Invest with Spare Change

All you need is a dollar and a dream. There’s no better time to start investing than now.

There’s hope and investment opportunities for us all.

With investing, as in life, everybody’s gotta start somewhere. If that’s stacking nickels in a piggy bank—great. Investing 5% of your paycheck into a 401k? Better. Investing a little in this and a little in that with whatever extra cash you have? Now, that’s ideal.

From traditional stocks to real estate to luxury goods, there’s plenty of investment options out there for those of us looking to get started with $10 or less. So fear not if you’re still at the bottom like Drake before the Degrassi days. There’s hope and investment opportunities for us all, multi-talented generational superstars or not.

Swipe me down

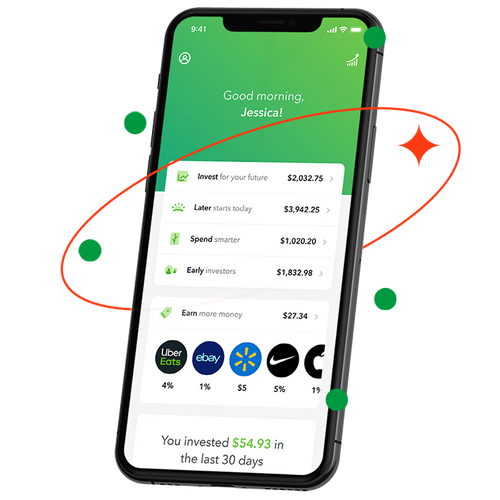

How many times did you swipe your card or hit that ‘place order’ button last month? Too many to count? Now imagine if you could automatically round up each of those purchases and put the spare change aside as an investment in your future. Oat milk matcha for $6.50—that’s $0.50 toward retirement. Hazy IPA at your local dive bar for $8.73—that’s another $0.27 toward your long-term financial goals.

Dividends on draft

The average millennial spends $3,600 a year on booze. If each pint of craft beer costs $5.50 (who doesn’t love a good happy hour deal?) and you invested the 50 cents in spare change, you’d be putting away an extra $327 every year. That’s a healthy investment for minimal effort. (PS we’re not guilting you about your margarita habit. How else are you supposed to wash down those tacos?)

Three simple tips for investing your extra cash

1. Invest with spare change, literally

Acorns takes the extra money from all of your purchases, no matter how big or small, and puts it in an investment fund crafted by experts. This is an awesome option if you’re brand new to investing or are looking for a low-effort way to build out your portfolio.

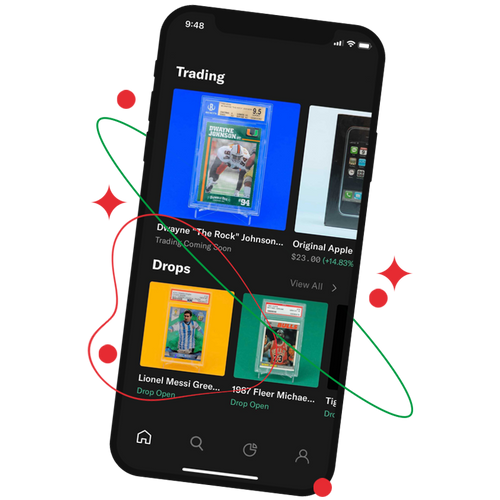

2. Invest in interesting things

For those of us whose bank account doesn’t yet match our taste or ambitions, there’s an accessible (and arguably more financially savvy) way to own pieces of things like the Birkin. Through Public, you can buy shares of culturally important items with as little as $10. Like in the stock market, you’ll make money if the value of what you own goes up and you sell your share.

3. Buy into real estate with $100

If you’re looking to get in on the action but don’t have thousands to put toward a down payment or an expensive real estate investing fund, there are now platforms like Groundfloor that let you get started with as little as $100. Through Groundfloor, your investment is automatically diversified and goes toward loans that real estate pros use to fix and flip investment properties.