Many companies on MoneyMade advertise with us. Opinions are our own, but compensation and in-depth research determine where and how companies may appear.

Aug. 23 Markets Report: A Dumptruck Named Recession

Biden signs Inflation bill, Adam Neuman gets a second chance, and U.S. bankers are caught using WhatApp (an apparent nono).

Macro

Macro Scoops OTD

- Energy and food shortages and rising prices stemming from Russia’s war against Ukraine have globally thrown 71 million people into poverty, according to the U.N. Development Program.

- The Kremlin blames Ukrainian spies for a car bomb that killed Daria Dugina, the daughter of Russian political ideologue and close Putin confidant Alexander Dugin.

- China unexpectedly lowered key interest rates for the second time in a week. This surprise move is likely a desperate attempt to stimulate the country’s stagnant economy and failing property market.

- Unemployment among China’s urban youth has reached a new record—19.9% among those aged 16 to 24.

- Citi Bank warns that surging energy costs in the UK may drive CPI inflation to 18.6% in Great Britain by January 2023.

US economics

- Interest Rates: 2.50%

- Unemployment Rate: 3.5%

- GDP YoY: -0.9%

- CPI YoY: 8.5%

Biden’s Big Bill

- Biden signed Democrats’ massive climate change and health care bill into law last Tuesday. The law:

- Imposes a 1% excise tax on companies’ purchases of their own shares. Taxes on stock buybacks could rake in $1 trillion this year.

- Pours about $385 billion into fighting climate change. It will encourage clean energy production and incentivize the reduction of carbon emissions.

- Introduces a tax credit for electric car purchases. Only people up to a certain income are eligible.

- Fed Chairman Jerome Powell will speak on the central bank’s economic outlook at their annual Jackson Hole retreat this week. Wall Street will have its eyes and ears on his speech this Friday.

- Financial regulators are seeking over $1 billion in fines from major banks like Bank of America, Morgan Stanley, JP Morgan Chase, Goldman Sachs, Barclays PLC, and others for employees’ alleged use of personal messaging apps like WhatsApp as well as email.

Stocks & Bonds

Bond yields

- US3M: 2.7116%

- US2Y: 3.3056%

- US10Y: 2.998%

- US30Y: 3.244%

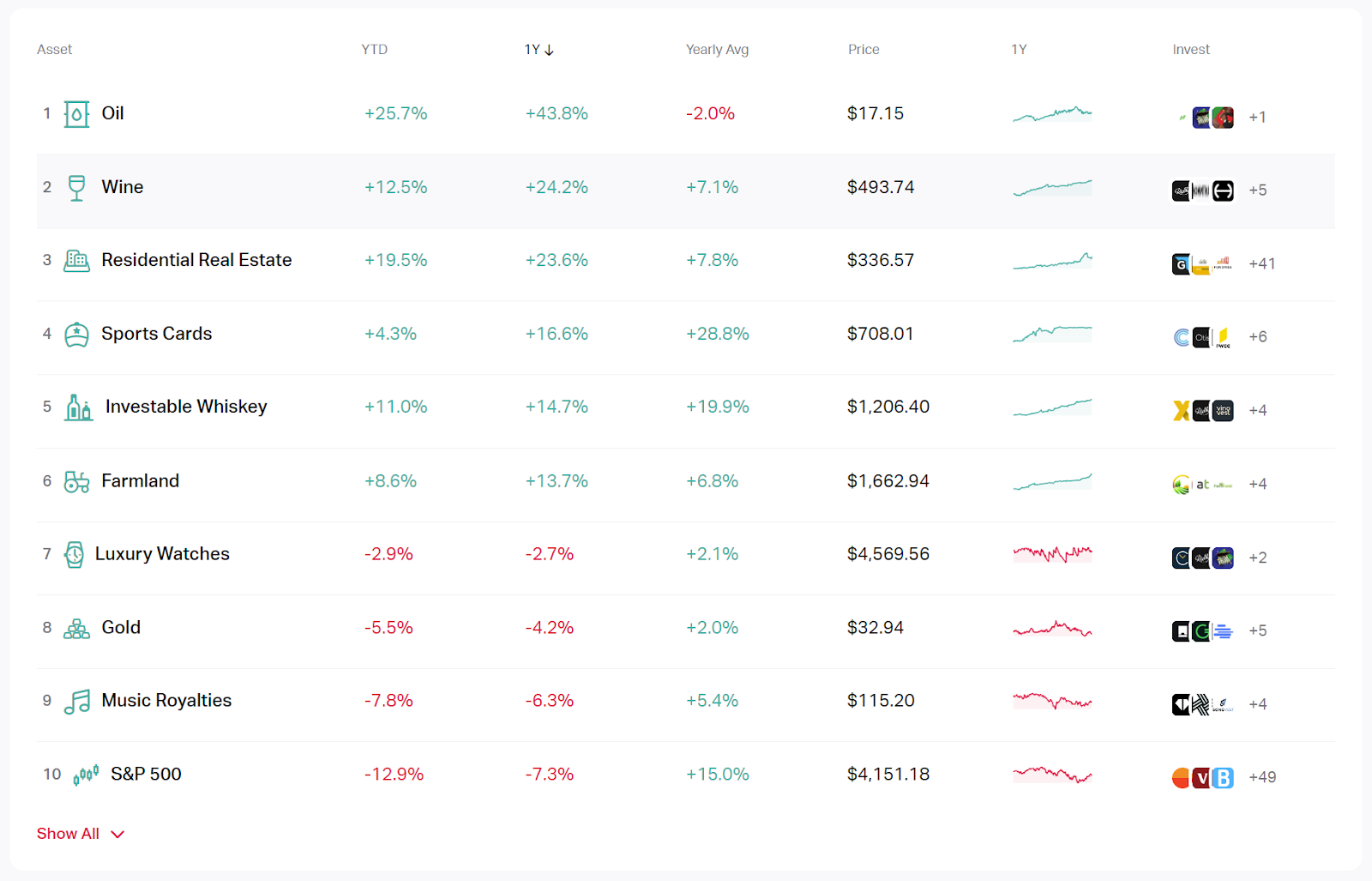

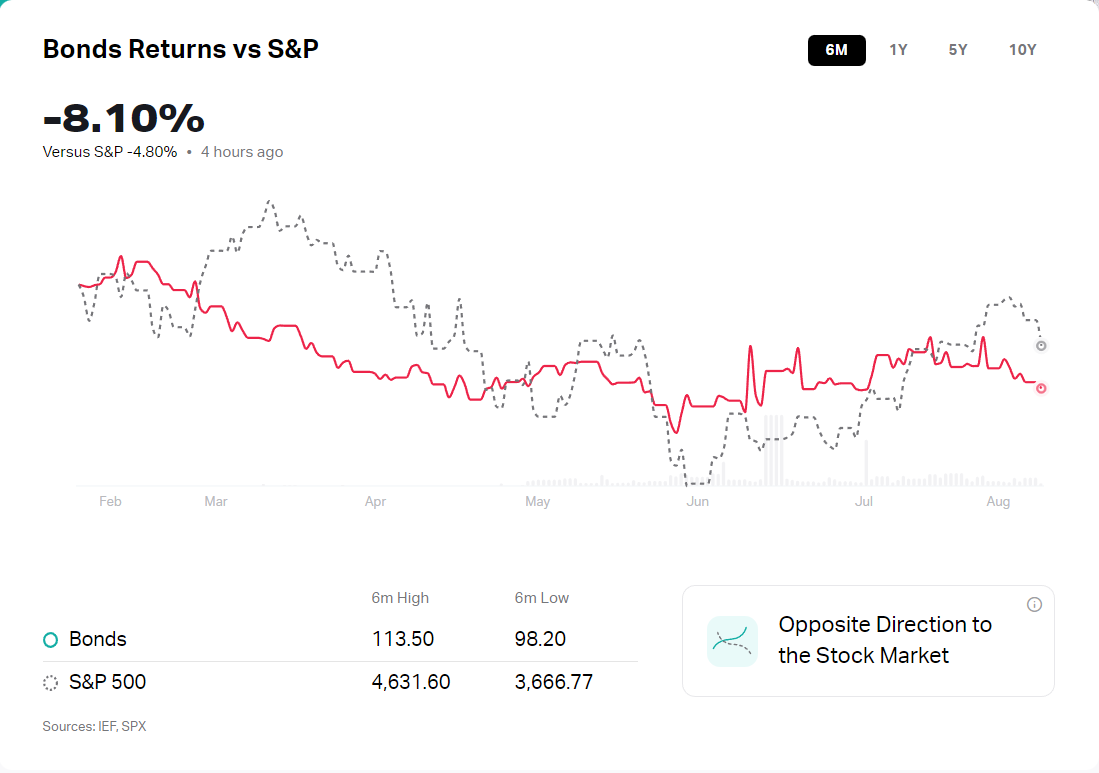

Make Bonds Great Again

- An analysis by Morgan Stanley Chief Cross-Asset Strategist Andrew Sheets found that holding cash is more attractive than stocks. Accelerated quantitative tightening—reduction in the Fed’s balance sheet—will deteriorate the appeal of riskier assets in favor of treasury bonds.

- Refinitiv reported that $4.1 billion in junk bonds were sold in the U.S. this past week, marking the highest issuance level since early June. S&P Global Rating expects 3.5% of junk bond issuers to default on their debt in the next 12 months, and ICE Data Services found that 6% of junk bonds—roughly worth $90 billion—are in distress (defined as yielding at least ten percentage points more than treasuries).

- Prices for meme stocks fell across the board on Monday:

- AMC dropped 38% after offering new APE preferred share class

- BBBY dropped over 12% after it was reported that the company’s suppliers stopped shipments due to outstanding bills. The dumping of shares by investor Ryan Cohen also contributed to the decline.

- GameStop shares dipped 4.3% as revenue from their NFT marketplace took a plunge.

- Ford promised to appeal a $1.7 billion class-action verdict that connects the automaker to a pickup truck crash that killed a couple in Georgia, USA. CEO Jim Farley said that Ford “continue[s] to be hampered by recalls and consumer-satisfaction actions” in an earnings call last month.

Sector performance

- Energy: 3.03%

- Consumer Staples: 0.88%

- Telecom: -3.74%

- Real Estate: -2.40%

S&P 500 winners & losers

- Coterra Energy Inc: 6.28%

- Occidental Petroleum Corp: 4.99%

- Moderna Inc: -17.84%

- Match Group Inc: -13.31

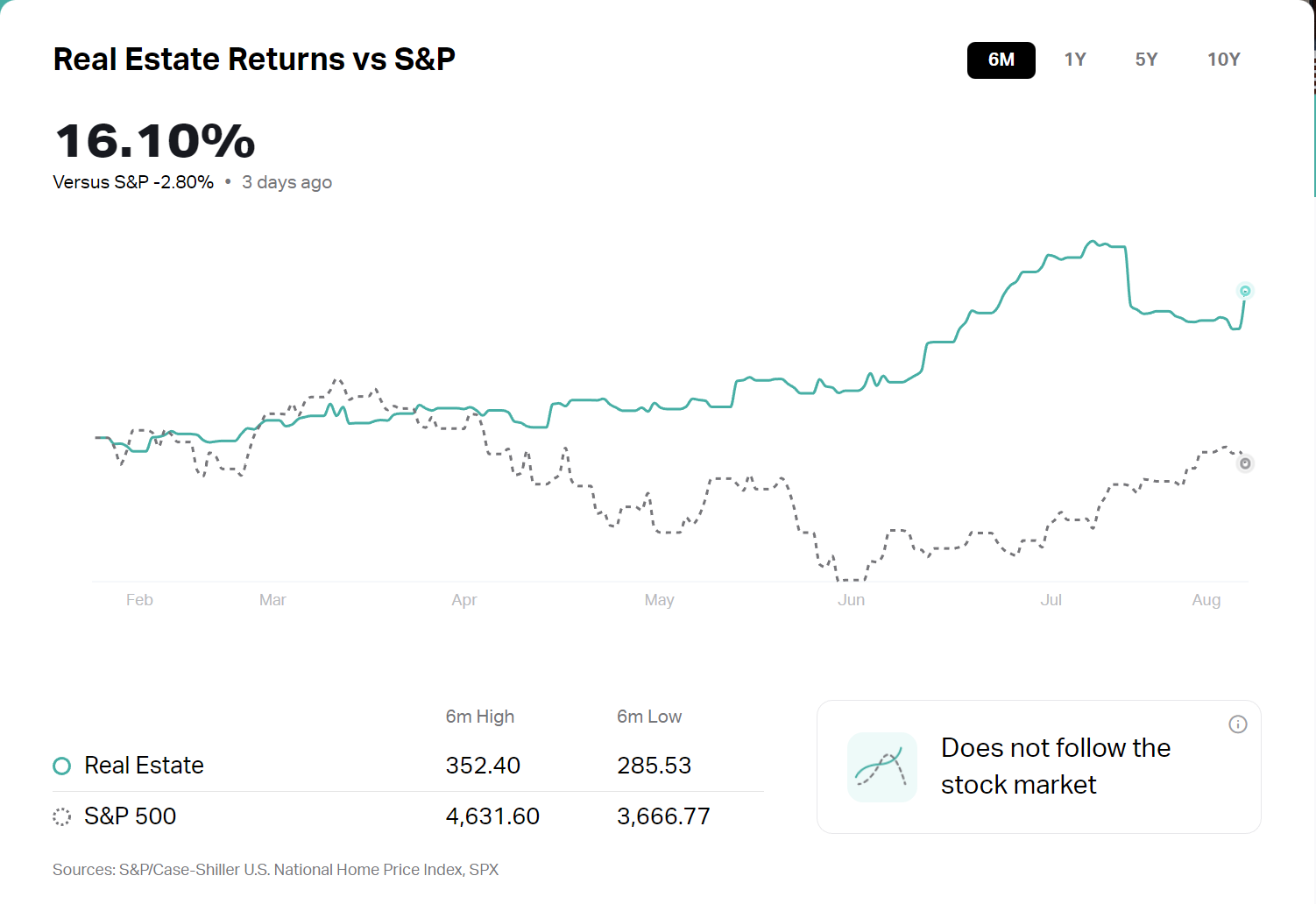

Real Estate

The Housing Market is Hurting

- Home sales dropped 20.2% since last year and 5.9% from June to July, marking the sixth consecutive month they fell. Meanwhile, the inventory of unsold houses rose to 1.31 million at the end of July.

- National Association of Home Builders Chief Economist Robert Dietz declared a housing recession as costs rise and home affordability declines due to supply chain issues and high federal interest rates.

- National Association of Realtors economist Lawrence Yun said that home sales and home building are in a recession, but not home prices.

Crypto

SBF Gets the Bag

- Bankrupt cryptocurrency brokerage Voyager Digital got heat from its creditors after saying it’ll hand out $1.9 million in bonuses to retain 38 of its key employees.

- Leaked documents revealed that FTX made $1.02 billion in 2021. If true, this means that the revenue from Sam Bankman-Fried’s crypto exchange spiked 1,000% from $89 million at the year’s start.

- FTX.US got a cease-and-desist letter from the FDIC for allegedly misleading consumers regarding whether their funds are federally insured.

- Binance CEO Chanpeng “CZ” Zhao allegedly subtweeted Bankman-Fried for trader’s orders getting stuck on FTX in a rare bout of online drama between crypto founders.

- Seven South Korean financial brokerages have begun seeking preliminary approval to launch virtual asset exchanges. This embrace of cryptocurrencies contrasts with the aftermath of the Terra Luna collapse, which a Korean firm had developed.

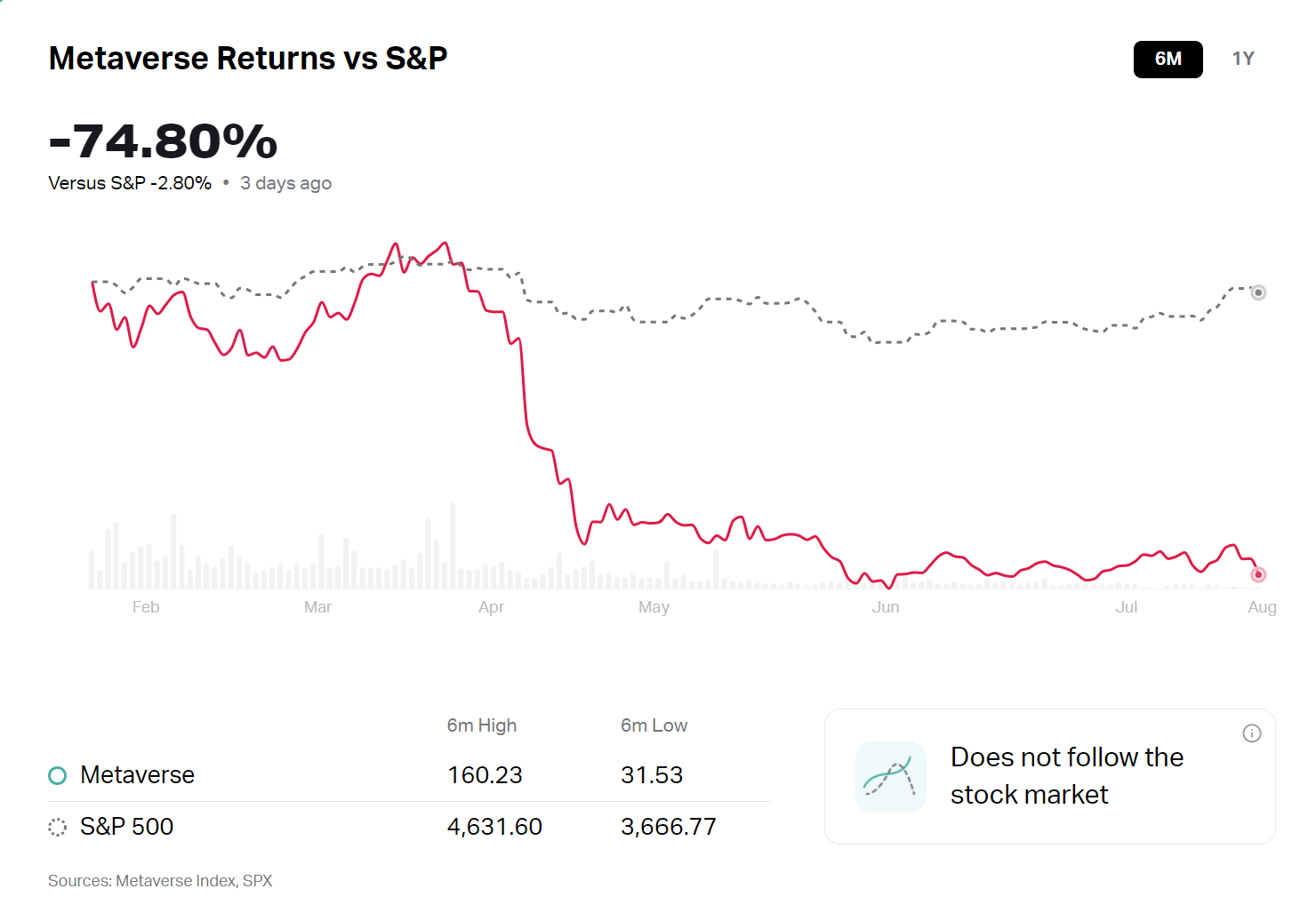

NFTs & Metaverse

From Metaverse to Mainstream

- Asset management firm Invesco launched a $30 million Metaverse Fund. The fund will be actively managed to invest in seven key areas, including blockchains, hardware, operating systems, and artificial intelligence and will charge investors a 0.75% management fee.

- Decrypt reported that the CryptoPunks floor price briefly surpassed that of Bored Ape Yacht Club. They found that BYAC NFT prices hit an 8-month low over the weekend after falling 33%—Punks’ prices only dropped 24%.

Commodities

Gas Exports Hit the Breaks

- Erdogan and Putin are getting cozier and cozier. Turkey doubled Russian oil imports this year compared to last year, as per Refinitiv Eikon data, and remains one of the only countries not to sanction Russia in response to its military actions.

- Gas shortages may cripple German industries like steelmaking and pharmaceuticals. If the war continues, Germans may have to ration their gas supply if stockpiles don’t last the winter.

Startups

Second Chances?

- Adam Neumann, the co-founder of famously failed office-sharing unicorn WeWork, got Andreessen Horowitz (a16z) to invest $350 million into Flow, his new residential real estate startup, valuing it at over $1 billion.

- The firm also gave Neuman $70 million to start a web3 carbon credit platform called Flowcarbon. The connection between Nueman’s two companies remains unclear.

- Fund-day Monday—Crunchbase reported some major funding this past week in energy and biotech.

- Bill Gates’s nuclear energy company TerraPower raised $750 million in a funding round led by the South Korean SK Group.

- Cambridge, Massachusetts-based biotech Orna Therapeutics mustered $221 million in Series B to develop RNA therapies.

- Senda Biosciences, another Cambridge biotech firm developing programmable medicines, got $123 million in a Series C round.