In For a Penny: Fractionalized Sports Card Investing

Millionaire Gary Vee knows the value of sports card investing, and so do we. We looked at the pros and cons of fractionalized sports cards investing.

When the bears arrive, the stock market reacts instantly. It’s fallen as much as 27% in a single day. Wall Street investors might hit the sell button on their Apple stock, but sports fans don’t run home to panic sell their Nolan Ryan rookie cards.

Collectors just go about building their collections as usual, even when the sky is falling. This is one of the greatest traits of sports cards as investments: They hold their value, even when shit hits the fan.

In August of 2022, when traditional markets were at the mercy of the Fed’s next move, trading cards were setting records.

Collecting sports cards and memorabilia is fun. It can take a lifetime to buy, sell, and trade your way to the collection you want, and there’ll still be white whales you never caught. The sports card industry changes constantly as promising rookies enter the scene and old favorites are rediscovered by new generations of collectors. There’s also a passionate community ready to share information and celebrate when you finally land that rare card.

So it’s no wonder that sports cards have continued to grow in value despite turmoil in traditional markets.

Investing in sports cards: Buying and selling

There are many ways to buy and sell trading cards for your collection, from breaking open packs and hoping to get lucky, to sleuthing out that one elusive card and making the perfect trade. You could go to trade shows, card shops, and meet ups or bid in auctions through online retailers like eBay, Goldin, and PWCC.

The benefits of investing in sports cards

If you’re an investor rather than a collector, you might not care about chasing down rare or autographed cards for your trophy case, but you can take advantage of the value sports and trading cards can add to your portfolio.

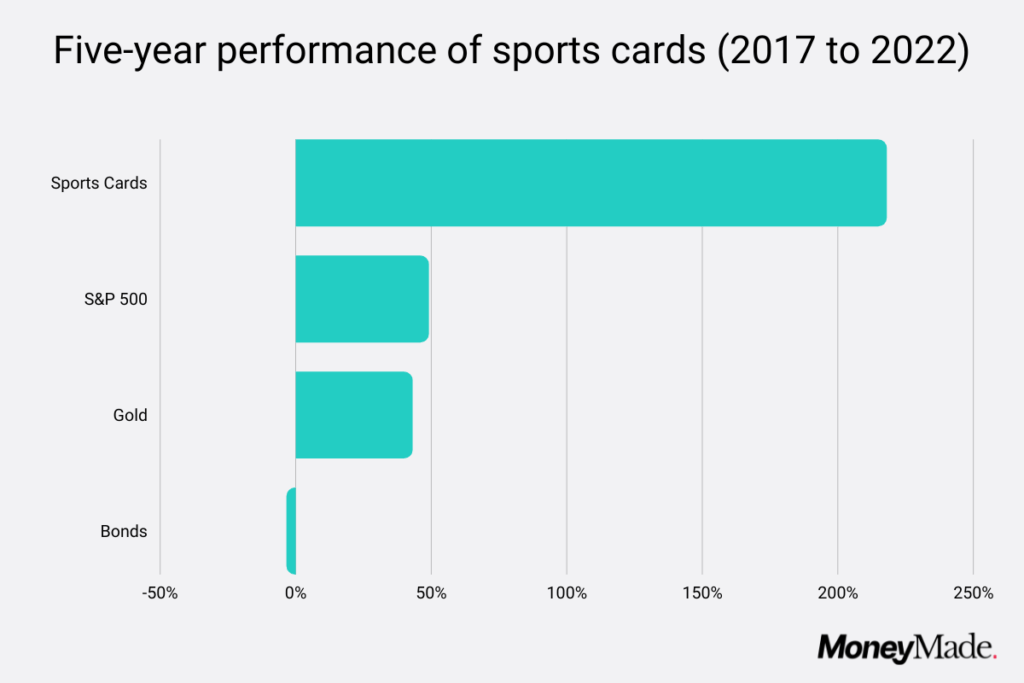

Sports card investors enjoy them as a great store of value in turbulent times. Even better, sports cards knock it out of the park when times are good. Over the last 5 years, trading cards have outperformed assets like gold, bonds, and the S&P 500.

In August of 2022, when traditional markets were at the mercy of the Fed’s next move, trading cards were setting records. The Holy Grail of baseball cards—the 1952 Topps Mickey Mantle—sold for a staggering $12.6 million. That sale sniped the last record, which was also set in 2022.

Slam dunk returns like this one can make sports card investing seem like a layup, but rewards always come with risks.

Risks of buying and selling cards on your own

Community and sizable returns are great, but there are risks to investing in sports cards this way.

Buying a card that decreases in value or doesn’t sell

Not all old cards are guaranteed winners. For instance, while some junk wax era cards proved to be hidden gems, many pandemic-inspired casual collectors went overboard buying up all the trading cards they could find.

As the values of these overproduced cards started to rise, shoebox raiders flocked to markets with their rediscovered inventory. The supply influx sank the newly inflated value of these cards, leaving uninformed newbies holding a sad balloon.

This goes to show the importance of doing your research before you start buying trading cards (or any investment asset), no matter how promising the recent history may look.

Damaging your card with improper handling or storage

At their core, trading cards are just cardboard photos and can easily be damaged or stolen. A bent corner could mean the difference between a $4 million PSA-10 Mickey Mantle baseball card and a $2 million PSA-8.5. If you’re putting significant money into these collectibles, you need to make sure they are properly stored and insured.

Low liquidity

With diamond-handed collectors pushing card values higher, another thing you should watch out for is liquidity, or lack thereof. One of the hallmarks of a great store-of-value asset is that you can get the value back out of it quickly.

With sports cards, you can’t just hit the sell button since you must find a buyer who’s willing to pay your asking price. This means sports card investing may not yield great short-term investments.

Fraud

Scammers gonna scam. An inexperienced collector with big bags is an easy score. Always make sure you know what you’re buying and who you’re buying it from.

If all of these potential pitfalls have you doubting this investment strategy, there may be a better way for you to get into sports card investing: fractionalized investments.

Investing in fractionalized sports cards

Fractionalized investing is a method of offering an expensive asset in more affordable bits, which opens them up to a greater number of investors. Once an asset is acquired by a fractional investment platform, it’s (usually) registered with U.S. Securities and Exchange Commission (SEC) and it becomes a company of its own. This enables owners to offer shares in the asset and lets you invest without having to pay the asset’s total price.

This kind of investing isn’t limited to sports and trading cards—you can make fractionalized investments in NFTs, real estate, and even dinosaur fossils. But with the sports collectibles craze came plenty of opportunities to get a piece of a sports card investment.

Risks of fractionalized sports card investing

While many of the traditional risks of investing in sports cards—like fraud, storage, insurance, and buying under-researched assets—are negated by buying fractionalized shares from trusted platforms, they haven’t solved everything. Here are some of the risks of fractionalized sports card investing.

Price risk

A trading card is an investable asset, and all investable assets have price swings. Just because it’s well-researched doesn’t mean you can buy it worry-free. You always risk prices going down.

You don’t have full control over the asset

Picking your spots to buy and sell an asset is important in this hobby. When a fractionalized investing platform is interested in selling trading cards you’ve invested in, you don’t have much say in the matter. If an offer comes in from someone who wants to buy all the shares, you get a vote on some platforms, but your fellow investors might not agree with you.

Other platforms don’t give investors a say as to when profits are realized, which means you must ride out your fractional sports card investment with them.

Investors aren’t collectors

In traditional collecting, the owners of an asset could have real attachment to it. If you’re investing in a fractionalized card, your fellow investors may be more attached to their money than the card. If a better deal comes along, some investors might cash out rather than hold on for sentimental reasons.

Benefits of investing in fractionalized sports cards

There’s a lot to gain from investing little by little. Here are some of the standout benefits to sports card investing through fractionalized investment platforms.

Storage and protection

When you invest in fractionalized sports cards, you purchase shares of an asset that the platform is offering. Since that platform wants to attract as many investors as possible, they go above and beyond to protect the sports cards they fractionalize.

Your investment will be thoroughly examined by an appraisal team before it’s tucked into a temperature-controlled vault. You can rest assured that your sports card investments are safe and sound—or you might be able to sneak a peek of the 24/7 video surveillance to put your mind at ease.

Professionally researched and authenticated

Instead of spending hours trying to decipher the mysteries of trading card prices and origins, you can leave that to the experts. Fractionalized sports card investing platforms have professional researchers that pursue cards with the highest chances of increasing in value, so they can bring desirable, high-quality assets to investors.

Spare yourself the headache of trying to tell the difference between a Prism Gold Reflector Rainbow Sparkle card and a Prism Gold Reflector Sparkle Mist. Let the professionals handle it.

Emphasis on the fraction

Perhaps the most appealing aspect of fractionalized investing is accessibility. Alternative assets have been the purview of the ultra-rich for years because the price tag on the best alts was prohibitive for most investors.

But fractionalized investment platforms enable you to purchase shares for just a few dollars instead of demanding the full five- to seven-figure value. And many of these platforms are open to all investors, not just accredited ones.

Liquidity

As we mentioned earlier, one important quality of store-of-value investments is their liquidity. When you purchase a card outright, you’re stuck with that asset until you can find a buyer who will meet (or hopefully exceed) your asking price. Depending on the card, the current market value, and the point in the sports season, you might be in for a long wait.

Fractionalized investing platforms prioritize liquidity by making it possible to buy, sell, or trade your shares at virtually any point. There may be a 30- to 90-day lockup period after your initial investment, but after that, you’ll be able to sell or trade your shares when you’re ready. You can also put in buy or sell orders on most platforms for a more hands-free approach.

How can you invest in fractionalized sports cards?

Fractionalized sports card investing platforms are cropping up across the web, but not all are created equal. We gathered some information on two established platforms that can help you with fractionalized investing in sports cards.

Investing on Collectable

Collectable is an investment platform that specializes in sports memorabilia where investors of all levels can buy fractionalized shares of valuable sports cards and artefacts. Collectable’s expert team seeks out rare, high-quality sports memorabilia that they predict will increase in value.

After purchasing these assets, they are registered with the SEC, insured, and stored in Collectable’s vaults. The platform then offers shares in the asset, often for as little as $10 each, which investors can buy, sell, or trade at any time.

There are two ways you can make money on your investments at Collectable:

- If a card’s value increases, so does its share price

- When Collectable sells cards, the proceeds are distributed to investors

Collectable reports an average of 60% return on investment (ROI) on exited assets as of October 2022. While there’s no guarantee that an asset’s value will increase, the low price of shares allows you to easily diversify your sports card portfolio.

Investing on Rally

The Rally platform works similarly to Collectable—a team of experts with exquisite taste hunt down assets that show promise in terms of value appreciation. Rally also offers shares of these assets to investors for a fraction of their total value and let you trade them on their secondary marketplace.

Rally opened its digital doors by specializing in classic cars and expanded with a colorful array of alternative investment assets, like fine wine, retro video games, and luxury watches. They’ve since entered the sports card industry with several high-profile offerings, like the Mona Lisa of baseball cards: the Honus Wagner T206.

Rally is open to all investors, accredited or not, and they target returns of 13% and up on their investable assets. Data from Altan Insights shows that the top five performing fractionalized sports card investments of Q3 2022 were all traded on Rally, as were two of the top five vintage card investments. Those card values increased between 39% and 250% during that quarter.

What’s the best way to invest in sports cards?

Whether you stick with the classic approach to investing in sports cards or buy fractionalized shares of in-demand and vintage cards, this asset class is an excellent store of value.

Either option can be lucrative, but the difference in value is in the details. Do you like having full control over your investment but are also willing to take on the full risk? Buying cards outright might bring you more value.

On the other hand, if you don’t want to worry about negotiating deals, vetting and storing the card, and coming up with the full investment amount, fractionalized investing might bring the most value to you.