How Linqto Helps Me Invest in Private Companies

Traditional investments often set high barriers that average investors struggle to overcome. It’s why we like Linqto, a platform with a mission to change that narrative by making private investments more accessible to everyday investors.

Have you ever wondered why investing in private companies seems like a club for the ultra-wealthy? Traditional investments often set high barriers that average investors struggle to overcome. It’s why we like Linqto, a platform with a mission to change that narrative by making private investments more accessible to everyday investors. What if you could participate in the growth of private companies without having to meet steep financial requirements? Linqto has set its aim on lowering these hurdles, providing a new way for more people to engage in private equity investments.

Linqto’s approach isn’t just about reducing how much you need to invest, they’re eliminating added fees and simplifying the investment process through its user-friendly app. We all hear that portfolio diversification is key, but few are as focused as Linqto on doing this when it comes to private equity. But what are the real benefits of adding private equity to your investment mix, and how does Linqto help you to make more informed decisions? We’re going to dig into how this platform could potentially reshape your investing journey and bring you closer to the companies you invest in.

Making Private Investment Easy with Low Entry Barriers

For a long time, private investments resembled an exclusive club with hefty financial commitments, which often required $100,000 or more to play. Linqto, however, has shifted this roadblock by drastically lowering the minimum investment threshold to as little as $2,500 for the first investment and $5,000 for subsequent ones.

Chief Marketing Officer, Elisa Zoli Lai

Linqto’s vision is to democratize private investing by making it accessible, affordable, and liquid for individual investors. Through an intuitive platform, Linqto empowers individual investors to engage in the private equity market, which was once only within reach for the privileged few.

The removal of added fees is another fundamental aspect of Linqto’s approach to making private investments more accessible. Typically, private investing involves various fees, including management and performance fees, which can push aside smaller investors due to the additional financial burden. By eliminating these fees, Linqto both lowers the cost of entry and enhances the potential return on investment, making it a more attractive option for individual investors. Their mission is very clear. Linqto is setting out to democratize access to private markets, ensuring that more people can participate in and benefit from private equity investments.

Finding your Investment Couldn’t Be Easier

For most, Private Equity investments can be a daunting and complicated task. Linqto’s platform simplifies this process through their user-friendly app that guides you step-by-step on how to make an investment. From creating an account to selecting an investment opportunity, the app is designed to ensure that even those new to private equity can move forward with confidence.

Key features of the Linqto app include:

- Educational Resources: The app provides users with comprehensive information about each investment opportunity, including market trends, company performance, and growth potential. This arms you with the details needed to make informed decisions.

- Intuitive Design: The app’s interface is straightforward, making it easy to navigate through various sections and access the information they need without feeling overwhelmed.

They’ve clearly focussed on the user experience and made the process of investing in private companies as transparent and straightforward as possible. By educating and empowering you with information, Linqto ensures that you can take full advantage of the opportunities available in the private equity market.

Why Diversifying into Private Equity Gives You an Edge

Investing in private equity offers several benefits that can enhance an investment portfolio. One of the primary advantages is the potential for higher returns compared to traditional public market investments. Private companies often have greater flexibility to innovate and adapt, which can lead to substantial growth and, consequently, significant returns for investors.

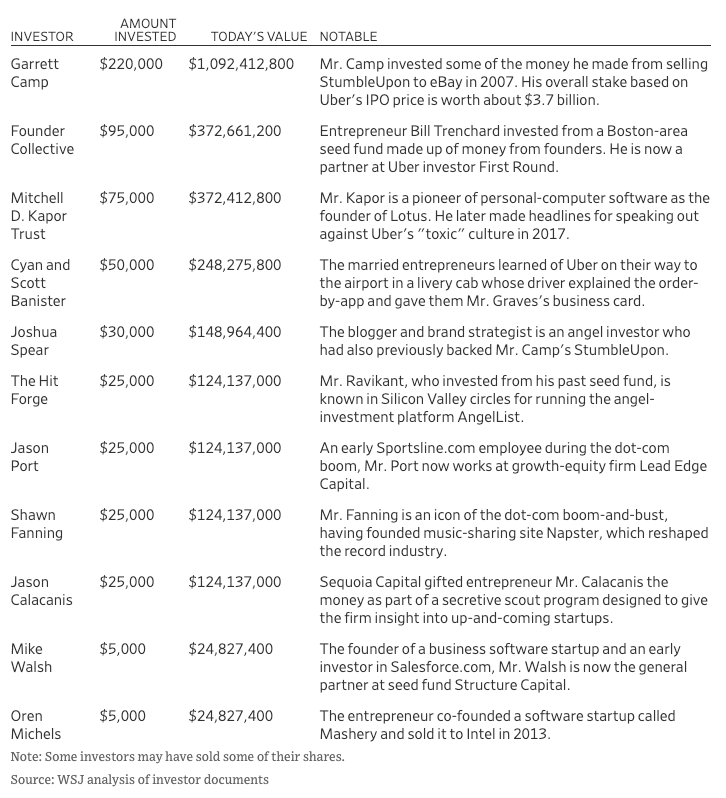

To better understand the potential of private equity investments, let’s look at some of the early investors in Uber, one of the most well-known private company success stories. As shown in the table below, these investors took a chance on Uber when it was still a startup, and today their investments have multiplied by staggering amounts.

The long-term growth potential of private equity is particularly appealing. As companies develop and expand, the value of equity in these firms can increase dramatically. This aspect of private equity investing is crucial for those looking to build wealth over time. Additionally, the direct earnings benefits, where private firm earnings can be paid directly to the owners, provide an additional incentive for investors. This direct financial benefit is often more pronounced in private investments than in public equity markets where earnings are typically reinvested into the company or distributed among a larger number of shareholders.

How Getting Involved in Private Companies Puts You in Control

Investing in private companies through Linqto empowers you by giving you a role in the decision-making process. Unlike public companies, where you’ll rarely have significant influence, private equity investors often enjoy closer connections with their investments. This involvement can range from voting on critical business decisions to participating in strategic discussions, depending on the structure of the investment.

Linqto facilitates this enhanced investor involvement by providing platforms for communication and interaction between you and company management. This closer connection ensures that you’re more than just financial backers – you’re an active participant in the growth and success of the businesses you invest in. This level of engagement is particularly satisfying for many investors, as it allows them to see the direct impact of their investments.

By breaking down traditional barriers and leveraging technology to enhance user experience, Linqto is making private equity investing more accessible, understandable, and engaging for everyone.

Wrapping Up

Linqto has significantly changed the approach to private investments, making it accessible for a wider audience to engage in opportunities that were previously only available to the ultra-wealthy. By reducing the minimum investment requirement and removing additional fees, Linqto has opened up private equity to more individuals, allowing them to diversify their portfolios and potentially achieve higher returns. The platform’s intuitive app and educational resources give investors the knowledge they need to make more informed decisions, simplifying what used to be a complex investment process.

Additionally, Linqto enhances investor engagement by creating a stronger bond between investors and the companies they invest in, transforming them from simple financial backers into active contributors to business growth. This shift improves the investment experience and fosters a more inclusive economic environment. Linqto is tackling a problem that can have significant tangible benefits for the people involved, whether it’s the investors providing capital or the growing companies. We’re excited by what we see and look forward to watching Linqto’s continued success.