Capitol Traders: Get Market Insights With The Best Nancy Pelosi Stock Trackers

Keep your eyes peeled—the best Nancy Pelosi stock trackers let you monitor her $42 million portfolio that includes stocks like Apple, Facebook, Amazon, and AT&T.

As the former Speaker of the House of Representatives and a prominent political figure, Nancy Pelosi’s financial investments are often scrutinized. Pelosi’s stock portfolio has become a topic of interest among investors who are keen on tracking her trades.

Apps like Yahoo Finance, Sharesight, and Morningstar, provide investors with a near-perfect view of their assets and financial situations with minimal effort.

According to public records, Pelosi’s stock portfolio is valued between $42 million and $150 million—consisting of stocks from industries like technology, healthcare, and finance. Pelosi invests in tech companies such as Apple, Facebook, and Amazon, plus notable firms like Visa, Comcast, and AT&T.

Keeping track of every stock trade can be daunting. That’s where stock trackers come in. With these tools, you can gain insights into the portfolios of top traders like Nancy Pelosi and implement the investment strategies of members of Congress.

We’ll look at the best Nancy Pelosi stock trackers and how you can use them to your advantage.

How to track former House Speaker Nancy Pelosi stock portfolio

A stock tracker allows you to monitor stocks you’ve purchased and those of others you’d like to follow, such as Nancy Pelosi’s. These stock market apps may also be used to gather stock market news and access investment tools that help with research and analysis.

Nancy Pelosi stock trackers are online tools that allow investors to track the former House Speaker Nancy Pelosi’s stock holdings and trades. These trackers compile publicly available information from Pelosi’s financial disclosures and provide users with up-to-date information about her stock portfolio, including companies she has invested in and recent trades she’s made.

Additionally, tracking Pelosi’s stock portfolio can provide users with congressional knowledge—valuable information about market trends and what may be worth investing in. Stock trackers differ in their functionality, so it’s essential to pick one with the features you need.

Criteria for choosing a stock tracker

With the plethora of stock trackers on the market, it’s a bit tedious to find the best one. Here are the highlights of what to consider when choosing a stock tracker:

- Accuracy and reliability

- Frequency of updates

- Ease of use

- Portfolio analysis tools

- News updates

- Mobile app availability

- Pricing

Best Nancy Pelosi stock trackers

Whether you’re a beginner looking for a free way to track the trades former house speaker Nancy Pelosi or an experienced investor wanting access to advanced features, there’s an app to suit your needs.

Stock trackers like GuruFocus, Morningstar, Yahoo Finance, Stock Rover, Benzinga Pro, Seeking Alpha, and Sharesight each have unique features and benefits. Let’s break down each one and how they can make trading stocks easier.

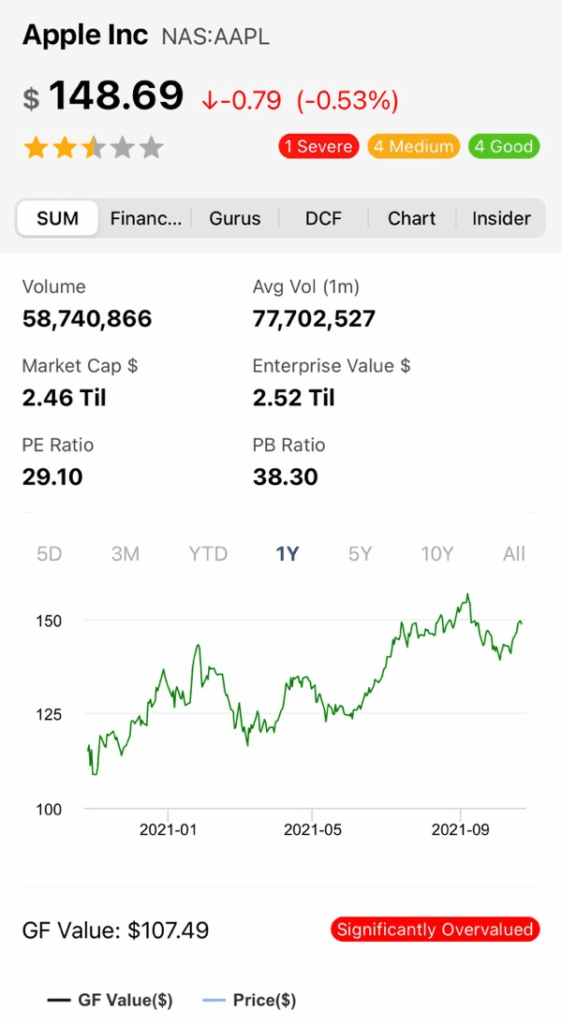

1. GuruFocus stock tracker

- Best for: Tracking individual stocks

- Pricing: Free to $5,210 per year

Pros and cons

Pros

- Free 7-day trial

- Access to important research, analyses, data, and picks

- All-in-one stock screener

- 24/7 customer support

- Mobile app available on all devices

Cons

- High annual fees

- Requires some investing experience

GuruFocus is an advantageous web-based money-related news and research utility launched by Charlie Tian in 2004. It surveys the trading activity of more than 175 experts, corporate administrators, and CFOs to give everyday investors insights into what the pros are trading.

Basic access to GuruFocus is available for free, and premium membership costs $449 per year for the U.S. market and $399 per year for the European and Asian markets. Users can also track real-time trades and portfolio holdings of investors such as Nancy Pelosi, Daniel Loeb, and even Bill Gates.

GuruFocus delivers information on corporate executives’ trading habits. The tracker provides dozens of useful investment features, making it a great choice for stock traders.

Source: gurufocus.com

2. Morningstar stock tracker

- Best for: Investment research

- Pricing: $249/year or $34.95/month

Pros and cons

Pros

- Research depth

- Easy to use

- Intuitive interface

- Access to important features

- Mobile app available on all devices

Cons

- High cost

- Clunky interface

- Complex for beginners

Morningstar is a valuable tool for those trading individual stocks by offering high-quality data and analysis at an affordable price. Founded in 1984 in Chicago, it has since become an essential tool for financial professionals, offering a comprehensive analysis of individual stocks, third-party analyst reports, fund screeners, rankings, and more.

To help people gain a more active approach to investing, Morningstar ensures its premium subscription cost is within reach. Users can save an additional $50 off the one-time $249 fee, so you pay just $199 for the first year.

For anyone looking to make more informed investment decisions, Morningstar might just be the way to go.

Source: morningstar.io

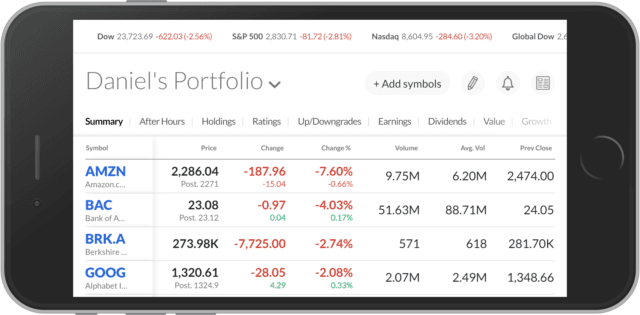

3. Yahoo Finance stock tracker

- Best for: Stock tracking and research

- Price: $0 to $350 annually

Pros and cons

Pros

- Free to use

- Ideal for research

- Perfect for analysis and live trading

- Easy to use

- Simple analysis

Cons

- No groundbreaking features

- Can’t buy and sell stocks

- Most features are only available on the Premium version

Yahoo Finance is the ultimate lifeline for any retail trader looking to blend their strategies of fundamental and technical trading. The platform is intuitive and easy to navigate with a customizable dashboard, so users get the most out of the features and data available.

With a 14-day free trial and a reasonable subscription price of $35 monthly or $350 annually, Yahoo Finance’s stock tracker is a steal. Speaking of features, Yahoo Finance Plus has got you covered. Stocking research, ratings, scanners, portfolio management, live trading, and expert stock analysis—these tools will make sure your portfolio is on track.

Source: dribbble.com

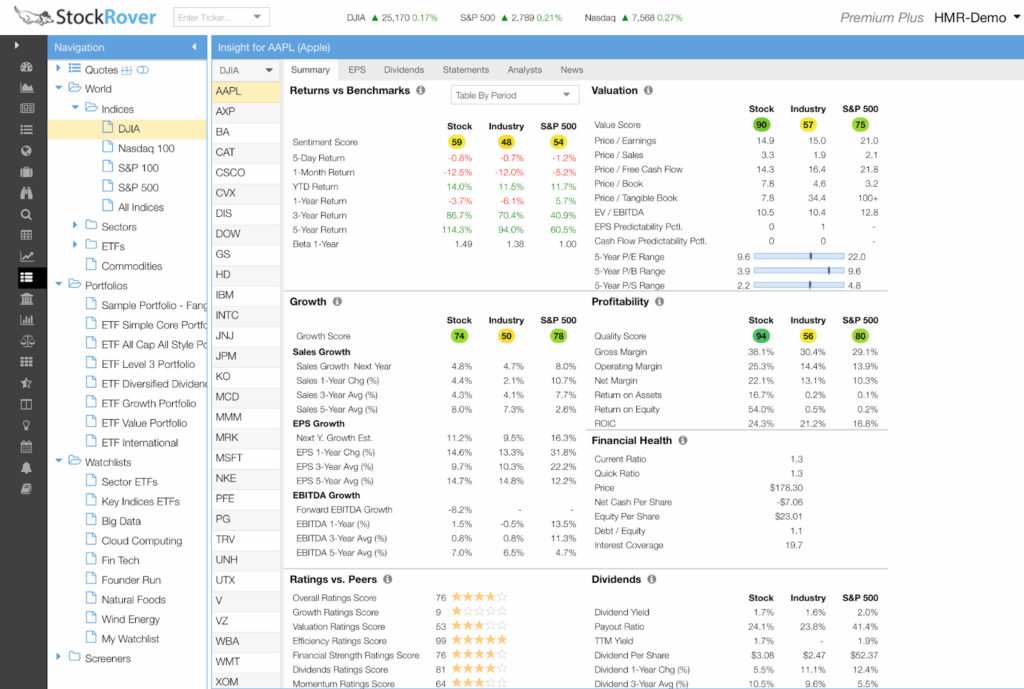

4. Stock Rover stock tracker

- Best for: Fundamental analysis

- Pricing: Free to $279.99 annually

Pros and cons

Pros

- Over 600 fundamental metrics

- Create custom metrics using logic

- Flexible charts

- Customizable alerts

- Portfolio tracking

Cons

- Overwhelming layout

- Low technical indicators

- Not robust enough for intra-day traders

Stock Rover is a powerful and user-friendly platform that allows investors to research stocks, find trading opportunities, and manage their portfolios. It’s perfect for both beginner and advanced active traders as well as long-term investors. Stock Rover offers a free plan and three paid tiers: Essentials, Premium, and Premium Plus.

Each plan offers a variety of unique features and benefits to help traders make the most of their investments. Stock Rover also provides customer support by email and phone and offers research reports, weekly market briefs, and educational content.

Overall, Stock Rover is a great tool for investors who want to take the guesswork out of stock research and portfolio tracking.

Source: stockrover.com

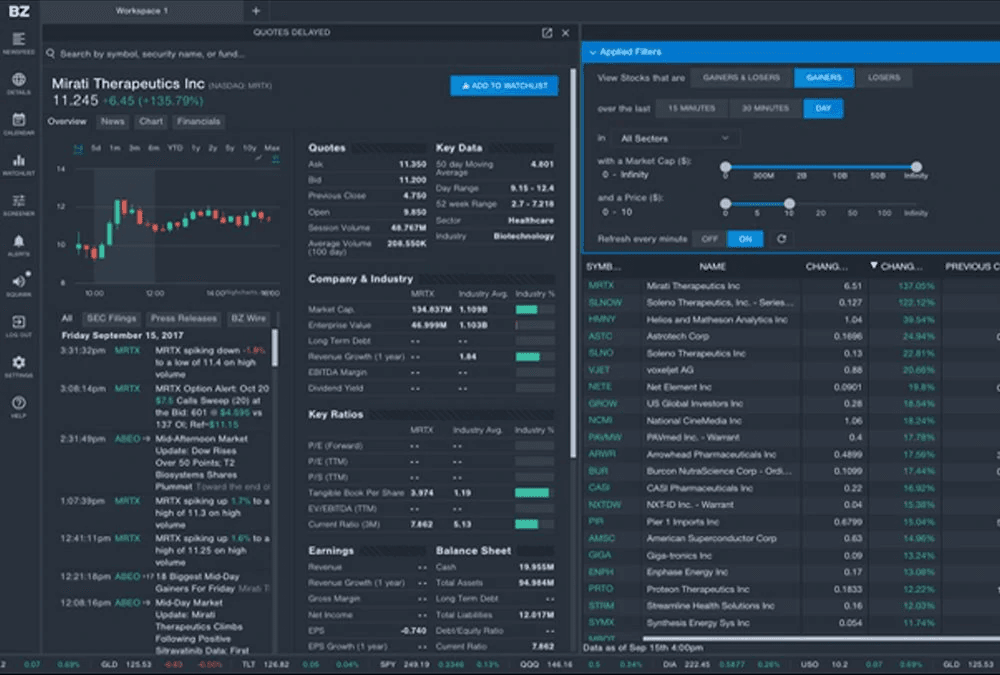

5. Benzinga Pro stock tracker

- Best for: Trading news distribution

- Pricing: $99 to $249/month

Pros and cons

Pros

- Faster news distribution

- Competitive pricing

- Exclusive stories

- 14-day free trial

Cons

- Only covers equities

- Squawk coverage is not 24 hours

- No real estate Investing

Benzinga Pro is quickly becoming the go-to resource for active traders and investors. With three affordable pricing tiers, users can access the most up-to-date market news and commentary from top experts at Benzinga Pro. The Basic plan provides essential live news, while the Essential plan offers all tools and features.

The platform offers a range of valuable features, such as a customizable news feed, an advanced news filter, a corporate calendar, newsletters, and a stock screener.

Benzinga Pro is the brainchild of Benzinga founder Jason Raznick and has a stellar reputation with a 4.5 rating on Trustpilot. With a range of advanced tools, Benzinga Pro is the perfect tool to add to any trader’s arsenal.

Source: tradingskeptic.com

6. Seeking Alpha stock tracker

- Best for: Stock news & research

- Pricing: Free to $69.99/month

Pros and cons

Pros

- Accessible and free to use

- Active community of investors

- Portfolio tracking

- High-quality articles

Cons

- Not for rookies

- Not ideal for mutual funds investors

- Limited free content

Seeking Alpha has created a great platform for active investors and swing traders. Founded in 2004 by David Jackson, Seeking Alpha was created with the individual investor in mind as a place where users can access stock news, analysis, and research with ease.

Seeking Alpha offers various membership tiers to meet the changing needs of its users. Its basic membership is free for beginners, but those looking for more exclusive access can pay for the premium or pro membership for just $29.99 and $69.99 per month, respectively.

With its intuitive design and years of experience, you can trust Seeking Alpha for all your investment and trading needs.

Source: seekingalpha.com

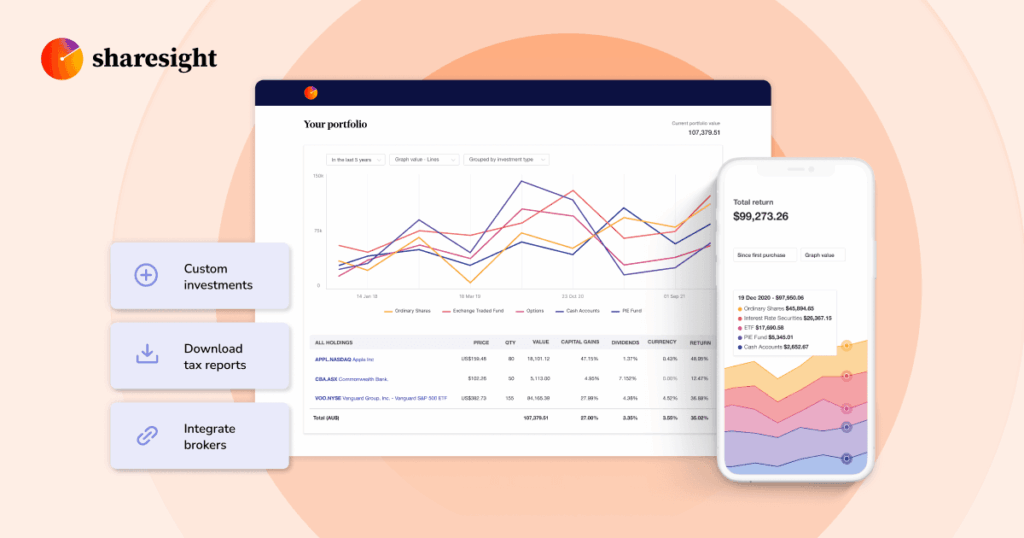

7. Sharesight stock tracker

- Best for: Portfolio tracking

- Pricing: Free to $21/month

Pros and cons

Pros

- Tracks investments across multiple accounts

- Creates dividend income report to forecast distributions

- Powerful tax reporting feature

- High customer ratings

Cons

- Limited support for crypto

- High cost

Sharesight is the perfect portfolio manager for anyone looking to get a handle on their investments. For starters, the platform was designed by a team of experienced financial software developers to create an easy-to-use portfolio tracker for their personal financial needs.

Sharesight supports stocks, ETFs, mutual funds, cryptocurrencies, and more, enabling users to manage multiple accounts and investments in one spot. It also has four account types, from free to expert plans, making it accessible to people of all budgets and experience levels.

Source: sharesight.com

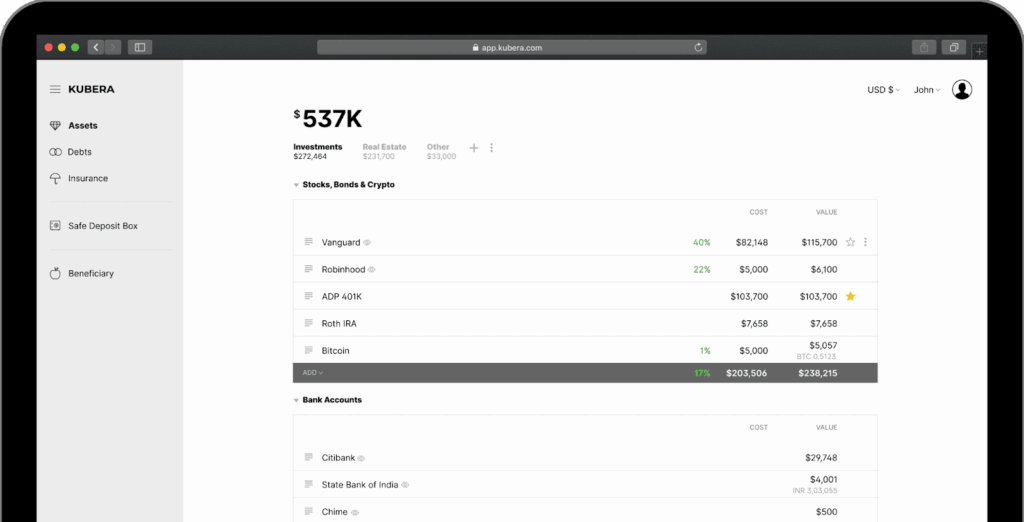

8. Kubera stock tracker

- Best for: Portfolio tracking

- Pricing: $12.50/month or $150/year for Personal Plan; $150/month for Standard Plan

Pros and cons

Pros

- Seamless connection with over 20,000 banks and brokers

- Allows listing of several asset classes

- Best-in-class cryptocurrency tracking

Cons

- No mobile app

- Relatively expensive

Source: kubera.com

Should you invest in a stock tracker?

Premium stock trackers can be an invaluable investment for anyone actively trading individual stocks. Apps like Yahoo Finance, Sharesight, and Morningstar provide investors with a near-perfect view of their assets and financial situations with minimal effort.

Additionally, trackers like Gurufocus can give you insights into the portfolios of experts like Nancy and Paul Pelosi and help identify potential investment opportunities based on their holdings and trades.

All of this, of course, can help you be the best stock trader possible and build successful and resilient portfolios. However, you should carefully consider what features work best for your needs and budget before committing to a particular platform.

With the right tools, you can harness the power of insider trading just like members of Congress do. And that’s the beauty of a free market economy.