The FaZe IPO: Are Esports Companies Next Up or Just a Phase?

FaZe is one of esports’ most recognizable names—the way investors treat its come-to-market moment might make or break the industry.

Say all you want, but the gaming industry is no game. The industry outshined the film and sports businesses in 2021, posting an estimated $180 billion in 2021 revenue according to data from global market intelligence firm IDC.

In 2022, that figure is expected to hit $208 billion—and by the end of the decade, the gaming biz will be worth more than every other segment of the entertainment industry combined. That’s probably unsurprising given the cultural impact of gaming. Video games permeate popular culture, Twitch and YouTube streamers have become celebrities, and the best players command impressive online clout.

While gaming titans like Activision-Blizzard, Twitch, Sony, Microsoft, and Electronic Arts sit at the forefront of this monstrous industry, scores of other businesses are cropping up around the culture of gaming and games. (And no, we’re not talking about all those Pokemon trading card businesses.)

The success—or failure—of FaZe Clan stock might change the trajectory of this niche industry.

Some of these up-and-comers are esports brands like FaZe Clan, which went public in a SPAC deal a few weeks ago. By doing so, it became the first major public esport company. That’s one reason why the success—or failure—of FaZe Clan stock might change the trajectory of this niche industry.

Let’s explore what esports companies are, what FaZe’s public debut means for the sector, and what can be said of its future.

FaZe’s Journey to Public Markets

On July 20, 2022, FaZe Holdings began trading on the Nasdaq. However, one could argue that the company began trading way before—back in October 2021.

Source: Nasdaq

That’s because FaZe Holdings went public through a unique arrangement called a special purpose acquisition company (SPAC). FaZe announced its intention to merge with a SPAC in October, kicking off a months-long business acquisition.

However, during that time, the SPAC didn’t get a whole lot of love. There’s a number of reasons why, but the biggest one was that special purpose acquisition companies have lost a lot of their luster on Wall Street because of changing attitudes and their association with “risky” businesses.

Fast forward: FaZe shares have started changing hands—and some very volatile hands at that (definitely not the diamond hands we’ve seen from the meme stock investing crowd). The stock has seen days where it rose over 42% and, on its worst day, lost a third of its value.

That volatility shakes hands with FaZe Clan on one thing: it’s a risky business that has never generated a profit and is generously overvalued. In 2021, the company reported $53 million in revenue—and a net loss of $37 million.

In spite of that, after one month as a public company, FaZe shares have risen more than 60% and notched a $1.2 billion valuation.

Earnings data from the company suggests that it will make about $70 million this year. This valuation means the company is trading at about 18x its annual recurring revenue (ARR), which is really generous given the company’s background and history. In fact, such a valuation implies that FaZe is being treated like a tech company.

However, just because the stock price is doing well now doesn’t mean that it’ll last. Wall Street might be paying a premium for a first-mover in the esports biz, but to discern whether or not FaZe and other esports leaders will have staying power you must understand why investors are paying to put FaZe Clan in their portfolio.

How do esports companies make money?

In 2022, FaZe is expected to make about $70 million. Where does that money come from?

The answer is a confusing one, in large part because esports—where pro gamers compete in tournaments in popular games like Fortnite and League of Legends—isn’t actually where these companies are making most of their moolah.

It’s not because the prize pools for winning these tournaments aren’t great, but rather because of other value drivers in the business: sponsorships and partnerships, merchandise and members, and eyes and ears.

In that sense, FaZe Clan and its competitors fall at a unique intersection bridging gaming, the metaverse, culture, and advertising. These businesses often sign popular streamers, creators, artists, and gamers to their brand. Then, they sell branded content and owned media to companies.

What does that look like practically? A company like McDonald’s, Mercedes Benz, or FTX paying millions of dollars to get their brand logo on the live streams of popular streamers; branded content about gaming and online culture; an in-game or metaverse installation; or perhaps branded merchandise which pro gamers wear while playing at a Call of Duty tournament or similar event.

In short, brands like FaZe monetize the very important relationship between influencers and creators and corporations who want to tap into Gen Z consumers. They sell access to youth culture, the creator economy, and online communities. Surprisingly, many companies are willing to pay to get access to this largely experiential global business.

What does the future of esports look like?

In April 2020, FaZe Clan raised at a $240 million valuation—and the $40 million that the company raised can almost entirely be prescribed as a symptom of the pandemic.

FaZe Clan CEO Lee Trink said in an interview that “we are positioned to be bigger on the other side of it,” citing the pivot away from traditional advertising and towards “esports and streaming.”

Less than 18 months later, FaZe Holdings was trading on the Nasdaq. That’s one indication that, despite its decade-long history, esports has really come of age in the past few years.

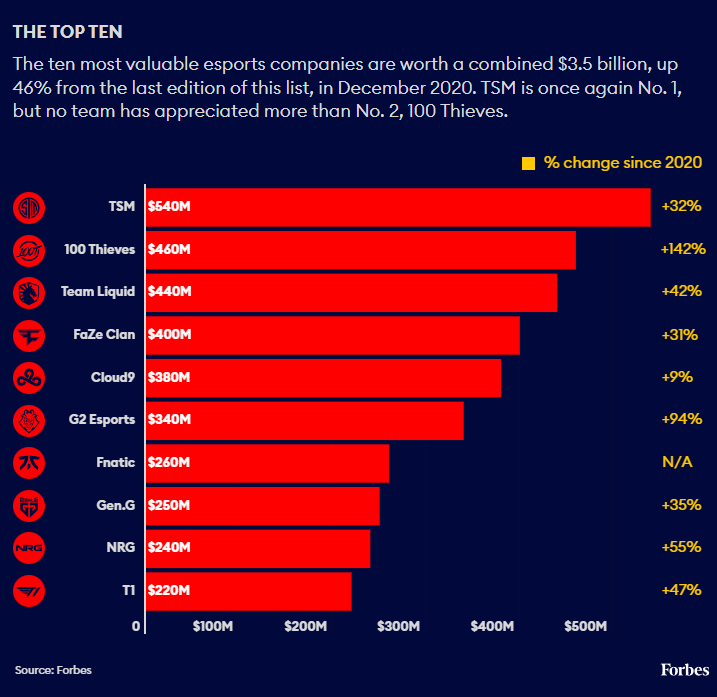

According to Forbes, the ten most valuable esports companies were worth a combined $3.5 billion in May 2022, a 46% rise since December 2020.

Source: Forbes

Some of the largest privately-traded esports companies have seen their valuations double in recent months. For example, 100 Thieves is worth $460 million, a 142% increase since 2020; Another is G2 Esports worth $340 million, which rose 94% over the same period.

Given the unprecedented rise of esports and the millions of revenue they’re generating, it only seems fair to say that esports is here to stay. While FaZe Holdings was certainly the first esports brand to go public, it certainly will not be the last.

How can I invest in esports?

People are paying a pretty premium to unlock FaZe’s “Gen Z touch,” its network of influencers of revenue-producing brand partnerships, and access to the emergent space surrounding competitive gaming tournaments.

However, long before FaZe, there were dozens of companies involved in the esports and gaming industry—many of them tracked by exchange-traded funds (ETFs). They aren’t perfect ways to track the booming esports business, but ETFs are close enough for investors who are looking for a convenient way to speculate on the growth of gaming-centric lifestyle brands.

The VanEck Esports & Gaming ETF (ESPO), Global X Video Games & Esports ETF (HERO), and the Roundhill Esports & Digital Entertainment ETF (NERD) are just a few funds that might offer exposure to the worlds of esports, the metaverse, and online entertainment.

You can pick up ETFs that invest in companies like FaZe Holdings Inc on brokerage apps like Public, M1 Finance, and Stash. Simply open an account to buy shares in FaZe or any of the ETFS tracking stocks in companies that cater to gamers, esports fans, and the highly-online.