Are Fractionalized NFTs a Good Way to Invest?

First, the tokens were fungible, then non-fungible. Now they’re making them fungible again, and here’s why.

Every asset class, from blue-chip art to vintage whiskey, has been securitized or tokenized. You can even buy fractionalized stocks and gold these days. So what’s stopping people from doing the same with non-fungible tokens? It’s no biggy, just a few lines of code. Right?

The barrier to entry for major NFT projects is so high that digital asset ownership is practically a pipe dream for many. That’s until people started making NFTs fungible again by selling tokens representing them on the blockchain. Here’s how fractional NFTs work and why they’re a boon for both NFT owners and those just starting to invest in digital assets.

What are fractionalized NFTs?

If you want to invest in major NFT collections like Bored Ape Yacht Club (BAYC) or CryptoPunks but can’t afford their exorbitant prices, then your best bet is to buy fractional NFTs. Fractionalized NFTs are fungible derivatives of one or more NFTs. Put simply, they’re fractional tokens that represent partial ownership of an underlying NFT or a collection of NFTs.

Any NFT owner can turn them into fractional NFTs by depositing them into decentralized protocols like Fracton or Fractional to let investors buy in. Despite minor differences, all NFT fractionalization protocols operate in almost the same way: Someone locks their NFT in a virtual vault and mints a finite number of tokens so traders and investors can buy NFT fractions to gain exposure to the underlying NFT. Pretty cool, huh?

Pros and cons of fractionalized NFTs

Pros

- Lets small investors access expensive NFTs

- Make it easier to diversify NFT portfolios

- Can serve as a price discovery device

Cons

- NFTs are locked in a vault indefinitely

- Could increase NFT price volatility

- Might cause intellectual property disputes

Benefits of fractional NFTs

It may sound great to new investors that’re trying to break into the NFT space, but what incentive do fractionalized NFTs have for the holders?

One problem NFT sellers face is low liquidity since the inability to find a buyer is the biggest obstacle to realizing their return on investment. Secondary markets for a token representing partial ownership of NFTs could help better guarantee market liquidity. Fractionalizing NFT ownership enables investors to realize NFT profits while still being stakeholders.

The other rationale for fractional NFTs is that higher liquidity means better prices for NFTs. The logic is that increasing liquidity through fractionalization creates depth in the NFT market—more people are willing to buy and sell at different price points—and NFT prices become fairer. Another benefit of fractional NFTs is that they enable investors to share ownership of NFTs without having to trust each other or implement extra security precautions.

Problem with fractional NFTs

A side-effect of the liquidity offered by NFT fractionalization is increased price volatility. Liquid assets attract a greater number of buyers and sellers, which generates higher speculation and creates more opportunities for impulse buying or panic selling. This could make the price of fractional NFTs fluctuate more than their non-fungible counterparts, so keep that in mind.

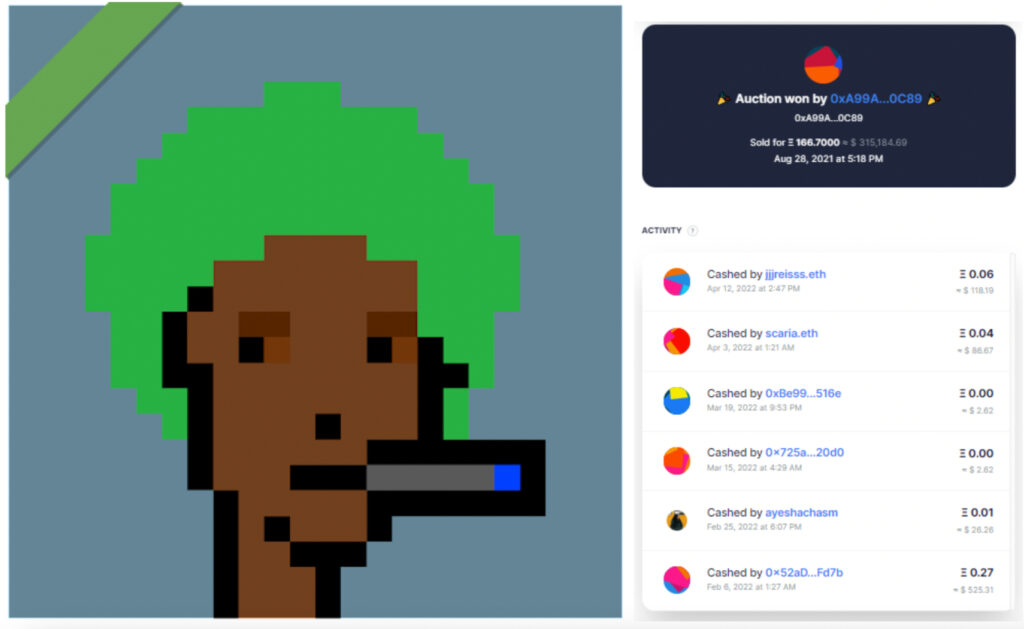

Source: fractional.art

The burning question regarding fractional NFTs is who gets the ownership rights. Some NFT collections offer holders special perks like exclusive NFT drops, access to events, and intellectual property rights. As an owner of a fractional NFT, you probably won’t have access to any of the perks given to the NFT project’s supporters. While those perks could raise the market value of your fractional NFT, this is a speculative assumption since no one can access them fairly.

How to invest in fractional NFTs

We get that most investors don’t have a fortune that they can just drop on a .jpeg of an ape. But, that’s where NFT fractionalization comes in handy. There are numerous ways you can gain exposure to NFTs without owning them outright, but there are also a few crucial details to look out for when choosing which NFT you want to fractionally invest in.

Source: fractional.art

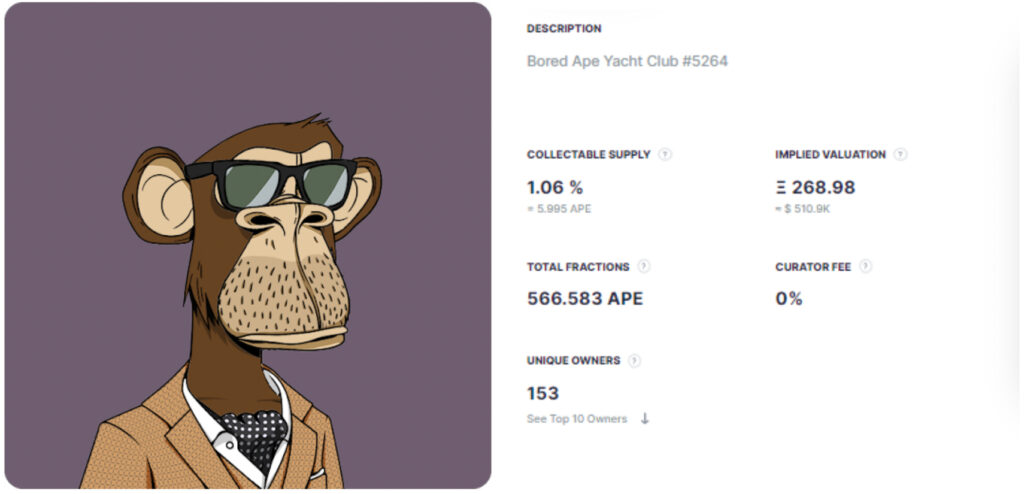

The three main things to note when exploring fractional NFT investments are market capitalization (the total market value of the underlying NFTs), the total number of tokenized shares minted, and the total circulating supply of tokenized shares. This information can help calculate what percent of the NFT is yours and how much it’s worth in either ETH or dollar terms. Knowing that shit will also help you better understand your NFT portfolio.

Fractionalized NFT protocols

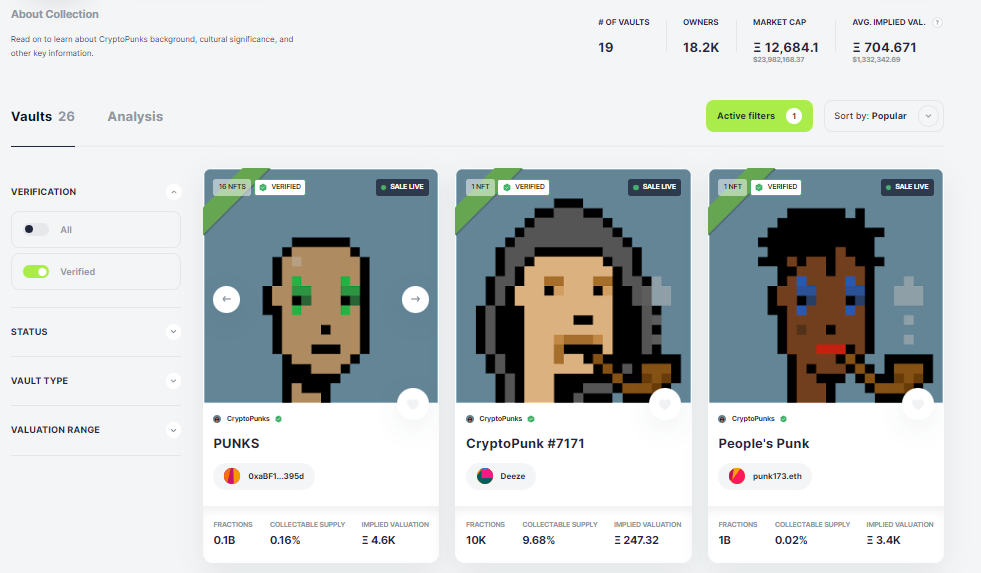

CryptoPunks is arguably the most culturally significant and coveted NFT collection in the world. With a market cap of $2 billion, there’s no wonder why so many web3 investors want one in their crypto wallets. The current floor price of a CryptoPunk NFT is over $140,000, but here are some ways to get more for less.

Source: rallyrd.com

If you’re looking to invest small on a big asset like CryptoPunks, a great place to start is Fractional. While it looks like any other NFT marketplace, Fractional is different because all the NFTs on the platform are deposited by holders who turn them into fungible assets. The holders get to decide what their NFT is worth, how many fractionalized tokens to issue, and when to sell the NFT.

Fractional is great for investors who want to own a small piece of CryptoPunk, Bored Ape, or a ‘basket’ of several NFTs. It’s also a bargain for NFT holders because they get to set the curator fee that they collect annually as a percentage of the total fractionalized token supply. NFT holders can use fractional ownership to create a pathway to exit their investment or can use fractional NFT trading activity as a price discovery tool to valuate their assets.

Source: fractional.art

On Fractional, the owners decide how much ETH to sell the NFT for by setting a reserve price, and the average return price serves as the starting price for an auction. When someone buys the underlying NFT, fractional ownership allows you to cash in your tokens for a share of the ETH it was sold for. Another platform that does this a little bit differently is Fracton—that’s without an ‘i,’ so like frack-ton. We didn’t name them.

Fracton is another protocol for fractionalizing non-fungible tokens, but the main difference is that there’s no mechanism for selling the NFT.

NFTs deposited into Fracton are automatically fractionalized at a flat rate of one million fungible “Hi- tokens”. For example, one CryptoPunk equals one million HiPunk tokens. But, the depositor can’t exercise ownership over the underlying asset.

Source: Fracton.cool

Instead of the NFT holder selling the NFT and sharing profit with fractional owners, Fracton uses a redemption system where anyone holding one million tokens can claim ownership of the underlying NFT. That means that if you own a million HiBAYC tokens, plus 0.6% for fees, Fracton lets you cash it in to redeem an actual BAYC NFT. This works because Fracton’s tokens are interchangeable and simply represent ownership in a bundle Bored Apes, CryptoPunks, or NFTs from any collection.

Fractional ownership hasn’t just revolutionized the NFT market but has also upended collectibles investing. While tokens on the blockchain are a great way to represent fractional ownership, there are drawbacks to decentralization. Human error and technical malfunctions are major risks of investing in fractional NFTs since they can cause crypto funds to get lost.

Fractional NFT platforms

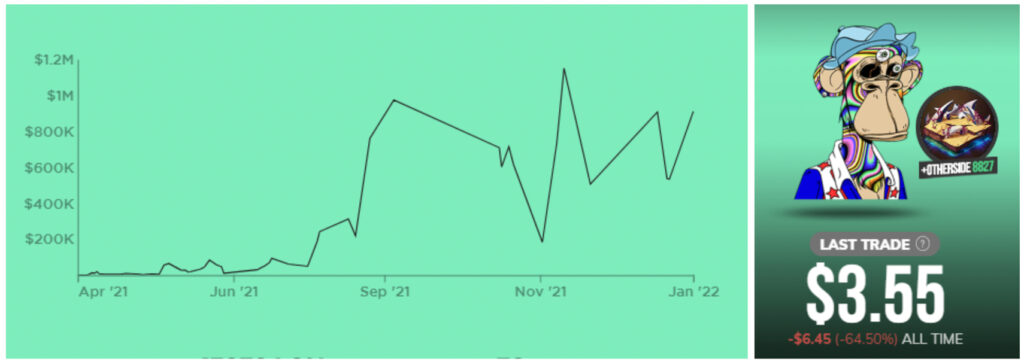

Basically, if the fractionalized NFT smart contract gets hacked or if someone loses the private keys to their DeFi wallet, then you may have to wave bye-bye to being an NFT owner. And that’s just the added layer of risk on top of the fickle and unpredictable NFT market. I mean, who wants to deal with all that? It’s easier to go to a platform like Rally and just buy fractionalized Bored Apes there.

Rally is a platform for trading fractionalized collectibles. They let you invest in NFT collectibles as well as things like luxury watches and vintage video games for as much as a cup of coffee or a Chipotle bowl (with extra steak). One of their most blue-chip NFT assets is Bored Ape #8827 with a side of Otherside metaverse real estate. It’s a 2-in-1 Bored Ape bundle that you can invest in for less than a Starbucks.

Source: rallyrd.com

Rally also has a CryptoPunk you can invest in. Shares for CryptoPunk #9670 flared in late 2021, launching its fractionalized tokens to nearly $20. This Punk doesn’t have many accessories, but he makes up for it with character. The crazy hair and nerd glasses give him a mad scientist vibe, like a ginger bespectacled Rick Sanchez NFT. Rally is fielding offers on its assets, so this CryptoPunk is up for grabs.

Source: rallyrd.com

All fractional asset platforms letting you invest in popular NFTs are virtually the same, with the most notable difference being their fractionalization process. Rally removes the hassle of dealing with digital assets but is way more centralized than platforms that are entirely on the blockchain. You can avoid the steep learning curve of using fractional NFT protocols or even trading NFTs on secondary markets, but you’ll have less command over your investment.

If you’re new to investing in non-fungible tokens, having more ways to invest in the asset class is great. The best way to invest should ultimately be determined by your investment goals. Rally is great for maximizing returns, but it doesn’t give you control over when to sell. Using a decentralized fractionalized asset protocol may be preferred by control freaks and investors that must have everything they own on a hardware wallet.