Rising Ashes: How to Invest in the Niche Luxury Cigar Market

From Gurkha cigars to Fuente OpusX, find out why cigars are the next niche asset class and whether you should invest in them.

Have you ever stepped into a cigar bar and felt like you were embodying the Mad Men vibe? From pairings with a Scotch or bourbon drink to old leather-backed chairs and temperature-controlled storage rooms, cigar smoking has long been associated with politicians, wealth, and three-piece suits.

While not everyone is a fan of cigars or even cigarettes (cancer doesn’t look good on anyone), these tobacco-related products have become increasingly popular as an asset investment class, like whiskey, sports cards, and luxury watches. Some people don’t see cigars as something to smoke with friends at a cigar bar on the weekend but as an investment opportunity.

If you want to become a serious cigar investor, you need to know the market, including the key players.

But just how much can you make from investing in luxury cigars like Gurkha cigars? Sit back in your leather chair and relax as we pull the smoke back on luxury cigar investing.

Getting started with luxury smoke

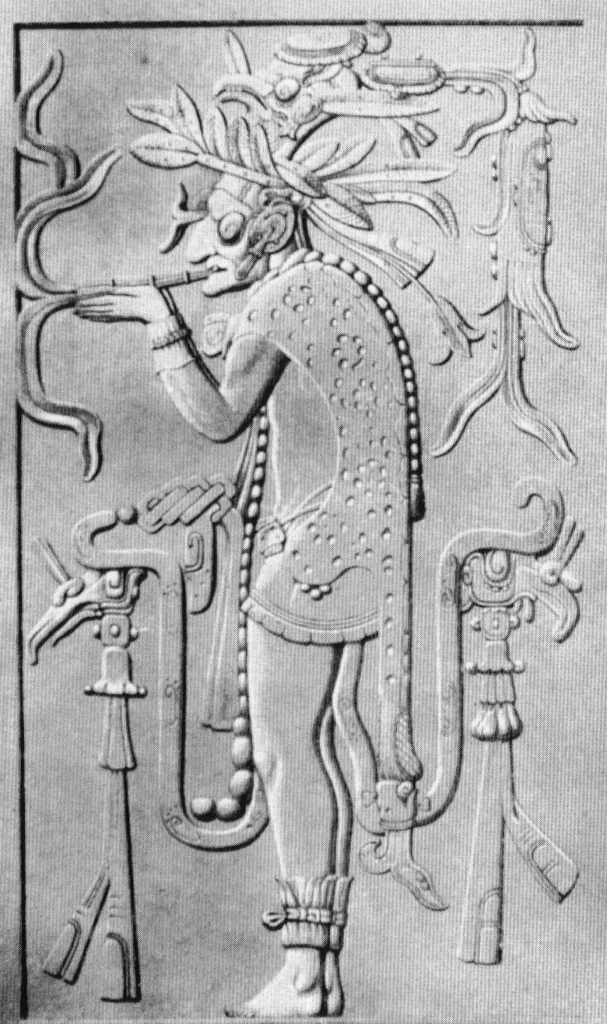

Cigars have a long history. They’ve been around for thousands of years. We don’t know exactly when they were invented, but temple carvings and pottery from the 10th century show Mayan men smoking the first tobacco leaves rolled up in either palm or plantain leaves. While the Mayans weren’t the only ones who smoked, they were the oldest recorded users, and smoking a cigar is still used in rituals today by some native tribes.

Depiction of a Mayan priest smoking a cigar from the Temple at Palenque, Mexico.

Source: Wikipedia.com

Cigars were later imported to the West after the discovery of the so-called New World. Cigars became popular around the globe after Europeans began growing the plant in places like Florida and Cuba and trading it around the world. Today premium cigars can be found in any cigar bar or any place that sells cigarettes, although not all are investment worthy.

Types of investment-grade cigars

The cigar industry as we know it today started in the 1990s with the start of limited-edition cigars. As the sector boomed, manufacturers needed to find ways to stand out. Special limited edition and exclusive cigars enabled their makers to charge a premium price, with value increasing even more on the secondary market. There are different types of cigars, with Cubans at the top.

Cuban cigars are considered the crème de la crème. This is partly due to their quality as well as their high demand. It’s been illegal to import Cuban cigars into the U.S. since the Cuban embargo in 1962, although the rules were relaxed somewhat during the Obama administration.

One of the key things to look for when buying a Cuban is to look at regional releases. Habanos SA, the governing body of the Cuban cigar industry, has several regional releases or certain brands that are only sold in one country. The UK, Spain, Italy, and Asia all have their own releases. The price of these regionals might be high, but the price skyrockets if you live in a distant country.

The other thing to look for are cigars that are not made anymore. For example, the Cubano Davidoff hasn’t been made in Cuba in decades, making it one of the most prized collections. A box can go for thousands of dollars and is likely to increase in value as time passes (although, like any investment, there’s no guarantee of a return).

A Gurkha cigar named after the legendary Nepalese warriors.

Source: gurkhacigars.com

There are other types of rare cigars that investors can buy as well, such as the Dominican Republic Gurkha. They are named after legendary Nepalese soldiers known for their ferocity, called the Gurkha. The Gurkha brand first came to the U.S. in 1990 and quickly sold out, leading to more demand and the crazy prices to match it. A rare Gurkha cigar can go for $750 or more apiece, making a Gurkha one of the most sought-after luxury cigars.

The Fuente Fuente OpusX is another great cigar for investors. The brand was created in the early 1990s after Carlos “Carlito” Fuente Jr. planted 37 acres of Cuban seeds in the Dominican Republic. The key distinction of the OpusX is its wrapper, which is a dark and oily Corogjo Cuban-seed wrapper. Fuente doesn’t sell any of the cured leaves from his farm, so it’s the only brand that makes cigars made with Fuente’s cured leaf. The OpusX can go from a few hundred to a few thousand dollars a case, depending on the edition.

A Fuente Fuente OpusX cigar known for its dark Corogjo Cuban-seed wrappers.

Source: cigaraficionado.com

What to keep in mind when investing in cigars

If you want to invest in cigars, there are a few things to keep in mind. First, if you light the cigar, your investment will also go up in smoke. Second, don’t open the box they came in. An unopened box is likely to be worth more than boxes with broken seals.

Storage is also key when investing in a luxury cigar. You’ll need to invest in a good humidor or find a place to store them properly. If a cigar is dry, it can go bad. And improper storage can decrease its value over the long term. Humidors are a box containing a humidifying system to keep cigars moist, and you can purchase one online for under $100.

Another thing to consider is age. Like a good wine investment or luxury scotch whisky investment, a premium cigar gets better with age. But that’s not because the cigar gets better. It’s because as time goes on, more are smoked, which means the box you hold onto goes up in demand and price. It’s simply supply-demand economics.

Are cigars a good investment?

The tobacco market is expected to grow by 2.4% by 2030 to $1.1 billion as new products, and marketing strategies by major industry players have increased demand.

Cigars, although less popular than cigarettes, are part of the growing market for nicotine products. And boxes of stogies can go for a few hundred to $1,000 or more at auction. But some have sold for even more, especially when bundled with a humidor. For example, the Arturo Fuente Aged Selection 2019 OpusX sold for $9,000, while the Cohiba Majestuoso 1966 humidors went for $4,000 when they were first sold and now go for as much as $52,000.

And in 2012, a collection of Mayan cigars thought to be at least 600 years old sold for $507,000 to Gary Liotta, the owner of the Santiago Cigar Factory in New York.

There’s no end to the luxury and wealth of a good smoke. The most expensive cigar in the world, the Gurkha Royal Courtesan, is wrapped in gold leaf and encrusted with five carat diamonds. And if that’s not enough, the Gurkha is infused with Remy Martin’s Black Pearl Louis XIII, which retails for $165,000 a bottle. Hand rolled with leaves filtered with Fiji water, this cigar costs a scolding $1 million each.

A box of Gurkha Royal Courtesans Cigars at $1 million ESRP.

Source: luxatic.com

How to invest in cigars

If you want to find a great cigar to invest in, you need to do your research first. Luxury cigars are a niche investment, but the market is quickly growing. If you want to become a serious cigar investor, then you need to become knowledgeable about the market—especially the key players.

There are a few ways to invest in the market, but the main one is to buy rolls at your local cigar bar, any shop where they sell cigarettes, or on a cigar store website like Fox Cigar in Arizona. Another great place to buy a luxury cigar like a Gurkha is through general auction houses like Goldin or specialized cigar auction houses like PuroTrader or Cigar Auctioneer. If you want to ensure you’re getting an authentic box, you can purchase them directly from cigar manufacturers.

Suppose you don’t want to buy some smokes directly. In that case, you can buy stocks in companies like Altria or Philip Morris or in exchange traded funds (ETF) that include tobacco companies, such as the AdvisorShares Vice ETF.

And if you don’t want to invest in a nicotine product, you could also look into other similar alternative investments like cannabis stocks, which is another budding sector now that recreational cannabis is legal in many of the largest states in the U.S.