Signature Assets: Is Signed Memorabilia a Good Investment?

Autographs of stars and athletes can increase an item’s value. But is collecting signed memorabilia a good investment or just a fun hobby?

How much would you pay for the signature of a famous person? What about $9.8 million? That’s how much a book owned and signed by George Washington sold for in 2012, while the signed baseball bat used by Babe Ruth to hit the first home run in the old Yankees stadium sold for $1.265 million in 2004.

Signed memorabilia can go for thousands or even millions, depending on the item signed and who signed it.

Though not everyone’s John Hancock is worth millions, music items, movie props, sports memorabilia, and even regular items can be worth more if they’re signed by a celeb. As interest in collectibles increases, investors are turning to signed memorabilia as an asset class.

Get your fountain pens and ink wells out because we’re taking a deep look at what makes signed memorabilia a good investment.

Signed memorabilia vs collectibles

Memorabilia and collectibles can often get confused with each other, but they’re very different. If you want to invest in signed memorabilia, it’s essential to make sure you understand the difference between the two.

Collectibles are usually items purchased for their rarity or popularity. Some examples of collectibles include baseball cards, coins, vintage Birkin bags, and antiques. In many cases, they’re worth a lot more than their initial worth, which is one reason why collectibles have become an increasingly popular alternative asset class among investors.

Memorabilia, on the other hand, is kept because it has sentimental value or is associated with an important event or person. It is often kept in museums for its historical value or collected by investors or fanatics in hopes that it increases in value.

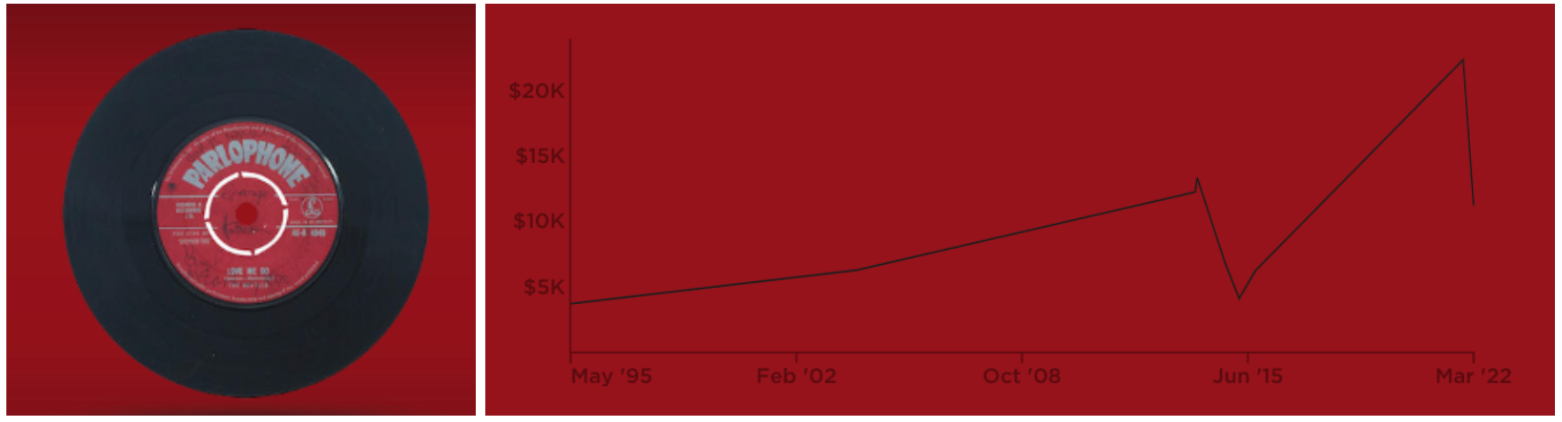

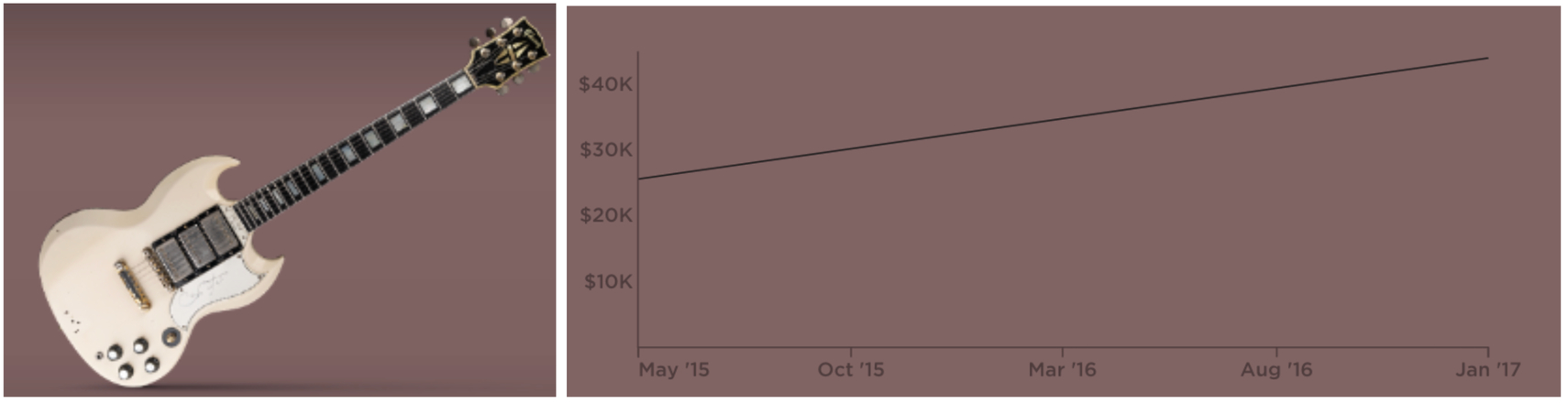

Source: rallyrd.com

Kim Kardashian, for example, caused a bit of a stir when she wore Marilyn Monroe’s famous happy birthday dress to the Met Gala in 2022. The dress is considered a historical American item, not just because Marilyn Monroe wore it, but because it was worn on May 19, 1962 when she famously sang Happy Birthday to President John F. Kennedy at Madison Square Garden.

While not all memorabilia is signed, a signature can often increase its value or even cause it to become memorabilia, such as the first issue of Macworld that was signed by Steve Jobs that fetched $47,775 in 2018.

Is signed memorabilia a good investment?

Signed memorabilia can go for thousands or even millions, depending on the item signed and who signed it. A Michael Jordan signed shoe is likely to go for more than a shoe that was signed by an athlete from a minor league team. Game-used gear can go for even more—a Michael Jordan rookie game-worn and signed Air Jordans sold for $55,200 in 2019.

Other sports memorabilia that has an autograph can also be valuable. A baseball signed by Babe Ruth sold for $180,000 in 2017, while a similar baseball also signed by Babe Ruth went for $77,675 in 2013.

Source: rallyrd.com

Sports memorabilia aren’t the only thing that gains value if it’s been autographed. A signed copy of the Beatles’ Sgt. Pepper’s Lonely Hearts Club Band album sold for a record $290,500 in 2013, while a guitar signed by several high-profile musicians, including Jimmy Page, Eric Clapton, Mick Jagger, and Sting, sold for $2.8 million in 2005 for a fundraiser to help tsunami victims.

Source: rallyrd.com

How to collect signed memorabilia

Like any type of investment, collecting signed memorabilia, whether it’s autographed baseballs or other autographed sports memorabilia, signed records, or even signed Star Wars memorabilia, can be risky. If you’re serious about investing in signed collectibles or memorabilia in the hope of a monetary gain in the future, keep these tips in mind:

Beware of fakes

Signatures can be easy to replicate, and there are many fake autographs sold. If you can, check the item beforehand to ensure the signature is genuine. Run your thumb over the signature to see if you can feel the ink. If it’s smooth, then it’s likely a stamp. Make sure you only buy items from a reputable dealer or auction house. Investment pieces should be authenticated and examined before you spend money on them.

Keep your collection in pristine condition

If you want to get top dollar for an item, it needs to be in pristine condition or museum quality. While it might seem like you have pristine items, there are particulars that can’t always be seen by the naked eye. You can have a professional check and verify your item or even get your item graded, like if you have sports memorabilia with a player’s autograph.

To make sure your memorabilia keeps its value, take proper care of it. You should also store it properly, ideally in a temperature-controlled safe or storage unit.

Do your research

Before you start collecting memorabilia, make sure to do your research. This is especially true when it comes to sports collectibles. Collecting sports memorabilia with autographs can be lucrative, but you don’t always know if an up-and-coming star will make it.

Some things are also out of your control. While winning a championship can increase the value of an item, things like a bad injury could cause an athlete’s career to end prematurely. This could potentially decrease the value of your sports memorabilia collection, especially if an athlete quits before they’ve reached their full potential. And remember, what might be a very good investment for one person might not make sense for your personal financial situation.

Source: rallyrd.com

Remember that prices fluctuate

Demand for sports memorabilia and other types of signed memorabilia can change. While the hope behind any investment is that it’ll increase in value down the line, it doesn’t always pan out. Just like the stock market, prices for collectibles and memorabilia fluctuates.

While today there might be high demand for a particular item or the signature of a celebrity, that demand can diminish in a few years, and with it the piece’s value. An autographed Tom Brady jersey goes for thousands of dollars today on eBay, but there’s no way of knowing how much it’ll go for in five or ten years.

How to invest in signed memorabilia

Investing in autographs can be a bit more complicated than other types of collectibles, usually due to supply and demand. There are generally fewer autographs than there are collectors, which increases the amount of money an item sells for and can also mean a lot of other people are vying for the same stuff—especially when it comes to sports memorabilia.

You can find memorabilia autographs on auction sites like eBay or through auction houses like Christie’s and Sotheby’s. These places don’t always have autographed items up for auction, so if you’re looking for, say, signed Elvis memorabilia, you may need to be patient.

Another way to invest in autographs is to buy fractional shares of collectibles through investing platforms like Rally and Collectable.

With Rally, you can invest in several collectibles, from cars to fine art and even wine. The company sources scarce items from around the world that could potentially see value appreciation. Then, they securitize the items through the SEC and offer shares on their app. Investors can either buy shares when the item is initially offered on the platform or buy and sell on Rally’s secondary market.

Collectable is similar, but focuses more on sports cards and other rare collections. With an average return on investment of 60% on exited assets, Collectable offers you a chance to own pieces of sports history.