Guide to Contrarian Investing in High-Ticket Niche Items

Get the lowdown on contrarian investing in high-ticket niche items. Follow our four-step guide for research, item selection, budgeting, and understanding value.

Recent surveys suggest that alternative assets such as fine wines, classic cars, high-end jewelry, real estate, vintage video games, and collectibles have become increasingly popular investments.

These asset classes are far from conventional, but more investors are turning to them as a way to beat the S&P that’s more accessible than things like real estate and private equity.

Alternative assets are becoming a mainstay of contrarian investing—the strategy of buying and selling assets that contrast the dominant market trend. When done right, investing in these unique items can be stores of value that could turn a profit in a few years.

The 1987 ‘Black Monday’ saw the Dow plummet 22%, but smart money considered it a firesale. The 1973 to 1974 bear market also wiped out 45% of all stock values in 22 months, thus creating a similar buying opportunity.

Investing against the grain can be a great way to secure high returns—contrarian investing in high-ticket niches is no exception. You can use the right knowledge and tactics to look for great opportunities in these emerging markets and make a profit.

So let’s explore what contrarian investing is and how you can use it to make the most of high-ticket niches.

What’s contrarian investing?

Contrarian investing is a long-term strategy that aims to beat average market returns on things like stocks and crypto. You buy low and sell high, expecting the market to recognize the true value of your investment eventually.

The contrarian investor often takes risks and goes against the market consensus when evaluating potential investments. They conduct research and evaluate market conditions to make educated decisions on investments that are out of favor or defy widespread sentiments.

Contrarian investors bet on the market going down when others are predicting an upturn. It’s all about taking advantage of undervalued assets and knowing when to buy and when to sell—in other words, being greedy when others are fearful, and vice versa.

The investor searches for undervalued stocks trading below their intrinsic value and ignores overvalued ones. Identifying undervalued assets is the essential first step. Remaining steadfast is also necessary because temporary value dips can happen despite an investment’s potential upside.

Value Investing

Value investing involves choosing stocks (or other assets) priced less than their intrinsic or book value. By sieving out undervalued stocks, value investors think they have a chance to make a profit by leveraging discounted stock prices.

The market often overreacts to good and bad news, leading to stock price movements that are not in agreement with a company’s long-term outlook. This overreaction provides value investors with an opportunity to buy stocks at reduced prices.

The origins of value investing date back to Benjamin Graham and David Dodd in the 1920s when both men began teaching at Columbia Business School. Many of the principles of value investing are explained in their book Security Analysis and Graham’s book The Intelligent Investor. Investments when assets are ‘on sale’ is nothing more than value investing.

Some famous value investors include Warren Buffett, Benjamin Graham (Buffett’s professor and mentor), David Dodd, Charlie Munger, Christopher Browne (another Graham student), and Seth Klarman.

Value investors maximize returns by purchasing stocks at prices lower than their intrinsic value. The greater the discrepancy between the price and the real value of the stock, the higher the safety margin for value investors.

If other investors recognize the disparity and the share price rises to match the intrinsic value, value investors win. Additionally, many investors value stocks less than their purchase price as it limits the effects of declines in the stock market—the opposite of how value investors view markets.

Patience is required to obtain sizeable returns on value stocks, but the main advantage is enjoying a low-risk margin of safety.

Purpose of fair value

Parties buying and selling an asset, such as a collectible or security, must understand the concept of fair value—the price two consenting parties can agree on. Factors such as the potential for growth and cost to replace are taken into account to assess an asset’s fair value.

Fair value is essential for financial reporting, relevance and reliability, and transparency and provides investors with accurate and timely information necessary for making the right investment decisions.

How to invest in the high-ticket niche

High-ticket niches can be a great alternative investment that can beat the market. Select your niches wisely to ensure your investments have (and maintain) the most long-term potential.

Investing in high-ticket niches can be attractive for contrarians looking to diversify their portfolios. You must stay ahead of the shifting market trends and research potential contrarian plays.

Additionally, check for any warranties and return policies for high-ticket items, as this can reduce the risk of facing potential losses. Diversify your investments across growth and value assets and you’ll be better positioned to weather downturns and capitalize on the upside.

Some contrarian investors take a more conservative approach by carefully assessing the current market price of a historically cheap and undervalued asset. Being patient and applying strategic timing will enable you to leverage high-ticket niches for a potentially impressive return.

1. Choose a niche

The first step to investing in high-ticket items is to pick a niche. There are a wide variety of high-ticket items, but choosing an area that interests you and that you have an understanding of will make you more likely to make informed decisions.

Some potential niches to invest in include:

- Commercial real estate

- Collectibles

- Video Games

- Antiques

- Fine wine

- High-end jewelry

- Classic cars

- Sports memorabilia

Investing in these niches can offer potentially high returns for knowledgeable investors. These alternative investments have become popular due to their lucrative potential and cult-like following.

Collectibles and video games can have higher returns than traditional investments such as stocks and bonds. Items like vintage wines, classic cars, high-end jewelry, and sports memorabilia are also often seen as safe havens of value and can offer investors significant returns over time.

Investing in these items is a means of diversifying a portfolio, which can help to reduce risks associated with volatility and broad market dips.

The Oppenheimer Blue is the world’s largest fancy vivid blue diamond and it sold at Christie’s auction for $57.5 million on May 18, 2016, making it the most expensive one ever sold.

Source: hearstapps.com

Antiques and fine wines can be attractive investments since they tend to increase in value over time. In 2022, the Liv-Ex 1000 fine wine index outperformed every major index and asset class except for gold. Rare vintages are often in limited supply and are usually bought and sold on the secondary market.

It’s important to research your niche before investing. Understanding the risks is crucial to making informed decisions and profitable investments.

2. Find high-ticket items

Choosing your niche is the easy part, but finding the right high-ticket items to invest in within that niche is easier said than done. The main ways to find high-ticket items are through online or physical auctions, private sellers and dealers, or boutique retailers.

Investing in high-ticket items like classic cars, jewelry, and vintage comic books can be a great way to build your alternative asset portfolio. Using a contrarian approach to find these valuable investments is a high-risk high-reward method of investing.

To achieve the highest rewards, focus on opportunities that’re being overlooked by the mainstream and search for items that have temporarily declined in value so that you can purchase them at a discount.

Additionally, monitor your investments, look out for potential changes in the value of the item, and be aware of what’s impacting the broader market. By researching and monitoring these investments regularly, your high-ticket investment portfolio will be more likely to succeed.

Collectibles

Antiques and other niche items can provide both financial and sentimental returns. Researching market trends and investing in forgotten or overlooked items is a great way to use contrarian investing to build tangible wealth.

Here are some niche collectibles you can invest in:

- First edition books

- Air Jordans

- Film memorabilia

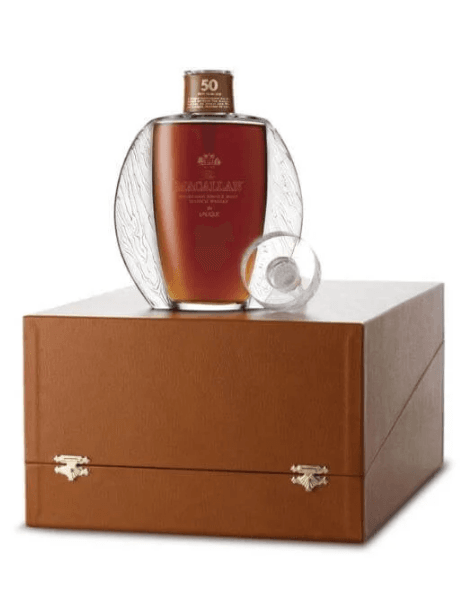

- Macallan whiskey

- Star Wars action figures

- Pokemon cards

- Soccer cards

- Luxury watches

- Comic books

This one-of-a-kind Macallan Lalique Single Malt Scotch Whiskey 50 Years Old is currently valued at $300,000.

Source: whiskeyexchange.com

For instance, the average annual return on rare first-edition books is approximately 3% to 5%, and famous props from movies have seen returns of 30% to 50%. Fine liquors have stood the test of time as investment assets—the most expensive bottles of Macallan Scotch whisky have sold for as much as $1.9 million.

Consider Star Wars collectibles, coveted Pokemon cards, or expensive sports cards that have fetched many times their original worth. There are also sought-after Rolex watches that have sold for up to 348% more than their initial retail price.

By investing in high-ticket niches like these, you can take advantage of tangible assets offering higher returns than traditional assets like stocks with the added benefit of being more accessible than real estate.

Vintage items

Investing in high-ticket vintage items can be a great way to make an outsized return on your investment. These can set you up for long-term returns that far exceed those of traditional investments.

Here are some vintage items that contrarians have their eyes on:

- Vintage macs

- Vintage guns

- Vintage bibles

- Vintage cameras

- Vintage guitars

- Vintage concert and events tickets

The 1976 Apple-1 is one of the most sought-after early personal computers and auctioned off at Christie’s for $387,750 in 2013 and sold again for over $470,000 in 2019.

Source: cnbcfm.com

Vintage Mac computers are highly sought after and have seen a massive surge in value in recent years. In 2014, Bonhams auctioned a rare Apple-1 computer in New York with an estimated selling price of $300,000 to $500,000.

The final price was much higher at $905,000, and this remains a record price for any vintage Apple computer in history. The runner-up is a sealed first-generation iPhone which auctioned for $63,356 in February 2023 after bidding started at just $2,500.

As the demand for vintage Macs and Apple products continues to rise, investing in them can be like printing money.

Collecting antique Bibles can be a great way to make a profit. In recent years, antique Bibles have seen a surge in value due to their historical importance and their extreme rarity.

The first book printed in the United States of America was a Puritan translation of the biblical psalms known as the Bay Psalm Book, and it sold for a record-breaking $14.165 million at a 2013 Sotheby’s auction.

The demand for vintage video cameras is rising as hipsters seek to capture memories in old-school ways. Vintage video cameras often have high resale value due to factors like rarity, provenance, or historical relevance to photography.

Vintage electric guitars can also make money as investment assets as many are now sought-after collectibles that can command sky-high prices. Take John Lennon and George Harrison’s Gibson J-160E guitars for example. Brian Epstein purchased them for around $5,000 in 1962, and they famously went missing in 1963 before eventually being found and selling for $2.1 million in 2015.

Vintage concert tickets may seem like scraps of paper but are seen by some collectors as symbolic representations of artists and their golden era. A ticket from a legendary concert like the Jimi Hendrix Experience in Monterey can now fetch up to $25,000.

All these examples demonstrate the potential for earning unlikely returns on things like instruments, first-edition books, and vintage tickets.

3. Determine fair value

It would be nice if everything had a set price when it came to high-ticket items. It would also be nice if investing in high-ticket items could be done in three basic steps.

But if you’re looking at something as an investment, you must think critically about the price you’re paying for it. If it’s overpriced, it’ll be harder to recoup the investment compared to if it was a bargain.

That’s why investing in an auction is hard. Most auctions have a price estimate or range of approximately what the sale price will be. But auctions are high-pressure situations, and prices in a bidding war can be unpredictable.

Many times the item will go for more than the estimate, but it can also go for less. Therefore, it’s important to do your research ahead of time and to understand the risks involved with investing in high-ticket items.

A 1959 Ferrari 250 GT LWB California Spider Competizione sold for $17.99 million at a Sotheby’s auction in December 2017.

Source: thumbor.bigedition.com

The key to maximizing your return on investment (ROI) when investing in high-ticket items is to purchase the item at a fair price. Having a grasp on fair value and understanding the risks involved are the first steps.

Ensuring you’re not overpaying for an item by comparing prices between different sellers is also essential. In the end, you’re investing in an item to make a profit, so make sure you’re buying it at a price that leaves room to yield a healthy return.

Regardless of the valuation method used to determine a fair price, it’s best to have a budget—and stick to it—when investing in high-ticket items. It’s important to have a game plan and to know what you’re willing to pay before walking into the auction.

With a budget in mind, it’s easier to know your limit and not be tempted to buy what’s out of your price range. It also helps to compare prices of similar items in different places to get an idea of what a fair price would be.

4. Make a purchase

Once you have done your research, set a budget, and determined the fair value of your high-ticket item, it’s time to buy. Generally, the safest way to buy high-ticket items is through an online store or a trusted dealer.

Be aware that online stores may offer additional protection such as return policies and warranties, while dealers may be better for finding niche assets.

It’s also important to be aware of the payment methods accepted, delivery times, and additional taxes or fees associated with the item. Lastly, read the fine print and understand any contractual obligations you may have when purchasing an item.

This is the rare Leica 0-series no. 122 is a vintage camera from 1923 that sold for $2.97M at an auction in Vienna in 2018, making it the most expensive camera of all time.

Source: pixinfocus.com

Depending on where you live, you may need to pay certain taxes when purchasing high-ticket items. While taxes will vary depending on the item and the location, it’s important to be aware of any additional taxes or fees associated with the purchase. It’s also important to be aware of any additional paperwork or permits that may be needed when making your purchase.

This is especially true for items that require special permits or licenses, such as firearms. Doing your due diligence and researching the laws in your area before making a purchase is an important step to ensuring that you’re compliant with the law.

When purchasing high-ticket items, always be on the prowl for hidden costs or fees such as shipping fees and delivery fees. Additionally, check for any warranties or return policies that may be offered. If something goes wrong with your purchase or you’re unsatisfied with the item, these extra protections can offer valuable peace of mind and help you get the most out of your purchase.

Value stocks vs niche high-ticket items

Value stocks can be an excellent long-term investment, as they’re typically relatively low risk and offer steady growth. On the other hand, niche high-ticket items can be a more lucrative investment, but can also be more volatile. The ROI on niche high-ticket items can be significant, but that also carries greater risk due to the unpredictability of the market.

For investors looking for low-risk and steady returns, value stocks may be the better choice. On the other hand, those looking for a potentially greater return on their investment may find that niche high-ticket items are the way to go. The choice should ultimately be based on your risk tolerance and investment goals.

| Value Stocks | High-ticket items |

|---|---|

| Less expensive | Higher profit margins |

| Less risky | Less Competition |

| Consistent returns | Time saving |

Is the contrarian investing high-ticket niche worth it?

Contrarian investors often find market opportunities during times of economic turmoil. The 1987 ‘Black Monday’ saw the Dow plummet 22%, but smart money considered it a firesale. The 1973 to 1974 bear market also wiped out 45% of all stock values in 22 months, thus creating a similar buying opportunity.

In the aftermath of the 9/11 attacks, Warren Buffet purchased a stake in the Washington Post Company, shares of which have since risen over 100 times in value. Similarly, following 9/11, Boeing’s stock tumbled, only to skyrocket more than four times in value five years later.

Sir John Templeton’s Templeton Growth Fund, which began with $10,000 invested in publicly traded stocks in 1954, grew to $2 million by 1992. Templeton’s contrarian investing tactics also made him astounding profits during World War II.

Despite the contrarian investing style’s high potential returns, it’s undoubtedly riskier, so investors must weigh their options before committing to an against-the-grain approach.

To succeed as a contrarian investor in high-ticket niches, you should use key metrics to evaluate investment opportunities, diversify your portfolio, practice risk management, and look for investment opportunities with a good margin of safety.

With careful analysis and a keen eye for market inefficiencies, you can build successful portfolios across stocks and alternatives, understand markets, and maximize your returns over the long term.