Bourbon vs. Scotch: How to Invest in Your Whiskey of Choice

No one wants to drink cheap whiskey, but you might think twice about breaking the seal on your most expensive bottles, as well.

As it turns out, they don’t make enough of it to go around, meaning people are willing to pay up.

The bourbon vs. Scotch rivalry usually comes down to flavor profile, heritage, and music preferences, but some of these historical investment returns may change your loyalties.

Raise a glass to making money.

Why invest in whiskey?

There’s arguably no better investment than whiskey. It takes a master distiller decades to create a good batch, so each distillation already has a rich, one-of-a-kind history the day it’s bottled.

Whiskey also has a real-world use which, consequently, is consuming the limited supply. It’s easy to store and doesn’t change once it’s bottled (unlike a fine wine). You can have a liquor cabinet worth seven figures if you make the right choices—just be careful not to crack open your kid’s college fund to impress the neighbors.

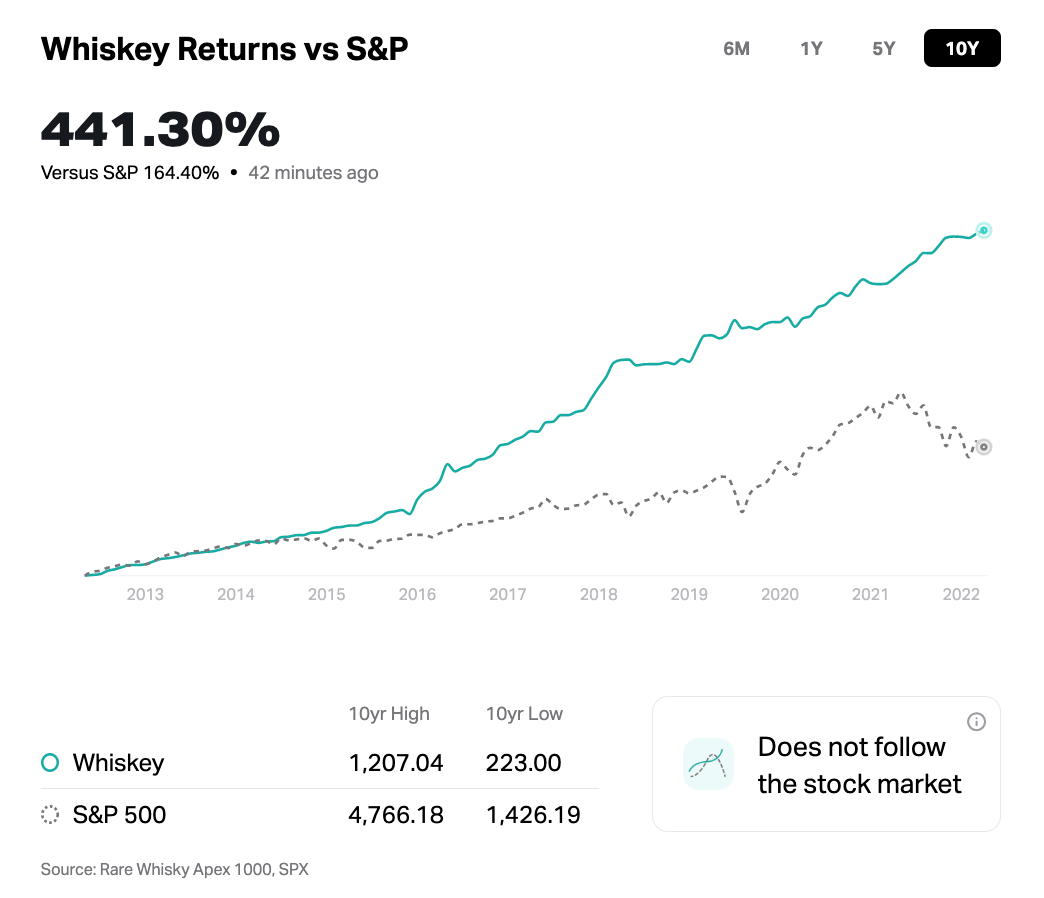

We’re not kidding. In most years, a bottle of the good stuff has dizzying results that often beat the stock market.

It’s not just the S&P 500 that whiskey outshines. Between 2010 and 2020, the Knight Frank Rare Whisky Index increased 586% and overperformed other luxury collectibles like vintage cars, fine wine, and watches.

With lower entry costs than purchasing rare artwork or investment cars, whiskey can be a friendly starting point to investing in alternative assets. But which whiskey should you choose? And how do you decide between bourbon vs. Scotch? Let’s start with the basics—telling them apart.

What’s the difference between Scotch and bourbon?

While both Scotch whisky and bourbon are whiskies, there are many differences between the two beverages. The most important thing to know is that bourbon whiskey can only be made in the United States and Scotch whisky can only be made in Scotland. While Irish and Japanese whisky are close cousins, they can’t officially be labeled Scotch whisky.

Scotch has a longer history than bourbon, which is usually associated with Kentucky but is made across the US. Indiana, Wisconsin, and Tennessee whiskey can hold their own at the bourbon tasting table. However, even in the wake of the trendy explosion of bourbon distilleries in the 2000s, a lot more Scotch is made today. In fact, according to the Scotch Whisky Association, more Scotch is enjoyed worldwide than American, Japanese, and Irish whiskey combined.

There’s also a difference in how the two are made. Scotch is made mainly of malted barley while bourbon production starts with a mash of grains that must be at least 51% corn. Both get their unique qualities from the barrels in which they’re stored—charred oak barrels, aged sherry casks, and used wine barrels are all possible vessels. But the clearest difference is the taste.

Scotch whisky has a spicy flavor with earthy notes and a signature peatiness—many say it’s an acquired taste. Bourbon, on the other hand, often has a smoother and sweeter taste, commonly with soft vanilla and cinnamon notes. Which one you enjoy is all about personal preference.

Just don’t let your personal favorite cloud your judgment when finding the right one to invest in.

How have Scotch investments performed recently?

When investing in a good Scotch, you want one that’s old, rare, and in demand. While there are many great Scotch whiskies to invest in, a few of these historical sales will sober anyone up.

Macallan Fine and Rare 60-Year-Old 1926

- Origin: Speyside-Highlands, Scotland

- Distilled: 1926

- Highest sale: $1.9 million in 2019

- Supply: 14

Macallan’s name has become synonymous with “highly valuable” in the world of whisky. The distillery dates back to 1824, when it was one of the first in Scotland to have a legal license to produce alcohol. Nearly 200 years later, Macallan is one of the largest single malt Scotch producers in the world.

Macallan Scotch has broken records year after year as whisky drinkers and collectors are willing to pay a high price for this prestigious single malt whisky. In 2019, a bottle of Macallan Fine and Rare 60-Year-Old 1926 Scotch sold for $1.9 million, setting the record for most expensive bottle of alcohol ever sold at auction. It broke the record another bottle of the same batch had set one year earlier, going for $1.5 million at Christie’s in London.

Macallan has produced at least seven bottles of whisky that have broken the $1 million price point since 2018. But even the bottles that don’t breach seven figures are still worthy of a toast. The Macallan Lalique 50 Year Old increased in value from $69,298 for a bottle in 2016 to $257,712 in 2022. That’s a 271% increase in six years.

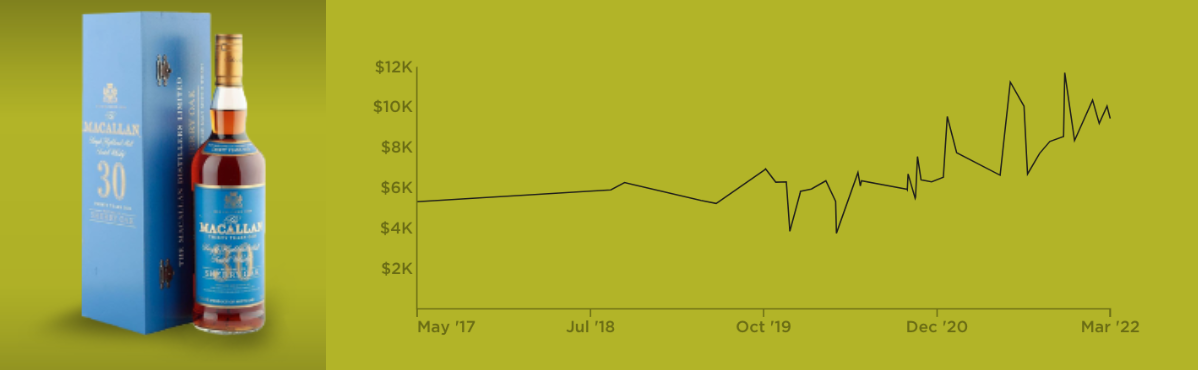

Source: Rally

Investments like this can pay off in big ways. A British bank manager who purchased two casks of Macallan in 1994 cashed out in 2021 for over $300,000. He bought the oak casks for about $5,300 (about $9,690 in 2021). That might seem like a hefty impulse purchase, but at least if the investment hadn’t worked out, he could have thrown a great party.

Fortunately, the Scotch whisky appreciated 3,138% in 27 years, allowing the bank manager to pay off his mortgage, take a family vacation to Florida, retire early, and buy a cask for each of his children. Hopefully, he bottled some for a celebration.

Bowmore 50-Year-Old Single Malt Scotch

- Origin: Islay, Scotland

- Distilled: 1961

- Highest price: $96,923 in 2022

- Supply: 200

Bowmore is even more established than Macallan, founded in 1779 on the island of Islay, a pilgrimage destination for Scotch whisky drinkers around the world. The abundance of peat, fresh water, and barley made Islay the promised land of single malts.

Bowmore’s 50-Year-Old single malt hasn’t yet broken seven figures, but that doesn’t mean they aren’t top performers. In 2016, Bowmore offered these coveted bottles for $23,000 each. Six years later, their value has gone up to as high as $96,923, a 236% increase.

Ardbeg 1975 Single Malt Scotch cask

- Origin: Islay, Scotland

- Distilled in: 1975

- Highest sale: $18.2 million in 2022

- Supply: 1

Also hailing from Islay, Ardbeg has been making Scotch whisky since 1798. Their whisky is known for its strong peaty flavor and most of its Scotch production is used in blends. That’s what made this cask particularly valuable—it’s filled with a rare single malt Scotch from 1975 that managed to avoid being bottled or drawn into a blended Scotch.

A private collector in Asia purchased the cask for $18.2 million in 2022, which is more than twice what the Glenmorangie Company paid to buy the entire Ardbeg distillery and all its stocks in 1997.

The cask is expected to yield 440 bottles of single malt Scotch, which the owner plans to draw over the next five years. Whether she sells them for more than the $40,000 each one is worth or hands out the best stocking stuffers her family and friends ever got, this investment will potentially yield promising returns.

Is bourbon a good investment?

The bourbon vs. Scotch rivalry usually comes down to flavor profile, heritage, and music preferences, but some of these historical investment returns may change your loyalties.

Old Rip Van Winkle 25-Year-Old

- Origin: Louisville, Kentucky

- Distilled in: 1989

- Highest price: $65,000 in 2022

- Supply: 710

The Van Winkles have been making Kentucky bourbon for three generations, ever since “Pappy” purchased the Stitzel Distillery in 1910. Not even Prohibition slowed Pappy down. So it’s no surprise that their bourbons are among the most desired by collectors and whiskey drinkers alike.

The Van Winkle 25 Year Old is the oldest bourbon ever released by the distillery, filling 11 barrels in 1989 but amounting to only 710 bottles when it was finally drawn. The bourbon was first brought to market in 2017 at the suggested retail price of $1,800 per bottle. Today, the price has rocketed to $65,000 for a single bottle, a 2,854.55% increase in just five years.

Source: Rally

Van Winkle bourbon has been a collectors’ favorite for years thanks to the legendary history of Pappy Van Winkle and Old Rip Van Winkle’s reputation for quality. While getting your hands on a bottle of your own can be a challenge, the Rally investment app offers an opportunity to purchase shares in a collection of six bottles.

Redemption 36 Year Old

- Origin: Lawrenceburg, Indiana

- Distilled in: 1978

- Highest price: $45,000 in 2022

- Supply: 18

Getting old is never easy, not even for bourbon. Distillers run the risk of producing flat, dry, woody whiskey if their batch sits for too long. Even if the flavor holds up, evaporation over multiple decades results in fewer bottles and qualities that are hard to reproduce.

Redemption pushed the envelope with its batch of 36 Year Old, which was distilled in 1978 and yielded only 18 bottles. With so few bottles available, it’s unlikely that many have tasted this heavily-aged bourbon, but its rarity has made it very valuable.

When it was released in 2014, a bottle was about $1,200 but it reached a high price of $45,000 in 2022—a 2,764.4% increase in eight years. And since each bottle came packaged with an authentic 1978 penny, you might end up with a lucky rare coin to add to your portfolio too.

Black Maple Hill 16 Year Old Premium Small Batch

- Origin: Bardstown, Kentucky

- Distilled in: 2010

- Highest price: $10,000 in 2022

- Supply: unknown

Black Maple Hill has its headquarters in California, but its bourbon has more classic roots in the Bluegrass State. That’s because instead of distilling its own whiskey, the company hired Julian Van Winkle III to source and bottle high-quality barrels of bourbon for them. When Van Winkle III entered into an exclusive agreement that terminated his contract with Black Maple Hill, the company picked up a similar arrangement with Kentucky Bourbon Distillers (KBD).

The Black Maple Hill 16 Year Old Premium Small Batch Straight Bourbon is labeled as being bottled in Bardstown, KY, which means it was sourced by KBD. KBD built a collection of high-quality bourbons from some of the best distilleries in Kentucky during the “bourbon bust” of the 1980s and 90s, so their bottlings from Black Maple Hill came from impressive stock. The 16 Year Old batch was likely drawn from barrels of Heaven Hill Distillery or the Barton Distillery.

In 2010, one of these bottles cost $125. The average price on WineSearcher in 2022 is $9,103, and with a high price of $10,000, that’s a 5,782% increase in 12 years.

How can you invest in whisky?

You don’t have to know which whiskies are creating a buzz to make smart investments. There are several platforms that make it easy to get exposure to an expertly-curated portfolio of coveted blended bourbons or limited-edition Scotch whiskies. And since they won’t be in your house, you don’t have to worry about proper storage, potential damage, or your liquor cabinet being raided.

Vint

Vint has their experts scour investible wines and spirits until they find the best deal. They buy it, store it, securitize it with the SEC, and then sell shares to investors like you—all with no management fees.

If you’re in it for the long haul, you can hold your shares until Vint determines the time is right to sell the collection and distribute the cash to investors like you.

CaskX

CaskX brings whiskey makers and investors together. Whiskey distilleries have millions of barrels aging in their warehouses, but the demand for bourbon is rising faster than they can find the resources to add more. That’s where CaskX fills the gap.

CaskX allows you to invest in whiskey barrels. They store the casks, insure it for you, and even help you build a portfolio to meet your investment needs. This frees up the whiskey producers to create more product by creating space in their warehouses and giving them a cash injection. Once you’re ready to sell, CaskX helps you with that too.

CaskX enables you to be more than an investor. You get to be an owner of a unique product. The longer you decide to hold and store it, the more rare and valuable your product becomes as it matures in the barrel.

There’s a minimum $20,000 buy-in, so if you’re looking for a unique way to invest your money in a proven alternative asset, CaskX gives you the opportunity to go big.

Vinovest

With their new product, Whiskeyvest, Vinovest works in largely the same way as CaskX but with a few added perks, like a free bottle from your cask sent to you each year. And if you think it’s perfect, you can opt to bottle it.

Whiskeyvest gives you the option to invest in American bourbon that’ll eventually be bottled by mainstay bourbon brands like Whistle Pig or High West Whiskey with as little as $1,500. But if you’d rather get a little more high-brow, they also give you access to rare Scotch whisky barrels starting at $15,000.

Should you invest in Scotch or bourbon?

For decades, the best whiskeys have proven to be excellent investments assets, and with good reason. Each bottle takes years to make and tells a story that can quickly become legend. Since you ideally won’t be drinking your investment, your choice of Scotch vs. bourbon likely depends on whether a bottle’s story quenches your thirst.