Many companies on MoneyMade advertise with us. Opinions are our own, but compensation and in-depth research determine where and how companies may appear.

Aug. 16 Markets Report: Inflation Does the Limbo

Inflation slows down, Mailchimp blacklists crypto publishers a popular VC takes a $20 billion loss.

Macro

U.S. Economics

- Interest Rates: 2.50%

- Unemployment Rate: 3.5%

- GDP YoY: -0.9%

- CPI YoY: 8.5%

Finally Some Relief

- The latest Consumer Price Index (CPI) readings brought some much-needed relief last Friday. Prices rose by 8.5% in July, down 0.6% from June’s 9.1% CPI—and lower than the 8.7% economists were expecting.

- Preliminary readings for the August’s Consumer Sentiment Index also showed that one-year inflation expectations are starting to fall.

- Even though the data is suggesting that inflation might have peaked, prices are still well-above the Federal Reserve’s 2% inflation target. So they might not slow the pace of interest hikes just yet.

- Across the pond, new economic data shows that the U.K.’s economy shrunk for the second quarter of 2022 by 0.1% — lower than the 0.3% that was expected.

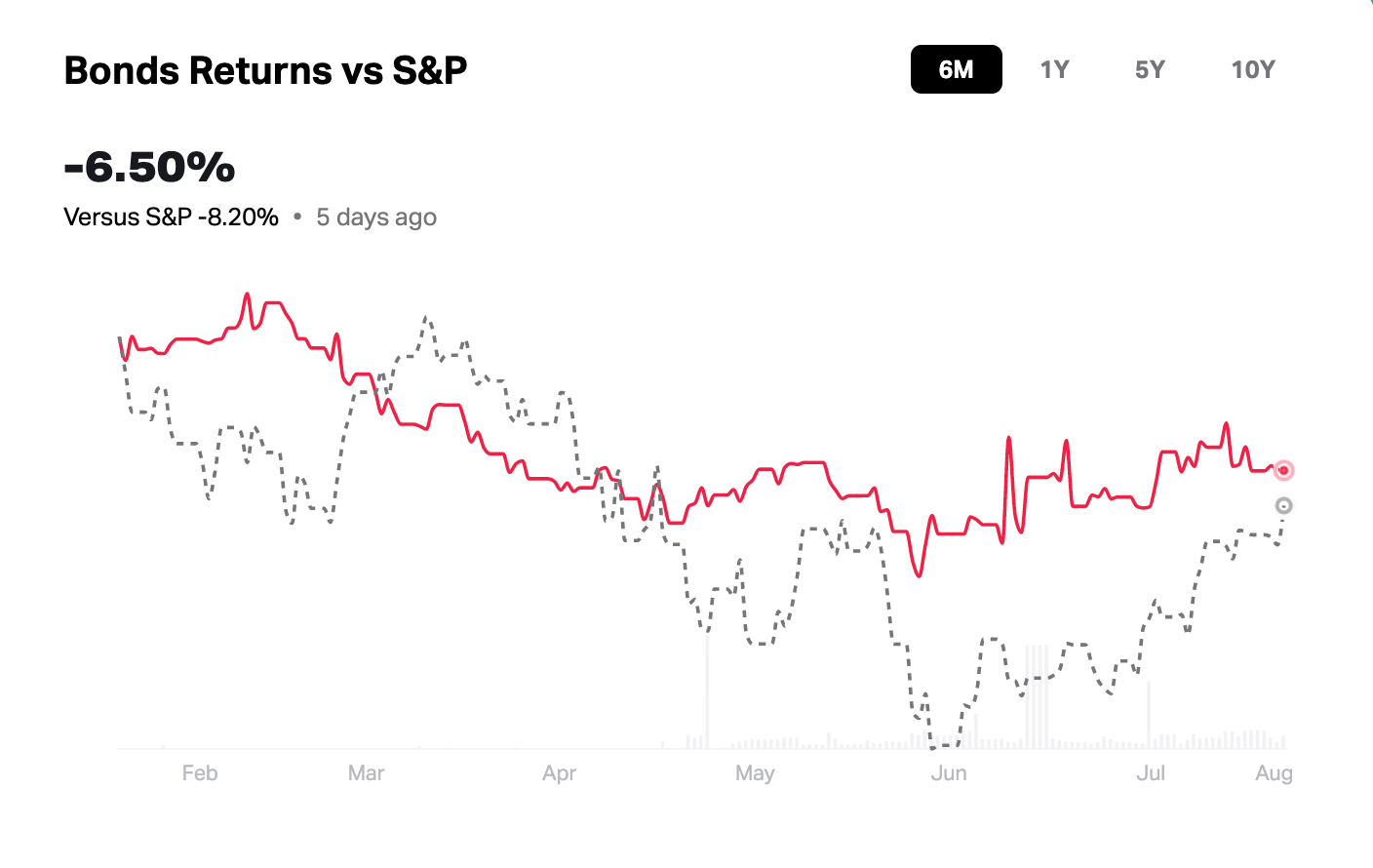

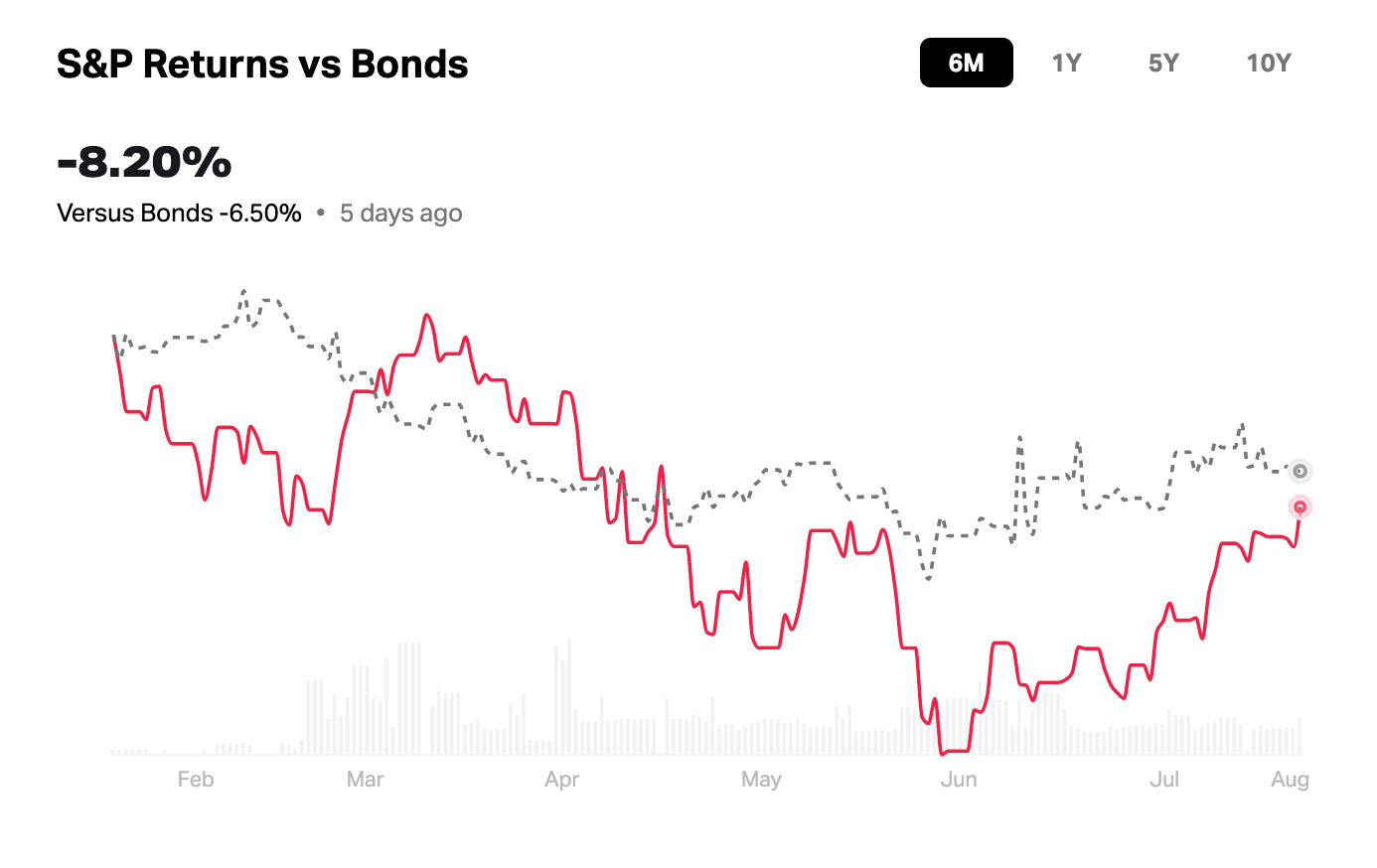

Stocks & Bonds

Bond Yields

- US10Y: 2.775%

- US30Y: 3.073%

Sustainable Gains?

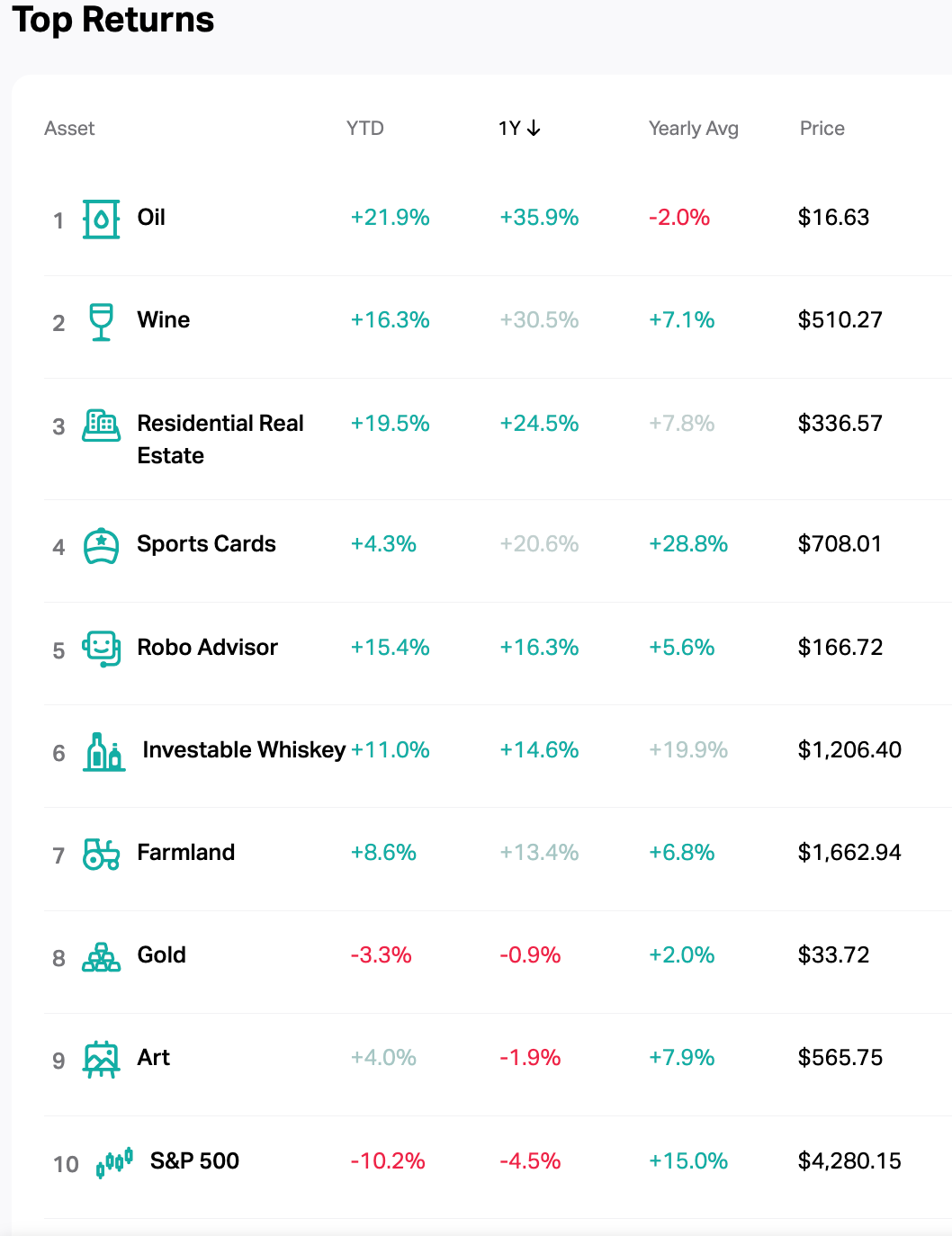

- All three major U.S. stock market indices saw gains this week, with the S&P rising for the fourth week in a row. But can these gains be sustained? That’ll depend on two key factors.

- Economic data out of China shows that manufacturing and retail sales and investment are all slowing down. The Chinese real estate sector is particularly hurting due to many homebuyers defaulting on their mortgage payments.

- Aside from that, this week investors will see a slew of retail earnings from the likes of Walmart, Target and Home Depot. Investor sentiment could switch on a dime depending on how much inflation and supply chain issues have cut into each company’s margins.

Sector Performance

- Energy: 6.61%

- Financial: 5.64%

- Consumer Staples: 1.26%

- Health Care: 1.41%

Dumping on Retail Investors

- The $2.369 trillion oil giant that is Saudi Aramco recently reported a 90% growth in its second quarter net income, which was a whopping $48.4 billion as compared to $25.5 billion the same time last year.

- Crypto exchange Coinbase posted a colossal $1.1 billion loss in Q2, as trading volume fell by 30% during this crypto downturn.

- Last week, Tesla CEO Elon Musk sold 7.92 million shares of Tesla, worth about $6.8 billion.

S&P 500 Winners & Losers

- Nielsen: 21.00%

- Principal Financial Group Inc: 14.61%

- Illumina: -6.57%

- Moderna: -6.43%

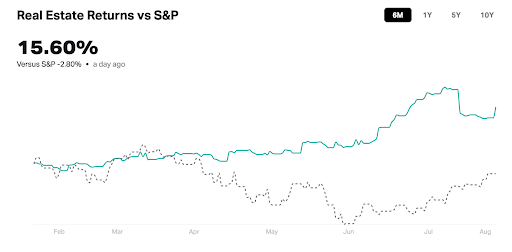

Real estate

Mortgage Rates:

- 30 Yr. Fixed Mortgage Rate: 5.33%

- 15 Yr. Fixed: 4.65%

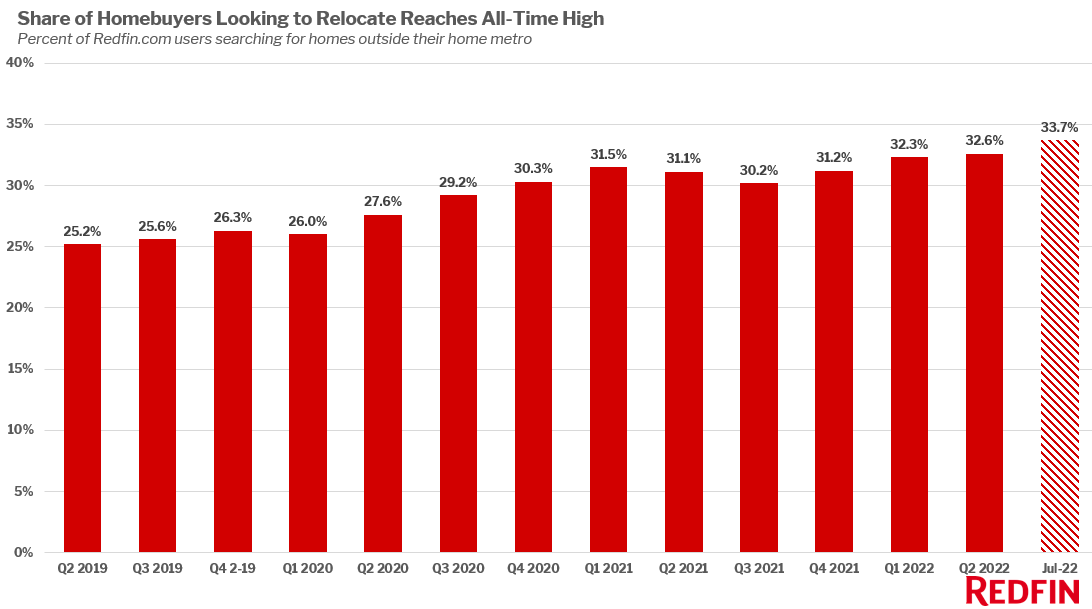

Gotta Keep Movin’

- According to real estate estate brokerage Redfin, a record 33.7% of its users nationwide looked to relocate to more affordable metros in July. During the second quarter of 2022, that number stood at 32.6%.

- The most popular migration destinations in July included: Miami, Sacramento, San Diego and Tampa.

- The National Association of Realtors also reported that housing affordability in June hit its lowest point since 1989.

Crypto & NFTs

Crypto Gainers & Losers

Bullish Signs Beginning to Appear

- BlackRock, the world’s largest asset manager with $10 trillion in AUM as of January 2022, just launched a private Bitcoin Trust for its institutional clients in the U.S.

- Ethereum’s price soared to a two-month high after successfully completing another pivotal test and setting the target date for the Merge to September 15.

The War on Crypto

- Last week the U.S. Treasury Department sanctioned Tornado Cash for its role in laundering more than $7 billion since 2019.

- Newsletter provider Mailchimp has recently deactivated multiple accounts belonging to crypto publishers, including Decrypt and Messari.

- Crypto investment firm Galaxy Digital reported over $500 million in “unrealized losses” on digital assets in Q2.

NFT Top Sales:

- Bored Ape Yacht Club #7863: $654.18k

- CryptoPunk #9400: $591.99k

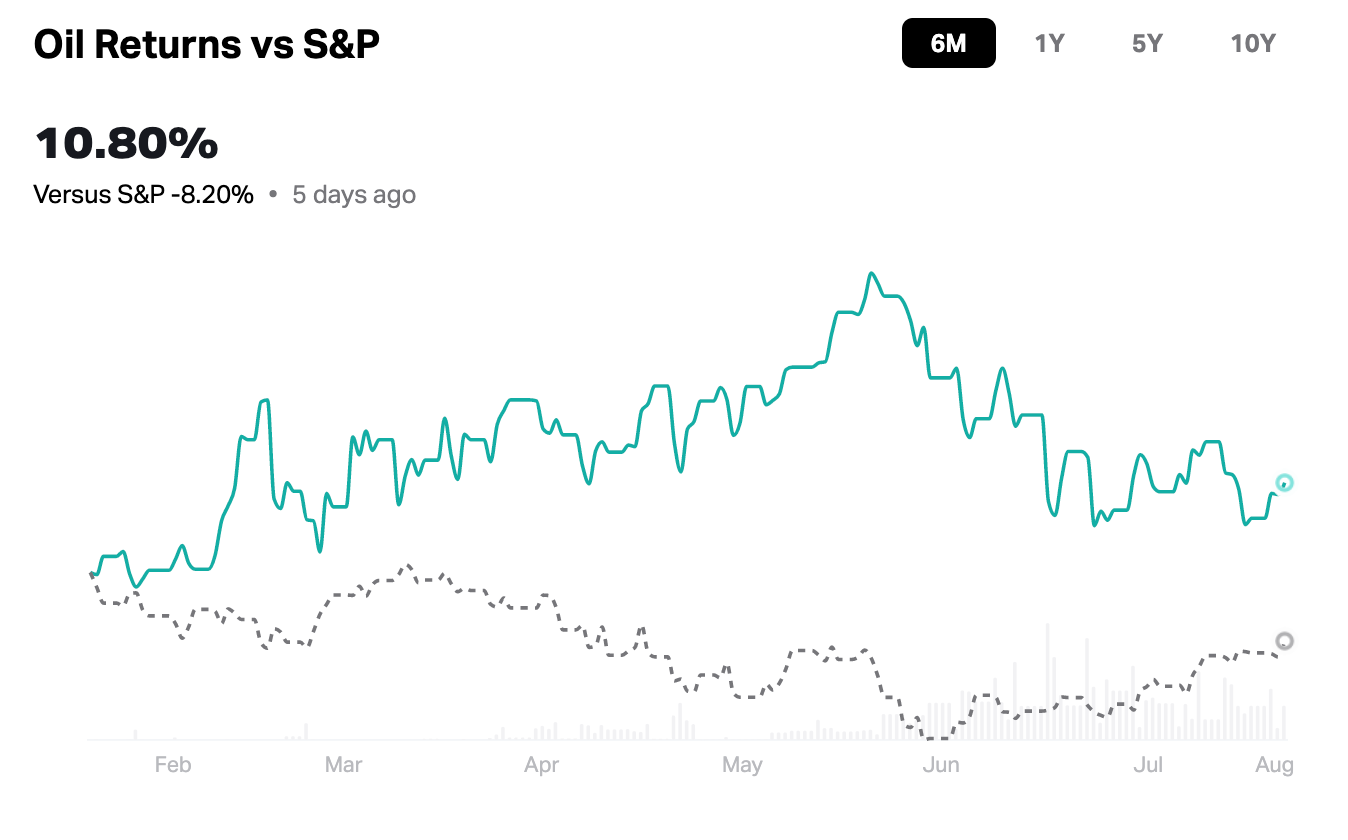

Commodities

A Deal with the Devil

- According to the latest figures from the United Nations’ FAO Food Price Index, food prices dropped 8.6% in July—particularly due to falling prices of wheat and vegetable oil.

- Some of the factors behind this sharp price decline include the Ukraine-Russia U.N. export agreement, decent crop harvests, and a strong U.S. dollar. Let’s hope these two warring countries continue to honor that export deal.

The Crude Bubble Pops

- Prices at the pump have fallen below $4 for the first time since March, after peaking above $5 in June.

- The main culprit behind this price dive is the U.S. oil benchmark WTI crude, which was trading at $88.22 per barrel on Monday—a far cry from its $130 price tag just a few months ago.

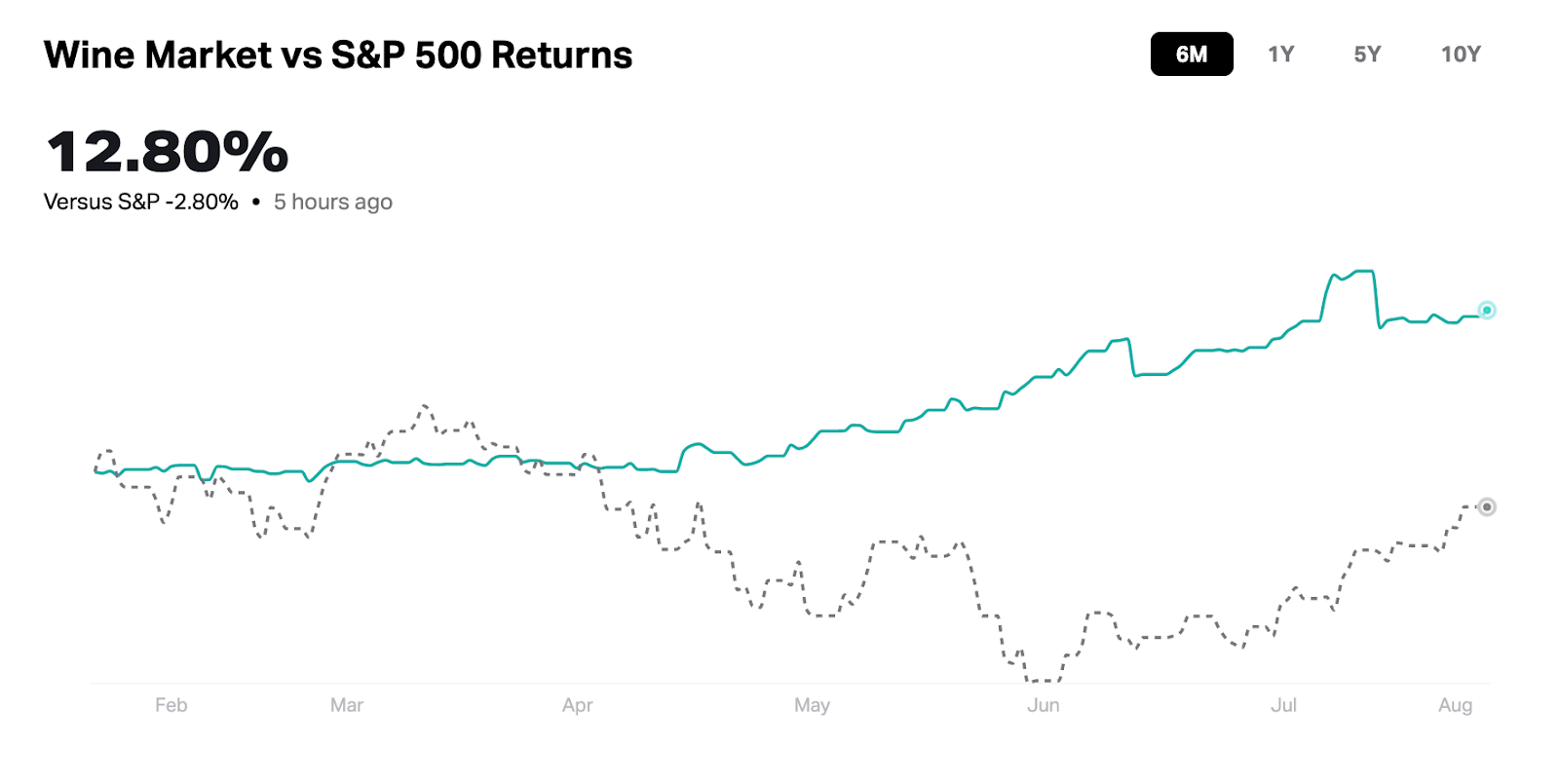

Wine

Fine Wine Gone Sour?

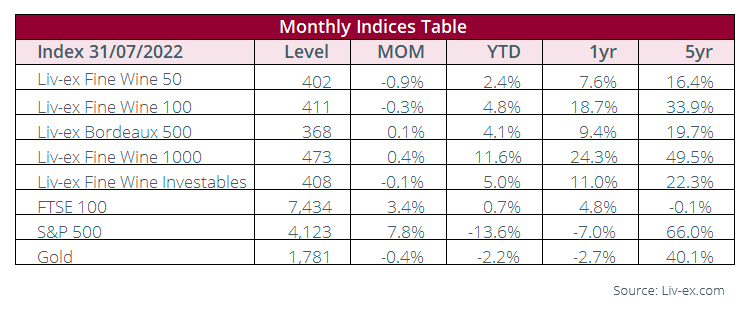

- Global wine marketplace Lix-ex just released their August Market Report, showing a slight month-over-month (MOM) decline in most of its wine indices. The Liv-ex Fine Wine 100 saw its first decline in two years (-0.3%), with the index rising by 36.1% from June 2020 to June 2022.

- The Liv-ex Fine Wine 1000, however, still managed to rise 0.4%. The Champagne 50 (3.1%) and Burgundy 150 (1.2%) were two of the best performing sub-indices in the broad market index.

Startups

$21 Billion Down the Drain

- Crunchbase reports another slow funding week, with only two rounds breaking the $100 million mark:

- CleverTap, $105M: A company offering customer engagement and retention tools.

- Overtime, $100M: A Kevin Durant-backed startup focused on creating sports video and social media highlights.

- A measly 14 companies joined the Crunchbase’s Unicorn Board in July 2022, the lowest number since August 2020. The biggest names on the list include:

- EV Co: A Mumbai-based electric vehicle company valued at $9 billion.

- Lionheart Studio: A South Korea-based online gaming company valued at $3 billion.

- Copper: A London-based crypto-custody firm valued at $2 billion.

- $67 billion investment firm SoftBank, known for its technology-focused Vision Fund that has backed the likes of Uber, WeWork and DoorDash, recently posted its second-biggest quarterly ever at -$21.68 billion.