from their trusty digital cousins.

One advantage that an investor might pick up by investing in securities, a publicly-traded business, real estate or farmland investment platforms, or individual borrowers is diversification. After all, NFTs and Bitcoin can only get you so far.

Too long; didn’t read? You can hedge your crypto by simply buying other assets that help you grow your net worth, even if they might be slightly correlated to digital assets like Bitcoin and Ethereum.

Optimizing for Non-Correlated Returns: Wine, Whiskey, Art, and Collectibles

Maybe you’re not big on stocks, bonds, and ‘business as usual.’ That’s okay, by the way—there are still plenty of ways to escape the temporary flux of cryptocurrency prices. The best way is to invest in assets which have non-correlated returns. That includes investments in art, collectibles, wine, and whiskey.

Wine investment platform Vinovest articulates the case for why non-correlated returns could be valuable. Sure, chasing yield is fun and profitable, but it’ll set you back in the form of more volatility.

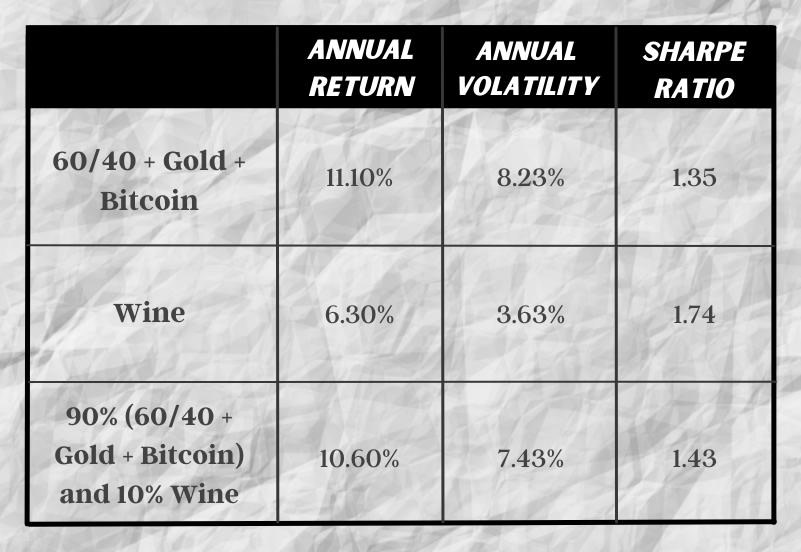

They observe that portfolios with gold, Bitcoin, equities, and bonds sometimes can see volatility of up to 8.23% in a given year. By contrast, wine has a much lower volatility—and the same can be said of other alternatives.

Source: Vinovest.co

Fractional blue-chip art platform Masterworks also observes the importance of non-correlated assets in wealth creation—69% of art collectors with a net worth of more than $1 million had nearly a fourth of their portfolio in art and collectibles. They also cite that the correlation between art prices and other asset classes was close to zero.

There’s more to non-correlated returns than fine art or wine and whiskey. Numerous alternative investing platforms are offering up investments with ideal risk-reward balances. You can dig deeper on MoneyMade to see what’s out there for yourself, or complete our MoneyMatch quiz and let us find the best ways for you to invest.