Turning the Stables: Tether vs USDC, Which Will Be the Best Stablecoin?

Stablecoins are a lot like cars—reliable ones are made by reputable companies and the rest won’t get you very far. Now the race is between Tether vs USDC.

With crypto investors increasingly looking to minimize risk while still combating inflation, stablecoins have emerged as one of the most popular ways to do just that. Stablecoins like USD Coin (USDC) and Tether (USDT) offer a way to hedge against the volatility of crypto while also benefiting from blockchain technology.

Both USDT and USDC are pegged to the US dollar, and they’re two of the most popular stablecoins—but they’re far from being the same thing. So what’s the difference between USDC and USDT? And when it comes to comparing USDT vs USDC, which one is better?

What are stablecoins?

Stablecoins are cryptocurrencies pegged to the value of an external asset. The best stablecoins are linked to the value of fiat currencies, mainly USD. The safest stablecoins are issued by companies that act as central authorities for ensuring that each token is backed by an asset in the real world. The top issuers in the stablecoin market are Tether and Circle which create USDT and USDC, respectively.

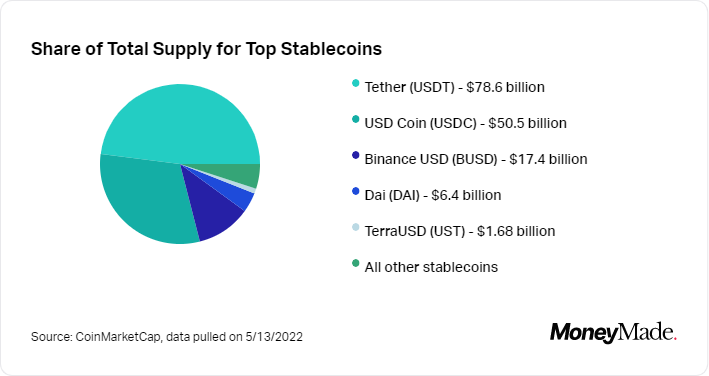

USDT and USDC are the two biggest stablecoins by a long shot. Tether comes out on top with a market cap of over , and USD Coin isn’t far behind with a market cap of . The next biggest stablecoin, Binance USD (BUSD) trails pretty far behind them both with a market cap of . USDC and USDT are very similar in that they’re both equal to the U.S. dollar and are issued on multiple blockchains, such as Ethereum and Solana. However, they’re not indistinguishable. So if the matchup was USDC vs USDT, which one would win?

USDC and USDT are very similar in that they’re both equal to the U.S. dollar and are issued on multiple blockchains, such as Ethereum and Solana. However, they’re not indistinguishable. So if the matchup was USDC vs USDT, which one would win? In order to answer that, you’ll first have to learn how the sausage is made, so keep reading if you think you can stomach the answer.

USDT vs USDC: Comparing the two stablecoins

In theory, there’s no difference between USDC and Tether and the things setting them apart are negligible on paper: They’re both blockchain tokens serving as stand-in assets for the US dollar on a given blockchain, and market cap is their major distinction. Additionaly, USDT and USDC are not perfect substitutes for the US dollar since they can’t be deposited into a bank account and are largely not accepted by businesses.

Nevertheless, Stablecoins introduce the utility of the dollar as a medium of exchange to the crypto ecosystem without the limitations of fiat currency. In practice, however, the differences between the two couldn’t be more inherent. USDC functions exactly as intended, but the same isn’t certain for Tether.

| Tether (USDT) | USD Coin (USDC) | |

| Issuer | Tether | Circle |

| Year established | 2014 | 2018 |

| Market cap | ||

| 24 hour trading volume as of 5/13/22 | $87.8 billion | $8.3 billion |

| Pegged to | USD | USD |

| Value | 1 UDST = 1 USD | 1 USDC = 1 USD |

| Reserve assets | Fully backed by traditional currency, cash equivalents, and receivables from loans made by Tether to third parties, which may include affiliated entities | Fully backed by cash and short-dated U.S. government obligations |

| Markets | Binance, KuCoin, FTX, Huobi Global, Bybit, Kraken, Bitfinex | Binance, Kraken, Uniswap, KuCoin, Coinbase, Huobi Global, Bybit, Gemini |

Circle’s USDC

USDC is issued and controlled by the Centre consortium, an entity founded by Circle and Coinbase. Centre is the only company that can create or destroy USD coin, sort of like how the Federal Reserve controls USD—the USDC supply is effectively determined by Centre. Other than the fact that USDC’s value is derived from USD, the major distinction is that Circle exercises full control over USDC.

USDC is the best of both worlds, providing the utility of cryptocurrency and the stability of fiat money. The introduction of stablecoins like USDC curbs the volatility of the digital assets market since it eliminates the need for centralized exchanges. Before stablecoins, gains could only be realized by offloading crypto on a centralized exchange, but now users can use decentralized exchanges (Dex) to trade for stablecoins without needing to take assets off the blockchain.

Stablecoins like USDC also enable decentralized finance (DeFi) for users who don’t want exposure to volatile crypto assets. While USDC gives your dollars the freedom of blockchain, it is not 100% trustless or decentralized. Circle exercises full control over every USDC, which means they can change the market cap or stablecoin supply and have the right to revoke or void tokens for any reason. While USDC does keep you safe from volatility, having a central authority retain control over your money sort of defeats the point of crypto.

USDC volume

USDC has a total market capitalization of and a 24 hour trading volume of $8.14 billion as of May 2022. While it’s catching up to USDT in terms of market capitalization, it still lags well behind it in terms of trading volume. It’s currently the 2nd biggest stablecoin and 4th biggest cryptocurrency by market capitalization. USDC has also grown significantly since its market cap of $14.4 billion this time last year.

USDC availability

You can find USDC on most major exchanges. Some of the top markets for USDC include Binance, Kraken, Uniswap, KuCoin, Coinbase, Huobi Global, Bybit, and Gemini.

Is USDC safe to hold?

USDC is considered one of the safest stablecoins because it’s issued by a trustworthy entity and is 100% backed by some of the safest reserve assets possible—cash and short-dated U.S. government bonds. Circle publishes attestation reports every month on its reserve balances backing USDC, and it’s a licensed money transmitter in 46 US states.

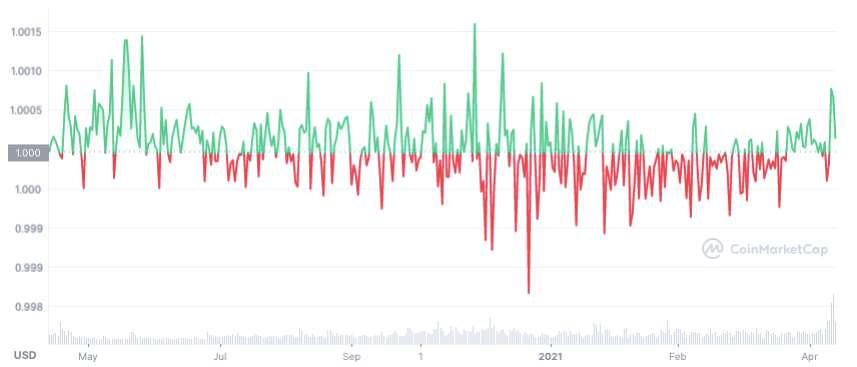

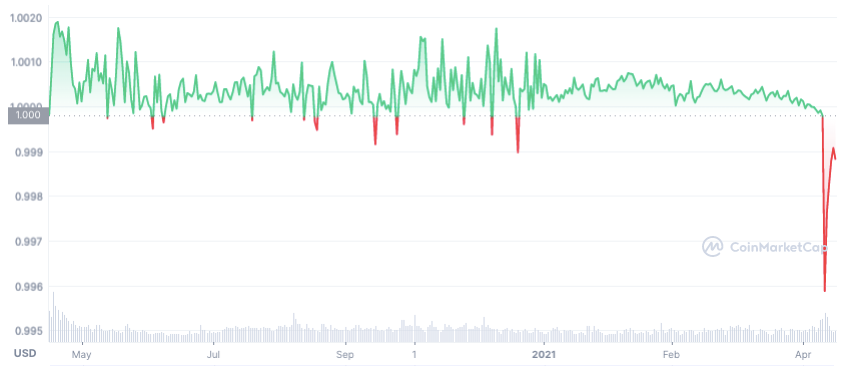

USDC has historically maintained its peg and remained stable, showing very little volatility. The highest it’s gone in the past year was $1.0015, and the lowest it dropped was $0.998.

Tether’s USDT

Unlike Circle, Tether has had trouble displaying sufficient transparency and accountability in its stablecoin issuing business. For one, Tether has a close relationship with the Bitfinex exchange, which experienced one of the biggest security breaches in crypto history. Bitfinex just recently finished paying a half-billion-dollar loan to Tether which was meant to help recover from the hack.

Aside from its questionable relationship to hacked exchanges like Bitfinex and Bitstamp, Tether is the epicenter of controversies all its own. First, Tether was hacked to the tune of 31 million USDT in 2017 and the company initiated an “emergency hard-fork” to brush it under the rug and save face rather than demonstrate accountability. This led to the New York Attorney General putting them in the hot seat when it was discovered that Tether was lending out its cash reserves. Tether couldn’t deliver a rational defense for not adequately backing their tokens with USD, so they instead antagonized the Attorney General as a way to feign victimhood and absolve themselves of responsibility.

Tether was able to get away virtually scot-free—an $18.5 million fine is basically a slap on the wrist—but this marked only the beginning of Tether’s legal trouble. A crucial revelation from the trial occurred when Tether’s legal counsel admitted that less than three-fourths of all USDT was adequately backed by fiat. This meant Tether lied about how USDT was backed, which has now culminated in them getting a $41 million fine from the US Commodity Futures Trading Commission.

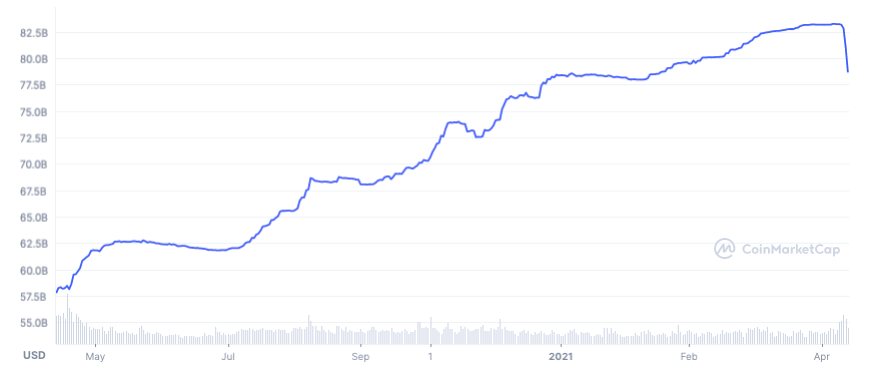

USDT volume

USDT has a total market capitalization of and a 24 hour trading volume of $86.3 billion as of May 2022. This places USDT well ahead of USDC it in terms of trading volume. It’s currently the biggest stablecoin and 3rd biggest cryptocurrency by market capitalization, behind Bitcoin and Ethereum. Tether has seen decent growth since its market cap of $58 billion this time last year.

USDT availability

You can find USDT on most major exchanges. The top markets for USDT include Binance, KuCoin, FTX, Huobi Global, Bybit, Kraken, and Bitfinex.

Is USDT safe to hold?

Many people consider USDC to be safer to hold than USDT because of the legal issues Tether has faced and the ambiguous nature of USDT’s reserve assets. While USDC is backed by cash and government bonds and undergoes regular audits to verify this, USDT is backed by “traditional currency, cash equivalents, and receivables from loans made by Tether to third parties” which is a little more vague. The fact that USDT is at least partially backed by loans made by Tether to affiliated entities has raised eyebrows.

That said, USDT has largely maintained its peg. Over the past year, the highest price USDT hit was $1.0020, and the lowest price it hit was $0.9959. This shows slightly more volatility than USDC, but it’s stayed at or very close to the $1.00 peg overall.

Playing it safe with USDC

USDC is one of the best digital assets for playing it safe when the crypto market is uncertain. Although having a central authority like Circle isn’t ideal, they’re a regulated and fairly transparent company. USDC is the closest thing we have to a digital dollar, but the catch is that Circle has the right to void any USDC that’s implicated in illicit activities like money laundering. Choosing USDC as your volatility hedge comes at the cost of financial independence since Circle is a single point of failure that will freeze your funds if the government asks them to.

The controversy behind Tether

The same applies to Tether and its relationship to USDT. Circle has earned public trust by upholding a positive reputation, but Tether is embroiled in controversy and stands as the embodiment of everything that can go wrong with unregulated centralization. Firstly, Tether has a very casual relationship with the truth. While there’s no definitive point where the lies begin and end, we know that Tether has been dishonest about how USDT is backed. It was revealed last year that only 2.9% of Tether was actually backed by USD and 75% was backed by commercial paper—a form of short-term corporate debt.

While the facts are unclear due to their lack of transparency, it seems as though Tether was basically the de facto central bank of crypto. Scrutiny from governments and regulators in the US meant Tether needed to somehow prove that USDT was fully backed, which led to Tether needing to reveal that commercial paper was propping up USDT. It’s uncertain whether USDT is fully backed by fiat currencies like USD.

Earning staking rewards with USDT and USDC

Stablecoins like USDT and USDC are popular because you can earn a generous interest rate by staking or lending them out on the right platform. The crypto lending program on MyConstant offers up to 12.5% APY on USDT and USDC through their crypto-lend program. Not only can this help you beat inflation and earn passive income on the side, but the platform also lets you withdraw your stablecoins for free at any time.

The bottom line

Despite being equal to the dollar, not all stablecoins are created equal. When it comes to USDC vs USDT, Tether might be one of the most popular stablecoins, but the company’s practices and vague relationship with exchanges make USDT less enticing to hold. This is opposed to USDC, which delivers the same benefits as Tether while not being implicated in any shady business or government investigations. While USDT still reigns supreme in terms of overall trading volume, this could change soon due to a growing sentiment that the more stable company has the superior stablecoin.