Invest like Bill Gates with the Best North Dakota Farmland

Farmland is so great at fighting inflation that even Bill Gates is buying it. Here’s why Gates is investing in North Dakota farmland.

Bill Gates and his purchase of nearly 2,100 acres of North Dakota (ND) farmland made headlines earlier this year. According to Land Report, nearly 1% of the nation’s total farmland is tied to Bill Gates, making him the largest private owner of U.S. farmland. But why is a techie like Gates so interested in agriculture (AG)?

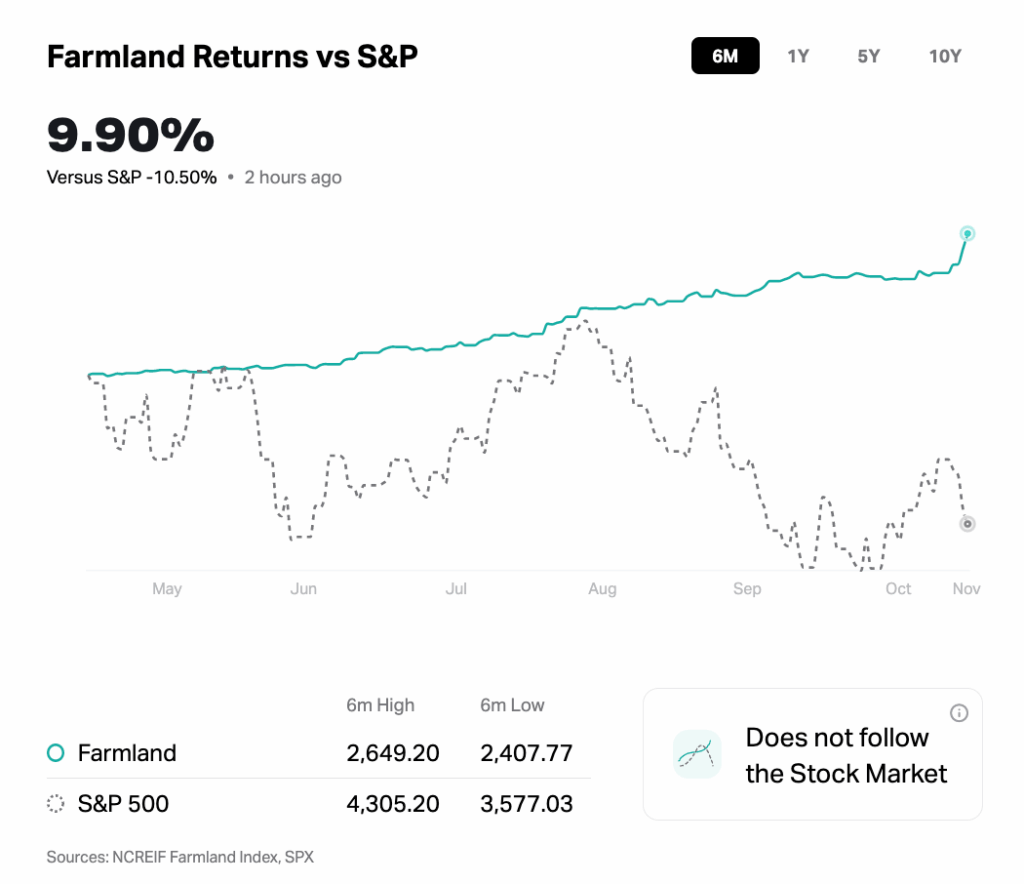

Farmland is an investment with a history of steady growth, can hedge against inflation, and isn’t closely tied to the S&P 500.

Farmland is an often overlooked asset class that has historically yielded steady growth. This is mainly because its performance is uncorrelated to fluctuations in traditional markets, such as those for stocks and bonds.

From an investment standpoint, Farmland is a way to diversify your portfolio and hedge against inflation. Inflation reached over 8% this year, so it’s understandable if you’re not eager to invest more of your dough in stocks.

Source: MoneyMade.io

Why invest like the nation’s largest landowners?

There are around 911 million acres of farmland in the U.S., according to the USDA. Despite the staggering amount of land, it’s still considered a scarce commodity and steadily increases in value over time.

According to a land values report from the USDA, farmland value has doubled for two decades straight, returning 112% from 2010 to 2020. Like an index fund or investing in real estate, the value of farmland usually goes up over the long term.

Hot Tip: Our in-depth study on farmland investing found that the asset class has returned over 385% with an average volatility of less than 3%.

Farmland returns are made from increasing farmland values and crop yields or cash rental income. For North Dakota AG, the farm real estate average value per acre increased by 12.6% from 2021 to 2022.

From a supply and demand perspective, farmland is an agricultural commodity that’ll always be in demand—we all need food, right? With a projected population increase of two billion by 2050, plus growing demand for richer diets, the world may need nearly double the amount of food to sustain itself—holy cow.

Since this trend is unlikely to reverse, farmland will only become scarcer and more crucial to civilization over the long term.

Farmland Benefits for Investors

- Low volatility: Historically, farmland had less volatility than most other asset classes, including the 10-year U.S. Treasury Bond, S&P 500, gold, and Dow Jones REIT Index.

- Isn’t strongly correlated with stocks: If the stock market goes down, your farmland investments may hold steady or even produce positive returns.

- Real asset: Crop income from commodities such as corn and grain makes farmland investments a real commodity, like gold.

- It’s an inflation hedge: Some investors consider farmland investments to protect their assets against inflation.

Chart tracking the value of U.S. farmland from 1970 to 2020 (adjusted for inflation).

Source: bloomberg.com

Why Farmland in North Dakota?

North Dakota is made up of nearly 90% farmland. Farmland in this state has rich, fertile soil that may yield commodities such as dry edible beans, pinto beans, canola, flaxseed, wheat, and honey. The Peace Garden State is also the second biggest producer of lentils, black beans, and sunflowers as of 2017.

ND’s soil, combined with the climate and weather makes it ideal for raising livestock and producing crops without irrigation. ND also made our list of the top 10 best states for farmland.

North Dakota Farmland Returns

Since 1990, the total returns for North Dakota AG have been positive. These come from two factors: the rising value of land and capitalization rates of the properties.

According to a 2021 survey by the American Society of Farm Managers and Rural Appraisers, the value of ND farmland went up by 28% that year, with an average of $3,172 per acre, statewide. That’s the highest price since 2013, when an acre went for $2,953 on average.

Source: quickstats.nass.usda.gov

In 2017, North Dakota’s agricultural profits totaled $8.2 billion with 81% of that coming from crop sales. The state produces 68% of its canola domestically.

It’s probably starting to make sense why Bill Gates purchased farmland in North Dakota and holds the largest private portfolio of farmland assets in America.

The Best North Dakota Farmland to Invest in

There are specific regions within North Dakota that are better suited for growing certain commodities. Here are the top farmlands in ND.

Drift Prairie

This region has a special kind of soil—it’s actually called “drift” and is made from a combination of clay, sand, and gravel. Honey, spring wheat, canola, barley, dry beans, corn, and soybeans are the biggest commodities produced there. Drift Prairie contributes to making ND the top producer of canola, honey, and wheat.

Missouri Slope and Badlands

Just the name lends itself to being a money maker for ND—dontcha think? Within the Missouri Slopes, you’ll find a backdrop of grazing livestock, including beef and dairy cattle as well as sheep. Commodities they grow here include sunflowers, potatoes, and honey.

Red River Valley

Red River Valley in the eastern part of North Dakota is fertile because of its close proximity to the Red River. The region is known for its dense black loam soil that’s ideal for growing soybeans, sugarbeets, spring wheat, and corn, dry edible bean varieties. The warm daytime weather and cool nights make Red River Valley make it a great place for growing these root crops as well as hosting hog farms.

Missouri Coteau

The next time you fix yourself a bowl of yogurt, topped with flaxseed and honey, you’ll have Missouri Coteau to thank. This area expands from the Missouri River to Drift Prairie and produces flaxseed, oats, honey bees and honey, lentils, and dry edible peas.

How to Invest in Farmland

You don’t have to be a tech billionaire or a farming insider to get a piece of the action. There are some ways to get started with farmland investing that won’t put you in debt.

REITs

Pros

- Low-cost way to invest

Cons

- These trade on stock exchanges, so they have market risk.

You can invest in publicly traded REITs (real estate investment trust) to gain exposure to an actively managed farmland portfolio. It’s an easy way to get started, especially with a smaller budget. REITs trade on stock exchanges, so they may be volatile if the stock market is shaken up.

Crowdfunding Platforms

Pros

- Less correlated to the stock market.

Cons

- Most platforms require investor accreditation.

If you want options outside the stock market, you may want to consider crowdfunding with FarmTogether or AcreTrader. These companies enable you to access farmland investments through their online marketplaces.

FarmTogether is an online marketplace that makes it simple for accredited investors to take advantage of North Dakota (and other states’) farmland. They provide direct access to specific farms or tap into funds with exposure to diverse farmland allocations.

AcreTrader provides accredited investors direct access to farmland, but requires you to invest a minimum of between $10,000 and $40,000.

Harvest Returns is a crowdfunding platform that offers a variety of ways to invest in farming and agribusiness, such as farmland and timberland. It’s mostly open to accredited investors with limited non-accredited deals.

Steward is a crowdfunding platform with a focus on investing in sustainable farms. You can participate in Steward Regenerative Capital and get started with a small minimum investment of $100.

Farmland Investing Risks

There’s no such thing as the perfect investment, and there are various things that may impact farmland’s profitability, such as increasingly dry weather, drought, and wildfires that can wipe out entire crop fields.

Interest rates can also influence farmers’ incomes and production costs. Also, the prices of farming materials such as fertilizer, chemicals, and seeds have reached all-time highs. These things make farms costlier businesses to operate, which means less profits for investors.

How to invest like Bill Gates in farmland

When Bill Gates first purchased North Dakota farmland, he may not have realized that a Depression-era law prohibits corporations or limited liability companies from owning farmland to protect family farms, although there are exceptions. Ultimately, Gates won approval from the North Dakota Attorney General to buy his land for $13.5 million from Campbell Farms.

This is relevant because, just like you, Gates isn’t a farmer. But he probably surrounds himself with experts to help him better understand the implications of owning farmland. You may not have a team of agriculture savants at your disposal, but you can use your good old-fashioned moxie to take initiative.

Start by researching online, talking to friends, colleagues, and brokers, or using sites like FarmTogether and AcreTrader to understand farmland investing through expert knowledge and data analysis.

Farmland has a history of consistent growth despite recessions, rising inflation, or stock market downturns. It’s a good portfolio diversifier that can be a cushion against inflation and a solid long-term investment. Make sure you take the time to get familiar with the investment options, understand the risks and where returns come from, and form an exit strategy.