Lenme Review: Diversify Your Assets, Become a Bank

Lenme empowers individual investors to take on the risks and rewards of becoming a bank.

With the internet, you can truly be whoever and whatever you want to be. With apps like Lenme, you yourself can become a bank.

Lenme is a peer-to-peer (P2P) lending platform that allows investors to lend their money to borrowers who are unable to secure a loan in the traditional avenues (i.e. a bank or friends/family).

However, the big question for you is if you’re equipped to take on the responsibilities, ethical concerns, and risk considerations that banks do. There’s also a question of whether or not this platform is great for the little guy (but more on that below).

In this platform review of Lenme, we’ll explain the ins and outs—plus potential risks—of this platform, then discuss if it is possible to achieve extraordinary returns.

Borrow our cheat sheet

| $3 | $50 |

| 36% | Medium |

One Year Free Subscription for MoneyMade Investors (Exclusive Offer) |

Pros and cons of Lenme

Pros

- Diversify investments in a market-agnostic way

- Potentially make loans accessible to unbankable people

- High potential ROI

- No commission

- More liquidity compared to other P2P apps

- Friendlier to potential borrowers than many P2P platforms

- Claims “cutting edge technology” used in the vetting process

Cons

- Paybacks won’t improve borrowers’ credit scores

- Higher default rates in P2P lending, especially with non-asset-backed loans

- Subscription-based with a monthly fee

- Negative customer reviews

- Leadership team is spread out

- F rating by the Better Business Bureau

What is Lenme?

How does Lenme work?

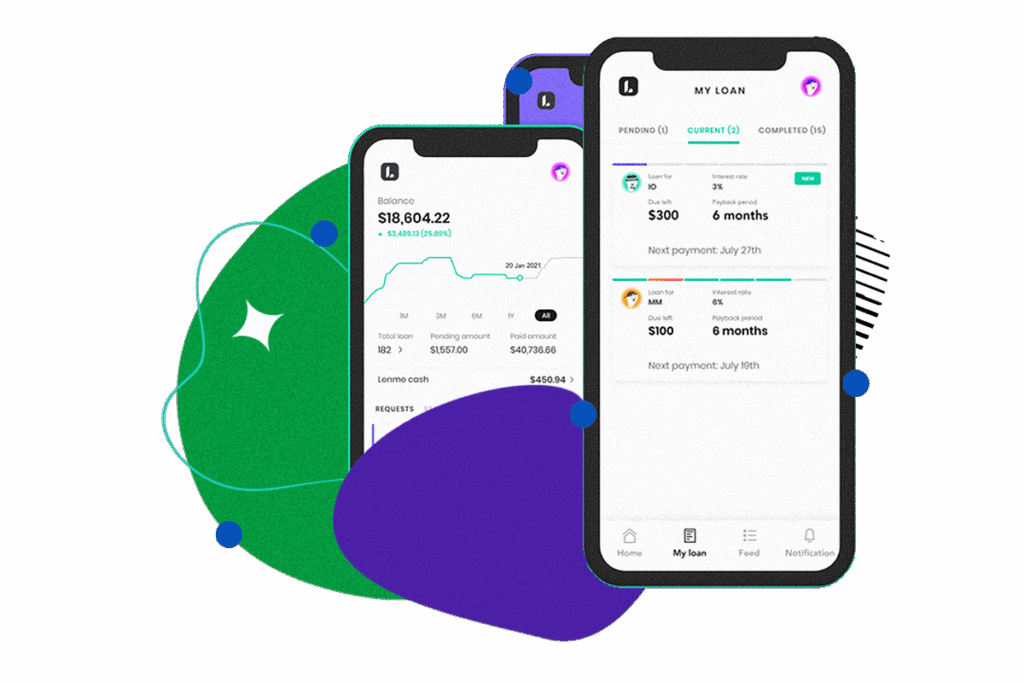

Lenme is a peer-to-peer (P2P) lending platform. A potential investor can start loaning out their money to borrowers on the Lenme platform and choose the APR at which they want their borrowers to pay back the money. The APRs range from 3% to 200% (which is technically payday loan territory). With a quick scroll through the app, investors can state their terms. The borrower will have their credit score, credit utilization, annual income, and other relevant facts presented on their borrowing bid.

Who can invest with Lenme?

Lenme is only available to US investors who have a Social Security number, government-issued ID, and a bank account number. Other than that, anyone who is able to loan out $50 to $5,000 is allowed to join and lend money. Signing up and connecting to a bank account should take less than 30 minutes.

How Lenme makes money

Lenme makes money through a subscription model. They also take a minimum of $3 or 1% (whichever is greater) from each deal as a cost of origination. This fee is divided up between a one-time fee during the borrower’s loan request (aka an origination fee) and broken up into the borrower’s monthly payment installments.

Where Lenme gets it right

More liquid than other lending apps

One of the biggest issues with P2P lending is that investors end up getting their capital tied up in loans that will take years to pay off. Lemme bypasses this criticism by having a maximum loan period of one year. This means you’ll be able to access your funds within a year and take part in different investment ideas.

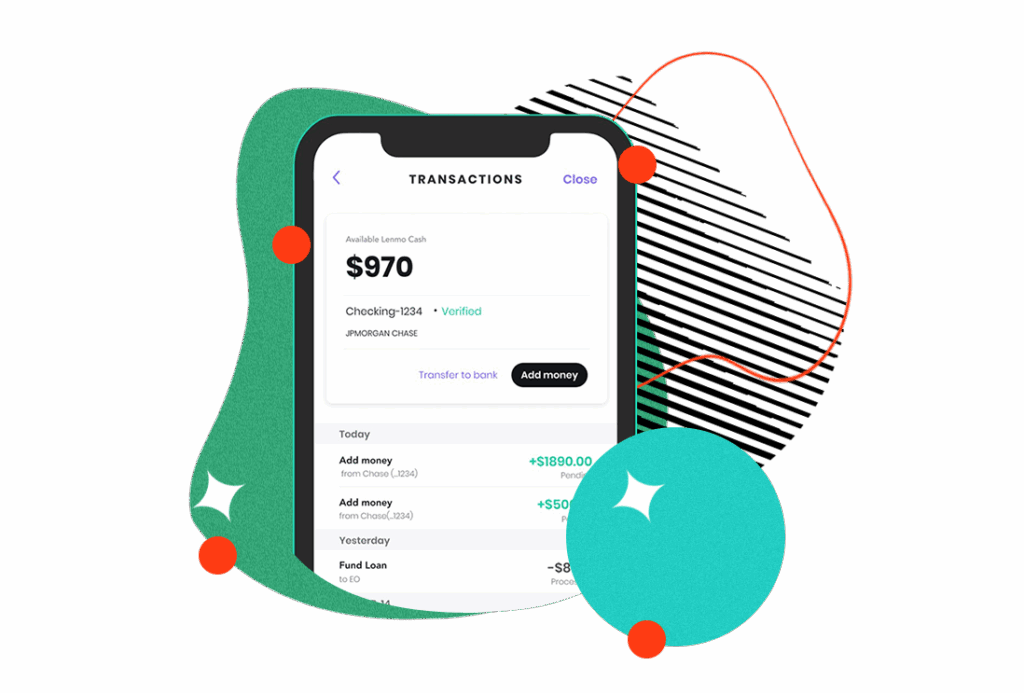

Clean user interface

In the complicated world of loan origination, a nice looking app may not seem like a huge deal. But we think it really is. Even negative reviews of Lenme have cited that the app looks clean, polished, and usable.

Diversify more easily than a bank

When lending your money to peers, you’re taking on greater risk than with traditional investing. Lenme creates an ecosystem that fights against this by having a large and diverse set of borrowers. There are close to 300,000 users on the platform.

Where Lenme could do better

Not-so-great customer service

From Youtube to Apple store reviews, the Lenme platform seems to have garnered a slightly unfortunate reputation from its users for having poor customer service. On the App Store, Lenme has a 4.3 star rating, but even positive reviews have some negative commentary about the lack of responsiveness from the Lenme team when problems arise. This is especially worth seeing through the context of the problem with default rates. If your borrower defaults, who will you complain to about that?

Engages a potentially predatory system

The people who are turning to Lenme and other P2P money borrowing apps likely have some money woes. Giving loans to who can’t qualify for traditional loans is potentially risky for both the lender and the borrower. And lenders themselves have to decide if they can live with charging sky-high interest rates to people who need a break.

Higher default rates are probable

In a YouTube review of Lenme, Jonathan Brutt shares that of his roughly 10 Lenme investments, 40% of them defaulted (meaning borrowers didn’t pay back his money or interest). As Lenme offers loans that are between $50 and $5,000 (with the majority in the $100 to $1,000 range), you’ll have to think about whether you can afford to live with higher default rates. Yes, Lenme investors can submit a statement to the credit agencies, but smaller loans might not cause a big enough stink to force borrowers to recuperate losses—at least not without some teeth pulling.

Can you really make money on Lenme?

You can make money on Lenme, but there’s a wide range when it comes to how much. P2P lending is risky, but it can also offer some potentially high rewards.

P2P lending has existed for a while now. The two flagship P2P lenders were LendingClub and Prosper. With a quick YouTube search, you will see that the majority of the popular videos on the subject cite that you can earn a modest amount of passive income on Lenme, given you understand the risks involved.

As of writing, $3,483,261 has been originated through Lenme. There is a community of 365,000 and growing users on the platform. Potential exists to make up to 200% returns per individual investment. We assume a target return of 36%, making it a competitive investment option.

How do I make money with Lenme?

You make money with Lenme through interest payments made to you by borrowers. As an investor, you can set your APR rate to borrowers, and this can be up to 200%. Theoretically, this means that you could 2x your investment, but typically the higher the rate, the riskier the loan. While borrowers choose the repayment time frame and schedule, you can choose who you want to lend your money to.

How do I cash out with Lenme?

As an investor, you collect repayments over time after you loan money to a borrower. Once the payment period is over, you will have made your money back with interest. This money goes into your Lenme account, and you can then loan it out again or cash out by transferring it to your bank account. There are no transaction fees to transfer money from your Lenme account to your bank account. According to Lenme Reddit threads, there is a transfer period of up to two weeks in terms of cashing your money out of the platform and into your bank account.

Lenme vs traditional investing

While Lenme allows investors to charge up to 200% APR to its borrowers, MoneyMade pegs target returns at 36%. This is well above market average. To compare it to traditionally “safe” investments, the S&P 500’s average return is about 10% to 11%. (Although, given the high performance of the stock maket lately, returns for 2021 are projected at 22.2%.) On the wholly speculative side, alternative investments like Bitcoin have had 302.8% returns throughout their notoriously volatile ups and downs.

Lenme can be seen as somewhere in between the mega-speculative world of cryptocurrencies and the comparably more stable world of passive investing in the good ol’ S&P 500.

That said, the reviews reveal that people who have actually invested their money in the platform say that it wasn’t exactly a stress-free paycheck. So do your homework.

What other people are saying about Lenme

The Lenme platform has its fair share of negative reviews. The only customer review on YouTube is by Johnatan Brutt, who complains about ethical issues with the platform and his 1.67% return on investment over the course of six months. Meanwhile, Reddit users complain about the lack of protection on the investor end for this platform.

The Better Business Bureau gave Lenme an F rating, and the customer complaint was related to how it conducted it’s customer service—not about returns specifically.

Amid the Reddit complaints, however, are a few positive reviews from people who pushed back. One user set forth his three rules for how they made Lenme (back when it was called Lenmo) profitable for himself. The user attributed their success to 1) keeping good track of the loans you give out—and always speaking up if you notice a discrepancy; 2) remembering the transfer period and preparing to wait 5 to 10 days to get paid; and 3) Give out multiple smaller loans rather than one large loan (aka spreading out the risk).

Are there other apps like Lenme?

Two similar platforms to Lenme are Worthy and SMBX. With all three companies, you, the individual investor, are behaving in the way of a “bank”—however there are differences.

Worthy creates and sells bonds. The proceeds from the bonds are loaned to businesses (compared to Lenme’s individual borrowers). And while Lenme’s loans are unsecured, Worthy’s bonds are collateralized by things like inventory and accounts receivable rather than being crypto backed.

SMBX also gives a platform for investors to buy small business bonds and get paid back their principal and interest payments on a monthly basis. Borrowers include collateral information in their loan applications, and investors can participate with a low minimum of $10.

Both Worthy and SMBX carry lower risk than Lenme. In fact, SMBX is governed by the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority).

Our hot take on Lenme

While the prospect of becoming a digital bank sounds cool, and the Lenme platform seamlessly allows for that to happen, it is far from an easy passive income generating strategy. In fact, based on most of the reviews, a lot of people were stressed about lending out their money on the platform. Moreover, while borrowers choose to come on to the platform, APRs can go pretty high, making the ethics of this platform less than warm and fuzzy.

Lenme is still a young company. There is only one person listed on their Linkedin who works full time, the founder Mark Maurice. The previous idea of Lenme was to incorporate social media with loan origination. The idea was you would set up oyur Facebook with Lenme and from there you would see who in your circle of friends needed a loan, and that way the vetting is done in a unique way.

The present app is coded in React Native, which some speculate contributes to why there are a lot of glitches and customer complaints. While Lenme’s ideas are intriguing, it almost feels like it is the prototype for something bigger. Perhaps it is worth keeping an eye on this platform and revisiting Lenme when it incorporates the social features.

I’m in! How do I sign up for Lenme?

1. Create a MoneyMade account and sign up for Lenme.

Once you create a MoneyMade account, you can go to our Lenme platform profile and visit their website from there to sign up.

2. Download the Lenme app.

You can enter your phone number on the Lenme website, and you’ll receive a link to download the mobile app on iOS or Android.

3. Create an account.

In order to invest, you’ll need to upload personal information like a Social Security number, banking details, etc.—and then you can start lending or borrowing.

4. Fund your account and start investing.

Once your account is ready, you can browse loan requests and select a loan to invest in based on information like credit score, credit report, Lenme score, and more.

FAQs

Is Lenme legit?

Lenme has conducted roughly $3 million in funding so far. As of right now, the company is still quite young. Lenme is real but there is a decent bit of risk involved with taking part in a startup P2P lending business.

Is Lenme ethical?

P2P loans are created to help borrowers who are denied traditional means of borrowing money get access to capital. In some circumstances this empowers them to be able to pay off unexpected debts that are pressing. For some others it allows for them to continue to practice poor financial habits. Lenders can set their own APR rates, but we recommend they do so according to their own values. Not to mention, charging sky-high interest rates may attract some borrowers who get in over their heads—which benefits no one.

Is Lenme safe?

When you make an investment you are taking a risk with your money. It is through risk that you are able to grow your wealth, but it is also how you can lose your principal investment. While Lenme claims to use industry leading methods to vet borrowers, the key to success appears to be focusing on diversification of loans given to peers.

Who are the borrowers?

The borrowers on Lenme can range in persona. Some may have credit scores well above 650 and just need a loan to help pay off a sudden unexpected expense. Others may be habitual borrowers living above their means, who, now banned from traditional loan originators, are turning to new companies like Lenme to get a loan. The responsibility of vetting is on the lender, though Lenme uses AI and other leading technology to help users make responsible decisions.

How long does it take to get a Lenme loan?

Expect it to take about 1 to 2 business days after agreement between the lender and borrower.